Table of Contents

- What is the Bitcoin Halving?

- The Mechanics of the Bitcoin Halving

- Projecting the Price Impact of the Bitcoin Halving

- Evaluating the Bitcoin ₿ Halving: The Good and The Bad

- The Bitcoin Halving’s Impact on Miners

- Countdown to Impact: The Next Bitcoin Halving in 2024

- The 2024 Bitcoin Halving: What to Expect

- Conclusion

Written by Werner Vermaak

Introduction

Every four years, a highly anticipated crypto event takes place that helps to explain the unstoppable rise in the price of Bitcoin since its genesis block in 2009 and serves as a convincing reason why you should HODL your satoshis in a safe Bitcoin wallet like CoolWallet. After triggering a crazy bull run in its wake for 3 consecutive cycles, with the biggest yet in 2021 following the event in 2020, expectations are high for the next Bitcoin halving in Q2 2024, most likely end of April.

Here’s what to know about this uber-important feature engineered by the genius of Satoshi Nakamoto that could very possibly be the most important event to understand in all of crypto.

What is the Bitcoin Halving?

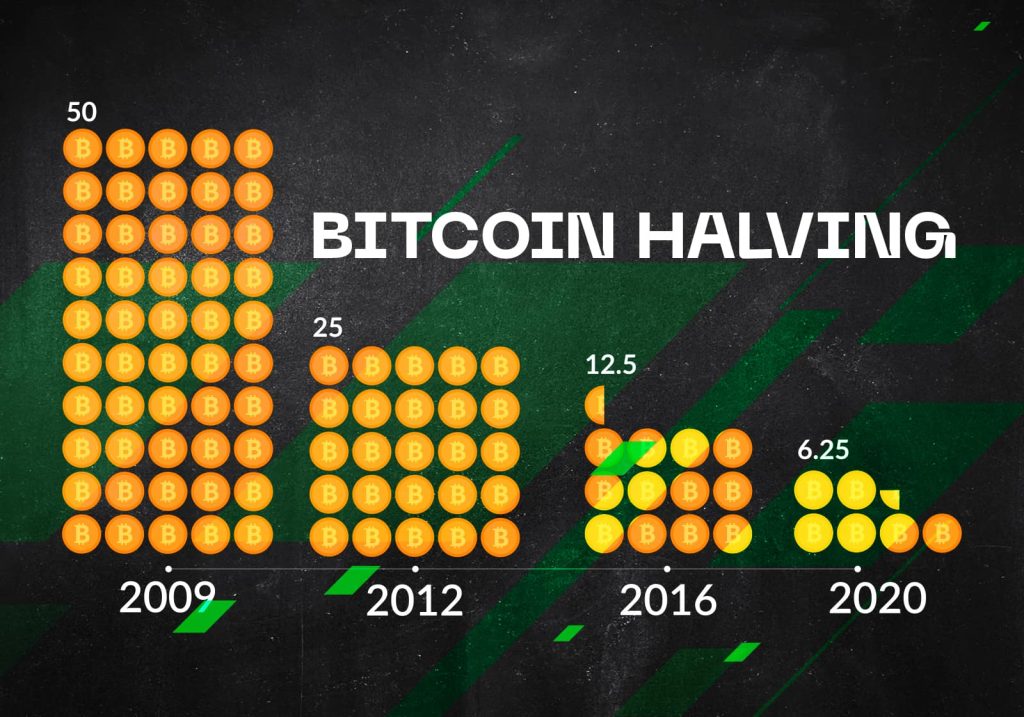

The Bitcoin halving (or halvening) is a built-in feature of Bitcoin’s algorithm that kicks in every four years. This event cuts the reward for confirming Bitcoin transactions, known as mining, by 50%, in order to preserve Bitcoin’s scarcity and manage inflation. When Bitcoin launched, miners were initially rewarded 50 BTC at every 210,000 blocks (around 10 minutes), then 25 BTC in 2012, then 12.5 BTC in 2016, and finally 6.25 BTC in 2020.

According to the NiceHash Bitcoin Halvening Countdown ticker, in early May 2024, less than a year away, the world’s oldest blockchain will once again see its rewards slashed, this time to a mere 3.125 BTC per block. This process will be continued until the year 2140, when the last Bitcoin is mined. After already mining over 19 million of the maximum 21 million Bitcoin in less than 15 years, the next century and some change will only see less than 2 million BTC distributed to miners, while the mining difficulty keeps going up.

The process of the Bitcoin halving ensures a gradual reduction in the issuance of new Bitcoins, leading to a lower inflation rate. This restricted new supply, coupled with rising demand, is the key to helping Bitcoin gradually grow into its intended role as a global digital, decentralized peer-to-peer payment network. But is less more in this case?

The Mechanics of the Bitcoin Halving

Think of the Bitcoin halving as a systematic “savings plan” that improves the lifecycle of Bitcoin as its demand increases over time.

Cryptocurrencies often use a vesting schedule for founders and early investors to avoid market destabilization. Unfortunately, pre-sale tokens can still create selling pressure and price volatility. Additionally, strategies to artificially inflate token supply mainly benefit early participants and may lead to market manipulation. Unlike these practices, Bitcoin has had a halving schedule in place since its inception, ensuring a controlled supply, counteracting inflation, and promoting long-term value.

This process curbs the creation of new Bitcoins, ensuring the digital asset’s maximum supply remains at 21 million. By halving the rewards to miners every four years, the network gradually reaches this cap, thereby maintaining the value of Bitcoin as a finite digital commodity.

Projecting the Price Impact of the Bitcoin Halving

The imminent question is: how will the next halving affect Bitcoin’s price? Considering the law of supply and demand, as the halving reduces the number of new Bitcoins entering the market, the price could rise if demand stays constant or increases.

The motivation of miners, the creators of new Bitcoins, is also pivotal. Post-halving, they earn fewer Bitcoins. If the price doesn’t sufficiently compensate for this reduction, some miners might cease their operations, further shrinking the supply and potentially driving up the price.

Historically, Bitcoin’s price has surged following a halving. However, past performance doesn’t guarantee future results. Various factors impact Bitcoin’s price, including global economic events, technological advancements, and regulatory changes. While halving could positively affect Bitcoin’s value, it’s vital to conduct thorough research and understand the associated risks before investing.

Especially in the current geopolitical and economic climate, with a recession on the cards, war in Ukraine and tensions elsewhere, tight monetary policy and high-interest rates strangling businesses around the world, bad news takes an exaggerated toll on crypto prices, due to digital assets’ status as risk-on assets.

Evaluating the Bitcoin ₿ Halving: The Good and The Bad

The Bitcoin halving is an inherent part of Bitcoin’s protocol, playing a vital role in its valuation, scarcity, and security. Here’s an analysis of the pros and cons:

The Advantages

Controlled supply and deflationary pressure:

Bitcoin halving maintains a finite limit of 21 million bitcoins, preserving its value akin to ‘digital gold’. By managing the creation of new Bitcoins, halving events help control inflation, potentially increasing Bitcoin’s value over time. As we’ve seen with gold and other precious metals, in a world of money-printing central banks and governments who inflate their money supply willy nilly, scarcity matters for investors.

Sustainable network growth:

By regulating Bitcoin’s inflation rate, halving events give the network time to grow and improve before max supply is fully reached in 2140. By setting the date to reach the max supply far into the future, the creators of Bitcoin ensured transactions will still be processed for at least 100 years before a different method to reward miners is implemented.

Reduced energy consumption:

As we’re constantly reminded, Bitcoin mining is energy-intensive. Halving events cut miners’ rewards, potentially reducing the Bitcoin network’s total energy consumption by either forcing miners to buy more efficient equipment or use less electricity.

The Disadvantages

Lower rewards for miners: Halving events decrease miners’ block rewards. If the price of Bitcoin doesn’t compensate for their efforts, some miners may cease operations, which impacts the network’s total hashing power, security, its level of decentralization, and potentially its transaction processing speed.

Encourages hoarding: Bitcoin’s deflationary model promotes ‘HODLing’ (holding onto Bitcoin expecting a price appreciation), contradicting the idea of Bitcoin as a transactional currency and framing it as an investment.

Potential for price volatility: Halvings introduce uncertainty and potential for price volatility due to supply and demand dynamics, market sentiment, and external economic factors.

DELIVERED EVERY WEEK

Subscribe to our Top Crypto News weekly newsletter

The Bitcoin Halving’s Impact on Miners

One might wonder if miners would lose interest as their Bitcoin rewards continually decrease. However, with fewer rewards, the

Notably, the price of Bitcoin has typically increased significantly each time a halving has occurred, keeping miners engaged as the value of their reduced rewards also rises.

However, if the rewards become too small and the price doesn’t rise accordingly, some miners might find it economically unviable. Despite this risk, so far, the system has functioned as planned, ensuring the steady generation and distribution of new Bitcoins.

Countdown to Impact: The Next Bitcoin Halving in 2024

Every 210,000 blocks, another Bitcoin halving occurs. We’ve already witnessed this thrice: 2012, 2016, and 2020. Our current countdown is set for the next halving event in Q2 2024. Let’s take a historical tour of Bitcoin’s halving dates:

A Glimpse into Bitcoin’s Halving History

| Year | Block Height | Block Reward | Date (Projected) |

| 2024 | 840,000 | 3.125 BTC | April 27, 2024 |

| 2020 | 630,000 | 6.25 BTC | May 11, 2020 |

| 2016 | 210,000 | 12.5 BTC | July 9, 2016 |

| 2012 | 210,000 | 25 BTC | November 28, 2012 |

| 2009 | Genesis Block | 50 BTC | January 3, 2009 |

The block reward—a miner’s or pool’s prize for solving a block with a valid hash—is scheduled to halve per the Bitcoin protocol.

Future halvings to come

Below is an extended table of historic and future Bitcoin halving dates, block number and block reward changes, provided by Cryptoanswers.com, that takes us all the way to 2040 and mining rewards of only 0.1953125 BTC!

| Halving # (BTC) | Date | Block Number | Block Reward | BTC % Mined | Price on Halving Day (USD) |

|---|---|---|---|---|---|

| 0 (Bitcoin launch) | 3rd Jan 2009 | 0 (Genesis Block) | 50 BTC | 50% | N/A |

| 1st halving | 28th Nov 2012 | 210,000 | 25 BTC | 75% | $12.35 |

| 2nd halving | 9th Jul 2016 | 420,000 | 12.5 BTC | 87.5% | $650.53 |

| 3rd halving | 11th May 2020 | 630,000 | 6.25 BTC | 93.75% | $8,821.42 |

| 4th halving | between Feb to May 2024 | 840,000 | 3.125 BTC | 96.875% | ? |

| 5th halving | approx. 2028 | 1,050,000 | 1.5625 BTC | 98.4375% | ? |

| 6th halving | approx. 2032 | 1,260,000 | 0.78125 BTC | 99.21875% | ? |

| 7th halving | approx. 2036 | 1,470,000 | 0.390625 BTC | 99.609375% | ? |

| 8th halving | approx. 2040 | 1,680,000 | 0.1953125 BTC | 99.8046875% | ? |

The 2024 Bitcoin Halving: What to Expect

Come April 27, 2024, at block 840,000, the Bitcoin block reward is set to drop from 6.25 to 3.125 BTC. This date could fluctuate depending on Bitcoin’s hashrate—higher hash rates could lead to an earlier halving. The event is usually very bullish for Bitcoin, essentially making the digital asset much more expensive and competitive to mine, thereby leading to an increase in prices.

Is the 2024 Bitcoin Halving Priced In?

With the future supply of Bitcoin being public information, you would think all future halving events would be priced in, but according to a controversial crypto pundit’s model, we have already entered a new bull market and Bitcoin’s price will likely see triple digits post-2024 halving.

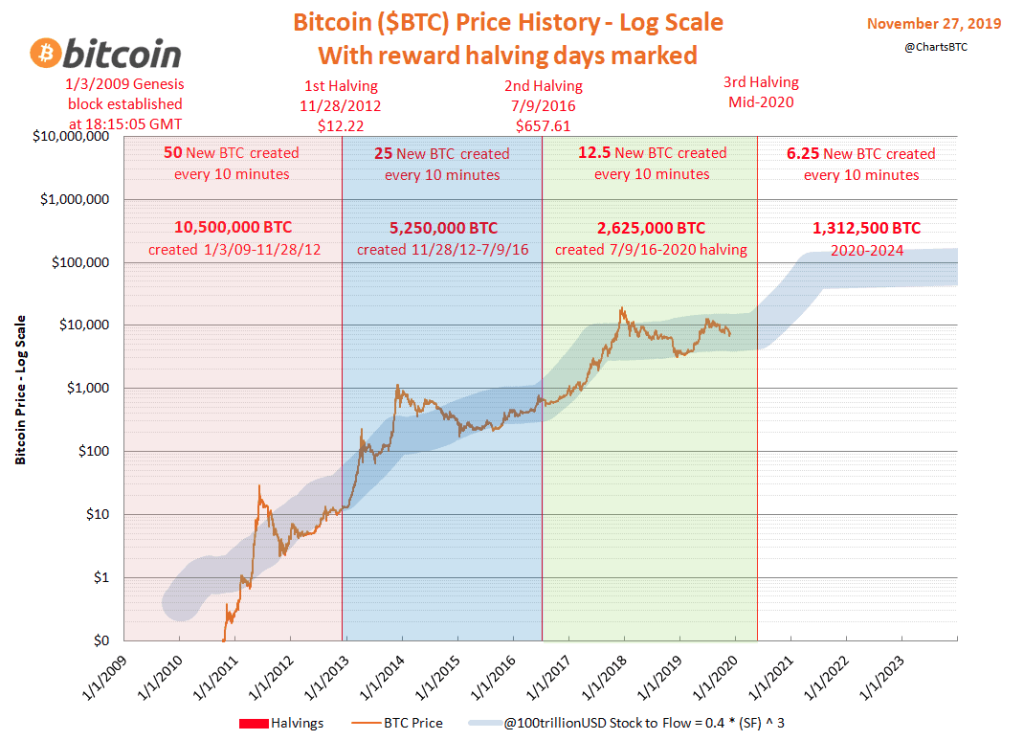

The Stock-to-Flow (S2F) model, developed by the prominent cryptocurrency analyst PlanB, predicts Bitcoin’s price based on its scarcity. Historical data supports its accuracy: after the first halving in 2012, Bitcoin’s price rose from $11 to over $1,000 within a year. Similar spikes occurred after the 2016 and 2020 halvings.

PlanB forecasts that the next halving in 2024 will push Bitcoin’s price past $100,000, potentially even reaching $200,000 due to wider adoption and the S2F model’s influence. However, according to Bloomberg Intelligence analyst Jamie Douglas Coutts, as of April 2023, about 50% of this predicted price increase is already reflected in the current market price.

While PlanB’s S2F model has proven reliable in the past, predicting cryptocurrency prices is inherently uncertain. The market has partially adjusted for the next halving, but the exact impact on Bitcoin’s price remains to be seen.

It’s important to understand that financial markets react in anticipation of future events like the Bitcoin Halving way in advance, and that’s there almost always an immediate sell-off right after in line with the “buy the rumor sell the news” mantra(for example, the two bull market tops in 2021 were in the aftermath of the Coinbase public listing and El Salvador Bitcoin legal tender announcement).

However, there’s a lot of potential good news coming in Q2 of 2023. Following September’s 6 month delay on a ruling, the halving will coincide with a decision by the SEC on whether or not to approve a bunch of Bitcoin spot ETFs by the likes of BlackRock and Grayscale. Coupled with a possible reduction in sky-high interest rates, these might help to pump Bitcoin’s price up. Just be aware that when everyone shares a similar opinion in crypto, the opposite usually happens. Therefore, employing a more conservative investment strategy such as dollar cost averaging (DCA) will help you get a more reflective overall buy-in price. There will be a lot of price volatility in both directions in 2024 most likely, and it’s important to be confident in the cost of your investment if you want to succeed.

Conclusion

The Bitcoin halving mechanism is an essential ingredient in Bitcoin’s continued success as a scarce investment asset, and the chain effect that its occurrence every 4 years sets off reverberates through the entire industry, affecting all stakeholders. While it shouldn’t be viewed in isolation, it’s a very bullish event that usually results in a supply shock and increased prices, which eventually find their way across all cryptocurrencies. Keep an eye not only on May 2024, but also the months preceding it. For example, the August and September before a halving are usually bloody, as the following chart shows.

As history has shown thus far, it’s a smart strategy to accumulate Bitcoin consistently instead of trying to time the market. What better way to do this than to utilize a highly secure and easy-to-use Bitcoin hardware wallet like CoolWallet S or CoolWallet Pro to stockpile your digital gold over time?

CoolWallet is the world’s original Bitcoin mobile hardware wallet, first launched in 2016, and comes with a sophisticated secure element that clocks a rating as high as EAL6+, biometric verifications that ensure all transactions must be physically executed, military-grade encrypted Bluetooth, an award-winning design, a wafer-thin waterproof and tamperproof exterior, and the ability to buy and sell, send and receive Bitcoin any place, any time, without drawing any attention.

Get your CoolWallet today and HODL your Bitcoin in style!

Disclaimer: This article is not financial advice in any way, but intended as educational content only. All opinions are that of the writer and doesn’t reflect CoolWallet’s viewpoints.