Table of Contents

- Intro: Bitcoin and COVID-19

- Bitcoin and Ethereum in 2021

- Institutional adoption of crypto

- Crypto regulations will help adoption

- Hackers and scams: Can they be stopped?

- The rise of stablecoins

- Ethereum 2.0

- DeFi in 2021

- Biden’s Presidency and crypto

- Virtual Summits

- Ripple (XRP) vs SEC

- Conclusion

The following article constitutes opinions from the author that are neither endorsed by CoolBitX and should under no circumstances be considered financial advice.

Hi everyone! Glad to see you’ve survived and made it to 2021. Jokes aside, the year 2020 will go down in history books for a number of reasons (I mean seriously, there’s a “Death to 2020” movie topping Netflix right now!) and the crypto space was certainly no exception, as our year-end review explained. By now you probably know that 2021 will be no picnic either.

Bitcoin blooms while Covid-19 pandemic rages on

The COVID-19 ravaged the global economy and has redefined how we will be living our lives for the foreseeable future. Spoiler alert: Not well. The pandemic has also necessitated a “new normal” and an earlier transformation to “digital everything” in the new decade in response.

For the crypto sector, it was the most important 365 days of their turbulent existence, with significant gains toward the end that has skyrocketed in the early new year. Notably, the gains took many forms; regulatory greenlights, price increments, institutional adoption of cryptocurrencies, and expansion of blockchain across major industries.

The stage is now set for 2021 to be an even bigger year. The question is, can the crypto industry be able to maintain this momentum? In this article, we’ll venture a guess, whether institutional adoption has enough fuel, and whether we should anticipate the introduction of stringent measures from regulators. Please note that nothing in this article should be construed as financial advice of any kind.

We’ll also look at crypto’s key drivers in 2020 and their possible impact in 2021, most notably Ethereum 2.0 and its transition to Proof-of-Stake this year, the direction the DeFi space is heading,and whether Ripple has a chance to floor SEC in court, among other important trends.

Bitcoin and Ethereum in 2021

As usual, Bitcoin is THE cryptocurrency to watch in 2021. The crypto king started the year changing hands at above $30K, then rising at a new all-time high above $35k in January 6. On January 7, Bitcoin crossed into moon territory, hitting a magical $40,000. Days later, it tanked to just over $30,000 before rebounding by the time of writing. Completely normal by crypto standards.

Respected industry heads are very bullish. Marcus Swanepoel, co-founder and CEO of Luno, predicts that the king of all coins could likely end the year trading between $50K-$100K. But for other industry players, even that is a bit conservative. The Winklevoss twins make a case for “at least $500K” BTC in 2021.

Ethereum is the second coin to see high price appreciation. ETH was trading above the $1,000 mark on the fourth day of the year. And this price range is likely to continue into the year, the closer it gets to Ethereum 2.0’s final transition.

Although it’s been seen towing behind Bitcoins price appreciation, Ethereum appears to have a mind of its own. In fact, in the last month of 2020, it officially activated Beacon Chain, a blockchain platform supporting its shift from a proof of work (PoW) to a proof of stake (PoS) network.

Please note: It’s important not to be swept up with all the hype, but to do your own research. We had these crazy predictions in 2017 as well, with the likes of John McAfee and other crypto bulls losing their minds (and potentially body parts) over the potential value of Bitcoin in the 2020s.

While things are very different in 2021 compared to 2017 (for example institutional adoption is a big new driver), it’s important to remain vigilant and take smart financial decisions. Stay safe and invest with your head, not your heart. As always, do your own research (DYOR).

Billionaire entrepreneur and crypto sceptic probably offers some of the best advice for investors, drawing an analogy to the infamous dotcom bubble of 1999:

It’s important to note that even though Cuban is worried about a possible bubble, he is actually bullish on Bitcoin, Ethereum and a few others, comparing them to Amazon and eBay. It’s worth a few minutes to compare the share prices of these companies 20 years back to their current values!

Institutions will continue to hoard Bitcoin

The current BTC bull run has been attributed to institutional money flowing into the cryptocurrency space. From PayPal, Square, Microstrategy, One River, Ruffer, Grayscale, Guggenheim, MassMutual, and others, billions of institutional dollars have made their way into Bitcoin thanks to friendlier U.S. banking regulations, political turmoil, and a precariously weakening U.S. Dollar. Luckily, the momentum doesn’t show any signs of abating just yet.

Institutional investment executives like MicroStrategy’s Michael Saylor and Grayscale’s Barry Silbert and Michael Sonnenshein believe that institutional crypto adoption is here to stay.

Bitcoin has gained trust among institutions to the extent that they believe that digital currency is the future. In fact, Morgan Stanley has just bought a 10% stake in MicroStrategy, arguably on the back of their strong Bitcoin portfolio.

Additionally, the CSO is optimistic that the incoming Biden administration in the United States will see roughly $5 trillion find its way to various industries, including cryptocurrencies and blockchain projects.

Other analysts observed that the current shift by institutions to take up Bitcoin is powered by the monetary policy in the US. The country has been driving fiat inflation by printing more money via stimulus checks and others. As such, institutions use Bitcoin as a “natural home for liquidity seeking shelter.”

Apart from the USA’s monetary policy, Bitcoin is slowly but gradually replacing gold as a store of value. Therefore, as news of the revolution spreads, so do the institutional investments roll in. Bitcoin is considered to be “digital gold” after all.

Regulations will be bad medicine

Over the years, governments have taken a wait-and-see approach to cryptocurrency regulations. In 2019, the Financial Action Task Force rewrote the regulation playbook with its Travel Rule guidance. In late 2020, U.S. regulators took aim at companies that violate their securities and anti-money laundering (AML) laws, such as Ripple Labs (XRP issuer) and BitMEX.

In 2021, regulators across the globe are likely to increase their watch on crypto-based activities. While the new regulations may be stricter, they’re also more likely to provide a clear regulatory stand in the digital currency industry.

Interestingly, regulators’ move to shine their watchful eye on cryptocurrencies will be driven by the growing number of digital services caused by the coronavirus pandemic. Their regulatory reach will also touch on digital banking and the blockchain industry. In fact, the OCC now allows banks to issue stablecoins, as well as use them for payments,while Wyoming’s revolutionary blockchain laws help companies to offer both traditional and crypto custodial services to their clients.

On the flip side, decentralized finance (DeFi) is likely to be among regulators’ top concerns. For example, the European Union is already pushing for crypto regulations that would encompass crypto tokens used as investment vehicles.

In 2021, regulatory bodies such as the Financial Crimes Enforcement Network (FinCEN), Financial Action Task Force (FATF), the United States Department of Justice (DoJ), the Commodities, and Futures Trading Commission (CFTC) are likely to breathe a new wave of regulatory actions on private crypto storages and stablecoins. This doesn’t mean that crypto companies can’t fight back. In fact, Coinbase, Square, and Andreessen Horowitz have already started opposing regulators in early January 2021.

Furthermore, tax authorities are also expected to take a fresh look into crypto as a possible revenue stream.

Without proper regulations in place to protect investors from dealing with scammers, money launderers, or worse, terrorists, crypto will never truly attain mass adoption. This purge of criminal activity is very good for your Bitcoin holdings in the long run, so don’t fret!

Can crypto hackers and scammers be stopped?

2020 was another bumper year for crypto investors and hackers alike. KuCoin and Altsbit, an Italian exchange, suffered big losses in the hands of hackers.

Although KuCoin announced it had recovered over 80% of the $280 million stolen, others were not as lucky. Furthermore, hackers targeted poorly-coded DeFi protocols. For instance, users on bZx lost roughly $1 million to hackers.

Unfortunately, the trend is likely to continue in 2021. Experts from Kaspersky, a Russian cybersecurity company, have warned that hackers will continue to traverse the cryptosphere for new targets. However, Bitcoin holders will be the highest targets due to the coin’s dominance and appeal.

Another cybersecurity firm based in India, Lucideus, noted that it had started noticing “multiple types of cyber fraud around cryptocurrencies.” The firm has also seen an increase in new types of malware for little known cryptos, pyramid schemes, and scams involving crypto wallets.

However, analysts see cryptocurrency investors as the biggest fuel factor for hacks. This is because hackers and other malicious actors rely largely on “social engineering and getting you to install crappy software.”

Stablecoins: How will they be used?

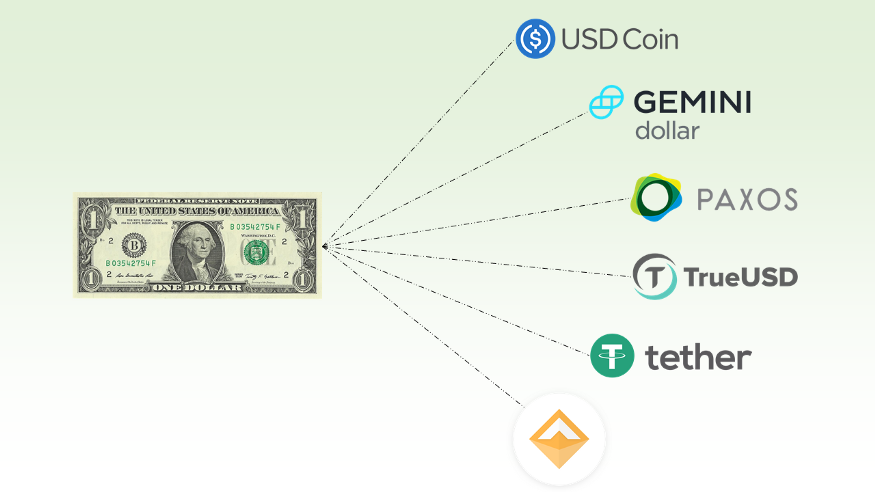

Thanks to the price volatility of cryptocurrencies, stablecoins may be the next best thing for investors looking for a stable value in 2021. Their increased usage in 2021 will also be catapulted by the possible dethroning of Tether (USDT), the leading stablecoin.

In the past, USDT has received negative energy to the extent of attracting scrutiny from regulators. Moreover, it has raised issues as to whether it’s adequately collateralized. With new entrants such as USDC and BUSD, USDT fans are bound to lose interest. Increased usage of stablecoins in 2021 acts as a key entry point for new cryptocurrency investments.

Blockchain, on the other hand, will see increased usage beyond the financial sector. For a long time, non-experts take blockchain to mean Bitcoin. This is the year for them to make that distinction. Blockchain is poised to be adopted in the mainstream world, where it’ll be visible in logistics, transportation, and healthcare.

The COVID-19 pandemic is part of the reason blockchain is finding new hosts away from finance. The pandemic has brought out the need for innovations. A section of industry participants view healthcare as the next big home for blockchain and tokenized access.

To elaborate, Chrissa McFarlane, an executive of a healthcare technology startup, told Cointelegraph that there’s a rise in tokens encouraging users to stay “healthy while providing them with access to their medical records.”

Will Ethereum 2.0 find Serenity?

Ethereum ended 2020 in style: the launch of the Beacon Chain last December 1, which signaled the beginning of Ethereum 2.0. ETH 2.0 marks Ethereum’s shift from PoW to PoS.

In the first week of 2021, Ethereum crushed the $1,000 mark for the first time since 2018, leading to a rally in altcoins as well. These are incredibly bullish signals for the world’s 2nd most popular cryptocurrency whose network provides much of the infrastructure for the rest of crypto, such as DeFi protocols and other smart contract-based projects.

This cycle first ran its course when promising cryptocurrencies like EOS, Tron, Ziliqa, Icon and OmiseGo first launched as ERC20 tokens on Ethereum, eventually spinning off on to their own mainnets.

In 2021, the new ETH-powered platform is likely to make more headlines as its transaction confirmation becomes faster. The new platform is also slated to undergo improvements to guard it against security threats from quantum computing, as well as introduce sharding to increase scalability.

According to Monica Singer, a Consensys executive, 2021 will be a year for ETH 2.0 “to advance its roadmap.” Part of this roadmap would involve bringing together the Ethereum 1 chain and ETH 2.0. The merging will lead to increased adoption by powering staking and new economies.

DeFi to explode again

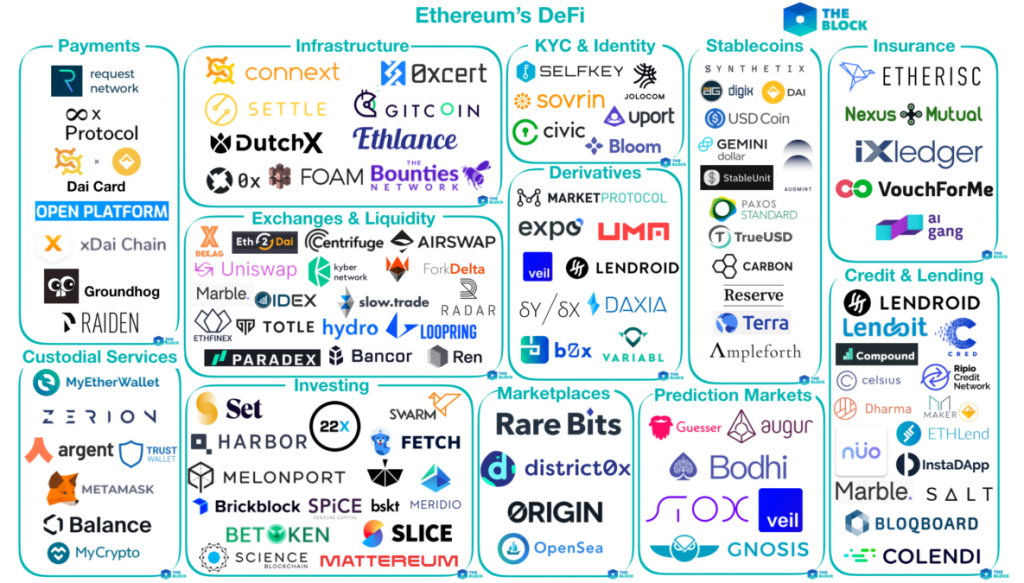

Last year, the number of DeFi protocols increased, and funds followed them. For instance, the space started the year with roughly $1 billion locked in DeFi platforms but finished the year with over $14 billion.

Experts project that the vigorous growth will continue deep into 2021. Moreover, the sector will experience heightened public awareness. According to Erick Pinos, an executive at Ontology, a blockchain platform, decentralized finance brings more ways for users to earn money. These ways are wrapped in decentralized lending, exchanges, mutual funds, derivatives, and insurance.

Pinos notes that in 2021, the DeFi crypto subsection will grow in development and the volume of transactions.

However, the growth may be curtailed by a regulatory cloud that may hover around the space. Fortunately, it will provide clearer regulatory guidelines boosting the adoption of DeFi applications.

Also, making the platforms user-friendly will serve as an additional force for further adoption in 2021. The rise of DeFi is likely to be boosted further by the introduction of DeFi protocols on Ethereum 2.0.

Although Ethereum 2.0 is viewed as the holy grail of DeFi scaling, Ethereum co-founder Vitalik Buterin had stated that Rollups could provide aid sooner, especially in decreasing gas costs.

DELIVERED EVERY WEEK

Subscribe to our Top Crypto News weekly newsletter

Biden’s Presidency Looks Green to Crypto

On January 20, 2021, president-elect Joe Biden will be sworn at an inauguration event held in the United States’ Capitol, Washington, DC. After taking the oath of office, Biden will officially be the 46th US president and deliver an inaugural address. With plans of a $3 TRILLION stimulus plan coming soon, this extra money could have a huge impact on Bitcoin.

There are hopes that the incoming US administration will be lenient or open-minded towards virtual currencies. Kristin Smith, Blockchain Association’s executive director, is optimistic that a Biden administration will give crypto an “opportunity.”

According to Smith, the incoming administration is keen on getting “some fresh faces” to occupy major regulatory agencies. The executive noted that the new faces are “more willing” to discuss cryptocurrencies compared to the current heads.

A good example is Biden’s inclusion of a former Goldman Sachs banker, Gary Gensler, into his transition team. Gensler is attached to the MIT Sloan School of Management, where he’s involved with courses touching on blockchain and digital currencies.

Another pro-crypto individual hoisted to take up key positions in the Biden administration is Lael Brainard, a Fed director in Boston who interested in the research of a digital dollar. Brainard is among the top minds lined up to head the United States Treasury Department.

Virtual conferences are back for more

Despite the coronavirus pandemic, the blockchain and cryptocurrency community are ready to meet. Whether physically or virtually, cryptocurrency conferences are densely spread across 2021. On January 19-20, crypto enthusiasts will meet in Abu Dhabi for this year’s UNLOCK Blockchain Forum.

The ASIA CRYPTO WEEK is another crypto-centric event marked to happen in the summer of 2021 in Hong Kong. The event brings together educational and developer-based events to foster mass crypto adoption.

Other crypto and or blockchain events slated to happen in 2021 include Blockchain Life 2021 (Moscow, Russia), Bitcoin 2021 (Los Angeles), and World Blockchain Forum (Seoul, South Korea). Virtual conferences in the year’s calendar include Futurist Conference (November), Human DeFi Haek (November), and LA Blockchain Summit (October).

And of course, Consensus Distributed 2021 looms large as the industry’s flagship (virtual again) conference.

XRP vs SEC: Who Will Win?

February 21, 2021, is the date for a virtual pretrial conference for the SEC and Ripple team to meet. The SEC has pressed charges against Ripple for dealing with unlicensed security. At the end of the conference, the US District Court of the Southern District of New York will need a joint statement. In the report, the two parties will give an overview of the case, the prospects for settlement, the contemplated motions, if any, among other details.

Looking back on previous crypto VS SEC cases, the SEC may appear to have the upper hand against Ripple. For example, the SEC won in cases involving Kik, Tezos, Telegram, and EOS. Tezos and EOS never challenged the SEC’s charges in court and resulted in paying settlements. Telegram and Kik went to court but lost. Telegram was slapped with an $18.5 million civil penalty and commanded to return over $1 billion to investors. Kik suffered a $5 million fine.

With that being said, things might also work out for XRP investors’ favor. Brad Garlinghouse, Ripple’s CEO, is confident that they’ll win the case since they’re “on the right side of the law.” And as it turns out, only one side of the story has been heard: the SEC’s.

As such, anything can happen in the XRP trial. If declared to be a security, Ripple may be slapped with a penalty and required to be registered. Furthermore, marking it as security will mean the end of the road for what was once the third-largest cryptocurrency.

On a separate note, lawyer John Deaton had shared a document detailing a class-action lawsuit against the SEC for how it mishandled the Ripple situation, as well as the havoc it has wreaked against XRP holders.

Conclusion

Although giving a guaranteed forecast of the future is nigh impossible, crypto and blockchain trends in 2020 have cleared a visible path for 2021. As such, this year looks bright for the cryptocurrency industry in nearly all corners, including development, adoption, and regulation.

Furthermore, blockchain will take on other spheres, such as health and logistics. Although some players in traditional finance yet again tag Bitcoin and other cryptos as a bubble, 2021 and beyond will likely yet again prove them wrong, as Bitcoin has continued to do year after year since 2010.

About CoolWallet

CoolWallet is the most secure crypto hardware wallet for Bitcoin, Ethereum, Litecoin, Bitcoin Cash, ERC20 Tokens, and other quality crypto assets.

If you’re looking to have full control over your Bitcoin ownership, the best cold (offline) storage, while retaining complete access to buying, selling and trading features on platforms such as ChangeHero, Changelly, BitPay, Binance DEX, UniSwap (and other WalletConnect decentralized exchanges), then your choice is easy.

The CoolWallet S is a revolutionary hardware wallet first released in 2016. Its first-gen predecessor was the world’s first Bluetooth mobile hardware wallet. The CoolWallet S allows you to keep your crypto in cold storage, completely offline, in full control, and in your real-world wallet.

The CoolWallet’s EAL5+ secure element, encrypted military-grade Bluetooth protocol, and several biometric security checks ensure that you can take it with you everywhere you go, without the need to use custodial solutions like centralized exchanges.

Learn more: Here are 10 reasons why you should get a CoolWallet in 2021!

Written by Werner Vermaak

Disclaimer: CoolBitX provides these blog posts for general educational purposes only. Information on this blog expresses the opinion of the author only. It does not constitute professional legal or financial advice and should not be considered as such.

The author or company may update the information on this article at any time without prior notice and do not guarantee the work to be up to date and accurate. To the best of our knowledge, the information provided here is factual at the time of writing.