What is a Decentralized Exchange (DEX)?

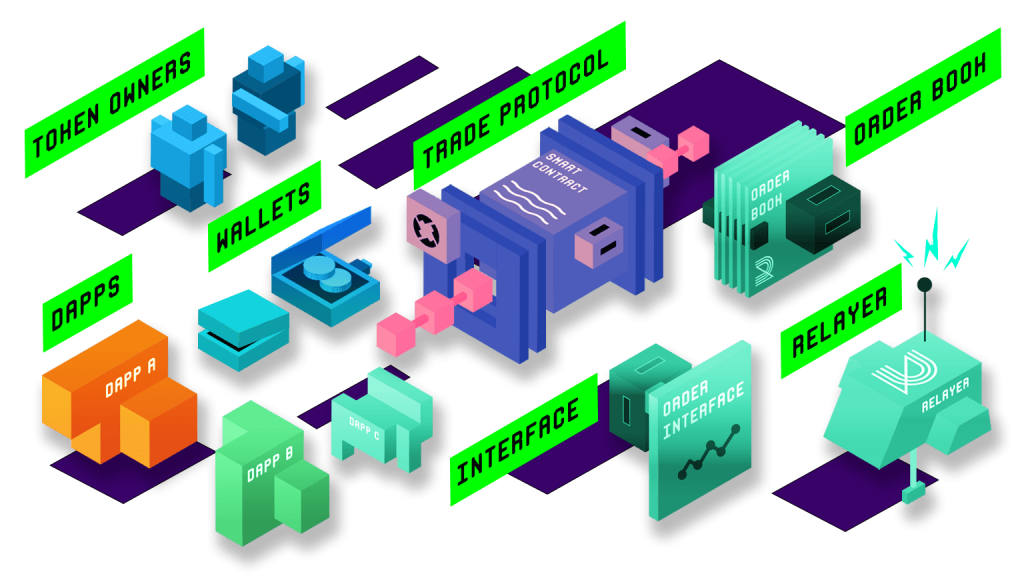

A decentralized exchange (DEX) is a peer-to-peer (P2P) marketplace and software protocol which connects crypto buyers and sellers without the need for an intermediary party to control transactions (and your assets) like on centralized cryptocurrency exchanges (CEXs). Decentralized platforms are non-custodial or unhosted, and doesn’t require the user to hand over the private keys to their wallet or transfer over to them like CEXs do.

Remember, a CEX like Binance, Coinbase and Bittrex takes custody of your crypto and charge you transaction service commission fee. They issue you what is essentially an IOU when you transact on their platform, which they redeem when you want to withdraw funds. As we have seen with countless hacks and scams in the crypto space amounting to billions of dollars, that IOU might be worthless by the time you want to cash out.

Of course, DEXs come with their own big inherent risks, such as scam or bogus smart contracts, or dishonest developers who can rugpull and take all your crypto with them.

Why are DEXs So Popular?

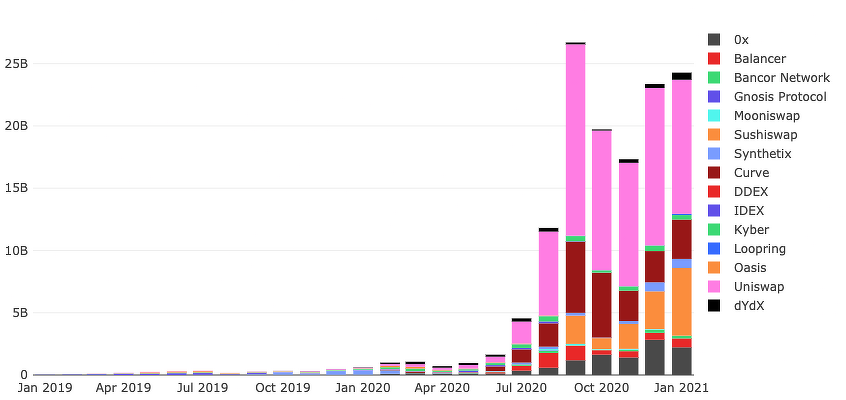

Increasing numbers of new users are exclusively conducting their cryptocurrency trading on DEXs since a lot of new tokens are listed there with exponentially higher possible returns, as has been seen with the flood of governance, liquidity mining, and non-fungible token (NFT) protocols since 2020.

Users also perceive DEXs to be safer as users keep control over their wallets, which is not the case with custodial solutions like Binance, Kucoin and Coinbase.

DEXs are decentralized by design, thereby appealing to crypto investors who value personal financial autonomy (“not your keys, not your crypto”) above anything else.

Apart from that, a lot of new tokens, these so-called “low-cap gems” as Youtube and Twitter influencers like to call them, are usually listed on DEXs like Uniswap, SushiSwap or Pancakeswap first since these platforms allow any token to be listed, unlike CEXs. This enabled not only DEXs, but the entire DeFi industry to explode in popularity.

In fact, the industry had received widespread recognition from the mainstream media in 2020 thanks to early DeFi networks such as Uniswap, Yearn.Finance, Compound, Maker, 1inch, Sushiswap, and Synthetix.

Here are some leading causes for the massive spike in the volumes of DEXs since 2019.

The Era of Decentralized Lending

Decentralized lending allows individuals to lend their crypto assets without any intermediary. Pioneered by Maker, basically, a lender receives a section of the interest paid by a borrower.

Compound popularized giving out governance tokens to liquidity providers, with their June 2020 COMP token rewards to its lenders and borrowers kicking off a dramatic surge in the token’s value as well as copycat incentives from other DeFi platforms. This attracted even more users, lured in by the prospect of earning both yield and liquidity incentives offering 1000s of percentages return on their investment.

AMM DEXs And Liquidity Mining

Liquidity mining is the process of providing liquidity to a DEX platform in exchange for rewards in the form of governance tokens and was first introduced by early AMM (automated market maker) DEXs like Sushiswap, which used it to “vampire mine” Uniswap, until the latter responded with its own token. Initially, tech-savvy users took advantage of these passive income schemes as liquidity mining was more technical in its early days.

It wasn’t until yield farming came when the DeFi space truly took off to unprecedented levels.

Yield Farming: The Holy Grail of DeFi

Yield farming is like liquidity mining on steroids, which makes it one of the most if not the most popular aspects of DeFi, paving the way for outsiders to get into the space and partake in farming various tokens. Yearn Finance championed this subsector, and continues to be a prominent DeFi aggregator protocol to this day.

Yield farming allows DeFi users to earn interest on funds deposited in smart contracts automatically. This attracted a lot of newbies as it does not require you to spend time finding good yields. Most users are generally enticed by the prospect of passive income, and yield farming does that, with some degree of risk.

Decentralized Autonomous Organizations (DAO)

DAO-focused platforms introduced decentralized governance where a distributed community can vote for or against new features or upgrades. In most cases, a DAO is crucial not only for DEX platforms, but any DeFi protocol as all systems need a governing body to manage ongoing development in order to become sustainable.

The Merging of NFTs and DeFi

/cdn.vox-cdn.com/uploads/chorus_asset/file/22362497/2021_NYR_20447_0001_001_beeple_everydays_the_first_5000_days034733_.jpg)

Additionally, non-fungible tokens (NFTs) marketplaces like OpenSea have contributed to the popularity of decentralized platforms by allowing distributed NFT trading. NFTs are currently the hottest area in crypto, with new sales and auction records being broken weekly.

Why should I use a hardware wallet with a DEX?

Users of decentralized exchanges (DEXs) probably already know that security should be your primary concern when owning cryptocurrencies, Of course, no crypto wallet is as safe as a hardware wallet, which keeps access to your crypto assets offline at all times, unlike Internet-connected wallets.

However, most DEX users also like to have a degree of flexibility and access their crypto much like they would do with a hot wallet or centralized exchange, requiring speed, efficiency and ease-of-use when transacting. For a hardware wallet that delivers all that and more, look no further than the CoolWallet.

A premium cold storage device like the CoolWallet (which has been mobile-only since 2016) is the most secure way to interact with DEXs.

This is because it protects your crypto assets with essential additional layers of security, such as

- a secure element chip that locks your private key away forever (preferably CC EAL5+ and up)

- biometric verification (in-app on your phone, such as fingerprint ID and patterns),

- Encrypted Bluetooth communication

- Visual check of the transaction details on both your app and the hardware wallet

- a physical button push on the card to confirm your transaction once

Super necessary safety warning:

Of course, taking personal responsibility for your assets is the best security measure of all. Keep in mind if you are tricked into sending funds to a bogus address or contract due to by a phishing or a counterfeit website, or reveal your recovery seed to a third party (such as by telling a friend, leaving it somewhere exposed or keeping a digital record of it) you could very well lose your assets. Always check the URL of a website, or use the blockchain explorer or a site like Coinmarketcap that will display the authentic address.

To learn more about staying safe on a DEX, check out our DEX Security Guide for 2021.

OK, with that PSA behind us, let’s look at how the CoolWallet is the ideal device to interact with the world’s best DEXs.

Not only does it allow you to buy, sell and trade supported crypto commodities and ERC20 tokens in-app on established platforms like Changelly, ChangeHero, Simplex and BitPay, but with the CoolWallet S, you can also trade with ease on the following decentralized exchanges, thanks to our integrated WalletConnect support features. WalletConnect was natively designed for mobile phones, and remember, so is the CoolWallet S.

What is WalletConnect?

WalletConnect is an open source protocol that connects decentralized applications (Dapps) to mobile wallets using simple QR code scanning or deep links. It allows a user to interact safely with any Dapp from their mobile phone, making WalletConnect wallets a safer choice compared to desktop or browser extension wallets.

WalletConnect boasts support for an incredible collection of Dapps, DEXs and even NFT marketplaces like OpenSea.

The 6 Best DEXs to use with CoolWallet

Uniswap

Uniswap is the biggest Ethereum DEX and a decentralized finance (DeFi) auto market maker (AMM) protocol used for decentralized and automated token exchanges on the Ethereum blockchain. The protocol is composed of a series of smart contracts that enable easy swaps between Ethereum (ETH) and any ERC20 token. Transactions are mostly automated through these contracts, eliminating the need for trust required among different actors.

Through its native token UNI, users can vote on governance proposals and discuss the future of the protocol with community members. Uniswap recently released their important V3 iteration, which will be released on 5 May 2021.

SushiSwap

SushiSwap is another Ethereum-based DEX where users can trade cryptocurrencies without the need for any middlemen. It functions similar to UniSwap, sourcing liquidity from pools where users supply assets. Liquidity providers earn incentives through the distribution of protocol fees and a portion of SUSHI tokens minted daily.

The protocol also has an application called SushiBar that lets users stake their SUSHI tokens to earn more SUSHI. SushiSwap will soon introduce its own decentralized autonomous organization (DAO) in order to give its native token holders control over the direction of the protocol.

SushiSwap cleverly took advantage of Uniswap’s open-source technology by copying it and then using vampire mining to lure its users away through its Sushi token. This duplication of source code is something that Uniswap V3 will stop through licensing.

1Inch

1Inch Exchange is a popular and innovative DEX aggregator designed to optimize the trades of its users by connecting its traders to multiple other exchanges, where it places their transactions accordingly to find the best prices. Its native token, 1INCH, can be used by holders to vote on governance proposals or provide liquidity to the platform and earn more 1INCH tokens.

Balancer

Balancer is an Ethereum-based DeFi protocol that aims to enable users to build their own exchanges. On this platform, anyone can create funds according to the assets that they keep in their portfolios.

The Balancer pool offers liquidity providers the ability to supply assets in exchange for token rewards. Additionally, users can bundle up to eight different tokens into a pool. Its native token, BAL, allows users to participate in the platform’s governance mechanism.

Binance DEX

Binance DEX is a decentralized exchange that allows users to execute peer-to-peer trading through its own matching system that links buyers and sellers together with a decentralized order book. Since it is built on the Binance Chain, it can settle transactions faster than Ethereum-based DEXs thanks to its one-second block time feature.

Its native token, BNB, can be utilized all throughout the vast Binance ecosystem including its centralized exchange.

In 2019, CoolBitX and Binance teamed up for this beautiful co-branded limited edition CoolWallet S below.

Open Sea (NFT)

OpenSea is an Ethereum-based NFT marketplace that allows users to trade NFTs with other digital assets. Users can purchase NFTs that represent digital collectibles, in-game assets, and digital artworks, among others. Furthermore, they also have the option to create their own secondary NFT marketplace on the protocol.

Please note that users won’t be able to see the NFTs displayed on the CoolWallet, as they are ERC721-based assets instead of in the ERC20 format.However, users will be able to “see”, access and trade them on the OpenSea.io platform.

How to use a DEX with CoolWallet and Wallet Connect

We’ll do a quick recap here, with Uniswap as example. Please note that WalletConnect-supported DEXs all operate essentially the same. Search for the WalletConnect button on your DEX’s website and use their QR code function for the quickest way to connect.

Please note that the Web is awash with fake websites trying to trick people in sending funds to scam addresses. Some of these sites even use sponsored ads to appear at the top of a Google Search result.

We recommend you CoinmarketCap or Coingecko’s list of DEXs ,where you can view the correct URL for a DEX. Also use these sites to get the correct smart contract address to send funds for tokens to.

How to Connect Uniswap through WalletConnect

Please follow the steps below to connect Uniswap through WalletConnect:

Step 1: Click Connect to a Wallet and choose Wallet Connect. A QR code should appear.

Step 2: Scan the QR code with your smartphone and your address should appear.

Step 3: If everything is correct, you may close the window.

How to Swap Tokens with Uniswap

Please follow the steps below to swap tokens with Uniswap:

Step 1: In the Swap tab, you can input the amount of ETH or token you want to swap. If you are exchanging an ERC or if this is your first time using Uniswap, please continue on to step 2.

Step 2: Click Please unlock token to continue at the bottom to approve the Uniswap contract.

Step 3: After unlocking, a Deal Summary should appear on your smartphone. If everything is correct, you can tap Confirm.

Step 4: Turn on the CoolWallet S by pressing the button and ‘SMART’ should be displayed on the screen. This indicates that it is utilizing a smart contract transaction rather than a simple transfer.

Step 5: Double-click the button on the card to approve the signing.

Step 6: You should now be able to click the Swap button to complete the transaction.

Step 7: After swapping, you can click the dots at the top-right corner to look at the status of all transactions.

Written by Werner Vermaak

This article is intended for educational and entertainment purposes only. Do not use this information as financial advice in any way. The author and CoolWallet reserve the right to change the content of this article at any time if needed, and will not be responsible for any financial losses the reader may incur as a result of the information in this blog post.

DELIVERED EVERY WEEK