2019 is coming to an end and we here at CoolBitX would like to reflect on some of the major headlines surrounding cryptocurrency over the past decade. Whether you are a seasoned investor or just looking to get your feet wet, it is always a good idea to analyze the past and search for patterns in order to prepare better for the future.

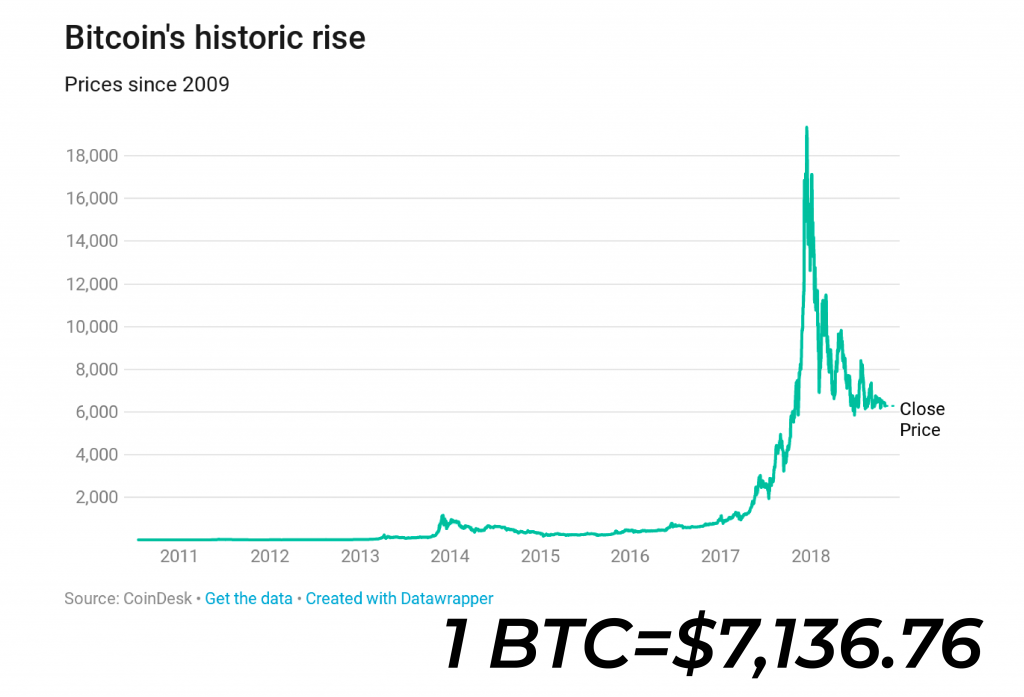

Since its inception in 2009, Bitcoin has had its fair share of adrenaline-fueled highs and devastating lows while gaining both praise and criticism from media outlets and governments worldwide. It all started with the simple purchase of pizzas in 2010 and has since snowballed into a multi-billion dollar market. How did it get there?

2010- Bitcoins for pizza

Bitcoin emerges with the idea of creating a decentralized digital currency that cannot be manipulated by any government or bank by borrowing ideas from cryptography and based on its blockchain technology. While Bitcoin was only viewed as an innovative idea in 2009, it wasn’t until 2010 when it was used to purchase a real-world object: pizza. People started seeing actual tangible value to this digital currency or cryptocurrency.

2011- Altcoins make their debut

With Bitcoin’s blockchain infrastructure well established and gaining traction among digital communities around the world, 2011 brings the introduction of other forms of cryptocurrency, also known as altcoins. These altcoins, such as Litecoin (created by Charlie Lee) are conceived with the idea of not only building on, but also improving some of the inefficiencies of Bitcoin, mainly focusing on ease of transaction and security. In June of 2011, Bitcoin experiences its first bubble, hitting $31, but then drops soon thereafter. Mt. Gox, a Japanese-based exchange, experiences a hack which prompts the transfer of a substantial amount of bitcoins from the online exchange into cold storage.

2012- Here come the scams

The cryptocurrency community sees steady growth into 2012. However, with the growing popularity of altcoins, also comes an increase in ponzi-schemes and scams that continue to threaten the security of cryptocurrency investors to this day. Coinbase, a popular U.S.based cryptocurrency exchange is also founded, making the purchase of crypto very simple and convenient for the average investor.

2013- Bitcoin breaks $1,000 and Ripple’s XRP is launched

Bitcoin’s value passes the $200 mark in mid-2013, most likely due to its increase in media coverage and the convenience of Coinbase. This sudden spike in price results in many selling off their Bitcoin, which culminates into a crushing 71% price drop overnight. Bitcoin experiences yet another surge in late-2013, hitting $1,150. However, as history tends to repeat itself, a 50% fall follows. Ripple’s XRP is also launched as a settlement asset for international transactions based off of Bitcoin’s blockchain technology. Overall, Bitcoin hit tremendous strides in 2013, even surpassing the price of gold in November.

2014- Mt. Gox hack devastates industry; CoolBitX is founded

The price of Bitcoin takes a huge hit in 2014 due to a security breach at Mt. Gox, resulting in the theft of over 850,000 coins which makes many question the overall security of cryptocurrency.

The same year, Michael Ou founds CoolBitX and its premier hardware wallet, CoolWallet is born, giving customers a secure way to transfer their funds out of exchanges and into their hardware wallets. The overall price of Bitcoin runs out of steam over 2014 and ends the year around the $300 range.

2015- Ethereum introduces smart contracts; Tether stablecoin launched

Proposed in late 2013 by developer Vitalik Buterin, and following a crowdsale in 2014, Ethereum is finally introduced as a new platform based on the blockchain technology that Bitcoin is built on in 2015. Instead of introducing an alternative to fiat currency, Ethereum’s aim is to provide a platform to run decentralized applications (dapps) and utilize smart contracts with the introduction of ICO’s. Ether is created as its currency to further motivate and award authors for creating efficient and secure contracts.

Other highlights in 2015 include Tether (USDT), which brings a stablecoin pegged to the US dollar to the market, as well as the first-generation CoolWallet crowd-funding campaign, launched on Indiegogo.

2016- Ethereum hardfork after DAO attack

A hardfork is introduced to Ethereum in 2016 as a result of the DAO incident, where $50 million is stolen during its ICO due to a security loophole exploit. The purpose of the hardfork was to roll back the platform’s date to reverse the hack. Many feel that the rollback was very much akin to a government bailout which goes against the ideals of crypto community. This results in the creation of Ethereum Classic and the (new) Ethereum.

2017- Bitcoin’s ATH

2017 dawns with more governments and businesses, such as Microsoft and Starbucks, gradually accepting Bitcoin as a legitimate form of payment. What is dubbed as the ‘summer of crypto love’, ICO’s see a boost in activity resulting in Bitcoin surpassing the $3,000 mark. The news of this price surge eventually attracts major Wall Street analysts to start following crypto, further bringing it into the spotlight. In an electrifying final few months of the year, where it gains mainstream awareness for the first time, Bitcoin’s price goes parabolic, crossing $10,000 for the first time. The price of BTC reaches an all-time high (ATH) of $19,783 in December 2017, but quickly falls over 45% in just a few days.

The altcoin market meanwhile benefits from the sudden mainstream interest in cryptocurrencies, making record gains that outpace even Bitcoin’s stellar rise.

XRP breaks the $1 mark around Christmas, shooting up to $3.20 in the next 2 weeks, and ending the year on a mindblowing 36,000% increase in value for investors! Check out this list of the top 10 list of best performing cryptocurrencies in 2017.

2018- The Crypto Winter and Lightning Network

Coming off the bull run of late 2017, Bitcoin and the altcoin market experience a painful retraction over most of 2018. The market is sent reeling as many ICO’s and other projects exit scam and over $800 million is lost due to hackers across various exchange platforms. The Lightning Network is introduced as an innovative way to make Bitcoin transactions both faster and cheaper. Regardless, 2018 proves to be a less volatile year than most and steadily stays above $6,000. It provides a tough learning experience for crypto investors, but there is light at the end of the tunnel, with several Bitcoin exchange-traded fund (ETF) proposals submitted to the SEC.

2019- Has it already been 10 years?

This year has seen a significant bump in Bitcoin’s price, helped by the steady reconsolidation period after its 2017 highs. Interest in cryptocurrencies pick up again slowly over the first half of 2019, with positive market developments breaking almost weekly.

Many investors are buoyed by the increasing mainstream interest that blockchain technology attracts. When Facebook’s ambitious Libra project is announced on June 18th, it validates the importance of cryptocurrencies and helps send Bitcoin along to another bull run of over $13,000.

The relatively low buy-in has attracted a lot of new investors due to FOMO, , a fear of missing out, on the next major raise in price. Various regulations and the introduction of stablecoins have also allowed investing into crypto seem a little less volatile.

However, as anyone in crypto knows, what goes up quickly, must come down. Bitcoin’s price has gone down quite significantly at the time of this writing, most likely due to China’s crackdown on the trading of crypto, though some of these claims have proven to be false reports. It’s also another record-breaking year for hackers, scammers and other criminals who steal billions of dollars through devastating exchange hacks, exit scams and crypto-related computer malware.

2020- To another decade of crypto!

As we go into the new decade, it is important to remember what the past has taught us to avoid any future missteps that may occur. Whether you invest in crypto for financial gain or for a store of value, we feel that security should be of utmost priority.

A recent survey reports that over 90% of investors still store their crypto in exchanges, which history has taught us, is not a very secure place to store it. To have complete control of your investments, it is recommended to transfer them into a hardware wallet, where only you can access them.

Cryptocurrency will always be evolving, making transactions quicker and more secure while gaining more mainstream acceptance. Unfortunately, this also gives way for more scams and hackers to find ways to compromise your assets. What almost always follows a major security hack is a drop in overall value. Together with the Ethereum hard fork, Istanbul, and the halving of Bitcoin in 2020, cryptocurrencies will continue to innovate and evolve as regulations and new use cases such as central bank digital currencies help make it increasingly palatable to a mainstream audience.

While we cannot predict the future value of cryptocurrencies, we can say this: A hardware wallet is the best way to futureproof your crypto while it hopefully grows in value. Keeping your digital assets in cold storage provides peace of mind. You don’t need to worry about your crypto getting stolen as long as you stay diligent and employ our best practice security tips. Check out more information about our revolutionary Bluetooth hardware wallet, CoolWallet S here.