“I’ve been working on a new electronic cash system that’s fully peer-to-peer, with no trusted third party.”

Nakamoto’s accompanying whitepaper, called “Bitcoin: A Peer-to-Peer Electronic Cash System“, and the technology it described, blockchain and cryptocurrencies, has since transformed the world we live in and acts as the unofficial bible of blockchain. It has provided the foundation for a slew of other digital asset innovations such as Web3, DeFi, NFTs and the BRC20 format, with more to come.

With its release on Halloween, it has also certainly been scaring the living daylights out of authorities and bankers ever since!

When was the Bitcoin whitepaper published?

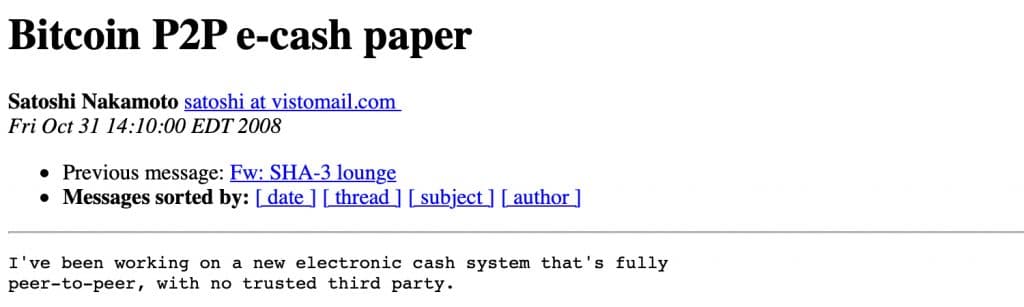

At exactly 2:10 pm Eastern Standard time on 31 October 2008, the mysterious and pseudonymous “Satoshi Nakamoto” submitted their Bitcoin whitepaper to the Cryptography Mailing List of metzdowd.com, a messaging service popular with cypherpunks at the time. Satoshi used the title “Bitcoin P2P e-cash paper” to describe the concept.

(Cypherpunks were early cryptography pioneers and activists who believed that using encryption for privacy could make the world better).

Mere months later, on 3 January 2009, the Bitcoin network came to life, when Satoshi “mined” the first block, also known as the genesis block.

What is the Bitcoin Whitepaper?

Read the Bitcoin whitepaper here: https://www.bitcoin.com/bitcoin.pdf

According to Wikipedia:

“A whitepaper is an authoritative report or guide that informs readers concisely about a complex issue and presents the issuing body’s philosophy on the matter. It is meant to help readers understand an issue, solve a problem, or make a decision.”

Satoshi’s P2P e-cash whitepaper described a decentralized, peer-to-peer (P2P) payment protocol that could facilitate and verify digital transactions and avoid the double-spending problem, recording all of this in a transparent public ledger that could be viewed by anyone as it happened.

The system would be secured by a Proof-of-Work algorithm, where new Bitcoins were created and given as rewards to “miners” who helped to verify Bitcoin transactions and distribute their validations to other nodes in the network.

This type of P2P decentralized network, already popular at the time through media-sharing applications like Bittorrent, would avoid the need to use any traditional financial institutions at all and finally allow the public to send and receive value without any intermediaries.

Why did Satoshi Publish the Bitcoin Whitepaper on Halloween?

The reason behind Satoshi Nakamoto’s decision to release the Bitcoin white paper on Halloween remains shrouded in mystery and open to interpretation. There are various theories that attempt to explain this timing. Some speculate that the release date may be a nod to Reformation, a the break from the Roman Catholic Church initiated by Martin Luther in the Middle Ages due to its corruption at the time where you could basically pay absolve your sins by paying money to the church. This symbolizes a similar break from traditional financial systems, which were bailed out (forgiven) by the government for their sins that caused the subprime mortgage crisis (the movie The Big Short is a must-watch).

Others believe it could be related to the ancient pagan tradition of Samhain, which marks the end of the harvest season and the beginning of winter. Regardless of the reason, the choice of Halloween for the release adds an additional layer of mystique to Bitcoin’s already enigmatic origins.

Bitcoin Whitepaper: Section by Section

31 October 2023 is the 15th anniversary of the Bitcoin whitepaper’s publication, which has 12 sections. We advise you to read the whole paper if you’re truly interested in understanding the roots of crypto, but in any case, here’s a very simplistic synopsis:

1. Introduction

Satoshi covers the Internet’s dependency on third-party financial intermediaries like banks to conduct electronic transactions. He criticizes the inherent weaknesses in these centralized intermediaries, such as the ability to reverse transactions, higher transaction costs, and limitations on amounts that can be sent.

A P2p decentralized system that used cryptography would allow participants to:

- remove the need for intermediaries

- send and receive direct P2P payments online

- replace intermediaries’ provision of trust with transaction verification

- combat fraud by creating irreversible transactions (as long as 51% controlled the computing power),

- establish mathematical proof and chronological order through a distributed timestamp recording each block.

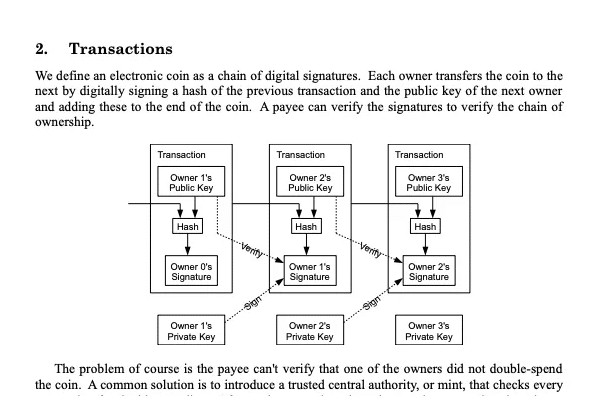

2. Transactions

Satoshi describes the technical nature of the blockchain, or electronic transaction process, defining it as a chain of digital signatures. He explains hashing, public keys and privates keys, and timestamps.

About the double-spend problem, or possible duplicate payments, he says transactions must be publicly recorded and a chronological order must be adhered to.

3. Timestamp Server

A timestamp records the hash of a block of transactions and makes it public, validating the data and recording the preceding timestamp, in order to form a chain of validated transactions.

4. Proof-of-Work

Proof-of-work (PoW) must be used to help distribute the block timestamps to the decentralized network. Participants much use their computers’ CPU power to facilitate this and “vote”, to ensure that the data is immutable and cannot be changed after it’s been distributed.

The longest chain of blocks validated by “honest” nodes in the network and distributed would be the correct one and could not be undone by hackers unless they took over the network and undid the preceding transaction blocks.

5. Network

Nakamoto defined the steps needed for a peer-to-peer network and explained why it’s important to publicly broadcast new transactions:

- New transactions are broadcast to all nodes/computers in the network.

- Each node collects new transactions into a block.

- Each node tries to solve a difficult proof-of-work for its block.

- When a node discovers a proof-of-work, it broadcasts the block to all nodes.

- Nodes accept the block only if all transactions in it are valid and not already spent.

- Nodes express their acceptance of the block by working on creating the next block in the chain, using the hash of the accepted block as the previous hash.

6. Incentives

This section covers “mining”, how miners could be rewarded for validating transactions, the cost involved, the deflationary aspect of it and why it was important to reward mining with new Bitcoin, for example to deter hacking attacks.

7. Reclaiming Disk Space

Nakamoto says that old transaction data can be discarded and only the root kept in the block hash. He quotes Moore’s Law and doesn’t foresee a problem storing data in the future due to bigger storage devices and faster network speeds.

8. Simplified Payment Verification

Satoshi explains how transactions can be validated without the need to run a full network node, by verifying the longest proof-of-work chain. He says that businesses with different needs can create their own rules for better security and speed.

9. Combining and Splitting Value

This section covers single and multiple transmittal outputs, where it’s more effective to send multiple Bitcoin in a transaction than splitting them up in smaller ones. It basically equates to sending your Bitcoin to another party and getting “change” back if required.

10. Privacy

To ensure user privacy when transaction blocks are published online, public keys should be alphanumeric addresses and not carry any identifiable information.

11. Calculations

This covers ensuring that honest nodes’ transactions are accepted over that of hackers and that invalid blocks are rejected by the network. The more blocks added, the more difficult it becomes for a hacker to attack the network.

12. Conclusion

Satoshi’s P2P system for electronic payments requires a distributed network of honest nodes to replace trust with verification, make it hack-resilient and prevent double-spending. As long as the honest nodes have more CPU power than hackers, the system will stay secure and be able to reject fraud. The nodes “vote” with their computer power. A voting system can also be used to govern changes, rule changes and incentives.

While it may seem complicated at times, Nakamoto concludes with this eloquent observation:

“The network is robust in its unstructured simplicity.”

12 Bitcoin Whitepaper Trivia Facts

We’ve scoured the Internet for some fun facts on the Bitcoin whitepaper, here are 12 good ones, one for each year!

- The earliest known use of the term “Whitepaper” was with the British Government and the Churchill Whitepaper of 1922.

- The Bitcoin whitepaper is only 9 pages long and has 12 sections.

- Satoshi Nakamoto wrote the code for the entire network before he wrote the Bitcoin whitepaper, as “he” was “better with code than with words.” and wanted to make sure Bitcoin could solve what he was to promise first.

- There are currently 33 translated versions of the whitepaper available, although unofficial ones may not have been cited yet.

- Words that NEVER appeared in the whitepaper: Blockchain, Cryptocurrency, Wallet, 21 million.

- Words that DID appear: Bitcoin (2), Cash (2), Incentive (7), Miners (1), Money (5), Node (38), Proof-of-Work (18)

- Satoshi registered the Bitcoin.org domain in August 2008, more than 2 months before the whitepaper publication

- Bitmain founder Jihan Wu translated the paper into Chinese

- Satoshi Nakamoto first connected with Hal Finney via the Metzdowd site’s Cryptography Mailing List. Finney of course went on to become the first recipient in a Bitcoin transaction (with Nakamoto the sender) and has been widely rumored to have been Satoshi himself, as it was common practice for developers to do a first test transaction with themselves first. Finney died in 2014. =

- Over 5000 crypto whitepapers have referenced Satoshi’s paper, including Ethereum.

- Some analysts say Satoshi’s publication on Halloween is not a coincidence and hides an Easter Egg.

- Satoshi cited 10 people in the paper: Dave Bayer, Stuart Haber (time-stamping concept), W. Scott Stornetta, Wei Dai (creator of b-money), Henri Massias, Xavier Serret-Avila, Jean-Jacques Quisquater, Ralph Merkle, William Feller and Adam Back (Hashcash creator).

DELIVERED EVERY WEEK

Subscribe to our Top Crypto News weekly newsletter

13. Here are some of the Cypherpunk documents that influenced Bitcoin’s creation:

- “Security without Identification: Transaction Systems to Make Big Brother Obsolete” (1985) by David Chaum, which described anonymous digital cash and pseudonymous reputation systems.

- “A Cypherpunk’s Manifesto” (1993) by Eric Hughes, which laid out the core beliefs of the Cypherpunk movement, including the importance of privacy, cryptography, and freedom from centralized authority.

- “The Crypto Anarchist Manifesto” (1992) by Timothy C. May, which advocated for the use of cryptography to create a stateless society.

- “b-money” (1998) by Wei Dai, which proposed a decentralized digital currency that used proof-of-work to prevent double-spending.

- “BitGold” (2005) by Nick Szabo, which described a decentralized digital currency that used proof-of-work and was backed by gold.

Satoshi Nakamoto, the creator of Bitcoin, was aware of b-money and cited it in the Bitcoin White Paper. He also added an acknowledgement to BitGold on the Bitcoin website. The Cypherpunks’ work and their writings laid out the assumptions that would drive the cryptocurrency industry, years before the Bitcoin White Paper was even committed to text. The creation of cypherpunk money in the 2000s was a pivotal point that ultimately laid the groundwork for the creation of something like Bitcoin.

While many pundits believe that Hal Finney was Satoshi, a controversial documentary by Barely Social in 2020 claims that Satoshi Nakamoto is indeed Adam Back of the powerful Blockstream conglomerate! Whether it’s true or not, the documentary makes for fascinating watching.

Decide for yourself, or read our Satoshi Nakamoto guide first!

What was the initial response to the whitepaper?

Surprisingly, not much. Satoshi’s post apparently sunk without nearly a trace. Only a few people replied, so Nakamoto reposted the paper on November 3, 2008. This time they got more of a response but readers were doubtful of the scalability of Bitcoin.

Pseudonymous cryptographer James A. Donald was the first to react to Satoshi’s post and pour cold water on their idea.

We very, very much need such a system, but the way I understand your proposal, it does not seem to scale to the required size.

Fifteen years though has proven that Satoshi Nakamoto’s proposal has stood the test of time. Thanks to new adoption by the likes of Tesla, PayPal, Apple, a slew of Bitcoin spot ETFs expected to be approved before the 2024 Bitcoin halving and friendlier regulations that deem it as a commodity not a security, Bitcoin is once again prospering and the network arguably stronger than ever.

Not only this, but it has created a gigantic industry of blockchain and cryptocurrency projects that will eventually likely lead to full mainstream adoption, especially after central bank digital currencies (CBDCs) clear the way further and the U.S. continues to print excess fiat currency.

Bitcoin’s price reached a high for 2020 of $14,000 on 31 October 2020, following an all-time high hash rate of 157 exahashes per second on October 10.

With over 800,000 daily active addresses now, and a current market cap of $255 billion and counting, Bitcoin will be sure to remain a bogeyman to traditional finance for the foreseeable future. Happy trick-or-treating!

Written by Werner Vermaak

Disclaimer: CoolBitX provides these blog posts for general educational purposes only. Information on this blog expresses the opinion of the author only. It does not constitute professional legal or financial advice and should not be considered as such. The author or company may update the information on this article at any time without prior notice and do not guarantee the work to be up to date and accurate. To the best of our knowledge, the information provided here is factual at the time of writing.

Keep your Bitcoin safe with the CoolWallet S hardware wallet for ultimate cold storage!

Mass adoption is coming. Need a proven safe place to store your Bitcoin, Ethereum and other crypto? Look no further than the world’s original mobile hardware wallet. The CoolWallet S is the world’s best Bluetooth cold storage wallet and allows you to take your crypto discreetly everywhere all the time. It fits in your real wallet!

The CoolWallet S is paper-thin, waterproof, and comes with a CCEAL5+ secure element and military-grade Bluetooth encryption. Trade, store or swap crypto safely on your phone while keeping your assets and your private key offline at all times.