Consider this your go-to guide for everything surrounding Bitcoin mining – from what mining actually is, to how to mine Bitcoins, all the way to joining a Bitcoin mining pool, we’ve got you covered.

Before actually tackling how to mine Bitcoin, we strongly recommend you read up on what Bitcoin is, the fundamentals driving it, and how it’s leading the charge of today’s cryptocurrency ecosystem.

Simply put, Bitcoin proposed (and quickly became) a viable alternative to the traditional, trust-based financial institutions and mechanisms for executing financial transactions.

Familiarize yourself with the history behind Bitcoin, its contentious fork into BTC and BCH, some commonly used terms in order to better grasp and understand the below ideas and concepts.

Our Mining Guide- For educational purposes only

Just remember, our CoolWallet guide to Bitcoin Mining is strictly educational and should only be used as a launching point for those interested in mining Bitcoin and other cryptocurrencies. Bitcoin mining variables change as fast as the price of BTC. While we will update this artile periodically, please, make sure to do your own research .

Looking to mine Ethereum instead? Not a problem at all, check out our comprehensive guide on how to mine Ethereum, Ethereum mining profitability, and its transition towards Proof-of-Stake here.

And, if you’re curious about what Bitcoin is, how it’s different from Bitcoin Cash and Ethereum, and where to store it, check out our ‘What is Bitcoin’ and ‘Bitcoin Wallet’ guides. More specifically, our ‘What is Bitcoin’ guide walks you through:

- What Bitcoin is,

- How it works,

- Core fundamentals and features,

- Who Satoshi Nakamoto is speculated to be,

- Advantages and disadvantages,

- Where to buy BTC, and more.

If you’ve brushed up on Bitcoin and its storied history, then you’ve probably heard of the Bitcoin Cash fork on August 1st, 2017, which increased the overall block size on the network. You can read up further on Bitcoin Cash by checking out our comprehensive guide here.

Now, let’s get into what Bitcoin mining is and how to mine Bitcoin (BTC).

1. What is Cryptocurrency Mining & How Does It Work?

Bitcoin mining is an effective and viable option for users looking to contribute GPU and CPU space in order to validate and facilitate transactions on the Bitcoin network in exchange for rewards. However, mining Bitcoin should be approached with a thorough and well-structured gameplan, otherwise, you risk running up exorbitant costs for “juice” that just isn’t worth the squeeze.

Drawing inspiration from the California gold rush of the mid-1800s, cryptocurrency mining is today’s modern technological day equivalent – where instead of forty-niners armed with shovels and pans sifting through dirt, users are contributing GPU and CPU space to score themselves a piece of digital gold (also known as cryptocurrencies).

So how do users utilize GPU and CPU space to mine Bitcoin?

Through a consensus and economic measure known as Proof-of-Work or PoW for short.

Proof-of-Work (POW)- What is it and how does it work?

PoW is a consensus mechanism geared towards preventing blockchain network attacks, abuse, and vulnerabilities. It does this by utilizing network actors who perform realizable computations and calculations (“hash puzzles”) to verify transactions and information on the blockchain. Such hash puzzles make up what’s commonly referred to as a “block” or collection of mathematical equations to be solved.

In exchange for solving blocks and broadcasting their completion of mining across the network, miners are granted a reward (think BTC, BCH, ETH). Naturally, as a network expands and accepts more information and users, the mathematical equations and blocks adapt – becoming exponentially harder to solve. This ultimately requires more hashing power in order to successfully mine them (something we’ll address below). The reason for the increasing difficulty in mining is to compensate for Moore’s Law and to keep inflation in check (together with rewards “halving”, like we recently saw Litecoin, when block rewards dropped from 25 to 12,5 LTC.)

PoW can be compared to the equivalent of a Sudoku contest, where persons compete head to head in order to “solve” mathematical computations and equations the quickest.

Benefits of Proof-of-Work mining:

- Consensus amongst the network between miners,

- Decentralization of the network,

- Proper recordation of “blocks” on the blockchain, &

- Denial of attacks and spam on the network.

Disadvantages of Proof-of-Work mining

-Proof-of-Work mining of a mature cryptocurrency like Bitcoin is incredibly energy-intensive and in fact, current electricity used by miners exceeds the total energy consumption of many small countries. Bitcoin critics deride mining as wasteful and ecologically very unfriendly. However, a report last year indicated that over 80% of Bitcoin mining is done with green energy.

-Proof-of-Work blockchains also are not always that secure. Their security depends on the number of miners they have that are validating the transactions. If there are not enough miners to protect the network, then the whole blockchain can be susceptible to a 51% attack, where certain miners take over the whole blockchain and do as they please

-Finally, it is also very expensive to ensure you have the most competitive hardware in order to stand a fair chance of gaining block rewards. The hardware you buy today might be outdated in a few months, leading to a very bad ROI.

POW Mining- A closer look

As PoW miners are using their computational resources to solve hashes and blocks – ultimately validating and verifying the legitimacy of network transactions and information) while ensuring a decentralized nature (no central trusted third-party in control of functions) – they are the very gears that make the network turn.

What are some examples of “mathematical puzzles” and functions Bitcoin miners are solving?

Let’s take a look at a few:

- Hash sequences,

- Assorted puzzles (including Diffie-Hellman-based puzzles),

- Merkle tree based hashes,

- Integer factorization,

- Signatures, & more.

The Bitcoin network follows Proof-of-Work for its consensus mechanism, so let’s get into how exactly Bitcoin mining works.

CoolWallet Security Tip: Before choosing a cryptocurrency exchange or platform to purchase Bitcoin, make sure to conduct your due diligence. Look for whether it has been subject to any past malicious attacks and hacks, whether it supports two-factor authentication, and its liquidity.

Looking for another explanation of Proof-of-Work and how it facilitates and validates the Bitcoin network? Check out our comprehensive guide to Bitcoin, where we tackle Satoshi Nakamoto’s original vision for Bitcoin and PoW.

2. Bitcoin Mining Explained: How Does Bitcoin Mining Work?

An excerpt from the white paper explaining the immutability of a block after the completion of PoW. Effectively, the network cannot be “rolled back” and compromised.

If you’ve read our guide to mining Ethereum, it’s integral to understand that Bitcoin and Ethereum are entirely separate blockchains and entities, with their own specific tokens (Bitcoin/BTC and Ethereum/ETH). They also boast differing hashing algorithms.

Bitcoin mining is the process of miners keeping the blockchain stable, complete, and immutable, through the solving of blocks (compiled transactions and hashes). Successful miners who find and solve the newest blocks are then in return, rewarded with newly minted and issued Bitcoins and transaction fees.

Specifically, “the system is secure as long as honest nodes collectively control more CPU power than any cooperating group of attacker nodes.” You can read up further on the potential centralization threats posed to the Bitcoin network here.

SHA-256 algorithm

Each block on the Bitcoin network contains a SHA-256 cryptographic hash, which ultimately links it to a previous block and connects the blockchain. Think about it, blockchain is literally the definition of a “chain of blocks.” Think of the SHA-256 hashing algorithm as a means to ensure a timestamp server, which exists “to generate computational proof of the chronological order of transactions.”

Double-spending protection

By providing an effective and identifiable timestamp, the network is protected against a popular issue of double spending – or the spending of money more than once (which avails the network to fraudulent attacks). For example, Bitcoin users are protected from double spending and fraud through waiting for confirmations when engaging in transactions. With each transaction confirmed, the transaction becomes more permanent and irreversible.

Representation and majority decision

Additionally, Bitcoin’s Proof-of-Work implementation solves the problem of representation and majority decision making on the network. For example, if the majority of miners and users were concentrated into a single IP address with one vote, it could subsequently fall prey to persons looking to allocate numerous IPs.

Proof-of-Work ensures “one-CPU-one-vote,” where honest chains and network actors are rewarded, and become the driving force of the direction of the network.

On the Bitcoin network, every 2,016 blocks (or roughly 14 days at 10 minutes per block), the difficulty target is modified based on the network’s recent transactions and performance, with the overall goal to stay at 10 minutes per block. Bitcoin’s Proof-of-Work system makes the ability to actually significantly modify the blockchain (or modify it at all) difficult, due to the number of blocks increasing.

Where Can I Store My Bitcoin? Bitcoin Wallets

Keep in mind, after mining your first batch of BTC, you’ll need somewhere to have it sent. Enter, a Bitcoin wallet. Bitcoin wallets are not actually traditional wallets that you might think of, as they are not a physical place to store or hold Bitcoins. Instead, they are a way to access the blockchain transaction ledger and hold a user’s digital keys and credentials.

Careful! Some wallets don’t accept mined BTC

However, it’s important to choose accordingly, as some Bitcoin wallets in the blockchain ecosystem explicitly prohibit and warn against using their wallets to receive mining payouts. This means that should you have your hard-earned and mined BTC sent to one of these wallets, you risk it never showing up altogether.

For example, Jaxx’s wallet’s website states:

“Jaxx is a lightweight wallet that is not ideal for receiving frequent tiny transactions that mining efforts in general produce. Receiving frequent mining rewards (or even faucet rewards) will create a lot of micro transactions that will need to be queried when you want to spend your balances.”

Additionally, they note:

“If you find that your Jaxx Wallet frequently freezes or will not initialize and you have been receiving mining/faucet rewards, it is possible that the sum total of your frequent micro-transactions have become heavier than our lightweight wallet can manage.”

Finally, they conclude:

“We are recommending that you do not point your mining rewards to your Jaxx Wallet.”

Many digital exchanges can’t receive mined BTC either

And, if you think it’s just certain wallets that discourage against having BTC mining rewards sent, then you’d be wrong. Even Coinbase, one of the largest purchasing and trading platforms in the blockchain ecosystem states they aren’t able to receive mining rewards.

And, while it may seem like your best option to have your Bitcoin mining rewards sent to your hardware wallet (ex. CoolWallet, Nano Ledger, or Trezor), hardware wallets and storage should be viewed more as a long-term solution for storage – meaning you shouldn’t likely have daily or weekly mining rewards sent. Instead, we strongly recommend having BTC mining rewards sent to an online Bitcoin wallet, where you can then consolidate larger amounts of BTC, and later send it to cold storage.

So, which Bitcoin Wallet should I download to send my BTC mining rewards to?

Best Bitcoin Wallets for BTC Mining Rewards

Wondering about the best Bitcoin wallets to send your BTC mining rewards to? In this section, we’re tackling 3 of the best Bitcoin wallets for doing so.

Bitcoin.org Bitcoin Core Wallet

Geared towards seasoned Bitcoin users and experts-alike, the Bitcoin.org Bitcoin Core wallet is the go-to wallet for miners looking to have their BTC mining rewards sent to. Hailed as the “original and official” Bitcoin wallet, the Bitcoin Core wallet offers “high levels of security, privacy, and stability,” and enables users to exercise full control over their money and fees, with improved privacy, and full validation of the Bitcoin network.

Full validation of the Bitcoin network means that users no longer have to rely on a third-party service, however, it may exercise large amounts of storage space and avail users to potential computer devices. Due to its relative technical nature, this might not be the best wallet for a newcomer to Bitcoin and Bitcoin mining, and should instead be utilized after acquainting yourself with the network and getting the hang of using several easier wallets.

Copay Bitcoin Wallet

Touting itself as the “secure, shared Bitcoin Wallet, Copay is an open-source HD multi-signature wallet from BitPay, authorizing Bitcoin miners and users to take security into their own hands through the elimination of having to trust a centralized third-party.

What’s unique about the Copay wallet is that it may be used similarly to a joint-checking account, where multiple users may approve transactions, perfect for sharing funds with coworkers, family, and friends. Or, if you’re looking to introduce a friend or family member to Bitcoin, this wallet is the perfect opportunity for doing so.

And, when sending money to a payment protocol-enabled merchant, rest assured Copay is securely verifying the payment is being sent to the right place – meaning, Copay wallet is not only a great wallet to have mining rewards sent to, but for everyday use and functionality.

Blockchain.com Wallet

With over 29 million wallets and $200B transacted since its inception, the Blockchain.com Bitcoin wallet is one of the most trusted cryptocurrency wallets in the crypto-sphere. It also doesn’t hurt that they boast some of the lowest fees in the entire cryptocurrency industry, making it a popular choice for Bitcoin miners looking for a wallet to send their BTC rewards to.

Additionally, it’s available for iOS, Android, and the Web, enabling users to access their funds from anywhere in the world. As the custodian of the wallet, you have complete control over your funds, as there are numerous preventative measures in place to protect against malicious hacks and attacks (2FA, email verification, backup phrase, etc…).

If you’re new to Bitcoin mining and Bitcoin wallets, we strongly suggest starting by downloading the Blockchain.com Wallet, as it is simple, quick, and supports an aesthetically pleasing (and easy to understand) interface.

Looking for an all-encompassing guide on the best Bitcoin and Ethereum wallets to store your BTC and ETH? Check out our past wallet guide, where we take you through the core differences between cold storage and hot wallets, the best wallets in the space, and more.

Now that we’ve walked you through the fundamentals of Bitcoin mining, let’s take a look at how to actually mine Bitcoin.

CoolWallet Storage Tip: Think of cold storage and hardware wallets similar to a savings account, only to be touched and used in very rare instances, while hot and online wallets should be seen as your modern-day checking account. Additionally, you can think of cryptocurrency hardware wallets as your own personal bank vault, where you HODL your Bitcoin and other cryptos for long periods of time.

3. How to Mine Bitcoin: Bitcoin Mining Hardware & Software

From the above historical chart, Bitcoin’s block difficulty has substantially increased since mid-2017, leading to lower BTC payouts for Bitcoin miners and a highly competitive mining ecosystem.

While it’s clear Bitcoin’s block difficulty has significantly increased over the last year and a half, mining may still be a profitable venture – however, you need to first develop a concrete and well though-out mining gameplan.

Before tackling Bitcoin mining profitability and estimated returns, let’s take a look at several core issues which has increased the overall difficulty for Bitcoin miners over the years.

- Electricity: It should be no surprise that miners with the lowest electricity costs have a clear advantage over those paying “through the roof” prices for energy. At present, Venezuela boasts some of the lowest electricity prices in the world (sitting around just USD .06 for a 320 kw electric bill), making it an attractive option for professional miners and organizations looking to dominate the Bitcoin mining market.

- Competition: Bitcoin mining has become a lucrative profession and industry, and it’s no longer only made up of recreational and hobbyist miners. As such, the competition is increasing, and certain countries taking advantage of low electricity costs are dominating the market. Furthermore, they are able to pool proper resources to purchase the most up-to-date and efficient hardware, making them hard to compete against.

- Hardware Costs: Probably the most obvious expense associated with mining Bitcoins is the hardware required to do so (we will address this below). With increased competition and the need to update your rig with the latest technology, Bitcoin hardware costs may run you a pretty penny (think power cables, software, cooling fans, etc…).

Now that we’ve taken a look at several fundamental reasons why overall Bitcoin mining difficulty has increased, let’s take a look at how profitable it is to mine Bitcoin.

Bitcoin Mining Calculator & Profitability

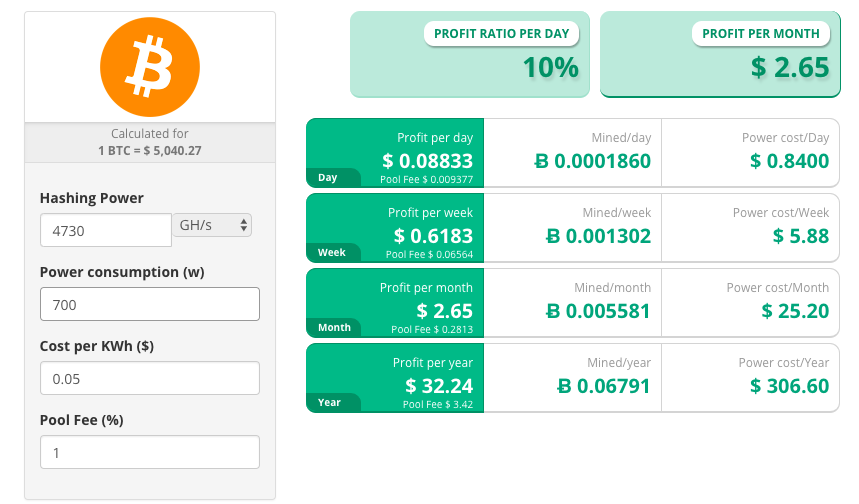

As we’ve noted throughout this piece, mining Bitcoins should be approached methodically (not haphazardly), therefore we strongly recommend you head over to one of the numerous Bitcoin profitability calculators to input your mining rig’s hashrate, cost per kWh, and power consumption. Doing so will give you a good ballpark of just how much you can expect to earn (or lose) per day, month, or year when mining Bitcoin.

Using the 99Bitcoins.com Bitcoin calculator, all you need to do is enter the:

- Hash rate of your mining rig and hardware,

- Any additional info (such as mining pool fees and electricity costs), and

- Sit back and enjoy your results in USD.

Or, head on over to CryptoCompare.com to input your rig’s hashing power, power consumption, cost per kwh, and pool fee to get a good idea of your overall profit ratio per day and profit per month.

Take some time to play around with the numbers on CryptoCompare.com in order to gain a better understanding of whether it’s actually worthwhile to mine BTC with your current or prospective mining rig.

It’s important to understand that the United States is not exactly the cheapest country to live in for electricity, and you may likely find yourself paying around USD .10 per 1000 watts/hour. Curious to see how your country ranks on the list of cheapest and most expensive countries to mine Bitcoin in? Head on over to this Bitcoinist map. As of date of publishing, Venezuela is the cheapest country for mining and electricity, while South Korea is the most expensive.

Just make sure to keep in mind that Bitcoin’s daily fluctuations and price, along with its mining difficulty may change rapidly, which may be hard to account for when determining the overall profitability of mining Bitcoin.

While building or purchasing a Bitcoin mining rig may seem like an easy money-maker, it’s not. Bitcoin and Ethereum mining rigs are depreciating assets, so not only could you be losing money on electricity and power costs, but you may risk ending up with a giant, burnt out GPU or CPU that you’re unable to sell after you’ve given mining a try. We strongly recommend heading on over to Amazon.com to check out the countless new and second- hand mining rigs which are being sold in order to get a good idea of how much (or how little) your rig may be worth.

Ultimately, it’s up to you to run the numbers and decide whether mining Bitcoins is worth it for you. Always make sure you are never investing more money in cryptocurrencies and mining materials than you are comfortable losing.

CoolWallet Bitcoin Fact: The total supply of Bitcoins is ultimately capped at just 21 million BTC. At the date of publishing, there are currently 17.3 million + Bitcoins in circulating supply, or roughly 82% of total Bitcoins. Based on the current mining rate of Bitcoin, and taking into account the fixed halving of blocks every four years, it’s estimated the last Bitcoin will be mined around 2040.

Now that you’ve decided you’re ready to start mining BTC and have formulated a thorough gameplan, it’s time to determine which hardware and software you’ll use to mine Bitcoin. Furthermore, you may be wondering, should I build my own or purchase one online? And, should I mine solo or join a mining pool to cut down on variance?

Let’s take a look.

Bitcoin Mining Hardware & Software

While mining initially was geared towards recreational miners and cryptocurrency hobbyist, it has since evolved into a billion-dollar industry, one where organizations and companies are assembling and distributing mining rigs by the boatload. As such, purchasing a Bitcoin rig has become the most popular route for mining Bitcoins. That’s not to say building your own mining rig isn’t an option, but in an age of convenience and immediacy, the consumer has heavily favored purchasing.

This section should be taken as an introductory guide to just some of the things you should consider when constructing and purchasing a Bitcoin mining rig.

Constructing & Building Your Personal Bitcoin Mining Rig

For a basic mining rig, you’ll likely need the following:

- PC Materials and Components: A motherboard, CPU, hard drive, power supply, and RAM,

- GPUs: Graphics cards,

- Miscellaneous Items: A frame for your rig, power cables, risers.

Most of these items can be found at your local computer store, and for anything else you can’t find, we recommend checking on Amazon or eBay.

Building your own Bitcoin mining rig will likely run you anywhere from USD $2000 to $4000. If you’re really serious about actually building your own, check out this thorough article diving into the construction process and essential materials further.

Purchasing a Bitcoin Mining Rig

If you aren’t that handy with tools and are looking to get started mining right away, purchasing an already assembled Bitcoin mining rig is likely your best bet.

Head on over to CryptoCompare.com if you’d like to see what a Bitcoin mining rig runs you these days, along with the estimated “payback period” just to break even on your initial investment.

Just remember, while Bitcoin and other mining rigs with higher hashrates will solve mathematical calculations and equations at a quicker rate than lower hashrate mining rigs, they will generally cost more and use more electricity. Make sure to factor this into your Bitcoin mining profitability and bottom line.

Bitcoin Mining Software

Once you’ve decided on your Bitcoin mining hardware and rig, you’re going to need to install the requisite mining software. While the actual Bitcoin mining is taken care of by the mining hardware, you’ll still need special Bitcoin mining software to connect you to the Bitcoin network and blockchain.

Specifically, software is the bridge which delivers the work in PoW to the miners and receives a miner’s completed work, ultimately relaying it to the blockchain or mining pool. Software will also account for and broadcast general statistics surrounding the Bitcoin mining process, displaying everything from the fan speed, to hashrate, to medium speed of all Bitcoin miners.

Below are just three examples of the best Bitcoin mining software for Mac OSX, Windows, and Linux:

- EasyMiner: a core feature of EasyMiner is the configuration of one’s miner, along with visual graphs of mining activity and performance.

- CGMiner: one of the most commonly used of all software for Bitcoin mining. CGMiner boasts numerous features, including fan speed control, self-detection of new blocks, and CPU and GPU support.

- BFGMiner: designed specifically for ASICs and quite similar to CGMiner.

For a comprehensive list of Bitcoin mining software, head on over to https://www.bitcoinmining.com/bitcoin-mining-software/.

Bitcoin to Fiat Exchange

How to Sell BTC for Fiat

If you’re mining BTC, you likely fall into one of the following categories – (1) a miner for-profit and profession, (2) a recreational miner, or (3) somewhere in between. Either way, there’s a good chance you’ll be looking to sell off a certain percentage of your BTC mining rewards in exchange for fiat (USD, SGD, GBP).

Should you choose to sell off a portion of your BTC mining rewards for fiat, it can oftentimes be difficult to find the proper exchange or website to safely and securely sell it. Think about it, there are BTC miners out there who earn their livelihood via Bitcoin rewards and returns, using it to cover their rent, food, and living expenses. Without a viable option to actually sell it off, mining would likely not be as large scale or lucrative of a profession.

Below are three of the best exchanges and mediums to sell your BTC rewards for fiat.

Coinbase

Coinbase is one of the most (if not the most) popular option for users looking to sell their BTC in exchange for fiat, as they offer crypto storage in almost 190 countries and fiat support in over 32 countries.

As one of the first mainstream cryptocurrency platforms to buy and sell BTC and ETH (founded in 2012), Coinbase grew to over 1 million users by 2014, catapulting it to the front of purchasing platforms and exchanges. As of date of publishing, they cater to 13 million strong users and generate over USD $1 billion in revenue per year, so don’t worry about having your order filled (they’re extremely liquid).

Furthermore, Coinbase is one of the most straightforward and simplest platforms to operate on, as they boast an aesthetically pleasing UI, straight forward deposit and withdrawal options, and both web and mobile wallets. Keep in mind when selling your BTC and ETH on Coinbase, you’ll be facing nearly a 1.5% transaction fee.

LocalBitcoins.com

Touting itself as the “fastest and easiest way to buy and sell Bitcoins,” LocalBitcoins.com is an online website and service which facilitates OTC (over the counter) trading of Bitcoins for local currencies. For example, users will post an advertisement for their Bitcoins, with set exchange rates and payment options, and then will be matched with a buyer.

What makes LocalBitcoins.com one of the most reputable websites for selling BTC for cash is that it has a reputation and feedback mechanism for users, along with an escrow and conflict resolution service. This isn’t just a small or niche website either, as it facilitates the trades of up to 3,000 Bitcoins per day, and has around 110,000 active traders.

If you’re a casual trader looking for privacy surrounding the conversion of your Bitcoins into fiat, then this is likely the perfect service and website for you. LocalBitcoins.com also facilitates the purchase and sale of Bitcoin Cash as well.

Kraken

If you’re hoping to swap your BTC for USD or other fiat on a well-known and reputation exchange, look no further than Kraken – the largest Bitcoin exchange for Euro liquidity in the world. Kraken has made a name for themselves in the cryptocurrency exchange space for an extremely transparent team, attentive customer support, and numerous fiat pairings.

Note that while signing up for Kraken is simple and straightforward, users will need to clear Tier 1 verification before being allowed to deposit and trade. For example, Tier 1 verification requires a user’s name, residence, date of birth, and telephone number. Once you’ve cleared Tier 1 verification, all that’s left is to generate a BTC address to send to, and then convert to either USD, GBP, CAD, JPY, or EUR.

Finally, in order to withdraw from Kraken, users must pass Tier 3 verification, which requires proof of a government-issued ID, social security number (for US residents), utility bill, and confirmation photo. What’s unique about withdrawals on Kraken is that a user’s withdrawal fees are calculated based on their maker/taker status, along with their third-day trade volume, which enables fees ranging anywhere from 0% to .25%.

CoolWallet Security & Storage Tip: Looking for a reputable exchange with core trading pairs and altcoins galore? Check out Binance. Binance has just announced they’ll be giving away all project listing fees to charity, and has a track record of excellent customer support and management, making it one of the go-to exchanges in today’s cryptocurrency market.

Is Mining Bitcoin a Waste of Energy?

While some might consider mining Bitcoins to be a waste of energy and drain on electricity costs, it’s just a small price to pay in order to secure and operate a decentralized network overhauling traditional financial institutions and mechanisms.

Just like any other payment processor or service, Bitcoin generates processing costs – for services which are necessary to further the operation of one of the most widespread monetary networks and systems in the world. Keep in mind while Bitcoin has been under fire for consuming large amounts of energy, its total energy consumption is in fact apparent and may be measured – as opposed to those associated with traditional payment institutions and services.

Curious about exactly how much electricity the Bitcoin network users? Head on over to digiconomist.net to check out the key network statistics. For example, the country most similar to Bitcoin in terms of energy consumption? Austria.

Furthermore, the current number of estimated U.S. households which can be powered for 1 day by the electricity consumed for a single Bitcoin transaction is nearly 29 households.

It’s clear there are still some serious kinks to work out in respect to energy consumption and Bitcoin mining, however, as cryptocurrency and blockchain is an always evolving and improving ecosystem, we only see it becoming more sustainable in the future.

4. Mining Bitcoins For Free

With cryptocurrency and blockchain’s push for mass adoption, it’s only natural services and mechanisms geared towards furthering such will follow suit. In this section, we’re going to take you through one of the best resources for mining Bitcoins for free.

Free Bitcoin Mining

Honeyminer gives new Bitcoin and cryptocurrency investors an opportunity to try their hand at mining by enabling anyone with a PC or laptop to get started right away, without the traditional, expensive costs associated with building a Bitcoin mining rig.

If you’re wondering how to mine Bitcoins for free, without having to invest in a Bitcoin mining rig or other setup, you’re in luck. Making cryptocurrency mining simple and accessible to those just getting into it is the Honeyminer, which enables anyone with a computer (PC or laptop) to mine cryptocurrencies.

Honeyminer gives users 1000 Satoshis (or roughly USD $.07) just for signing up, and utilizes a proprietary mining algorithm to identify the most profitable cryptocurrencies to mine at the moment. All mined coins are subsequently converted to Bitcoin, and users are free to withdraw anytime they want. Honeyminer is the perfect setup for users looking for free Bitcoin mining online, and boasts better payout rates than most BTC faucets.

You can calculate your potential earnings on their website, along with see estimated payouts based on annual Bitcoin growth rates. Note that computers with multiple graphics cards will earn more. It’s also important to understand that mining on a laptop may use serious power resources, which may ultimately devalue or slow down your computer.

If you have further questions about Honeyminer and free Bitcoin mining, head on over to their homepage and check out their FAQ.

5: Bitcoin Mining Pools: How to Join One?

Curious about how to join a Bitcoin mining pool? Don’t worry, in this section, we’re walking you through some of the best Bitcoin mining pools, their various reward schemes, and multipool mining.

Before getting into what exactly Bitcoin mining pools are, let’s first take a look at cryptocurrency mining pools and their role in the context of cryptocurrency mining.

As cryptocurrency mining has become more competitive over the years, with lower rewards at same computational costs, mining pools offer an attractive option for users looking to “pool” their mining resources with other miners, and in return, split rewards in a proportional way.

So, what are miners exactly pooling?

Cryptocurrency miners are pooling and sharing their computational and processing power, which in turn cuts down on the overall cost to mine a block.

Below are just several reward schemes associated with various mining pools in the crypto ecosystem:

- Pay-per-share (PPS): offers miners a guaranteed and instant payout in respect to their contribution to the pool. Miners receive payment from the pool’s existing BTC or crypto balance, and are able to withdraw immediately.

- Pay-per-last-N-shares (PPLNS): PPLNS are calculated according to the number of last shares, rather than the shares for the last round.

- Proportional: miners receive shares while searching for a block and is then awarded payouts in proportion to all shares of the mining round. Note that proportional shares are only awarded at the end of a mining round.

- Geometric & Double Geometric: two methods where miners are awarded the same BTC or crypto reward regardless of when they participate (geometric) and where miners accumulate a growing score which dictates their respective payouts (double geometric).

Now that we’ve taken you through what mining pools are and numerous reward schemes associated with them, let’s turn to what Bitcoin mining pools are and take a look at some of the most popular Bitcoin mining pools.

What are Bitcoin Mining Pools?

As their name implies, Bitcoin mining pools are mining pools where miners contribute power and computational resources in order to mine BTC. Bitcoin mining pools are an effective way to ensure quicker and more stable BTC payouts for solving blocks, while reducing overall costs and volatility associated with mining solo.

While mining Bitcoin solo may seem like the most attractive option, just remember, there are numerous hidden and unanticipated costs, such as:

- Electricity costs,

- Ventilation costs,

- Spacial costs,

- Cooling costs, &

- More.

Furthermore, mining solo can lead to excessive noise, heating issues, and frequent maintenance.

So, what should you look for when choosing a Bitcoin or cryptocurrency mining pool?

There’s several core factors to weigh before choosing a Bitcoin mining pool that is right for you and your situation, such as:

- Whether the BTC returns are sufficient to compensate for fees,

- Server and geographical locations,

- Number of miners in the pool,

- Difficult of mining blocks, &

- Overall payout threshold.

Now, let’s turn to three of the best and most popular Bitcoin mining pools in the cryptosphere today.

Best Bitcoin Mining Pools

While there’s no shortage of Bitcoin mining pools in today’s mining ecosystem, we strongly encourage new miners to first look to join a pool with a large user base and lower fees. Just remember to keep the following three things in mind before choosing a mining pool; it’s functionality, trustworthiness, and overall size.

Aligning yourself with a Bitcoin mining pool which emphasizes all three will help guard against future hassle and headaches, and allow you to better recognize payout loads and times.

AntPool

Owned and operated by Bitmain Technologies (the world’s largest designer of ASIC chips for Bitcoin mining), Antpool typically comes in at the top of the list for miners looking for an efficient and reputable mining pool.

Antpool has been around since 2014, and mines around 25% of all Bitcoin blocks. Keep in mind that there has been relative controversy and criticism of Antpool, as there was purported malware inclusion in the mining equipment sold by Bitmain. However, Bitmain denied such claims.

Just make sure not to have unrealistic expectations when joining a mining pool, as there are no guarantees in such a volatile industry.

BTC.com

BTC.com is the second-largest mining pool to produce the maximum number of blocks over the last six months in the Bitcoin mining ecosystem. Specifically, it generated over 16.5% of all Bitcoin blocks.

BTC.com is a bit newer than AntPool, and has only been around since 2016. Note that it is also owned by Bitmain Technologies – the same mining firm which operates and runs Antpool. What separates BTC.com from other major mining pools is its utilization of the full pay-per-share (FPPS) methodology, which has proven to be more beneficial to Bitcoin miners over the years.

Slush

If you’re looking to join one of the oldest mining pools out there, look no further than Slush. It also falls around fifth place for the most number of Bitcoin blocks mined. Slush goes all the way back to 2010 and has mined over 1 million Bitcoins, or 1/21 of all Bitcoins in existence.

Slush follows a score-based method, enacted to prohibit and demotivate miners switching pools during a mining round, and ultimately rewards loyal miners.

While Bitcoin and Ethereum profitability has declined over the years, there’s still value to take away. And, if you’re interested in mining altcoins and other “dust,” consider multipool mining, which uses a proprietary algorithm to select the most profitable altcoin to mine at the moment.

Multipool Mining: Geared Towards Profitability

Multipool mining is an exciting and innovative way to mine altcoins in today’s ecosystem, as it is a mining pool which alternates between the mining of different altcoins, opting for whichever is most profitable at the moment.

For example, a multipool may be mining Z coin at one stage, but hours later determine the block time and exchange price for X coin is more profitable, and switch over immediately.

Do I need to download multiple cryptocurrency and altcoin wallets?

No. That would be just silly and a waste of time and resources. As multipool mining is geared towards profitability, and is constantly changing between the most profitable altcoins to mine at the moment, most multipools will automatically exchange an convert whichever crypto is mined into one of the core trading pairs – ex. Bitcoin, Ethereum, etc…

As we’ve noted above, mining BTC and ETH has decreased in profitability over the years, so multipool mining offers a way for participants and miners to receive larger payouts through the initial mining of a profitable altcoin and later conversion to BTC or ETH. Some have noted that multipools and their automatic conversions to BTC, ETH, and other core market actors may ultimately drive mainstream demand for a coin and stabilize the market.

If you’d like to take a look at just some of the coins a popular multipool offers, we suggest heading on over to https://www.multipool.us/ – one of the most popular multipools out there.

CoolWallet Cryptocurrency Tip: It’s important to invest in cryptocurrencies which you find utility in. Don’t just choose to follow the herd and invest in a project because everyone else is doing it. Take time to acquaint yourself with the project’s fundamentals and ideals, the team behind it, and decide whether you think it solves a current issue plaguing traditional institutions. If you take time to actually familiarize yourself with a project and choose something you think is bringing value to society, then you can rest easy.

Finally, while this may seem like an obvious concept, you cannot join an Ethereum mining pool and receive payouts in Bitcoin, as they utilize completely different algorithms.

6. How to Store Your Bitcoin

The CoolWallet S is your go-to Bitcoin hardware wallet for the secure and seamless storage of your BTC, ETH, ERC20 tokens, and other cryptocurrencies. Pick yours up today and experience a hardware wallet which enables you to literally keep your funds at your fingertips!

Now that you’ve mined your first batch of Bitcoin (or received your 100th payout), found an online wallet to have your rewards sent to, and decided to HODL it long term, it’s time to figure out how to best secure and store it. In this section, we’re going to take you through how to store you Bitcoin offline and two of the best Bitcoin hardware wallets in all of cryptocurrency to use.

Once you’ve accumulated a stack of BTC, ETH, or other cryptocurrencies that you are not comfortable with losing (this generally falls within the one month salary range for most investors), it’s time to start considering a move and transfer to cold storage. While cold storage and Bitcoin hardware wallets may seem overly complicated and overwhelming, they are actually quite simple and straightforward. Think of hardware wallets and cold storage as possessing your own personal bank vault (or underground storage bunker), where your private keys are kept away from online connections and away from the control of a centralized entity.

Think about it, you wouldn’t choose to keep thousands of dollars in your wallet, where you may subsequently be robbed or lose your wallet altogether, so why would you keep large sums of Bitcoin and crypto online? It’s time to take your crypto to the blockchain and utilize cold storage.

Note that a small investment in cryptocurrency security now, could ultimately prevent heartache and loss of your Bitcoin and other funds in the future.

The CoolWallet S: Storage at Your Fingertips

Looking for a hardware wallet that not only securely stores your BTC and other cryptocurrencies, but protects against phishing attacks and enables you to trade with an exchange? Look no further, and check out the CoolWallet S.

For Bitcoin and cryptocurrency HODL’ers looking to keep their BTC and other cryptos at the tips of their fingers, consider using the CoolWallet S. The CoolWallet S is a sleek and dynamic cryptocurrency hardware wallet for securing and storing Bitcoin, Ethereum, ERC20 tokens, and other cryptocurrencies. Furthermore, it pairs both with your iPhone and Android, enabling users to seamlessly set-up their own personal “bank vault” without all the clunky and confusing cables associated with other crypto hardware wallets.

The CoolWallet S not only emphasizes functionality, but security and anonymity too, authorizing investors and users to anonymously set up and store their BTC and other investments in just minutes. And, that’s not all. It’s the first Bitcoin and crypto hardware wallet to partner with a decentralized trust and reputation protocol, MetaCert Protocol, giving users peace of mind that they don’t fall victim to malicious and predatory phishing scams. Finally, CoolWallet has just partnered with Changelly (an instant swap platform), and is now integrated into the Changelly API, sanctioning users to initiate fast and seamless crypto exchange within the wallet interface.

If you’re worried about your CoolWallet weathering all the elements (aside from malicious attacks and phishing scams), don’t stress, the CoolWallet S is:

- Tamperproof,

- Waterproof,

- Impact resistant, &

- Heat and cold resistant.

So, if you’re in the market for a Bitcoin and cryptocurrency hardware wallet that is built to last and geared towards cryptocurrency mass adoption, look no further and head on over to our homepage to read up further on the CoolWallet S. We also recommend swinging by our FAQ to check out some of the most frequently asked questions about the CoolWallet S and how it’s changing the hardware wallet ecosystem entirely!

Ledger Nano S

The Ledger Nano S enables users to operate not only with their specific wallet interface, but countless others, such as MyEtherWallet, MyCelium, and Electrum.

Known as one of the “heavyweights” in the world of cryptocurrency hardware wallets, the Ledger Nano S is well-deserved in its reputation, having sold their millionth Nano S at the beginning of 2018. Furthermore, the Ledger Nano S supports the most altcoins and cryptos of all the major hardware wallets and is priced just under USD $80, making it one of the most affordable as well.

Specifically, the Ledger Nano S boasts an OLED display double-check for transaction confirmations, authorizing users to connect their device to virtually any computer (even a corrupted one). Known for quality customer service and an ever growing list of supported coins, the Ledger Nano S is worth considering when looking to secure your BTC or cryptos.

To read up further about the Ledger Nano S, its durable and tested metal casing, and the upcoming supported coins, head on over to their website and check out their FAQ and blog.

Looking to read up further on the different types of cryptocurrency wallets available and which might be best for you? Head on over to our cryptocurrency corner to check out our blog post detailing the best Bitcoin wallets, hardware wallets, hot wallets, and other important information.

CoolWallet Storage Tip: When deciding on whether to purchase or utilize a hardware wallet, we generally recommend following the ‘one month rule’ – meaning, if you are holding more than one month’s salary on a cryptocurrency exchange, then we strongly advise on turning to cold storage. Or, if you are storing an amount of BTC or cryptocurrency that you aren’t comfortable losing, then you should be picking up a Bitcoin or cryptocurrency hardware wallet.

Looking to read up further on how the CoolWallet S is securing your Bitcoin and cryptocurrencies at unprecedented levels while bringing cold storage to your fingertips? Head on over to our cryptocurrency corner or check out our FAQ.

7. Additional Bitcoin Mining Resources & Documents

While Bitcoin mining isn’t for everyone out there, it is an extremely popular and viable way to increase your BTC and cryptocurrency portfolio, all while helping advance the Bitcoin network and the overall blockchain ecosystem.

It’s pretty safe to say Bitcoin is likely the most polarizing cryptocurrency in today’s blockchain ecosystem, as it’s divided numerous core developers, and ultimately split the community into two core factions. However, no matter the contention surrounding it, it has still remained top dog in terms of cryptocurrency market capitalization, making it a lucrative and appealing coin to mine.

Mining Bitcoin and cryptocurrencies is at the very heart of blockchain’s ethos, as it literally places power and voice into the hands of the very persons who make up its fabric, ensuring they have a traceable and direct hand in verifying and validating transactions (and information).

If you aren’t able to construct or purchase a Bitcoin mining rig, don’t worry! In an ecosystem overhauling our major political, legal, financial, and social institutions, there’s value to be extracted everywhere – mining is just one area to contribute and extract value.

At CoolWallet, we’re not only building one of the most comprehensive and practical Bitcoin and cryptocurrency hardware wallets in the space, but striving to educate the blockchain community. Below are several additional resources to assist in your Bitcoin and cryptocurrency mining endeavors.

- What is Bitcoin? The Complete Guide: a comprehensive breakdown of Bitcoin’s history, fundamentals, and how it’s bringing value to your current blockchain ecosystem. This guide is your go-to guide to everything Bitcoin.

- Bitcoin Wallet: The Complete Guide: an all-encompassing guide to Bitcoin storage, including the differences between hot and cold wallets, paper and steel wallets, and the best wallets in our crypto-sphere for securing your BTC.

- Bitcoin: Top Security Tips: a post addressing the various potential threats to Bitcoin’s network, storage, and security.

- Bitcoin.org: the single most comprehensive website for everything Bitcoin – from resources, to purchasing Bitcoin, to frequently asked questions, Bitcoin.org has everything.

- Bitcoin’s White Paper: Satoshi Nakamoto’s 9-page vision of a peer-to-peer electronic cash system unperturbed by centralized institutions and censorship. Take a read for yourself and make your own decision on whether Bitcoin or Bitcoin Cash is the intended manifestation of Nakamoto’s white paper.

- Bitcoin Reddit: a subreddit dedicated to information and questions concerning everything Bitcoin.

- Bitcoin Mining Reddit: a subreddit dedicated to information and questions concerning Bitcoin mining.

- Bitcoin Github: a forum and repository for all technical documentation and information surrounding Bitcoin Core, enabling you to see exactly what Bitcoin developers are up to and the commits they are making.

- Bitcoin Blockchain Explorer: a popular website for viewing all information and charts on Bitcoin transactions and blocks.

- CoinMarketCap.com: the most popular tracking website and tool for investors and users looking to keep up to date with cryptocurrency prices and market capitalizations.

It’s pretty clear Bitcoin isn’t going anywhere, as it is driving today’s cryptocurrency market, and rolling out some of the biggest commits of any project.

To close with a quote by Tyler Winklevoss, most commonly associated with the invention of Facebook (and founder of Gemini Capital), “We have elected to put our money and faith in a mathematical framework that is free of politics and human error.”

We, at CoolWallet, wish you happy and safe HODL’ing. And, just keep in mind the volatility and vulnerabilities associated with the cryptocurrency and storage market, and make sure to move your funds to a hardware wallet once you’ve accumulated more than you are comfortable losing. It’s time to start securing your Bitcoin and other cryptocurrencies today!

Let us know in the comments what you think about mining Bitcoin, whether you’ve mined BTC before, and any questions you might have!