Move over ERC-20, BRC-20 is here.

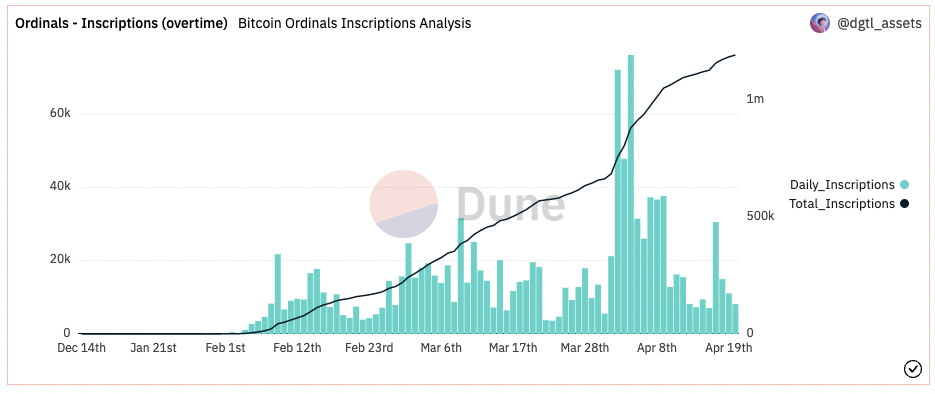

Q1 2023 saw a jump in Bitcoin’s value, powered partly by the Bitcoin Ordinals protocol craze that allowed users to “mint” Bitcoin NFTs for the first time by inscribing data on a satoshi, thereby bringing non-fungible tokens to Bitcoin while clogging up the network. At present, there are over 1,100,000 Ordinal NFTs now minted, according to Dune.com (see below). The number has essentially doubled in the last 30 days.

Over the years, Bitcoin has taken on the role of the reliable and rather predictable patriarch of the crypto industry, with its developers and army of supporters fiercely resistant to change and content to see it rise in value as sound money and a “digital gold” hedge against global monetary inflation.

Meanwhile, Ethereum and other layer-1 and 2 chains have been aggressively expanding the borders of the crypto universe with a slew of smart contract-powered innovations for altcoins such as decentralized finance (DeFi), Web3, non-fungible tokens (NFTs), and GameFi, while Bitcoin remained largely unchanged. If it ain’t broke, why change it, amirite?

Well, change did eventually come to Bitcoin, thanks to the important Taproot update in late 2021, which with it brought smart contract capabilities and increased privacy to the world’s oldest blockchain and digital currency. Now, it’s also allowing users to store different assets in their Bitcoin wallet with the new BRC-20 token standard.

So what is BRC-20 and is it really going to be a key future player in Bitcoin’s rise to mass adoption?

Since March, a new implementation of the Ordinals protocol, called “BRC-20,” has been gaining traction. The highly experimental BRC-20 is inspired by a pseudonymous user’s tweet and the Sats Names (.sats) standard.

So what are BRC-20 tokens, how do they work, and what is their potential impact on the world of cryptocurrency, specifically Bitcoin?

What are BRC-20 Tokens?

BRC-20 tokens are digital assets that are inscribed on a satoshi, the lowest denomination of a Bitcoin. Short for “Bitcoin Request for Comment ”, and similar-sounding to ERC-20, they are created using the Ordinals protocol, which allows users to inscribe data onto the Bitcoin base blockchain.

It’s different from token standards used on EVM chains such as ERC-20 and BEP-20 where smart contracts are used to manage the token standard and its various rules. Instead, BRC-20 tokens are created by deploying token contracts using Ordinal inscriptions of JSON data. These tokens can then be minted and transferred between users.

Although BRC-20 tokens are still experimental, they offer an interesting use case for tokens on the Bitcoin blockchain. They also provide a way to create fungible tokens on Bitcoin, which has traditionally been difficult due to the lack of smart contract functionality.

Who created BRC-20?

The BRC-20 implementation was launched on Wednesday by a pseudonymous on-chain data enthusiast who goes by the name Domo. According to Domo, BRC-20, which stands for “Bitcoin Request for Comment,” is an experiment that was inspired by another pseudonymous user’s tweet and the Sats Names (.sats) standard.

In a Decrypt interview, Domo explained that he had heard about the possibility of BRC-20 on Twitter and was curious if he could apply the .sats name format to create it. Domo further added that he was trying to create an off-chain state with the tooling he had at hand, which included Dune Analytics and inscriptions. In another tweet, he cautioned that BRC-20 tokens are worthless and people shouldn’t waste money mass-minting them.

DELIVERED EVERY WEEK

Subscribe to our Top Crypto News weekly newsletter

How do BRC-20 Tokens Work?

BRC-20 tokens work by leveraging the Ordinals protocol to inscribe data onto the Bitcoin blockchain. The protocol allows users to create digital assets in the form of text, images, audio, or video, and inscribe them onto a satoshi. Once inscribed, the asset can be traded or exchanged just like any other token on the peer-to-peer Bitcoin network.

Potential Impact of BRC-20 Tokens

The launch of BRC-20 tokens has captured the imagination of Bitcoin users just like Ordinals NFTs have, but also drawn criticism from some for unnecessarily bogging down the Bitcoin network. While many users see the potential of BRC-20 tokens as a means of creating a variety of valuable non-fungible and fungible digital assets on the Bitcoin blockchain, it is still early and experimental, and BRC-20 should not be considered the “standard” for Bitcoin-based tokens just yet.

Galaxy Research predicts that the Bitcoin NFT market could be worth $4.5 billion by 2025. BRC-20 tokens could be a significant part of this market, offering users a way to create fungible digital assets on the Bitcoin blockchain. The potential use cases for BRC-20 tokens are vast, ranging from digital art to games and video-based web apps.

Are BRC-20 tokens worthless?

Domo’s Ordi token kicked off the BRC-20 craze, followed by meme-inspired tokens like Doge and Meme itself. Nearly all of the 385,000 total inscriptions made via Ordinals to date have been created over the last 2 months.

Bored Ape Yacht Club auctioned its original art collection via Ordinals, yielding $16.5 million. However, Domo cautioned against mass-minting BRC-20 tokens on Twitter, calling them “worthless.” Ultimately, as with all things in crypto, the market will decide whether that’s true.

Unisat Wallet announced on 27 March that it worked with Domo to create a balance sheet and browser explorer for BRC-20, with a TX history and transfer function, Full compatibility with the latest BRC-20 protocol, and visualization of holders.

Conclusion

BRC-20 tokens are an exciting new development in the world of Bitcoin-based tokens. They offer users a way to create fungible digital assets on the Bitcoin blockchain, which could have a significant impact on the Bitcoin NFT market. However, it is still early and experimental, and BRC-20 should not be considered the new “standard” for Bitcoin-based tokens.

BRC-20 is still a fad at best, and with Bitcoin Ordinals these new Bitcoin-powered assets are probably more analogous to Ethereum’s blockchain-clogging Crypto Kitties of 2017 than 2021’s BAYC and CryptoPunks blue-chip NFT collectibles. However, the early bird gets the big rewards later, and they will continue to innovate and get better though, especially if they receive backing from the Bitcoin community en masse.

While the potential use cases for BRC-20 tokens are vast, there are likely better ways of achieving what BRC-20 does. It also raises the question of whether Bitcoin is simply digital gold that should be hoarded up or used in Lightning micropayments, or if it should aspire to do more, in which case it may become something altogether.

As we saw with 2017’s bitter WWSD (What would Satoshi Do?) arm-wrestling that led to the Bitcoin Cash fork, selling this to such a passionate community of Bitcoin maximalists is easier said than done.