Contents

- Introduction

- CoolWallet Founder Says The Future is DeFi, How We Get There Matters

- Current State: DEX to CEX Spot Trade Volume

- Understanding Centralized Exchanges (CEXs)

- How Decentralized Exchanges (DEXs) Work

- 6 Reasons To Use A DEX instead of a CEX in 2024

- What are DEX drawbacks?

- How are DEXs boosting liquidity?

- Conclusion

This article is not financial advice of any kind and serves only as educational content based on the opinions of the author. Please do your own research.

Written by Werner Vermaak

Introduction

Since the crazy DeFi Summer of 2020 kicked things off, decentralized exchanges (DEXs) like Uniswap and 1Inch have become an essential part of crypto trading for more experienced crypto users. With centralized exchanges (CEXs) under siege from both regulators and bad actors and DEXs making huge innovations, there is a growing debate whether smart investors should just give up CEX in favor of DEXs.

In 2022, the failure of crypto custodians like FTX erased billions of dollars in retail investor funds. This in turn resulted in US regulators in particular sharpening their knives for CEXs in 2023, with the biggest exchanges like Binance, Coinbase, Kraken and now also Bybit targeted by the SEC, CFTC and other federal agencies. While Binance could afford its $4.3 billion fine, how many other exchanges can stay afloat in these conditions? In the battle of Proof of Keys vs Proof of Reserves, control matters.

This is leading more and more crypto owners to give up on CEX, moving away from centralized finance (CeFi) and into the world of decentralized finance (DeFi), where there is no risk of intermediaries getting sanctioned or hacked. And it’s not only users, but even exchanges themselves, as we’ve seen with Coinbase’s launch of its Base network this year, while others like Binance and Crypto.com already have their own chains (BNB Chain and Chronos).

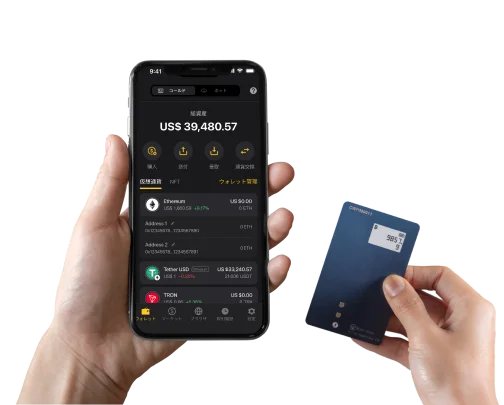

CoolWallet has been Team Self-Custody since day 1. Soon after our launch in 2014, the cataclysmic Mt.Gox hack gave us a mission to provide crypto users with a safer alternative: ultra-secure and portable cold storage you can keep in your actual wallet. Nearly a decade later, our prized Web3 hardware wallet models the CoolWallet Pro and CoolWallet S still stay true to a simple vision: Not your keys, not your crypto.

As we head into 2024, is it time to definitively say that using a DEX is better than a centralized exchange? We certainly feel so, but let’s weigh up the arguments.

CoolWallet Founder Says The Future is DeFi, How We Get There Matters

CoolBitX CEO and creator of CoolWallet Michael Ou recently commented on LinkedIn on ex-Binance’s CEO Changpeng “CZ” Zhao’s intention to explore DeFi at some stage in the future.

Ou pointed out that Uniswap has already surpassed Coinbase in trading volume in the first half of this year, and that centralized exchanges are launching their own public chains and decentralized applications for clear reasons.

He believes that the full potential of Web3 can only be reached if we combine self-custody with DeFi and Dapps. While DeFi is set to overtake CeFi, how it does it and captures new users will be critical, and CoolWallet will throw its full support behind this journey.

Current State: DEX to CEX Spot Trade Volume

Looking at CEX vs DEX data in the graph below (January 2019 to November 2023), we can see that DEXs have steadily grown their trading volume in the last few years. Still, as of November 2023, DEXs account for less than 10% of the trading volume compared to CEXs, after it reached an all-time high of 22% in June 2023 when the SEC first went after Binance and Coinbase.

In terms of specific exchanges, Binance, the largest CEX, processes a $14 billion spot trading volume per 24 hours. In comparison, Uniswap, a well-known DEX, has a lower volume but in the last year its trading volume outpaced that of Coinbase, a major CEX, for several consecutive months.

January 2019 to November 2023

Understanding Centralized Exchanges (CEXs)

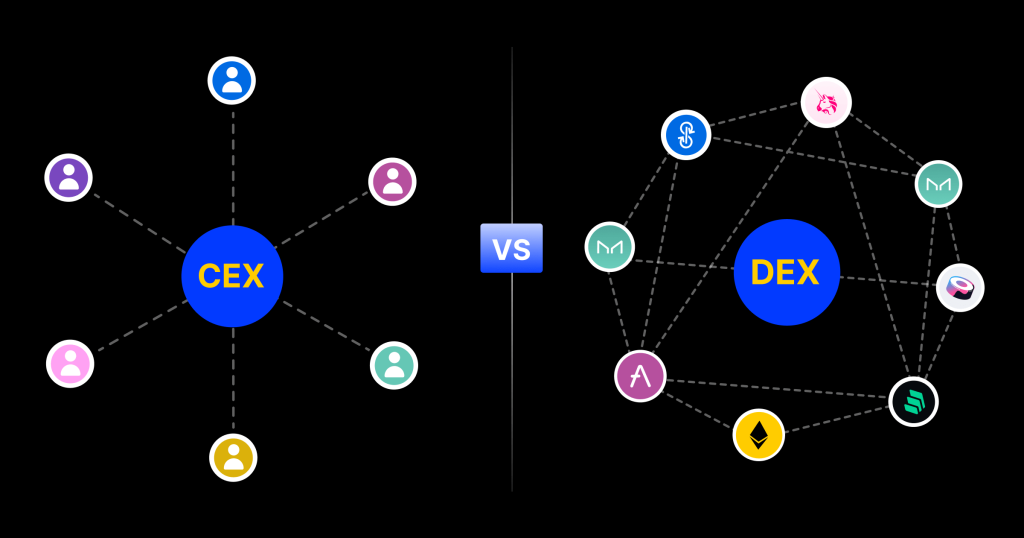

Centralized exchanges function similarly to traditional stock exchanges. They are operated by a central authority which controls the platform’s operations. This includes overseeing the order book, executing trades, and holding user funds. Well-known examples include Coinbase, Binance, and Kraken.

Key Benefits of CEXs – User-Friendly Interface: They often provide a more user-friendly interface that is suitable for beginners. – Higher Liquidity: CEXs generally offer higher liquidity, facilitating quicker trades and better prices. – Customer Support: They provide customer support and services, which can be crucial for new users. | Key Limitations of CEXs – Security Risks: Holding funds centrally makes CEXs a target for hacks. – Regulatory Oversight: Being centralized entities, they are subject to governmental regulations, which can impact their operations. – Privacy Concerns: Users have to go through KYC (Know Your Customer) processes, compromising anonymity. |

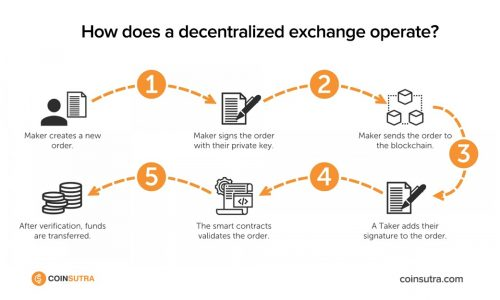

How Decentralized Exchanges (DEXs) Work

In contrast, DEXs operate without a central authority. They utilize smart contracts on blockchain networks, like Ethereum, to facilitate peer-to-peer trading. Users retain control of their private keys and thus their funds, trading directly from their wallets. Leading examples include Uniswap, 1Inch, Raydium (Solana), Sushiswap, PancakeSwap (BNB Chain) and Osmosis (Cosmos). All these DEXs can be accessed in the CoolWallet App by using native features such as WalletConnect.

| Key Benefits of DEXs – Enhanced Security: Since there’s no central point of failure and users hold their funds, the risk of large-scale hacks is minimized. – Anonymity: DEXs typically do not require personal information, preserving user privacy. – No Counterparty Risk: Users trade directly from their wallets, mitigating the risk of losing funds due to the exchange’s insolvency. | Key Limitations of DEXs – Complex Interface: They can be less intuitive, posing a challenge for beginners. – Lower Liquidity: DEXs often suffer from lower liquidity compared to CEXs, leading to price slippage. – Limited Customer Support: The lack of centralized customer support can be a drawback for users requiring assistance. |

Quick Comparison: CEX vs DEX Features

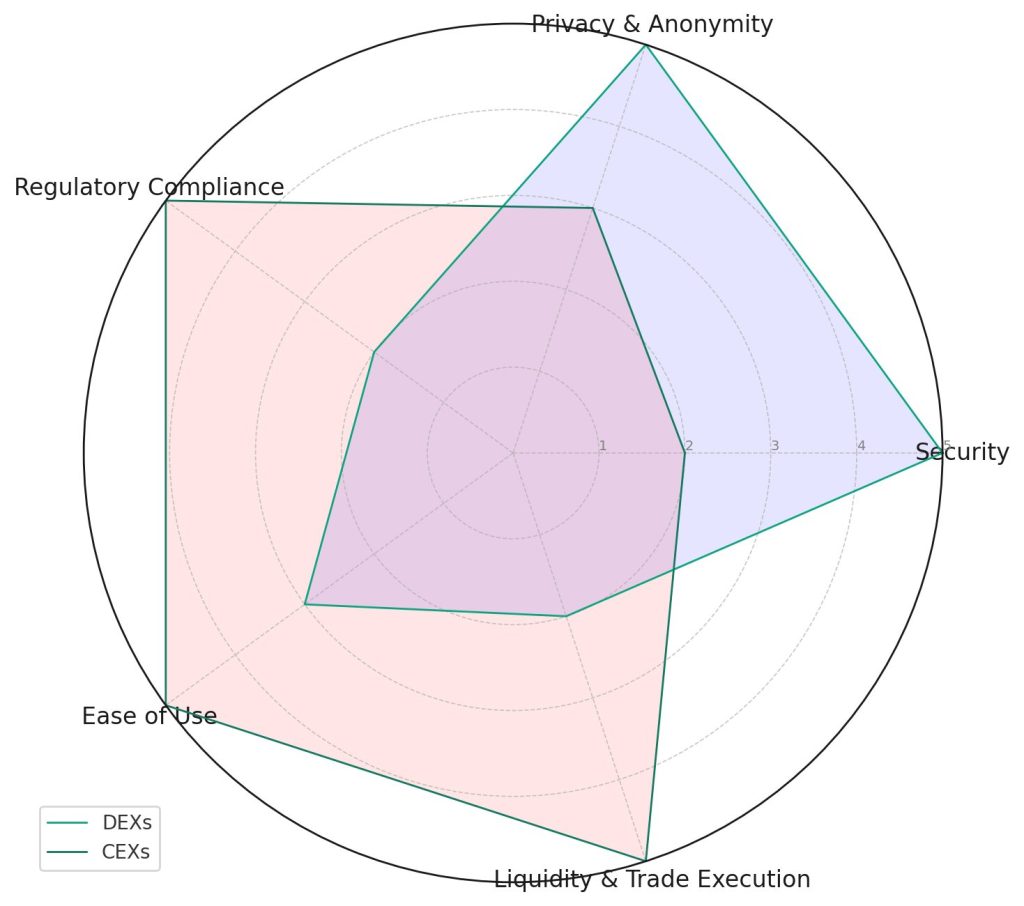

- Security: DEXs have a clear advantage in terms of security. The decentralized nature and user control over funds significantly reduce the risk of large-scale breaches.

- Privacy and Anonymity: DEXs offer greater privacy as they usually don’t require personal information for transactions.

- Regulatory Compliance: CEXs, being centralized, are more compliant with regulatory frameworks, which can be seen as both an advantage and a limitation.

- Ease of Use: CEXs are generally more user-friendly, catering to a broader audience including beginners.

- Liquidity and Trade Execution: CEXs excel in providing higher liquidity, resulting in better trade execution and less slippage.

6 Reasons To Use A DEX instead of a CEX in 2024

Source: Medium

In most cases though, choosing a centralized or decentralized exchange hinges on personal preference and what’s most important to you. Here are a few benefits that DEXs have over CEXs that you might not be aware of.

1. Better Security

DEXs are generally considered more secure than CEXs because they operate on a decentralized network, making them less vulnerable to hacks and other security breaches. Users maintain control of their private keys, ensuring full ownership and control over their assets at all times.

2. Total Control Over Your Funds

In a DEX, you have full control of your wallet and private keys. This grants you complete ownership, but it also means you are solely responsible for protecting your assets. Learn more about the Proof of Keys movement here.

3. More Privacy

DEXs do not require users to disclose their personal information or identity, such as through Know-Your-Customer (KYC) procedures, which is important for users who prioritize privacy. Traders using DEXs don’t need to disclose their private keys or identity (yet!) because wallets are held externally, and the DEX is not liable for the funds.

4. Less Market Manipulation

DEX automation, along with the fact that they do not hold user-submitted data, means that these new-generation exchanges are harder to manipulate.

5. Transparency and Verifiability

All transactions on a DEX are recorded on an immutable public blockchain. This ensures complete transparency and allows any user to verify the legitimacy of transactions.

6. Access to small-cap altcoin gems

It’s a well-known fact that by the time a cryptocurrency is listed on a big exchange, it’s already well-established and with a large market cap. DeFi degens know the real money is made earlier, and want to frontrun CEX listings by buying promising tokens as soon as they are created. The only way to do this is to get the smart contract address and swap assets or provide liquidity on a DEX like Uniswap in exchange for staking rewards. Of course, these early-stage tokens come with a very high risk of fraud and scams, so keep this in consideration at all times. Also, be really careful of signing any transaction with a wallet that holds significant funds, as it can be drained.

This is where CoolWallet’s SmartScan feature comes in handy- It analyzes smart contract code in real time and flags any suspicious behavior immediately.

What are DEX drawbacks?

However, it’s important to note that DEXs also have their drawbacks.

Complex Learning Curve

They can be more complicated to use, especially for those less familiar with decentralized blockchain technology. This is why most newbies opt to get started on big centralized exchanges.

Security concerns

DEXs also have potential security concerns, such as smart contract vulnerabilities, rug pulls (when the team drains all liquidity and exits) and protocol and implementation risks. The newer the coin and smaller the market cap, the bigger the risk.

DELIVERED EVERY WEEK

Subscribe to our Top Crypto News weekly newsletter

Liquidity Fluctuations

Furthermore, DEXs may struggle more than CEXs when working with larger investors due to issues with liquidity, since the trading pairs are often newer and therefore have less coins circulating.

Non-reversible

Lastly, the irreversibility of transactions means that if your funds are stolen or lost due to inadequate security measures, there’s usually no recourse to recover them. This is a feature, not a bug, of blockchain technology, where immutability is gained by giving up centralized control over transactions.

Regulations

Regulators are slowly turning their gaze to DeFi, and in the US, regulators have made it clear that decentralized protocols will have to comply with AML/CFT laws and other regulations. As the arrests of some DeFi developers have shown, they mean business.

How are DEXs boosting liquidity?

The perception of DEXs having low liquidity is becoming increasingly outdated, as they evolve and become more and more sophisticated, sucking up liquidity from a range of sources to cater for traders both big and small. Here’s how:

- Liquidity Pools: DEXs use liquidity pools, which are crowdsourced pools of cryptocurrencies or tokens locked in a smart contract. These pools facilitate trades between assets on a DEX, allowing digital assets to be traded in an automatic and permissionless manner

- Automated Market Makers (AMMs): AMMs are algorithms that set the price of a token pair in a liquidity pool based on the ratio of the tokens in the pool. This mechanism allows for continuous and automated trading, which can increase liquidity.

- Incentives for Liquidity Providers (LPs): DEXs incentivize users to provide liquidity by offering rewards, often in the form of governance or native tokens.

- Fragmentation of Liquidity Supply: DEXs allow for fragmentation of liquidity supply between low- and high-fee pools. This means that small liquidity providers (LPs) can converge to high-fee pools, accepting lower execution probabilities to mitigate smaller liquidity management costs. On the other hand, large (institutional) LPs can dominate low-fee pools, frequently adjusting positions in response to substantial trading volume.

- DEX Aggregators: DEX aggregators optimize token prices, swap fees, and slippage by sourcing liquidity from multiple DEXs, offering better rates for users and improving overall liquidity.

- Direct Peer-to-Peer Trading: DEXs allow users to trade directly from their wallets by interacting with the smart contracts behind the trading platform. This direct trading can increase the overall liquidity of the platform.

By boosting liquidity, DEXs can offer more stable prices, reduce slippage (price changes due to large trades), and improve the overall trading experience for users.

How do DEXs handle user disputes?

In a DEX, the terms of a trade are decided using a smart contract, and an Automated Market Maker (AMM) handles the trade itself. This process does not involve scrutiny by a third party.

Decentralized exchanges (DEXs) may handle disputes between users through a process known as Decentralized Dispute Resolution (DDR).

Smart contract dispute resolution is another method used to resolve disputes in DEXs. This involves resolving disputes that occur when a smart contract is executed. Smart contracts are self-executing programs contained in a blockchain, such as Ethereum. The program ensures the actions agreed on in the contract happen, which removes the trust generally required when exchanges occur.

In some cases, blockchain startups have created dispute-resolution solutions using blockchain technology, smart contracts, and online applications. For instance, a user might find a dispute transaction button on the decentralized application (dApp), and a smart contract would execute dispute resolution actions. The blockchain network would then select a group of mediators or arbiters.

Another approach is the use of Online Dispute Resolution (ODR) mechanisms, which are being adapted to the blockchain context.

Conclusion: Is a DEX Better Than a Centralized Exchange in 2024?

The answer largely depends on the user’s priorities and expertise. If security, privacy, and self-custody are paramount, a DEX is superior. However, for users valuing ease of use, higher liquidity, and regulatory compliance, a CEX might be more suitable.

Or at least, that was the old argument. While the above drawbacks certainly applied to decentralized exchanges at the start of the decade, and smart contract risks and hacks are still very much a big concern in DeFi, there has also been a lot of innovation in what is still a very young industry with a very big mission.

Recent DeFi innovations such as perpetual DEXs which allow for leverage trading, Telegram trading bots which enable you to automate your trading strategy and “snipe” good buying opportunities, and convenient features such as limit orders on DEXs like 1inch have blurred, if not erased, the lines between the existing ideas of a DEX vs CEX. Add to this exciting swap bridges like XY Finance, our latest partner, and the answer is clear:

It’s simply faster, cheaper, safer and more private to use a DEX, if you know what you’re doing.

And the great news is that you can do it all on CoolWallet, in cold storage.