Litecoin has successfully completed its 2nd halving (aka “Halvening”) on August 5, 2019, slashing block rewards by 50% to 12.5 LTC. What can we expect in 2019 and beyond from the world’s 5th largest cryptocurrency?

Table of Contents

- Litecoin 2019 Halving Overview: What happened and why?

- LTC 2019 Price Movement: Before, during and after August halving

- First & Next LTC Halvings: 2015 and 2023 impact

- Litecoin Mining: Intro, ROI, Final LTC mining date

- About Litecoin: Overview, History, Design

- CoolWallet S: Official Litecoin hardware wallet

Disclaimer: No financial or investment advice is offered or suggested in this article by CoolBitX or coolwallet.io. This article is to be considered for recreational reading only.

1. LITECOIN (LTC)’S 2019 HALVING

What is the Litecoin Halving?

Litecoin is designed, much like Bitcoin, to make it more difficult and expensive to mine over time as an anti-inflationary measure. It does this by halving block mining rewards earned by LTC miners who “solve” increasingly difficult equations while keeping the network secure and updated. Litecoin reduces its mining rewards by 50% every 840,000 blocks, roughly every 4 years. The first halving occurred in 2015, when LTC was only $3 each.

2019- Litecoin’s Completes 2nd Halving Succesfully

Litecoin, the world’s 5th biggest cryptocurrency by market cap (over $6 billion), successfully concluded its second halving on August 5th, 2019. This followed a much-publicized and at times frenetic build-up over the last 6 months, during which its price soared from $30 to over $140 at one point.

Following Litecoin’s halving with high price volatility in 2015, the new update came into effect just after 10 am (UTC) on Monday, August 5th, 2019, when the Litecoin blockchain reached a height of 1,680,000.

This triggered a reduction in miner rewards by 50%, from 25 LTC to 12.5 LTC. This follows 2015’s reduction from 50 to 25 LTC.

Litecoin miners’ block rewards cut from 25 to 12.5 LTC

The latest halving cuts LTC block rewards from 25 LTC to 12.5 LTC and might be the end for smaller miners. Most of these small mining pools running on outdated hardware will now find it unprofitable to keep mining unless Litecoin has a massive uptick in value. Also, rewards will once again be cut in half in 2023, this time to a meager 6.25 LTC per block.

Why do Litecoin’s mining rewards halve?

A “halving” in crypto rewards serves a specific agenda. As Litecoin is based on the Bitcoin protocol and mimics much of its behavior, here’s a theory about why halving occurs in both Bitcoin and Litecoin:

Satoshi’s genius inflation-buster?

A halving is essentially a method to combat inflation in cryptocurrency, as explained by Bitcoin creator Satoshi Nakamoto in an email a decade ago.

If the supply of money increases at the same rate that the number of people using it increases, prices remain stable. If it does not increase as fast as demand, there will be deflation and early holders of money will see its value increase. Coins have to get initially distributed somehow, and a constant rate seems like the best formula.

Benefits and Risks of Crypto Rewards Halving

Halving aims to slow down the mining of that asset, by making it more costly and difficult to mine, thereby theoretically making it more valuable.

However, it could also make the blockchain network less secure and stable as many miners cease their operations due to a negative or reduced ROI. This would mean that hash power is concentrated in the hands of fewer miners and susceptible to security risks.

Normally, only mature and very liquid digital assets with big market caps will enforce halving, as there are serious security risks involved, such as a potential 51% attack.

How did Litecoin’s halving affect its mining and network?

In the days following Litecoin’s halving, Charlie Lee tweeted that the Litecoin network did not suffer much disruption and that new blocks were actually being mined much faster than expected (1.4 minutes vs. 2.5 minutes).

2. LITECOIN PRICE MOVEMENT IN 2019

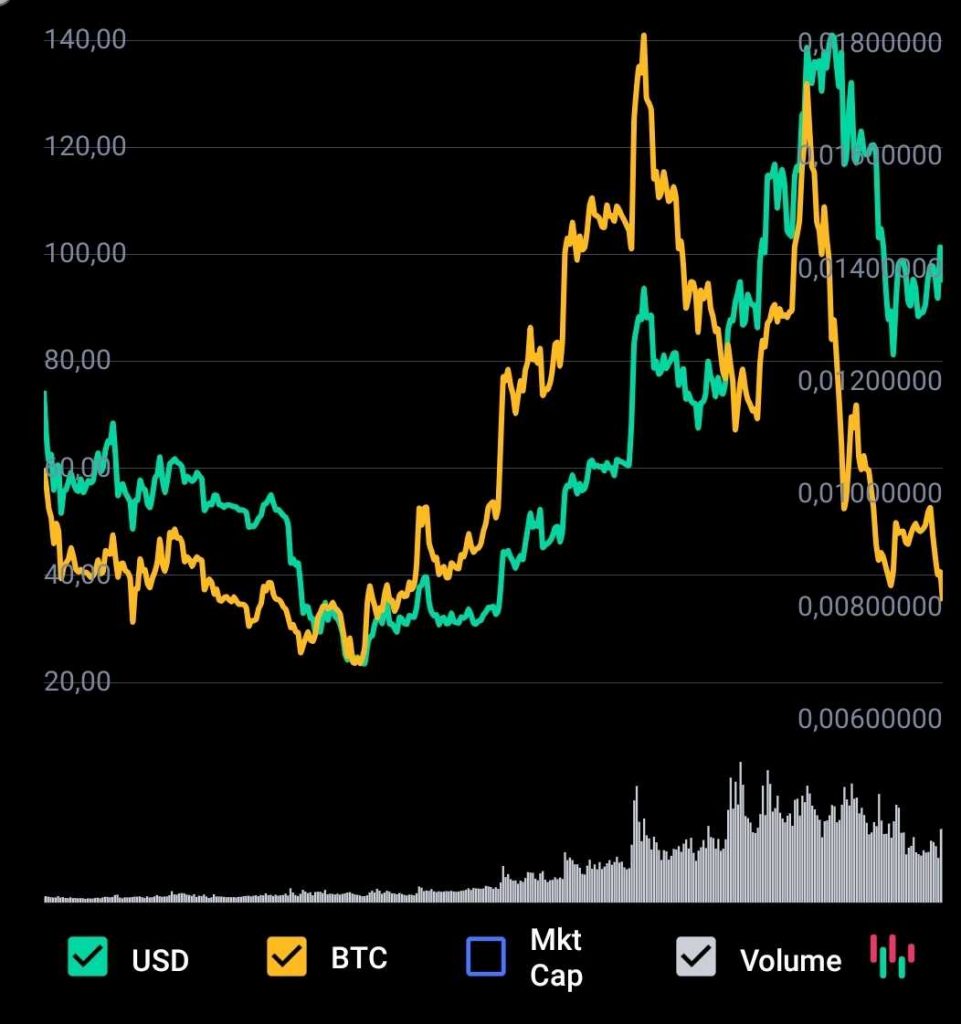

It’s been a slow and painful downward spiral for Litecoin (and most other altcoins) since it reached its all-time-high price of $357 on the 18th of December 2017.

January 1st, 2019: LTC price – $30 (before halving)

After kicking off 2019 on January 1st at just over $30, LTC soon joined the Bitcoin bull run, hitting a high of $142 on June 23, before running out of steam. Litecoin currently trades at the time of writing at around $90 each.

Much of Litecoin’s ascendance has been attributed to its looming mining halving, which created presumptively favorable conditions for investors by facilitating a decrease in supply.

June 2019: Before halving, LTC price up to $142 high

Analysts expected Litecoin to go as high as $200, but it never came to be, as Bitcoin’s price crashed from $13,000 to around $9,000 just as Litecoin hit its peak.

Since the end of June, Litecoin has fluctuated between the $80-$100 range, but has lost considerable ground if measured against Bitcoin in satoshi units.

(Source: CoinMarketCap App)

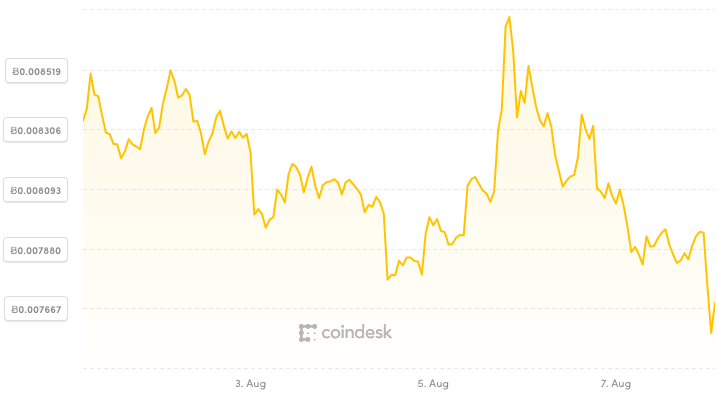

August 2019: After halving, LTC drops to $90

There has been much speculation that Litecoin’s halving has already been “factored in” by investors over the last 6 months and many analysts predicted a swift and precipitous price dump. This hasn’t quite played out.

So far, a few days in, the price has held steady between $100 and $90, but lost ground against Bitcoin in satoshi value, dropping roughly from Ƀ0.0087 at the time of the halving to Ƀ0.0075 by August 7th.

3. LITECOIN’S LAST AND NEXT HALVING

2015: How did the first halving impact LTC?

In 2015, Litecoin had its first halving implementation. Its price jumped from a low of $1.30 (!) in April to almost $9 by July 2015, about 45 days before its first halving, when it started correcting all the way down to $2.40 at the time of the event.

In the months after, it hovered below and above $3, which indicated that the halving had a massive influence on the price leading up to the event. Similarly, some voices in the crypto community attribute the big rise in Bitcoin’s price the last few months to its halving next year (2020).

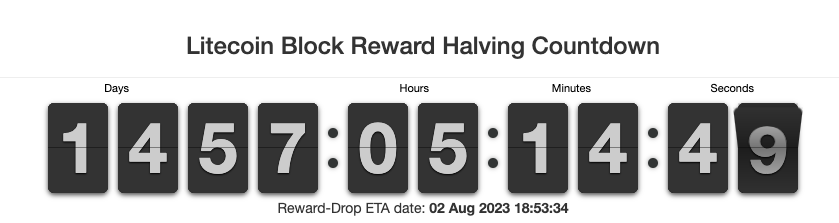

2023: When is Litecoin Halving’s next halving?

Litecoin’s 3rd halving is currently scheduled for 2 August 2023, in less than four years time, when block rewards will drop from 12.5 LTC to only 6.25 LTC. You can tick off the days at litecoinblockhalf.com.

4. LITECOIN MINING

How will LTC’s Halving Impact Miners?

Based on comments made by Litecoin creator Charlie Lee and the founder of f2pool, a large mining pool, the 2nd LTC reduction will be a “shock” and make mining unprofitable for many miners with older machines, based on current Litecoin prices and electricity cost.

Miners can check profitability here: f2pool’s miner profit index

Litecoin mining explained

A Proof-of-Work cryptocurrency like Bitcoin and Litecoin requires powerful computers to validate transactions on the network by solving problems.

There is a finite supply to mine (BTC, 21 million; LTC, 84 million), yet technological advances (such as ever-improving ASIC miners and mining software) massively increase the speed and lower the cost with which blocks are mined if it goes unchecked. This can lead to a drop in the value of the cryptocurrency due to oversupply.

Crypto Mining Halving: Less profit, less supply, more value

The halving of crypto mining rewards makes it less profitable, or not profitable at all, for certain miners to continue when factoring in electricity and hardware costs.

This ensures that fewer Litecoins get mined, which in turn has the knock-on effect that less LTC enters the general circulation for trading. This makes it less available and raises its valuation based on the fundamental Economics 101 law of supply and demand, where less of something equates to a rise in its value.

Daily Litecoin mined drops to 7200 LTC

The daily average of new LTC minted now drops from 14,400 LTC to 7,200L TC – like explained in the previous section, reducing Litecoin’s future “production” in theory and thereby making it scarcer and more valuable.

At the time of writing (Aug 2019), only 20 million of the potential 84 million is still available to be mined in the future.

DELIVERED EVERY WEEK

Subscribe to our Top Crypto News weekly newsletter

The Case for “Virgin” Litecoin

Interestingly enough, there has recently has been a fresh spate of media coverage on “virgin” Bitcoin – i.e. BTC that has been freshly mined or never spent, thereby ensuring it’s a type of “collectible” investment, immune to many regulatory hurdles that older, more circulated Bitcoin likely previously used for nefarious money-laundering and other illicit gains might have to jump over.

Who knows then, the same might apply for the remaining 20 million LTC to be unearthed by the blockchain, which could put its value at a premium over older Litecoin and very well might keep incentivizing Litecoin miners to keep their machines running.

What is the block time of Litecoin?

Litecoin has a block time of 2.5 minutes, which means that a new block is expected to be generated roughly every 150 seconds. Charlie Lee tweeted that in the aftermath of the halving, block time has actually sped up to 1.4 minutes. This seems to indicate that most miners are continuing their efforts, or haven’t reduced their machines’ hash power yet.

When will the last Litecoin be mined?

The final Litecoin is predicted to be mined more than 120 years from now, in the year 2142! Who knows, by that time we will have reached the moon and Litecoin owners might be able to book a return ticket to Mars instead!

Again, if you’re really bored, you can follow the journey here.

5. ABOUT LITECOIN

Litecoin is an open-source, peer-to-peer virtual currency that was created by developer Charlie Lee in 2011. Lee, who formerly worked for Google and Coinbase, released the code on Github on 7 October, 2011. Litecoin was initially designed to help miners generate new crypto by using their CPU’s, not expensive GPU’s.

Litecoin Supply and Scrypt Protocol

Litecoin (LTC) has a total potential supply of 84,000,000 LTC, with over 62 million already mined and in circulation. The blockchain is based on Bitcoin’s protocol but with a different algorithm that uses the Scrypt proof-of-work mining algorithm instead of SHA-256.

The Scrypt protocol (consumer-level computers to mine Litecoin (via memory-intensive graphics processors or GPUs) and made it resistant to ASIC miners (dedicated mining machines) until recently. In 2019, though, there are ASIC miners which have been adapted for Scrypt. However, the latest halving seriously dents the profitability of older models.

Litecoin Network- Faster and more efficient?

Litecoin is a decentralized payment network that enables instant, almost fee-less payments across the globe. According to its website, Litecoin blockchain offers faster transaction confirmation and better storage efficiency than other cryptocurrencies and acts as a “proven medium of commerce” complementary to Bitcoin. The established virtual currency has a big and active support base around the world through its Litecoin Foundation.

6. COOLWALLET S – OFFICIAL LITECOIN HARDWARE WALLET

Litecoin Foundation and LTC creator Charlie Lee officially endorsed the CoolWallet S as Litecoin’s hardware wallet of choice in 2018 after CoolBitX met up with Charlie in Taipei and he became taken with our world-first Bluetooth mobile hardware wallet.

CoolBitX often collaborates with Litecoin and Charlie Lee and recently managed a booth with the Litecoin Foundation at the Asia Blockchain Summit 2019 in Taipei, Taiwan, where we sold our Special Litecoin Edition of CoolWallet S hardware wallets.

Both CoolBitX CEO Michael Ou and Charlie Lee are firm believers in how the mass adoption, ownership and daily use of cryptocurrency and Litecoin can substantially improve the global economy’s inherent flaws and operation, empowering normal users to big institutions to conduct their finances more effectively.

To conclude this article, here’s a discussion Charlie and Michael had with Thomas Hu of Kyber Capital last year.

To learn more about Litecoin, check out our Litecoin resource section for guides, news and more information.

By Werner Vermaak

Disclaimer: CoolBitX does not endorse and is not responsible for or liable for any content, accuracy, quality or other materials on this page. Readers should do their own research before taking any actions.

CoolBitX is not responsible, directly or indirectly, for any damage or loss caused by or in connection with the use of or reliance on any content, goods or services mentioned in this guide.