How and where to store your crypto has become the biggest narrative the last quarter of the year, as centralized crypto custodians we trusted with our money collapse like a game of dominoes, and even industry leaders like Binance seem to reel from orchestrated FUD despite their Proof-of-Reserves initiative. With the collapse of the centralized exchange FTX and broader contagion in the markets, the public is increasingly paying attention to the ins and outs of digital-asset storage.

In short, Not Your Keys Not Your Crypto and Proof of Keys are IN, while leaving all your eggs in one basket on centralized exchanges and custodians is OUT. Unless you’re a bank or other large institution using a bespoke crypto-custody solution, the answer is always going to be some form of cryptocurrency wallet, which happens to be our specialty.

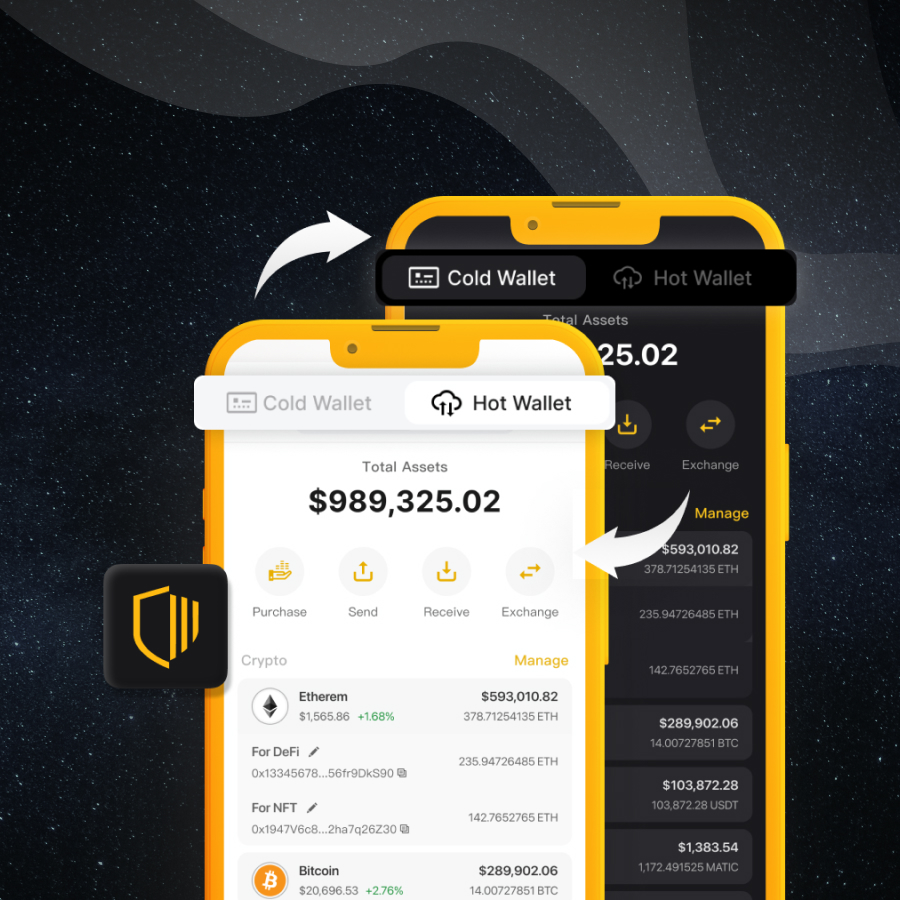

CoolBitX has recently branched out only doing cold-storage wallets like the CoolWallet Pro and the CoolWallet S, and we created our newest offering, the CoolWallet HOT, to enable all crypto users to safely keep their assets in a non-custodial wallet. Users can access this new hot wallet module free of charge via the CoolWallet App and take advantage of its many features, which will include faster coin support, airdrops, NFT mints, and more.

If you’re new to the world of cryptocurrency, you might be wondering how to store and manage your digital assets. One of the most important tools for any crypto investor is a cryptocurrency wallet, which is used to store, send, and receive digital assets.

The choices can be overwhelming when it comes to crypto wallets, and it’s important to learn the basics to be able to make informed decisions. There are two main types of cryptocurrency wallets: hot wallets and cold wallets. Let’s explore the distinction between hot and cold wallets and take a look at all the different varieties out there.

What are Cryptocurrency Wallets?

Cryptocurrency wallets are the tools that crypto users use to store, send, and receive their digital assets. Some are controlled by exchanges or other third parties, and these are called custodial wallets. Others are non-custodial (also called private, unhosted or self-custody wallets) and give users complete responsibility for managing their crypto.

With non-custodial wallets, users are required to keep track of important account details. These include their private keys to maintain ongoing access as well as their seed phrase if they need to restore the wallet. With custodial wallets, the third party manages all of this for users, though they can theoretically revoke access at any time.

Another important distinction is the difference between hot and cold wallets. Hot wallets live on the internet, while cold wallets store crypto offline. Hot wallets are less secure, but they are also more convenient. Cold wallets are the only responsible way to store large sums of crypto, but sometimes it’s necessary to take funds out to perform certain transactions. Essentially, both have their uses and all serious crypto users rely on a combination of the two.

Hot wallets vs cold wallets: TL;DR

Hot and cold wallets are both important tools for securely storing and managing digital assets, such as cryptocurrencies. Each type of wallet has its own unique features and benefits, which make them useful for different purposes.

One of the main benefits of hot wallets is their convenience and ease of use. Because they are connected to the internet, hot wallets can be accessed from any device with an internet connection. This makes them ideal for making quick transactions or managing small amounts of digital assets. Hot wallets are also user-friendly, with easy-to-use interfaces and support for a wide range of devices.

On the other hand, cold wallets are offline wallets that are not connected to the internet. This makes them more secure, as they are not vulnerable to hacking and other forms of cyber attacks. Cold wallets are often used to store large amounts of digital assets, as they provide an extra layer of security to protect against potential losses. Cold wallets can also be useful for the long-term storage of digital assets, as they are not subject to the same risks as hot wallets.

Overall, both hot and cold wallets are important tools for securely managing digital assets. Hot wallets are generally useful for quick transactions and managing small amounts of digital assets as they’re software-only, while cold wallets are ideal for storing large amounts of assets and long-term storage, but take a little longer to use due to the physical hardware technology involved.

Let’s take a closer look now at hot and cold wallets in more detail.

Hot wallets: Online self-custody

Exchange-hosted wallets

Exchange-hosted wallets are easy to use and tend to have fiat on-ramps, but they are probably the worst way to store crypto. These wallets are custodial, so the exchange controls the private keys. It’s wise to only keep crypto in an exchange-hosted wallet for a short time, then move it somewhere more secure for long-term storage.

If the exchange gets hacked or becomes insolvent, users are out of luck. The only recourse left will be a multi-year legal struggle that is unlikely to provide full recompense. This has happened with Mt. Gox and others before, and it is happening again now with FTX.

Web wallets

Web wallets are browser-based and very easy to get up and running with. They are always online; typically support a wide array of cryptos; and can easily integrate with P2E games, NFT marketplaces, and more. They are also useful for getting funds in and out of exchanges and making purchases.

While cold-storage options like hardware wallets are always more secure, web wallets are necessary and useful. Many also use strong encryption and offer additional security measures like two-factor authentication. Since these are non-custodial wallets, users are responsible for their private keys and seed phrases.

Browser extensions are small pieces of software that are installed in a web browser and are used to store and manage cryptocurrencies. These extensions are convenient and easy to use, but they do require the user to have access to the web browser in order to access their cryptocurrency.

Desktop wallets

Desktop wallets are just software applications for personal computers, with many of the same conveniences as web wallets. With these wallets, people hang on to their private keys, so there is no threat of exchange failures. They also tend to be somewhat feature-rich, with support for lots of cryptos and offline transactions. Dangers include the possibility of malware infiltration as well as forgetting to make backups.

Mobile wallets

Mobile wallets run on apps for smartphones and tablets. These are the most efficient crypto wallets, combining maximum features with mobile convenience. Security perks include PINs, biometrics, and more. It’s a good idea to use a mobile wallet along with a more secure option like a hardware wallet. That way, you get access to the extra features when you need them while keeping the bulk of your crypto offline.

CoolBitX’s new CoolWallet HOT is an example of a non-custodial mobile wallet. It runs on the CoolWallet App and can be used free of charge, allowing newcomers to get a taste of features like our WalletConnect and OpenSea integrations, Enhanced Coin Support, best-in-class security, and seamless UI.

Cold wallets: Offline self-custody

Paper or steel wallets

Paper wallets date back to the early days of cryptocurrency. The user has a printed piece of paper with public and private keys and sometimes a QR code. To access the crypto, the paper wallet usually interacts with a hot wallet. While paper wallets are very secure as there’s no way to access them online, they are the least convenient of all the crypto-storage options mentioned in this article. Furthermore, they’re extremely vulnerable to damage, loss, and theft. Meanwhile, steel wallets like CoolWallet BilFodl are what they sound like: a metal plate and letters that are assembled to securely store a private key or seed phrase and protect it from the threat of fire and water.

Dedicated phone

Some people use a dedicated phone as a crypto wallet, connecting to another device using Bluetooth or WiFi. After the person transfers funds, they can power the wallet phone back down. While this method may offer some of the benefits of cold storage on the cheap, in almost every case, it’s smarter to just shell out for an actual hardware wallet with advanced features and physical resilience.

Hardware wallets

Hardware wallets are physical devices for storing crypto offline and remain the gold standard in terms of crypto security. These wallets generally use an encrypted USB (eg Ledger or Trezor) or Bluetooth connection (Ledger or CoolWallet) to sign or verify transactions without being directly connected to the internet. The safest hardware wallets, such as those made by CoolWallet, have a secure element (SE) chip that locks away the private key forever. These devices are small, portable, and easy to use, making them a popular choice for many crypto investors.

Our flagship model, the CoolWallet Pro, is among the most secure ways to store crypto. It has a multi-step verification process and an SE chip for added security. At the same time, the CoolWallet App uses face and fingerprint recognition as well as passcodes over a private, encrypted connection. It’s also waterproof and tamperproof, with an e-ink display that lets people see the receiving address on transactions.

On top of letting users send and receive crypto, the CoolWallet Pro makes it easy to buy crypto with a credit card or bank transfer, as well as withdraw fiat to a bank account. It also lets users stake supported assets, and it even has integrations with top NFT marketplaces like OpenSea and Rarible.

What are the 5 biggest differences between hot wallets and cold wallets?

- Online vs. offline: A hot wallet is an online wallet that is connected to the internet, whereas a cold wallet is an offline wallet that is not connected to the internet.

- Accessibility: A hot wallet is more easily accessible because it is online, whereas a cold wallet requires physical access to the device it is stored on.

- Security: Cold wallets are generally considered to be more secure because they are not connected to the internet, making them less vulnerable to hacking and other forms of cyber attacks. Hot wallets, on the other hand, are more vulnerable to security breaches because they are online.

- Usability: Hot wallets are more user-friendly because they are easily accessible and can be used to make transactions quickly. Cold wallets are less user-friendly because they require physical access and may have a longer transaction process.

- Compatibility: Hot wallets are generally more compatible with a wide range of devices, whereas cold wallets may only be compatible with specific devices or software.

Are hot wallets safe to use?

While hot wallets can be convenient and easy to use, they also have some security risks that users should be aware of.

The biggest risk of using a hot wallet is that it is connected to the internet, making it vulnerable to hacking and other forms of cyber attacks. Hackers may try to access a hot wallet by attempting to guess the user’s login credentials or by exploiting vulnerabilities in the wallet software. If a hacker is able to access a hot wallet, they may be able to steal the user’s digital assets. This is where a cold wallet like CoolWallet Pro offers extra protection, as a transaction can only be authorized by someone physically pressing a button on the device.

Despite these risks, hot wallets can still be a safe option for storing and managing digital assets, as long as users take appropriate precautions to protect their wallet and their assets. These precautions may include:

- using strong and unique passwords,

- enabling two-factor authentication,

- keeping the wallet software up to date with the latest security patches.

Additionally, users should be cautious when interacting with unfamiliar websites or individuals, as these may be potential sources of scam or phishing attacks. By following these best practices, users can help to reduce the risk of their hot wallet being compromised.

Conclusion

CoolWallet built its strong reputation by creating groundbreaking hardware wallets for crypto purists willing to pay for the best in cold storage to help them avoid losing their assets on exchanges and hot wallets. This hasn’t changed and will not change. In fact, CoolWallet Pro is our most secure and feature-packed hardware wallet to date and will continue to be improved and iterated indefinitely.

However, with the pace of innovation across Web3, DeFi, SocialFi, GameFi, NFTFi, and all the other incoming”Fi’s” as the space continues to evolve, it’s important to be there early in order to help protect all users from bad actors. This is where CoolWallet HOT comes in, which will help to protect and educate newer crypto users and hopefully gradually convince them to move their long-term HODL and bigger portfolios over to cold storage.

Crypto self-custody should be a lifelong journey that empowers investors to become their own banks, free from the whims and corruption of fiat-based currency manipulation and monetary inflation. As with any journey in life, it starts with a single step.

CoolWallet HOT makes it super easy to take that first step, and get comfortable around the decentralized Web3 universe, then over time take the plunge to CoolWallet Pro or S so you can effortlessly move hot wallet assets over to cold storage based on your risk tolerance.

In 2023, the biggest question is whether to use a non-custodial or custodial wallet. The answer has remained the same since 2009: non-custodial.

The next question has been whether to use a hot or cold wallet, depending on how big your portfolio is. The answer is another question: Why not use both? By using both types of wallets, users can take advantage of the unique features and benefits of each, helping to ensure the security and stability of their digital assets. And if you have any doubts about security, move it over to cold storage when needed.

Here’s our guide to help you get started on your CoolWallet HOT journey. Safe travels in 2023 and beyond!