The opinions contained within this article are solely that of the author and don’t reflect the views of CoolBitX or CoolWallet team. The information provided herewith is for educational purposes only and should not be construed as financial advice of any kind.

If you believe in the concept of “Not Your Keys, Not Your Crypto” you probably take personal responsibility for your crypto portfolio by keeping it on a non-custodial solution (preferably a versatile hardware wallet like the CoolWallet) instead of centralized exchanges, which come with their own litany of horror stories of hacks and scams (the author may or may not have thousands of Dogecoins floating around the wreckage of the hacked and now-defunct Cryptopia exchange, forever lost).

Therefore, chances are you’ll know what a private key or recovery seed is. (If not, then Houston, we may have a problem and we probably won’t be seeing you on the moon…)

The road to crypto riches is paved with Bitcoin gold but unfortunately also littered with the wreckages of poorly managed, lost or hacked wallets. In fact, research shows that up to a staggering 20%, or 3.7 million, of all Bitcoins have been lost forever. And it’s not stopping there.

To drive home this scary statistic and help you protect your future wealth against yourself, we’re going to go over the basics really quick and then revisit the biggest private key horror stories and tragedies in Bitcoin’s brief history.

(New to Bitcoin? Check out our Big Bitcoin Beginner Guide for 2021 here)

What is a private key?

Simply put, we can analogize a private key with an ATM pin.

If you need to access funds in your bank account, you need to enter your pin number, right? But, unlike an ATM pin, which is usually some easy-to-remember sequence of 4 to 6 numbers like your birthday (please don’t use your birthday) , a private key is a randomly generated 256-bit number. This means it’s 256 numbers long and written in binary code.

Not so easy to remember, right? In comes the seed phrase, also known as the recovery seed.

What is a seed phrase?

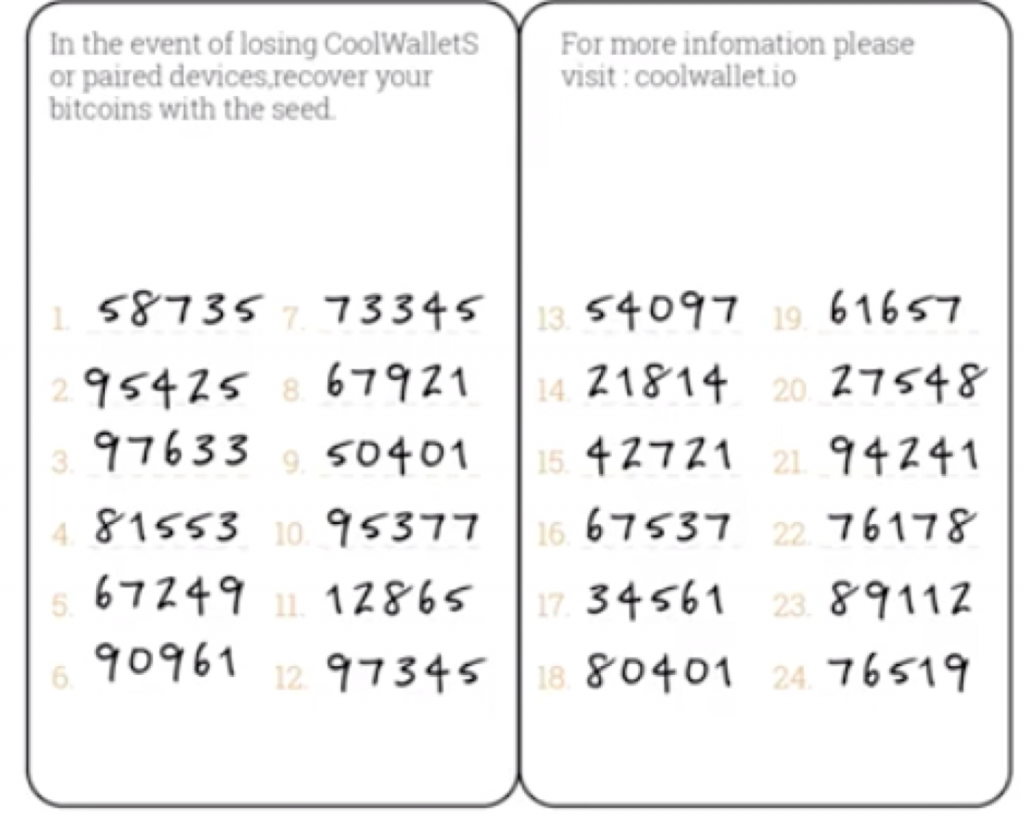

A seed phrase – also referred to as a mnemonic phrase, backup phrase, recovery phrase, or BIP39 seed phrase – is an easier-to-remember sequence of 12-24 words chosen from a list of 2048 words or in the CoolWallet’s case, numbers. This list of words represents your private key. Using cryptography, your crypto wallet can derive your private key from your seed phrase, and presto, you can buy bitcoin!

CoolWallet users will know of course that the CoolWallet doesn’t use seed words, but instead a sequence of 5-digit numbers that’s been derived from the BIP39 list. This is to ensure that non-native (and native!) English speakers don’t misspell words and thereby corrupt their recovery seeds. During the wallet generation, users also need to enter a checksum number to ensure they wrote their seeds down correctly.

Why should I keep my recovery seed or private key safe?

When creating a cryptocurrency wallet for the first time, you are required to backup your seed phrase. Some wallets may allow you to access your seed phrase from inside the wallet, but this is risky if your phone is not secure.

For example, when generating your CoolWallet recovery seed (no parties can access the private key, which is securely locked for all eternity inside our secure element), we strongly recommend you use our offline hardware wallet’s screen to show the seeds and commit them to a paper wallet only. To be as safe as possible, make sure that you never enter your recovery seed on a digital device and never ever keep a digital copy of any kind. Hackers know where to find them faster than you can say Siri or Bixby.

However, misplace your private key or seed phrase, and access to all your safely HODLed coins is denied. This is why it’s critically important to keep it in a safe, dry place and not to share it with anyone. If someone else gets a hold of it, they can steal your crypto assets and you’ll have no way of getting them back, other than pulling a Liam Neeson “Taken” revenge mission on them. Remember, all transactions on the blockchain are (theoretically at least) irreversible.

What should I do if I’ve lost or exposed my private key or recovery seed?

Losing your private key or seed phrase could just be the worst thing that could happen to any crypto owner. We wish we could tell you that there is something you can do if you misplace them but unfortunately unlike ATM pins, which can be reset through a phone call to the bank and answering a few security questions, all your crypto will be irretrievable if you need to restore access to your wallet and you don’t remember your recovery seed. POOF. Gone, just like that.

If you’re aware that you’ve lost access to your private key or recovery or exposed to it to third parties, you should immediately try to move your funds over to a new crypto address where you have full control over it (preferably a CoolWallet of course!).

If you don’t, you and your future generations might be crying over spilt milk for decades to come!

Just to prove how serious it is to keep your seed phrase and private key safe, we’ve listed 5 Bitcoin private key horror stories below. Some have happy endings, but most continue to this day with each new all-time high for Bitcoin piling on new misery. Don’t be these guys.

1) This British guy threw out a hard drive containing 7,500 bitcoin ($375m)

The original private key horror story and one that resurfaces every bull run. A 35-year-old British man has been urging city officials for years to let him search through a landfill in the Welsh city of Newport to retrieve a hard drive with 7,500 bitcoin on it, which he mistakenly threw out. At the time of writing, the coins would be worth over $375,000,000. Yes, you read that correctly.

According to James Howells, he accidentally disposed of the drive while clearing out his house in 2013. He is unable to retrieve it without being charged with trespassing as the landfill is not open to the public.

Howells believes that even though the external hard drive may be damaged, he will still be able to recover the bitcoin by reading the drive directly from the platter.

However, city officials have repeatedly denied him access on the grounds of the environmental and funding concerns of digging up the landfill.

2. This Russian politician lost 400 bitcoin ($200 million) after deleting his private key

A Ukrainian politician by the name of Davyd Arakhmia probably wants to throw himself off a bridge after deleting an encrypted file off his hard drive which contained his private key.

Before Arakhmia got involved in politics, he was an entrepreneur whose company accepted payment in bitcoin. According to Arakhmia, he wanted to free up space on his hard drive and deleted the file along with a few movies. Big mistake.

The good news for CoolWallet users: you can’t access nor delete your private key as it’s permanently locked inside your card’s secure element.

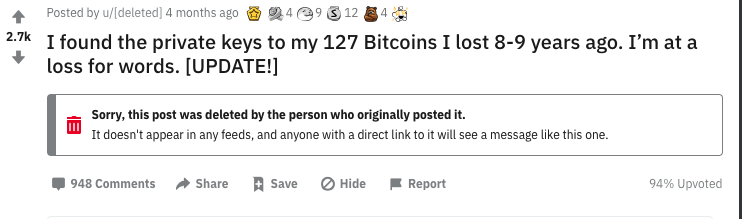

3. The student who lost (and found) his private key to 127 bitcoin ($6 million+)

Luckily for this guy, he found the private key to unlock his HODLed 127 bitcoin and cashed them out on December 22, 2020, for a cool $33,439.02 per coin, minus a 0.15% fee, which totaled roughly $4 million.

According to Reddit user BitcoinHolderThankU, he never actually lost the key but just forgot about it on an old Dell laptop. The anonymous bitcoin owner says he earned the coins through “surveys, watching videos, and completing random tasks”. Either this guy was very lucky, or absent-minded, or he just likes to flex his stacks of Satoshis. Probably a combination of all three.

Unfortunately, not everyone else on this list is as lucky.

4. The German engineer who forgot the password to his encrypted device containing 7,002 bitcoin ($350m)

Stefan Thomas, a German engineer living in San Francisco, has forgotten the password to his encrypted hard drive, called IronKey, which holds the private key to 7,002 bitcoin.

Thomas has lost the piece of paper with the password stored on it and IronKey allows users 10 attempts to guess their password before the contents are encrypted forever. He only has 2 attempts left before it becomes completely inaccessible.

Thomas, who was given the bitcoin in exchange for making an animated video in 2011 called “What Is Bitcoin?”, said in a recent interview that he’s made peace with the fact that he might have lost this gigantic fortune.

At the time of writing, his bitcoin would be worth over $356 million.

5. The exchange CEO who went to India and “died”, taking 26.5k BTC and 430,000 ETH with him

The next horror story pains us to share, because many normal retail investors were hurt in this now officially reported scam. Canadian exchange QuadrigaCX’s co-founder and CEOGerald Cotten allegedly died in India in 2018 while visiting the country to open an orphanage. Cotten was the sole custodian of the exchange’s cryptocurrency store, which is all held in cold storage.

According to Cotten’s widow, Cotten kept the digital wallet passwords on an encrypted laptop, which no one has been able to unlock since his death. This has resulted in over 115,000 users’ coins being lost, including 26,500 Bitcoin, 11,000 Bitcoin Cash, 200,000 Litecoin, and 430,000 Ether.

However, many believe that Cotten may have faked his own death and that this whole thing was a convenient exit scam to escape with investor funds.

In late 2020, the Canadian securities regulator OSC found that Quadriga was a fraud and its founder Cotten operating a Ponzi scheme, whose fraudulent behavior caused it to collapse.

Final Thoughts

Whatever the case, we want to reiterate the importance of being diligent with regards to where you store your digital assets. Don’t keep your coins on an exchange. It’s only a matter of time before the next hack happens.

Instead, opt for a crypto hardware wallet, like the CoolWallet S.

The device also has a safety rating of higher than CC EAL5+, is only 0.8mm thick, and 6g light so it fits in your wallet perfectly, allowing you to keep your digital assets discreetly close by at all times.

However,, you’ll still need to ensure your seed phrase is kept in a safe place. Don’t be like these guys and join this crypto wall of pain. Learn from their mistakes and protect your financial future.

Check out these articles for more tips on how to keep your CoolWallet and seed phrase safe.

Written by Werner Vermaak and Sarah Chapman