Another full-blown bull season is back, filled with crazy 2021 price predictions as Bitcoin tries to eclipse its highest ever price and cross into the promised land of $20,000 and beyond before 2020 mercifully concludes. Is justified or simply a perfect storm of market hype and events like the Bitcoin Halving, U.S. elections and stimulus, PayPal and financial institutions, COVID-19, or crypto-friendly regulations?

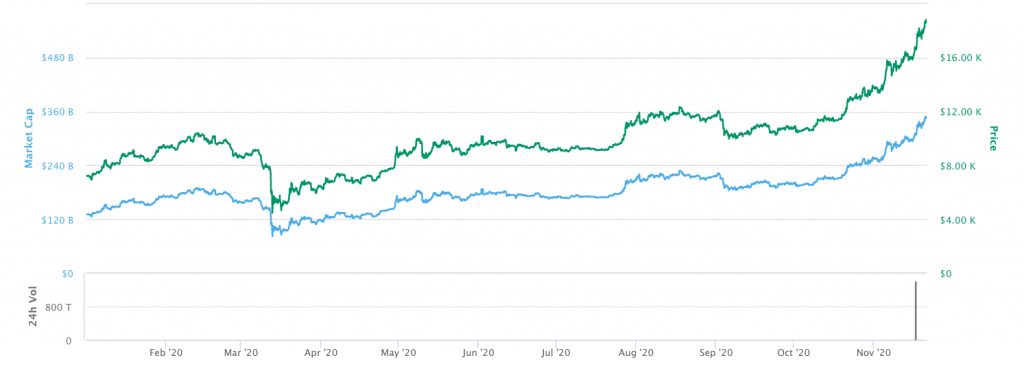

November 2020 has been an electrifying month for Bitcoin, the world’s first cryptocurrency, with prices not seen since the heady days of December 2017.

Continuing its rollercoaster ride this year, which has seen it bounce back from a March sub-$5k crash, one Bitcoin is currently nearly $19,000 on exchanges and closing in on its 2017 all-time-high (ATH) price. If 2020 has taught us one thing, anything is possible.

If you were around in crypto since 2017, you’ve probably learnt some invaluable lessons during its bull run and 2018’s devastating “crypto winter” that followed. This year feels different though, due to remarkable circumstances.

In fact, if you told someone a year ago that a Bitcoin would be worth $100k now, it would still sound less improbable than the pandemic’s fallout.

The big question for many now is: Will Bitcoin manage to cross $20,000? Maybe more important questions to ask are: Is that a market-related price and can it be sustained and improved on in 2021?

As the interest in Bitcoin switches from earlier this year’s FUD to irrepressible FOMO, social media and even traditional media are awash with bold predictions that Bitcoin will soon make everyone a millionaire (it would appear that 2017’s “lambo’s” memes are thankfully out of fashion this time around.)

Will it happen? Well, (fortunately!) Team CoolWallet is not in the business of speculating and making price forecasts. Since 2014 we’ve been solely concerned with keeping your assets, whether they decline or appreciate in value, as safe as possible in the most convenient and secure cold storage solution possible. Anyways, enough virtue-signaling.

Whether you’re a new crypto believer or bewildered traditional investor pulled in by market speculation, or a grizzled old timer who’s lived to tell the tale of Bitcoin’s numerous rises and crashes, this article is for you. No one is immune to FOMO or FUD.

We’ll leave the price speculation to you as the individual investor and rather focus on possible reasons for the crazy rise in the price of Bitcoin.

Why has Bitcoin soared in 2020?

It is important to note that Bitcoin was on the up before COVID-19 caused stock markets to crash worldwide, sheer panic nosediving Bitcoin’s price as well as everyone clambered to free up cash.

Starting 2020 at around $7,200, BTC hovered at over $10,000 as the Bitcoin Halving approached. As nations began to shut their borders and the coronavirus pandemic caught fire, Bitcoin dropped to under a terrifying $4,500 on Friday,13 March. Since then, it’s been onwards and upwards for Satoshi Nakamoto’s cryptocurrency, which celebrated its 12th birthday recently.

Here are some possible reasons for Bitcoin’s return to ascendance in 2020. Please note this list is not definitive in any way, and nothing in this article should be interpreted as financial advice in any way.

- The Bitcoin Halving

- COVID-19 pandemic

- The U.S. Elections and stimulus injections

- PayPal’s adoption of cryptocurrency

- Increasing regulatory clarity

1. The Bitcoin Halving

We’ve been told for ages that Bitcoin’s third halving would drive up the price due to increasing scarcity, and boy, did it ever. In May 2020 Bitcoin mining rewards dropped again, this time from 25 to 12.5 BTC, and it will again halve in four years time. Anyone with a basic understanding of supply and demand will understand that when supply drops and demand stays constant or increases, price should go up.

This is something that we’ve seen at previous halvings as well. Bitcoin’s lesser new rewards have driven up the cost of mining, making it unprofitable for many miners to operate and sell at low retail prices.

As its mining faucet slowly dries up until the last Bitcoin is mined in2140, there should be increasing price pressure affecting the buying and selling of Bitcoin.

2. The COVID-19 pandemic

At the time of writing, COVID-19 is far from done, with nearly 200k new cases recorded in the United States yesterday. As countries’ citizens are locked down and borders closed shut, it has been inevitable that unemployment has soared due to lower economic activity and domestic spending.

While U.S. unemployment has dropped from over 14% earlier in 2020 to 6.9% in October, it’s still nearly double pre-pandemic levels. This increasing economic uncertainty in all countries has caused many investors to look at so-called “safe haven” assets such as Bitcoin and other scarce assets like gold, which are more attractive to investors looking for stability and scarcity.

Case in point, a Mexican billionaire yesterday revealed he had invested heavily in Bitcoin after “losing faith” in his government.

The converse is also true: As more citizens get “free” money from governments, many of these retail investors use their stimulus checks to buy cryptocurrencies like Bitcoin as a safe haven asset.

With a maximum potential supply of only 21 million, Bitcoin certainly qualifies as the strongest digital safe haven asset out there.

3. U.S. Elections and Stimulus

As citizens and small businesses suffer, governments worldwide have no choice but to help their people through stimulus packages. With over $9 TRILLION in stimulus injections in 2020 alone, it is estimated that the United States this year has created 22% of the total US dollar since its birth in 1776. And more is coming.

This unprecedented printing of new fiat currency has caused the US Dollar to slump against other currencies, including the fixed-supply Bitcoin.

The uncertainty of the U.S. elections results have also driven many investors to the relative sanctuary of Bitcoin (ironic considering how volatile the price of BTC is!).

While neither presidential candidate had a clear policy on Bitcoin (although Trump disliked it), a slew of possibilities like further stimulus packages, increased social spending, potential trade wars with China caused the price of Bitcoin to keep climbing after it strongly rejected several bear attempts to drop it below $10,000 in Q3 2020.

Interesting fact: Did you know that Bitcoin also hit a record high after Donald Trump election win in 2016? The price? A staggering $738…

4. PayPal and banks are a-knocking

Some say this is the biggest reason for the current jump in Bitcoin’s price. In late October 2020, PayPal shocked the financial world when it announced it would offer crypto services in 2021 to its 350 million users at over 3 million online retailers. This massive endorsement from the payments giant was one of the most sought-after milestones for the crypto industry and a massive boost on the way to mass adoption.

And of course, don’t forget Grayscale, currently the world’s biggest institutional crypto investor, who made waves in August when they announced they had acquired $250 million in Bitcoin assets alone. Grayscale currently holds a staggering 500,000 Bitcoin for its clients.

As more and more big financial players and billionaires give their collective thumbs up to Bitcoin, more and more of the increasingly scarce Bitcoin is bought up and locked away in institutional vaults as long-term HODLs.

5. Regulatory clarity

It’s important to remember that PayPal’s decision to get into crypto followed that of the OCC, whose head published a vital clarification in June 2020, making it clear that U.S. banks were allowed to over crypto custodial services to U.S. customers if they adhere to the right licensing and registration requirements. Together with new simplified state-level licensing frameworks, is forcing the hand of big financial institutions to jump on the crypto bandwagon or be left behind for good.

While there has been bad news from regulators as well, countries and their crypto exchanges globally are now subject to the Financial Action Task Force (FATF)’s global virtual asset regulations, including the so-called “Travel Rule”.

This is forcing countries and jurisdictions to create and implement crypto regulatory frameworks in their countries to register and license crypto asset service providers (CASPs).

While these increasing rules are forcing a lot of smaller crypto companies out, it is also helping to boost institutional confidence in crypto and cleaning the industry up from a lot of fly-by-nighters and illegal operators.

Countries are beginning to take a long term view of crypto regulation (see for example the European Union’s new Markets in Crypto Assets proposal), which should be great news for an industry always uneasy about crypto bans.

Conclusion

The price of Bitcoin is determined by market sentiments derived from a mixture of economic, technological, and psychological factors. All are currently driving up its price as the world continues to slide into an uncertain future.

There are a lot of other reasons for the rise of Bitcoin (and Ethereum) in 2020 which we didn’t cover, such as possible price manipulation, the impact of stablecoins, the rise of decentralized finance (DeFi), The 2.0 coming of Ethereum, and more. There is no one single clear-cut answer.

Is the current price of Bitcoin an overvaluation, or can Bitcoin be worth $1 million or $0 in a decade from now as some advocates claim? Only time will tell.

What is certain if we look at its history is that BTC’s price will remain volatile for a while still, and that what goes up normally comes crashing down at a certain stage especially if the price moves parabolically. Just look at DeFi altcoins’ dismal Q3 track record after its incredible gains during the first half of 2020.

As more and more institutional investors enter the market, with deeper pockets and longer time frames to get a return on their investment, Bitcoin should hopefully become less volatile in its price.

As a retail investor though, it is important to do your own research and invest in crypto with a clear head, not only buying but also selling at the right price for you, based on your risk tolerance.

If you’re new to crypto and don’t really understand how Bitcoin works, do not repeat the mistakes that others made in 2017 and just throw your money at it, because that would equate to you betting randomly on a horse at the track.

Bitcoin’s market psychology oscillates wildly between FOMO and FUD, and what looked like the start of a glorious bull run can soon drop you off in the pits of hell as the cryptocurrency’s price goes over a cliff and forces you to sell at a steep loss.

If you’re going to invest in Bitcoin and other cryptocurrencies, please take a sensible approach and invest only what you can afford. Take a look at strategies like Dollar-Cost Averaging (DCA) and importantly, control your greed!

Do not be manipulated or swayed by social media “experts” who are shilling for you to invest your life savings in crypto as they make crazy price predictions for 2021 and beyond. Remember, they also benefit from you buying, as it drives up the value of their investments.

Most of these pundits were nowhere to be seen during the dark days of 2018’s crypto winter that followed the 2017 bull run and they will surely disappear again if Bitcoin were to ever drop again to those prices.

However, it’s clear that there are a lot of fundamental positives for Bitcoin leading into 2021 that were not there during 2017’s parabolic run. It has a bright future and both “caveat emptor” (buyer beware) and “caveat venditor” (seller beware) are now in play.

Bitcoin is growing up as a more mature asset class, and so should you as a part-owner. The higher the price, the bigger the stakes!

Good luck on your journey and whether you trade short-term or invest long-term, keep your crypto safe. Look no further than CoolWallet S for superior cold storage and safe and easy purchasing and trading of Bitcoin via both crypto and fiat options.

Written by Werner Vermaak

Disclaimer: CoolBitX provides these blog posts for general educational purposes only. Information on this blog expresses the opinion of the author only. It does not constitute professional legal or financial advice and should not be considered as such. The author or company may update the information on this article at any time without prior notice and do not guarantee the work to be up to date and accurate. To the best of our knowledge, the information provided here is factual at the time of writing.