(Please note- the following article should not be considered as legal or financial advice. )

Table of Contents

- 2008: The Creation of Bitcoin

- 2009: Bitcoin’s pre-exchange listing period

- 2010: Bitcoin lists on exchanges

- 2011: Bitcoin goes up and up…then down

- 2012: Bitcoin gets professional

- 2013: More Bitcoin highs and lows

- 2014: Mt.Gox hack crashes Bitcoin (again)

- 2015: Bitcoin shows a steady recovery

- 2017: Bitcoin’s record bull run

- 2018: Bitcoin and the Crypto Winter

- 2019: Bitcoin’s bull market returns

- 2020: Bitcoin’s halving vs coronavirus

5. The Best Bitcoin Price Trackers

1. Introduction

It doesn’t matter if it’s 2010 or 2020. Bitcoin is still the most important vital sign that everyone in blockchain check to assess the health of the cryptocurrency market.

Dropping from the highs of 2017 to the lows of 2018, just to bounce back up to $13,000 in late June 2019, and then crashing down again in 2020 due to coronavirus outbreak, the price of Bitcoin still dominates public discussion. Currently displaying a steady recovery in April 2020, with a price at the time of writing at $7400 as the Bitcoin Halving event on course for May 2020,, Bitcoin is once again living up to its reputation as a resilient but volatile new asset class.

Whatever happens to Bitcoin, affects almost 99% of the altcoins out there. Bitcoin, after all, was the very first cryptocurrency on the market. It has unwaveringly remained the crypto that most people know, talk about, and invest in.

This guide will give you a crash course in some of your most burning BTC price questions. Read on to discover more!

2. Bitcoin Price History: A Timeline

In order to understand Bitcoin’s price today, as well as its possible future price timeline, it is useful to take a look back on the history of Bitcoin price. While it would be impossible to list every event since its invention that had an impact its price, below, we’ve highlighted the most notable ones.

2008: The creation of Bitcoin

Let’s start right at the beginning, October 2008. This was the month the creator of Bitcoin, Satoshi Nakamoto, published a white paper in an online cryptography mailing list called Bitcoin: A Peer-to-Peer Electronic Cash System. In their piece, they highlighted the necessity for a new means of the payment system to tackle the long-standing problems of traditional currencies and financial institutions.

Satoshi outlined that the solution to such problems lays in their invention of a digital, decentralized currency called “Bitcoin”. They envisioned that Bitcoin would act as an “electronic payment system based on cryptographic proof instead of trust, allowing any two willing parties to transact directly with each other without the need for a trusted third party.”

But while Satoshi’s proposal was completely groundbreaking – the likes of which the world had never seen before – it didn’t make anywhere near the type of impact that one would expect for such an innovative creation. The reason for this is that the online cryptography mailing list the paper was published on was incredibly niche – targeted at those interested in cryptography (all the way back in 2008, mind you!).

Notice that we used the gender-neutral pronoun, “they” to describe Satoshi Nakamoto? That’s because the identity of Satoshi is still a complete mystery – we don’t know for sure about their gender, nationality, age, or even if they are one person or a group of people. Unbelievably, they have managed to keep their anonymity all of this time! This has caused rampant speculation and investigations to try to uncover who the real Satoshi Nakamoto is.

2009: Bitcoin pre-exchange listing period

It was on January 3, 2009, that Bitcoin was brought to life when Satoshi mined the genesis block (block number 0), allowing him to amass a mining reward of 100 bitcoins. The first ever bitcoin transaction took place on January 12, 2009, which was a transaction from Nakamoto to programmer Hal Finney.

Finney was an ardent supporter and contributor to the Bitcoin network from the very beginning, so was rewarded for his hard work with 10 bitcoins.

In these early days before Bitcoin was listed on an exchange, the price of mined bitcoins was determined via individuals trading BTC on a Bitcoin forum. There was no mandated price to look to – so it was wholly a negotiation between the seller and buyer to come to an agreement over BTC’s worth. To exemplify just how niche BTC was in those days, consider that in March 2010, a user by the handle “SmokeTooMuch” unsuccessfully tried to auction off 10,000 bitcoins for $50.

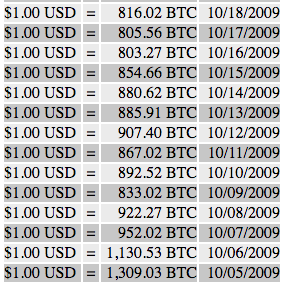

There was, however, a service called New Liberty Standard that allowed BTC to be bought via PayPal. In a fact that will make you want to travel back in time machine to this period, the first recorded exchange rate they published (on May 10, 2009) was 1309 BTC per 1 USD. With today’s exchange rate (August 30, 2018), a $1 investment in BTC back then would be worth over $9,000,000 today!

A glimpse at Liberty Standard’s BTC prices per $1 USD. (Image credit: Liberty Standard / WayBack Machine)

Interestingly, New Liberty Standard calculated their BTC prices by “dividing $1.00 by the average amount of electricity required to run a computer with high CPU for a year. This amount, 1331.5 kWh, was multiplied by the average residential cost of electricity in the United States for the previous year, $0.1136, divided by 12 months divided by the number of bitcoins generated by my computer over the past 30 days.”

2010: Bitcoin lists on exchanges ( for < $0.14!)

On March 17, 2010, the very first BTC exchange, BitcoinMarket.com (now defunct), opened for trade. For the first half year after it started trading, BTC remained below 14 cents. However, in the summer of 2010, the cryptocurrency started gaining momentum, with this triggering a movement in the price listed on exchanges.

It was during this time, on May 22, 2010, that a particularly noteworthy transaction took place – one which has already cemented itself firmly into Bitcoin folklore. Dubbed “the Bitcoin pizza,” a Florida programmer by the name of Laszlo Hanyecz transacted what is believed to be the very first real-world bitcoin transaction. He purchased two pizzas delivered from Papa John’s for a cool 10,000 bitcoins. At the time of writing, using today’s bitcoin exchange rate (February 2019), those two pizzas would be worth a staggering US$40 million!

The Bitcoin pizza transaction is still celebrated every year

On July 12, 2010, BTC’s price increased by 900% from $0.008 to $0.08 for 1 bitcoin in just 5 days. Five days later, the infamous cryptocurrency exchange Mt. Gox was launched.

Bitcoin’s first and only major security flaw

On August 15, 2010, the first and only major security flaw in bitcoin’s history was exploited when a vulnerability in the bitcoin protocol led to a staggering 184 billion BTC generated in a transaction. Although the transaction was identified, the bug fixed, and the transaction erased from the transaction log (as well as the network forking to an updated version of the bitcoin protocol), the hack caused the price of BTC to drop dramatically.

Bitcoin in 2011: Up and up… and then down

In October 2010, BTC passed one bit for the first time, that is, $0.125. One month later, not only did Bitcoin’s share capital reached 1 million USD, its exchange rate on MtGox reached USD$0.50 per BTC.

On February 9, 2011, the price of one BTC reached parity with the US dollar on MtGox for the first time. Bitcoin experienced its first major bubble on June 8, 2011, when it hit $31 – and subsequently, its first major price drop, when it plummeted by 68% in the days following. The price would keep falling for the rest of the year, finishing the year at around $2. It would take another 2 years for its price to hit July’s all-time high again.

For more info about the biggest Bitcoin crashes, take a read of this Forbes article.

Competitors emerge: the advent of altcoins

2011 was also the year alternative cryptocurrencies to Bitcoin – known as “altcoins” – began to populate the cryptocurrency landscape. Created from bitcoin’s open source code, examples of the altcoins that emerged include GeistGeld, I0coin, Fairbrix, Namecoin, and SolidCoin. Notably, this was also when Litecoin was created, a cryptocurrency marketed as “the silver to Bitcoin’s gold.” The emergence of competitors via the advent of altcoins meant that BTC would never again have a total monopoly of the market.

Bitcoin in 2012: Getting professional

After several successful hackings, including a theft on Linode of around 50,000 BTC in March 2012, and even an investigation by the FBI in April 2012, the Bitcoin Foundation was established in September 2012 with the initial aim to revive the cryptocurrency’s reputation and further its development and mass adoption. Since then, the foundation has helped to positively steer the public, political, and media discourse about Bitcoin. These three realms which we identify in the section below as having an influence on bitcoin price.

The front page of the FBI’s Intelligent Assessment of Bitcoin. (Image credit: Wired)

In October of the same year, the global bitcoin payment service provider BitPay reported having more than 1,000 merchants accept BTC with its services.

Bitcoin in 2013: More highs and lows

Like the years before it, in 2013, a number of events positively and negatively impacted the price of BTC over the course of the year. In terms of highs, in February, Coinbase reported selling US$1 worth of BTC in a single month at over $22 per coin. By the end of March, Bitcoin capitalization was over 1 billion USD. The first Bitcoin ATMs were introduced in October, opening the door for greater public adoption.

As for lows, in April, BTC’s price dropped 71% from $233 to $67 in just 12 hours. Another event that initially seemed right at the top of the list of lows was the FBI shutting down the online black market Silk Road in October and seizing around 26,000 BTC from user accounts (worth around $3.6 million at the time). Bitcoin was used as the primary means of payment on Silk Road, so its closure marked an end to a significant avenue of actual BTC usage.

Few could have foreseen that the closure of Silk Road would contribute to an unprecedented growth in BTC’s price. (Image credit: CoinMarketCap)

Interestingly, while most pundits expected its closure to result in a massive price drop for BTC, it did the opposite. Although it fell from $125.49 on October 1 to just under $100 the next day, by the third it had already started to recover to $116.82. The price kept rising, and rising for the rest of the year – eventually hitting a new all-time high of $1,122 on November 30. The high didn’t last, however, with the price more than halving in mid-December, timing that was concurrent with the People’s Bank of China prohibiting Chinese financial institutions from using BTC.

Bitcoin in 2014: The Mt. Gox hack crashes BTC

The year 2014 will forever be marred in Bitcoin history as the year when the Mt. Gox incident took place. As mentioned above, Mt. Gox was launched in 2010. It saw great success by becoming both the leading bitcoin exchange and the largest bitcoin intermediary by 2013/2014 when it was handling more than 70% of all bitcoin transactions worldwide.

However, in February 2014, the exchange reported that approximately 850,000 bitcoins belonging to its customers were missing in February 2014. At the time, the loss amounted to more than $450 million. As a consequence, the exchange was forced to shut halt bitcoin withdrawals.

It was unclear then how exactly the bitcoins went “missing”. In April 2015, the security company WizSec came to the conclusion that “most or all of the missing bitcoins were stolen straight out of the Mt. Gox hot wallet over time, beginning in late 2011.” It was, in fact, not the first issue the exchange had faced since its establishment, with all range of problems from lawsuits and a warrant issued by the US Department of Homeland Security to seize money, to major withdrawal delays.

All in all, the Mt. Gox incident shook the confidence (and emptied the pockets) of a great number of cryptocurrency traders at the time. With reduced confidence and substantial losses, the price of bitcoin dropped the $500 range, before recovering to the $600 to $700 range. The incident is still referenced as an example of the inherent problems with cryptocurrency exchanges, and thus cryptocurrency in general, and feeds into the perception by the general public and media that bitcoin is too complex, problematic, and niche to be widely adopted.

2014 was also the year Bitcoin’s biggest competition to date in terms of market cap burst onto the scene: Ethereum.

Bitcoin in 2015-2016: Relatively steady growth

2015 overall was a relatively quiet year, with no major highs or lows, nor events that significantly swayed its price. BTC experienced a slow but steady price growth by starting off the year at $315, and ending at $426. Initially, its price continued to steadily rise into 2016, albeit at a slightly faster pace than the previous year. Around June, BTC’s price picked up substantially, where it hit $772, only to fall again. From August until December, BTC had a bull run – with the price sharply rising mid-December to end the year on $953.

As far as BTC goes, 2015 and 2016 were both relatively steady years of growth. (Image credit: CoinMarketCap)

Bitcoin in 2017: Positive developments lead to an all-time-high (ATH)

2017 was a very positive year for bitcoin developments – with both greater user and business adoption. For instance, 4.6 times more Japanese online stores began to accept BTC over the past year, and the cryptocurrency exchange Poloniex had experienced an increase of more than 600% of active traders online from January to May, with 640% more transactions.

It was also the year many lawmakers and financial institutions worldwide signaled their greater support of the cryptocurrency. For example, Japan legislated to accept BTC as a legal form of payment, and Norway’s largest online bank integrated BTC accounts.

From January to April, the price rose steadily from $965 to $1316. On May 21, BTC surpassed $2000 for the first time, and from there, continued to quickly gain traction at price.

On August 1, the Bitcoin network split in an event now known as the Bitcoin Cash hard fork. Although many were expecting this to lead to a crash in BTC’s price, following the split, it fell slightly from $2874 to $2719. It quickly recovered, reaching a new ALT of $3000 on August 6, and surpassing $4000 by mid-August. At the start of September, it was $4710, but its bull runs briefly impeded by the announcement of China’s ICO crackdown on September 4, which resulted in a dip from $4531 to $4308.

Too many ATHs to keep up with

November and December were the glory days for BTC. (Image credit: CoinMarketCap)

From October to the end of the year, it was a case of one ATH replacing another. At the end of October, $6000 was reached for the first time, with $7000 following in early November. On November 20, a new ALT of $8000 was reached, demonstrating a quick recovery from a crash of $5760 just days before.

The rest of the year would go down in history as Bitcoin’s biggest bull run. What caused the bull run is attributed to a number of factors, including greater media attention, an increase in public interest fueled by a fear of missing out (FOMO), greater institutional interest, and the introduction of BTC futures trading. At the start of December, $10,699 was hit, and then the price continued to increase by thousands every couple of days – until it hit its all-time high to date of $19,429 on December 17.

The high was not sustained, however, with the price dipping in the following days, going back down to $13,311 on December 24, a correction that essentially shaved billions of dollars off BTC’s market capitalization. Ironically, the decline is considered by many, including the Federal Reserve Bank of San Francisco, to have been a consequence of the launch of Bitcoin futures trading. The year was finished on $13,313.

Bitcoin in 2018: A long slide into Crypto Winter

A year to date view of BTC’s price. (Image credit: CoinMarketCap)

BTC started the year off relatively strong at $14,112 and proceeded into a bull run that peaked on January 7 at $17,462. As you can see from the chart above, that peak represents this year to date’s highest price.

Just a day later, on January 8, CoinMarketCap removed the prices of South Korean exchanges from its calculations without warning. Consequently, a substantial selloff was triggered, causing the price to lose thousands in the days following, dropping to $13324 on January 11.

On January 26, CoinCheck, one of Japan’s most popular exchanges, stopped all withdrawals to respond to a possible hack. The news was widely reported in the media, which was perhaps a contributing factor to BTC’s price falling by 3.4%.

SEC steps in

While in early March, BTC was enjoying a price range in the $10,000’s to early $11000’s, it dipped sub $10,000 following the SEC’s March 7 announcement that online platforms trading digital assets must register with them.

Bans on ads

2018 has also seen some interesting announcements regarding the advertising of cryptocurrencies. These announcements are widely considered to have had an impact on the crypto market as a whole. For example, on January 30, Facebook announced a blanket ban on crypto ads. This was followed by Google announcing a ban on crypto and ICO advertisements on March 14, and Twitter on March 26. After all three announcements, BTC price dropped.

Major crypto exchange hacks

A number of significant hacks occurred in 2018, all of which have been said to have caused substantial price declines. Notable hacks include the aforementioned CoinCheck hack and the hacking of South Korean exchange Conrail on June 10, which contributed to BTC declining by 10%.

ETF – Will they or won’t they

One event that had many traders speculating over BTC price were the proposals for two bitcoin ETFs to be listed on the New York Stock Exchange. Those anticipating the proposal to pass speculated that it would lead to a massive bull run. In the end, the proposals were rejected, shutting the door on the bull run that many hoped would stimulate the price above the $6000 to $9000 range we have seen for most of the year.

Bitcoin Cash Hard Fork splits community in two

Coupled with an increasing focus by authorities to regulate or outright ban Bitcoin, an acrimonious Bitcoin Cash hard fork caused a bitter and public feud between Roger Ver and Craigh Wright and tremendous market uncertainty. BTC’s price continued to slide down as many investors seemingly gave up on the crypto industry. Hitting a low of $3130 during mid-December, Bitcoin closed 2018 out in miserable shape, clinging to life at $3831.

Bitcoin in 2019- The Bull Market Returns

With the Crypto Winter in full effect during the end of 2018, few analysts and even HODL’ers anticipated anything but another tough year for Bitcoin. However, as Lauryn Hill sings, “After winter, must come spring”, and this was prescient for Bitcoin too. After 11 brutal months, Bitcoin’s price started climbing again. And climbing, and climbing.

By the 1st of April 2019, Bitcoin’s price spluttered over the $4,000 mark. What was to follow would have sounded like an April Fool’s joke if it wasn’t true. By the end of April 2019, after a very positive Consensus conference week in New York, BTC traded at over $5,200. By the end of May, it skyrocketed to $8,600.

Bitcoin price history: January to August 2019 (Source: CoinMarketCap.com

Finally, on June 22, 2019, Bitcoin’s price once again broke the mystical 5-number barrier, cracking $10,000 effortlessly and powering up to over $13,000 in a matter of days before running out of steam. The bull market was officially back!

What caused the 2019 Bitcoin bull run?

What was the reason for Bitcoin’s great reversal of fortune, so to speak? While everyone speculated and conspiracy theories abounded once more, in reality it’s hard to point out one specific event or cause. More likely, a combination of factors helped to revive Bitcoin.

Some of these factors were:

Bitcoin’s hash rate and daily users (1million by June 2019) kept increasing, showing its potential and increased stability as an investment alternative.

Industry and government news were also predominantly positive, with institutional investors and politicians singing digital assets’ praises and big names like JP Morgan and Facebook jumping on the crypto bandwagon with their JPM and Libra corporate cryptocurrencies, which legimitised the potential of Bitcoin.

Facebook’s Libra alliance

Bitcoin’s resilience in the face of a prolonged bear market proved to investors that BTC had matured and was undervalued. With a trade war looming between the US and China and other macro-economic factors causing mayhem on traditional markets, Bitcoin suddenly became increasingly appealing as a safe haven asset.

Finally, some analysts view Bitcoin’s bull run as a natural reaction to the coming Bitcoin rewards halvening in 2020. Usually when Bitcoin’s mining difficulty is set to increase, its price shoots up a year beforehand.

At the time of this article’s previous update in August 2019, Bitcoin’s price was picking up momentum once again and changing hands at over $11,000.

Unfortunately, its resurgence seemingly decimated the altcoin market’s value, with almost all other digital assets suffering huge drops in satoshi (vs BTC) and fiat value (vs USD). Investors are especially disappointed in Ethereum and Litecoin’s current performance, considering the corresponding hike in value during Bitcoin’s 2017 bull run.

Bitcoin in 2020- The Halvening vs Coronavirus pandemic

The year 2020 has not been kind to Bitcoin’s price, and it’s not even it’s fault. Starting the year quick out of the starting blocks on 1 January ($6833), it quickly rose to $9500 by the end of January 2020, as hype around May 2020’s Bitcoin halving started building. February 2020 saw Bitcoin finally return to five figures as it cracked the $10,000 mark.

Then, an unlikely new nemesis arrived: COVID-19. The escalating coronavirus pandemic unleashed hell on both traditional and crypto markets in mid-March 2020 as the world’s borders shut close, causing a meltdown in Bitcoin’s price. With exchange markets like BitMEX struggling to keep liquid, Bitcoin’s price dropped from over $9000 to as low as $4421 (according to CoinmarketCap) by 13 March 2020.

While many doomsayers yet again predicting the demise of Bitcoin and cryptocurrencies after it seemingly failed its test as a safe haven asset, the cryptocurrency’s recovery since has been slow and steady. By April 7 2020, the time of this update, Bitcoin has recovered to just over $7400, as the halvening draws near (currently on track for 13 May 2020).

So what does the rest of 2020 hold for BTC’s price?

As we explore in the final section of this article, “Bitcoin Price Predictions,” no one really knows. But as you’ll read, that hasn’t stopped people from making predictions. There is once again a lot of bullish sentiment in the market.

One thing is certain though, Bitcoin’s price will remain volatile. With increasing regulation coming in, such as the Financial Action Task Force formalizing the Travel Rule for digital exchanges worldwide, trade wars happening, Bitcoin Halvening drawing nearer and scams and hacks continuing to wreak havoc on investors’ confidence at times, we’re certainly set for another bumpy ride. We’re just not sure if it’s going to be upwards or downwards!

If you’re interested in learning more about Bitcoin’s major milestones since 2008, we recommend checking out the following resources we referenced to write the above section i.e. the ‘Bitcoin History page’ on Bitcoin Wiki, the ‘History of Bitcoin’ on Wikipedia, and Investopedia ‘If You Had Purchased $100 of Bitcoin in 2011’.

3. What Determines Bitcoin’s Price?

When it comes to BTC’s price, there is not one factor that single-handedly influences its price. Rather, there is a multitude of factors that may influence its price at any one time. Listed below are some of the most notable:

First mover advantage

One intangible, but nevertheless the critical factor that influences Bitcoin price is its first mover advantage. First mover advantage is a term used to describe the set of advantages that come with being the pioneer in a given industry.

As Bitcoin holds the title of the world’s first cryptocurrency, it has a number of unique attributes (compared to cryptocurrencies that came after it) that work together to support its growth in both adoption and price. Examples include its:

- Greater overall media exposure,

- Greater level of public awareness,

- Earlier and greater adoption levels from merchants, and

- Ability to establish loyal investors early on

So, how do these attributes impact its price? Bitcoin is able to leverage them to instill greater investor, merchant, and media confidence in it as a cryptocurrency. However, there is also a flip side – its set of first-mover disadvantages. As many of bitcoin’s so-called shortcomings are associated with its early creation, being the first crypto on the block can be said to have a negative influence on its price. For instance, with additional media attention and public awareness also comes with additional scrutiny and criticism.

Moreover, many of the problems bitcoin faces, such as its lack of scalability, were not foreseen at the time of its creation. Conversely, cryptocurrencies that have come after it has had the opportunity to address these problems in their own design. By implication, anyone concerned about Bitcoin’s problems may choose to invest in these other cryptocurrencies instead.

Want to learn more about Bitcoin’s first-mover advantage?

We thoroughly explain what it is and its implications in our mammoth guide, ‘What is Bitcoin?’.

Positive and negative news

Given that it is the cryptocurrency which is not only the most well-known to the public but also the most written and spoken about in the media, Bitcoin price is also impacted by news cycles.

You can think about the impact the news has on its price as similar to how news stories impact stock prices. When there are numerous news outlets and stories reporting positive news about BTC and/or cryptocurrencies in general, the market may see a positive impact. One reason why is that positive news can cause what is popularly known as ‘fear of missing out’ or ‘FOMO.’ That is when people think that it’s their last chance to buy BTC at a certain price, and subsequently panic buys – causing the price to rise.

In contrast, when reporting takes a doom and gloom angle on either bitcoin or cryptos, the market may see a negative impact. In crypto, this effect is referred to as ‘fear, uncertainty, and doubt,’ or ‘FUD’ for short. FUD describes when people sell off their crypto due to feelings of uneasiness – causing the price to fall.

It’s important to note the use of the word “may” above, as the influence of the news cycle on cryptos shouldn’t be taken as an absolute – but instead be considered as one out of many factors that may impact the price.

A word of warning about looking to traditional news outlets for insights about the price of BTC, as Pedro Febrero points out, many of the experts who report on cryptocurrency markets have an understanding of traditional financial markets, but don’t understand the particulars of cryptocurrency markets to accurately report on them.

Bitcoin Regulations

If you’ve been following Bitcoin price changes with a sharp eye, you would have recognized the substantial impact that regulation laws can have on its price. Regulations impact BTC’s price in a more quantifiable way than many other factors as they either limit or expand citizens’ access to cryptocurrency and blockchain technology.

It is notable that up until 2017, Bitcoin was at large, unregulated. The lack of governmental intervention allowed for the market to grow in an unconstrained way. However this changed in 2017 when the popularity of cryptocurrency saw new heights, and the governments of many countries scrambled to issue legislation and regulations to assert greater control. Since then, the rate at which governments are issuing regulations is increasing.

This is notable as whenever there have been rumors or actual implementation of regulations that impact the trading of cryptocurrency in countries considered major crypto hubs, the market is perceivably affected.

Some well-known examples of the impact of regulations include:

- BTC fell 10% to sub $10,000 following the Security and Exchange Commision (SEC)’s announcement on March 7, 2018, that “online platforms trading digital assets that are considered securities need to register with the agency.”

- “Black Tuesday”: Regulatory uncertainty in China and Korea saw both BTC and altcoin prices drop by 40% on January 16, 2018

- Japan’s accommodative approach to cryptocurrencies has continued to contribute to price growth in a time of increasing regulations from other Asian countries

For more insights about the way regulation affects the market, check out this Coin Telegraph article.

Increasing adoption and utility

The level of utility BTC has both online and in the real world is one factor that affects its price. If individuals, as well as businesses, have more opportunity to make transactions with BTC in an easy and convenient manner, they will be more likely to adopt it as a technology to use in their daily lives. And with greater adoption, will come greater demand. Combine this with the fact that the total supply of BTC is capped at 21 million, and you have a perfect formula for price growth.

So how do you create greater utility? Greater levels of merchant adoption. One of the common criticisms about Bitcoin, and cryptocurrencies, in general, is the relatively low level of merchant adoption and therein ‘real world usage.’ Cryptocurrencies have still yet to reach mainstream merchant adoption, so the number of merchants that accept crypto payments for their products or services is still relatively limited.

That being said, Bitcoin leads all other cryptocurrencies in the number of merchants that accept it as a form of payment. This is in part due to its first-mover status, as highlighted above, but also because of its very nature as a digital currency (keep in mind that not all cryptocurrencies are designed to be used as digital currencies akin to fiat).

The general public’s knowledge of Bitcoin

If you’ve been in the cryptocurrency game for a while, or have just started out, you’ve probably already encountered the overall lack of knowledge and ignorance the general public has about Bitcoin.

Whether it’s someone making an absolute statement about Bitcoin being “a complete scam,” and “only a tool for criminals,” or someone who doesn’t properly understand the particular features, functions, or technicalities of Bitcoin, it’s clear that general misconceptions about Bitcoin are still rampant in the general public.

This has a considerable impact on the price of Bitcoin. Ignorance, after all, stymies progress, so if general discourse around Bitcoin is still primarily negative, adoption levels will be affected, and in turn, bitcoin price.

The total supply of coins limit

A factor that is predicted by many to cause the price of Bitcoin to drives up in the future is Bitcoin’s market cap limit. Bitcoin’s maximum supply of coins is 21 million bitcoins. That is, there will only ever be 21 million coins ever mined, and after they’ve all been mined – that’s it.

Bitcoin’s upcoming mining rewards halvening in 2020 will make BTC even scarcer, and the price likely higher.

At the time of this article’s first publication (August 30, 2018), 17,237,100 bitcoins have already been mined. This represents 82% of the total supply.

It is reasoned that as the amount of BTC yet to be mined becomes scarcer, and demand increases (due to a number of factors, including its growing scarcity), more people will be encouraged to buy in order to get a piece of the ever-dwindling cake. Even Litecoin creator Charlie Lee recommended that crypto holders should first own 1 BTC before buying other cryptos. He reasoned that there are not enough bitcoins for every single one of the estimated 32.9 million millionaires in the world to own one whole bitcoin!

Even Charlie Lee recommends buying BTC before other coins! (Image credit: Charlie Lee’s Twitter)

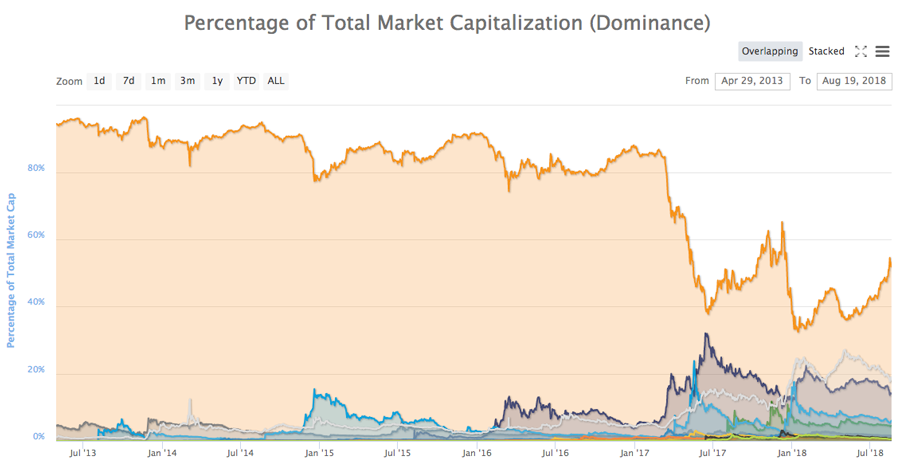

Market Dominance

Since its inception, Bitcoin has continually dominated the total cryptocurrency market cap. In other words, in comparison to other cryptocurrencies, Bitcoin has always had the greatest share of the total dollar value of the crypto market. While history has shown that its growth in dominance does not necessarily lead to its growth in price, there is oftentimes a correlation between the two.

Each colored graph line represents a different cryptocurrency’s percentage of the total cryptocurrency market cap. The orange graph line indicates Bitcoin’s percentage. (Image credit: CoinMarketCap).

Each colored graph line represents a different cryptocurrency’s percentage of the total cryptocurrency market cap. The orange graph line indicates Bitcoin’s percentage. (Image credit: CoinMarketCap).

4. When Should You Buy Bitcoin?

It’s the golden, but loaded question: “When should you buy BTC?” Just like you’ll find with everything anything cryptocurrency-related, you’ll get a range of different answers to this question depending on who you ask. Here is a selection of some common approaches traders take when deciding on the ideal time to buy:

Dollar Cost Averaging

Dollar cost averaging (DCA) is one of the most practical approaches to take when buying BTC. This isn’t an approach exclusive to buying bitcoin, nor cryptocurrency in general, however. Dollar cost averaging is a popular investment technique that has been used well before the advent of cryptocurrencies.

If you’re unfamiliar with the term, Investopedia describes dollar cost averaging as, “an investment technique of buying a fixed dollar amount of a particular investment on a regular schedule, regardless of the share price. The investor purchases more shares when prices are low and fewer shares when prices are high.”

One of the main advantages Investopedia identifies that DCA offers is a lack of emotion-led trading. This is because DCA is focused on “investing the same dollar amount in the same investment over a period of time,” rather than taking a more sporadic and emotionally-led investment approach. It therefore encourages investors to use a more methodical and strategic approach to reduce their investment risks – a particularly useful tactic for those prone to panic buying or selling.

“Anytime is a good time to buy Bitcoin”

Many of Bitcoin’s most ardent supporters will tell you something along the lines of, “anytime is a good time to buy Bitcoin.” Guided by the belief that Bitcoin will always be a – or the – dominant cryptocurrency on the market (a belief at the core of so-called “Bitcoin maximalists”), these investors will continually buy Bitcoin at both its highs and its lows.

In the minds of these traders, if BTC has yet to reach its peak – be it $50,000 or $1 million – then buying it anytime before will lead to a profit. While this shares similarities to dollar cost averaging above, the key difference is that this approach to buying isn’t as strictly methodical. A trader using this approach will buy BTC when they feel like it, and will not necessarily limit themselves to the same amount each time.

“Buy the rumor, sell the news”

“Buy the rumor, sell the news” is an investment approach taken by investors called “news traders.” In the case of buying BTC, they use the news cycle’s reports about cryptocurrency and bitcoin to guide their investment choices. To use Investopedia’s words, news traders attempt to leverage breaking news and any substantial reporting about cryptocurrency by “taking advantage of market sentiment leading up to the release of important news and/or trading the market’s response to the news after-the-fact.”

Before you pledge allegiance to this approach, keep in mind that the crypto market is ultimately unpredictable, and so is the influence of the news on it. To exemplify this point, let’s look at the case of Katy Perry’s crypto nails. The singer famously posted a picture on Instagram of her nails that were adorned in crypto logos. Many people (at least jokingly) commented that due to her large fan base and level of mainstream influence, her nod to crypto would influence the crypto market to rise.

However, the price instead fell slightly the next day. Of course, this isn’t the only time that the “buy the rumor, sell the news” approach didn’t guarantee the BTC price increase or decrease many expected. The point is to not rely too heavily on this approach.

“Buy low, sell high”

“Buy low, sell high” is another investment strategy that comes from traditional fiat trading. As the name suggests, the idea is to buy a crypto when the price is low and to sell it off when its price is high.

The problem is, highs and lows are relative, and can often only be understood in retrospect. Consequently, many traders have bought BTC thinking that it is a low price to buy at, only for the price to dip even further. This strategy is risky as it appears simple to master from the outset, however, it requires much more skill and trade analysis than many traders believe.

Do Your Own Research (DYOR)

If you’ve ever stepped into the land of crypto Twitter (that is, Twitter accounts that talk about all things cryptocurrency), you would have probably encountered people tweeting about #DYOR. DYOR is an acronym that simply means “do your own research.” It is used as a recommendation to urge people to do their own research – and not just follow the advice of others.

We’re including it in this section because as we touch on further below, there will be no shortage of people with theories and advice about when to invest in BTC. Of course, it is up to you whether to listen to this advice. But it’s a good rule of thumb to follow up by conducting your own research.

This is particularly important when it comes to people offering their “takes” on when to buy BTC, without offering any substantial analysis as to why. For example, on social media channels like Twitter, Reddit, and Telegram, claims without any backing like “BTC will definitely go up/down” by X date,” are a dime a dozen. Before you run with what you read, take the time to dig a bit deeper.

Remember, you can’t “blame the weatherman” when things don’t turn out the way they said. Crypto, like any investment, comes with its risks – some of which can be alleviated through thorough research and due diligence. At the end of the day, your investments are in your hands.

5. The Best Bitcoin Price Trackers: Bitcoin Price, Charts and Market Cap

Keeping track of the cryptocurrencies you are thinking about investing in, or have already invested in, is a fantastic way to develop your skills and habits with:

- Understanding certain trends

- Keeping an eye on your profits and losses, and

- Determining when the best time is to buy or sell your BTC.

For those interested in tracking Bitcoin price, the good news is that there are many tools and resources designed with that exact function in mind. Here are some of the most well-known:

CoinMarketCap

CoinMarketCap is an incredibly useful resource for tracking the price of BTC and any other cryptocurrencies you own. The site has become a go-to site for tracking price metrics like:

- BTC’s price history and the current price

- Opening price (the price of BTC at the start of the day)

- Highest and lowest price

- Closing price (the price of BTC at the end of the day)

- Volume (the amount of BTC in $USD traded in total on a given day)

- Market cap (the total market cap of BTC at the close of a given day)

- Past and current price in terms of $USD

Given it’s such a go-to resource for cryptocurrency holders, we created a step-by-step tutorial on how to use and understand CoinMarketCap’s Bitcoin Price Chart. Check it out to learn how to get the most out of this tool.

CoinTracking

One of your best bets for easily and accurately tracking the price of your BTC is CoinTracking. According to the company, it “analyzes your trades and generates real-time reports on profit and loss, the value of your coins realized and unrealized gains, reports for taxes and much more.” Just input any BTC trades you have made, and then you can begin to receive informative graphs and reports on its ever-changing price. Check out this step-by-step guide to start.

Coin Tracking Apps

As interest in cryptocurrency grows, the number of coin tracking apps available on the market has increased significantly. There are so many options for cryptocurrency holders to choose from that it can be difficult to know which one to start using. Here are a few we recommend to start tracking your BTC:

Blockfolio

In the words of Blockfolio, it is “the world’s most popular free Bitcoin and cryptocurrency portfolio management app.” But how does Blockfolio really stack up? Well, it boasts a very high 4.7 out of 5 stars rating on both the App Store (out of 4300 reviews) and Google Play Store (out of 73,776 reviews). Fans of the app highlight its easy-to-use tracking interface as one of its standout features. According to this user review, navigation is simple, there are a number of handy customizable components.

Delta

A sound alternative to Blockfolio is Delta’s free apps for iOS and Android. Likewise to Blockfolio, Delta has a 4.7 out of 5 star rating on Google Play Store (out of 10,777 reviews). However, it has a comparatively higher rating than Blockfolio on the App Store, with 4.8 out of 5 stars (out of 5,100 reviews). One major difference between Blockfolio and Delta is that the latter is also available on desktops. Delta is praised for its aesthetically-pleasing UI and its active development team, who regularly update the apps based on user feedback.

Want to read a comparison of Blockfolio and Delta’s services? The article ‘Blockfolio vs Delta Review: Which is the Best Cryptocurrency Portfolio Tracker?’ will give you an insightful overview of their different features, attributes, and drawbacks.

Bitcoin Pizza Twitter Account

Ok, we admit this is a bit of a cheeky entry to the list, but it’s a fun way to recognize just how far Bitcoin price has come since its early days. So what is the Bitcoin Pizza Twitter account all about? Well, remember how we mentioned in the Bitcoin history section above about the man that bought two pizzas for. The Bitcoin Pizza Twitter account every day posts the current USD price of those fateful “Bitcoin Pizzas.”

While we’re talking about tracking BTC’s price, it’s a good time to remind you to take proper security measures when dealing with any site, app, or wallet that requires you to provide any personal information or enter any data linked to your BTC holdings. Read up on some of our Bitcoin security tips here.

6. Bitcoin Price Predictions

Ah, so you want to know the future price of Bitcoin? Wouldn’t we all like to possess a crystal ball that could demystify the secrets of the future?

Unfortunately, the future price of Bitcoin is a case of “your guess is as good as mine.” Just like no one could say with 100% confidence what the Bitcoin Cash fork would do to the price of bitcoin, no one can offer this level of insight to what the price of bitcoin will be in the future.

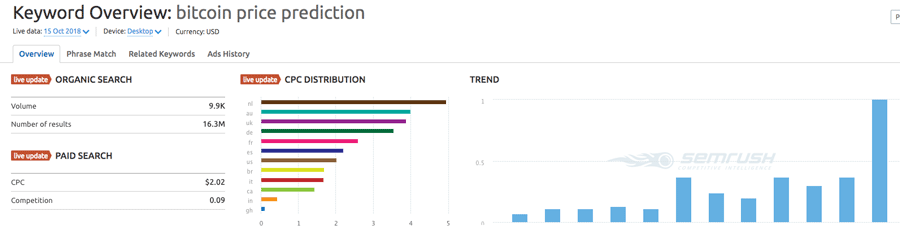

However, that hasn’t stopped everyone from ordinary traders and pundits alike from offering their predictions. This is no more evident than with how the search term “Bitcoin future price prediction” brings up around 19,400,000 search results in Google. As the graph below from the keyword research tool SEMrush indicates, the search term has been increasing in interest from users and has a monthly search volume of 9,990 in the US alone.

Interest in bitcoin price predictions is evidently increasing. (Image credit: SEMrush)

Interest in bitcoin price predictions is evidently increasing. (Image credit: SEMrush)

So who’s said what about the future price of BTC? Here are three of the most well-known predictions out there:

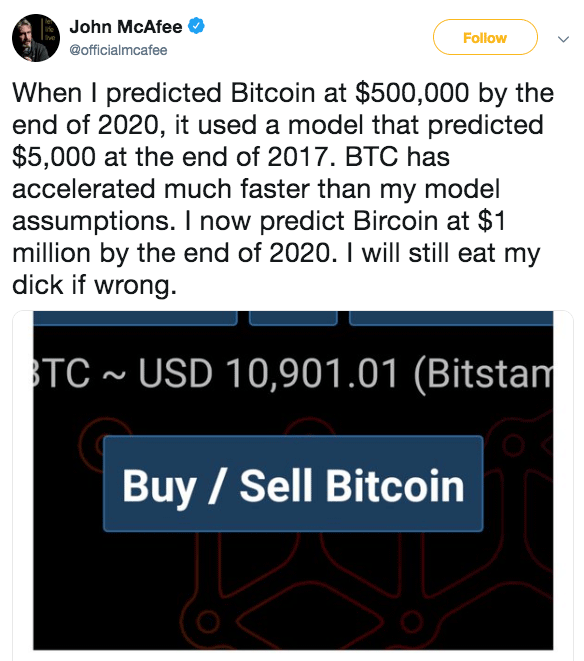

John McAfee

John McAfee’s bitcoin prediction is without a doubt one of the most well-known. McAfee made the prediction that bitcoin price will be $1 million by 2020. For the unfamiliar, McAfee is a computer programmer and entrepreneur who is best known for founding the anti-virus company, McAfee Associates, in 1987. After resigning from the company in 1994, and completely selling off his stake in it two years later, he founded a number of other business ventures.

McAfee’s venture into bitcoin began in 2016 when he was appointed the chief executive chairman and CEO of the technology holding company MGT Capital Investments. He initiated the company’s mining of bitcoin and other cryptocurrencies, stating it was a means to both increases the company’s bottom line, as well as its blockchain expertise.

A year later, he would Tweet a prediction that would establish him as an infamous and controversial figure in the cryptocurrency world. McAfee’s first prediction was Tweeted on July 17, 2017, where he predicted that one bitcoin would be worth half a million dollars within 3 years, or he would eat his penis on national television.

Kids, don’t try this at home! (Image credit: John McAfee’s Twitter)

Kids, don’t try this at home! (Image credit: John McAfee’s Twitter)

McAfee later revised his original prediction around four months later. He tweeted that due to the unexpected accelerated growth Bitcoin had already demonstrated, he would change his prediction to a cool $1 million dollars. One thing’s for sure is that no one can doubt that he’s bullish on Bitcoin. For his sake (and our portfolios’), we’re hoping that it comes true!

Arthur Hayes

The co-founder of BitMEX, the largest cryptocurrency trading platform by volume, last year predicted that Bitcoin price would reach $50,000 by the end of 2018. It was no doubt a lofty prediction – what with the Bitcoin price falling below $4000 by the end of 2018 – but Hayes remains optimistic.

“We could definitely find a bottom in the $3,000 to $5,000 range,” he said. “But we’re one positive regulatory decision away, many an ETF approved by the SEC, to climbing through $20,000 and even to $50,000 by the end of the year,” Hayes said.

Interestingly, Hayes shared his belief that it is fact Bitcoin’s volatile price that makes it so eye-catching to investors. “Now that we have more visibility, more people talking about [bitcoin], the time between an aggressive bear market and an aggressive bull market, I think, is going to shorten.”

In May 2019, Hayes reaffirmed his belief in Bitcoin’s resurgence in a Twitter post and remains confident about the digital asset’s high future value.

The bull market is real. A momentary dip below 7k, and a few days later we are back above 8k and the Sep and Dec contracts are in contango. Booyah! pic.twitter.com/qknhDQ8i7p

— Arthur Hayes (@CryptoHayes) May 19, 2019

Tim Draper

American venture capital investor Tim Draper predicts that Bitcoin will reach $250,000 by 2022. Initially, he tweeted that BTC would hit “$25k by 2022,” but he later corrected his tweet to clarify he actually meant that “$250k is the number!”

His quarter of a million dollar by 2022 prediction is definitely one of the higher predictions given by well-known investors. But with his investments in Skype, Tesla, Twitter, and SpaceX, many agree that Draper has a long history of demonstrating his investment skills – albeit with traditional companies.

Although it’s not known why Draper decided on his prediction, its notable that he is an early investor of BTC, having bought $30,000 of it in 2014 from the US government.

Remember, no one – from cryptocurrency experts, to think tanks, to your friend Bob – can with complete accuracy predict Bitcoin’s future price. So if you ever encounter any individual or organization claiming to know that the future price of bitcoin is – proceed with caution.