Written by Werner Vermaak

Welcome to Part III of our Stablecoin guide series, where we look at Libra-killing central bank digital currencies (CBDC) around the world, most notably China’s incoming digital yuan.

In Part I of our Complete Guide to Stablecoins, we discussed the history, benefits and current landscape of this young digital asset category.

In Part II: Libra- A Future Under Fire, we checked out Facebook’s fledgling Libra project.

In Part IV: Big Business Coins, our final chapter, we look at new stablecoins issued by Big Business (JP Morgan, Wells Fargo etc.) and Binance.

Part III Table of Contents

- Introduction

- Central Bank Digital Currencies (CBDC)

- The global state of CBDCs in 2019

- Case Study: China’s DCEP digital yuan

- Is China’s CBDC a trojan horse?

Introduction

The unveiling of Facebook’s Libra caused consternation amongst central banks around the world (as we discussed in part II), who had expected such a strong “globalcoin” contender to still be years, and not months, away.

Some policymakers even called Libra a “wake-up call for central banks”. Despite this, most G20 countries are either not yet officially concerned with creating a digital currency, or are still in very early stages of developing one.

Central banks hate Libra for a reason. The opportunity to develop a national digital currency that will simplify cross-border transactions and remove the need for intermediaries like SWIFT is very attractive to central banks and presents a once-in-a-lifetime opportunity.

It’s clear that central banks will not go down without a fight.

CENTRAL BANK DIGITAL CURRENCIES (CBDC)

The top 5 stablecoins in the market are all pegged to the US dollar…quite saturated already. In contrast, the opportunity in the other 180 fiat national currencies used by the majority of the world has barely been realised. That’s where the next frontier for stablecoins is.

George Harrap,CEO Bitspark (Source:Coindesk)

What are Central Bank Digital Currencies (CBDC)?

Stablecoins for central banks are collectively referred to as Central Bank Digital Currencies (CBDC). They represent a digital fiat currency (at a 1:1 ratio in value) for a specific country or region (e.g. China or European Union). A CBDC is are issued, underwritten and regulated by the financial authority in the jurisdiction it was created.

The World of Central Bank Digital Currencies in 2019

–United States

👎 Fed Chairman says “no plans” for digital dollar

Jerome Powell, Federal Reserve Chairman, recently said that the Fed has no plans at the moment to build a digital currency:

“We are following very carefully the whole question of digital currencies. It’s not something that we are actively considering … For us, it raises substantial, significant issues that we want to see carefully resolved.”

Back in August 2019 though, the U.S. central bank announced plans for FedNow, a real-time payment and settlement service that would support nearly instant payments and remittances around the clock. Unfortunately, it will only go live in 2024.

Congressmen to Fed: “Are you ready for digital currency’s rise?”

Two congressmen wrote a letter to Fed chairman Powell in October 2019, asking him if the U.S central bank is prepared for a new world running on digital currencies.

Congressmen Hill and Foster said the “nature of money is changing,” and feared the U.S are giving other countries like China a headstart which they won’t make up later. They pointed out how natural and simple it would be for the Fed to develop a “national digital currency’ and used J.P. Morgan and Fargo Wells’ native cryptocurrencies and Libra as examples.

Earlier, a Fed bank president called a Fed-backed CBDC “inevitable”.

–Asia

👎 Japan & South Korea CBDC

No plans yet, concern over implementation and impact on fiat banking

Japan also has no imminent plans for a CBDC, as their central bank has serious reservations over its potential effect on traditional commercial banking, according to the Bank of Japan’s deputy governor, Masayoshi Amamiya (July 2019).

However, Japan is the country where crypto and innovation go hand in hand most, and with a Yen-backed stablecoin approved by Japan’s FSA in January 2019 and being piloted for a year, we might very well soon see a digital yen.

👍 China’s CBDC

People’s Bank’s digital currency launching very soon

The People’s Bank of China has Libra-killing on its mind with its massive national digital currency, which we discuss in-depth later in this article.

👍 North Korea & Iran CBDC

Digital currency plans raise concern from regulators

International black sheep Iran and North Korea have recently announced that they’re developing their own stablecoins. With these countries being blacklisted by the Financial Action Task Force, there is a real fear that Iran, North Korea as well as other countries will use a CBDC to circumvent international sanctions and increase their international money laundering and terrorism funding activities.

North Korea, in particular, has a checkered past when it comes to digital currencies, with state-sponsored hackers blamed for stealing $2 billion to fund their weapons program.

-Europe

The European Central Bank (ECB) perceives Libra as a serious threat to the Euro and “wake-up call for central banks”. Both France and Germany recently made it clear they would not allow Libra into their countries. That doesn’t mean that European policymakers are opposed to all cryptocurrencies… only the ones they don’t control.In fact, the ECB has confirmed that they have started work on their own central European digital currency to counter Libra.

👍New ECB president is “pro-crypto”…if regulated correctly

Newly elected ECB president and former IMF head Christine Lagarde has made several positive statements about cryptocurrencies in the past, such as her Winds of Change: The Case for New Digital Currency speech in 2018.

Lagarde promised that if she were to be elected, she would help financial institutions immediately adapt to keep up with the rapidly evolving changes in finance.

Lagarde previously said this year that it was inevitable and necessary that cryptocurrencies become regulated, and that they are “shaking the traditional financial world”. In September she asked for a measured response to digital currencies and said in a statement:

“In the case of new technologies – including digital currencies – that means being alert to risks in terms of financial stability, privacy or criminal activities, and ensuring appropriate regulation is in place to steer technology towards the public good. But it also means recognising the wider social benefits from innovation and allowing them space to develop.”

Lagarde also expressed pro-CBDC sentiments recently and requested that central bank digital currencies should be explored more. All this bodes well for the prospect of an eventual European digital currency.

👍 Bank of England wants Libra to wean world off USD

The Bank of England (BoE) was one of the first central banks to consider the use of a CBDC, and released a working paper in 2018 on how such a central bank digital currency would work.

BoE governor Mark Carney, a Bitcoin-sceptic, said in August 2019 that a new global digital currency could bring an end to U.S. Dollar’s reign. He criticized the fact that the majority of USD is stockpiled outside the States to hedge against crashes in the U.S. economy and said the following:

“[A digital currency] could dampen the domineering influence of the U.S. dollar on global trade…If the share of trade invoiced in [a digital currency] were to rise, shocks in the U.S. would have less potent spillovers through exchange rates.

Mark Carney, Bank of England governor (Aug 2019)

Africa and CBDCs

Africa, with its vast distances, volatile third-world currencies and politics, improving living standards and increasing reliance on smartphone micropayments, could be the next frontier for payment-driven stablecoin adoption, starting with regional powerhouse South Africa.

👍 South Africa’s Digital Rand and Project Khokha

Crypto the beloved country?

It was reported last month that the South African Reserve Bank (SARB) is looking to build a digital Rand for the country’s Rand currency (ZAR). Moreover, a local company last month unveiled the first Rand-based stablecoin, the eZAR.

Due to high crime levels, a 3G/4G evolution that completely skipped over fixed-line Internet, and high smartphone penetration rate (80% in 2018), South Africa has been pioneering innovative solutions that target the unbanked for years.

The SARB’s widely lauded Project Khoka pilot project in 2018 connected the central bank with 7 commercial banks to trial a proof-of-concept blockchain running on Quorum (Ethereum enterprise solution). Project Khoka successfully simulated a real-world implementation of a DLT-based payment system and was honored by the Central Bank Publication as the “Best Distributed Ledger Initiative” of 2018.

South America

High inflation, informal economy, a volatile national currency, and widespread corruption? Check. Many South American countries are a dream match for stablecoins, and a CBDC could curtail rampant inflation and economic fraud, as this study shows.

With cryptocurrencies enjoying increasing popularity in many Latin American countries as a way to hedge against unrest, authorities are being pressured to develop central bank digital currencies in response.

👍(👎) Brazil

Brazil has been a regular point of interest for CBCB adoption, with recent studies and central bankers praising the potential benefits:

“I have been working intensely on the design of what might become the financial system of the future. I participated in studies on blockchain and digital assets, and I hope I will be able to prepare the Central Bank for the future market, where technologies advance exponentially, generating more rapid transformations,”

Roberto Camparo, Chairman of Brazil’s central bank

However, Brazil’s president Bolsonaro has expressed his strong opposition to cryptocurrencies and remains a large political obstacle for any CBDC.

2. CHINA’s “DCEP” DIGITAL CURRENCY

To counter the threat of Libra and possibly derail its chances of actually launching, the People’s Bank of China (PBoC) announced that they will soon release their own stablecoin, DCEP (Digital Currency/Electronic Payments) based on their national currency, the Chinese Yuan (renminbi).

It is in all likelihood the only large-scale stablecoin that the Chinese government will allow.

When did China start developing a digital currency?

While this might come as a surprise to many in the blockchain industry, it is estimated that China started developing its own stablecoin almost 5 years ago in 2014.

It is only because of Libra’s announcement that China’s authorities have sped up their rollout plan and made their intentions public.

The country and its 1.3 billion residents are perfectly primed for such a digital financial revolution, thanks to a sophisticated and integrated e-commerce industry that driven by its incredibly successful payment systems owned by the likes of WeChat and AliBaba.

China’s 2-Tier digital currency system

The Chinese stablecoin will likely operate on a 2-tier system:

- Layer One: The PBCOC will both issue and redeem CBDC through commercial banks.

- Layer Two: Commercial banks will be responsible for redistributing the central bank digital currency to the retail consumer market.

Social Credit Score implications

However, it’s doubtful that the Chinese government’s intentions are purely benevolent. Any stablecoin will likely be used to further enhance governmental control tools like the controversial social credit score system, which rewards obedient and punishes “misbehaving” citizens with Orwellian tactics straight out of a Black Mirror episode.

According to this Business Insider article:

“China plans to rank all its citizens based on their “social credit” by 2020. People can be rewarded or punished according to their scores. Like private financial credit scores, a person’s social scores can move up and down according to their behavior.”

Some of the ways the credit system can punish you are by denying you access to flight tickets, hotel reservations and good schools for your children, throttling your internet speed and even taking your dog away!

A globalcoin trojan horse?

China’s top bankers have indicated that any central bank-backed digital coin would only be used domestically. However, many analysts are not convinced, especially when considering China’s future plans and an escalating trade war with the incumbent world currency titleholder, the United States.

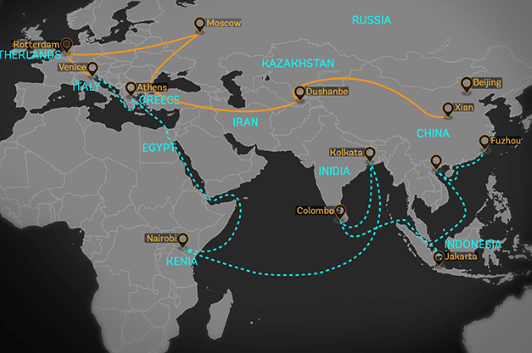

China’s ambitious Belt and Road project aims to connect Asia with European and African countries over land (Road) and sea (Belt) networks that stretch along six corridors.

A globally accepted China-centric digital currency would certainly put the communist country’s RMB currency in a strong position to eventually overtake the U.S. dollar as the world’s currency of choice.

Libra Blasts digital Renminbi

Facebook’s David Marcus took a big swipe at the Chinese CBDC during a French interview with a Swiss broadcaster, in which he painted Libra with a straight face as a potential defender of the “Internet of the Free World (democratic countries)” .

China is marching towards a digital Renminbi. And what is not really understood is that people think this is really just a domestic project for China. In reality, it’s a far more ambitious project — a project that really wants to replace certain financial networks in the Belt and Road countries. It’s a real risk.

The funny thing is, he’s not entirely wrong.

This is the end of Part III.

In Part IV, our final article in the Stablecoins series, we’ll look at new stablecoins from Binance, Bitfinex and Big Bank Coins from JP Morgan and Wells Fargo.

Disclaimer: CoolBitX does not endorse and is not responsible for or liable for any content, accuracy, quality or other materials on this page. Readers should do their own research before taking any actions.

CoolBitX is not responsible, directly or indirectly, for any damage or loss caused by or in connection with the use of or reliance on any content, goods or services mentioned in this guide.