Introduction

After a blistering up-only start to the final quarter of 2023 with excitement around the BlackRock Bitcoin spot ETF and 2024’s Bitcoin Halving turning into unbridled FOMO, markets came back down to earth this week as far-reaching news hit global headlines.

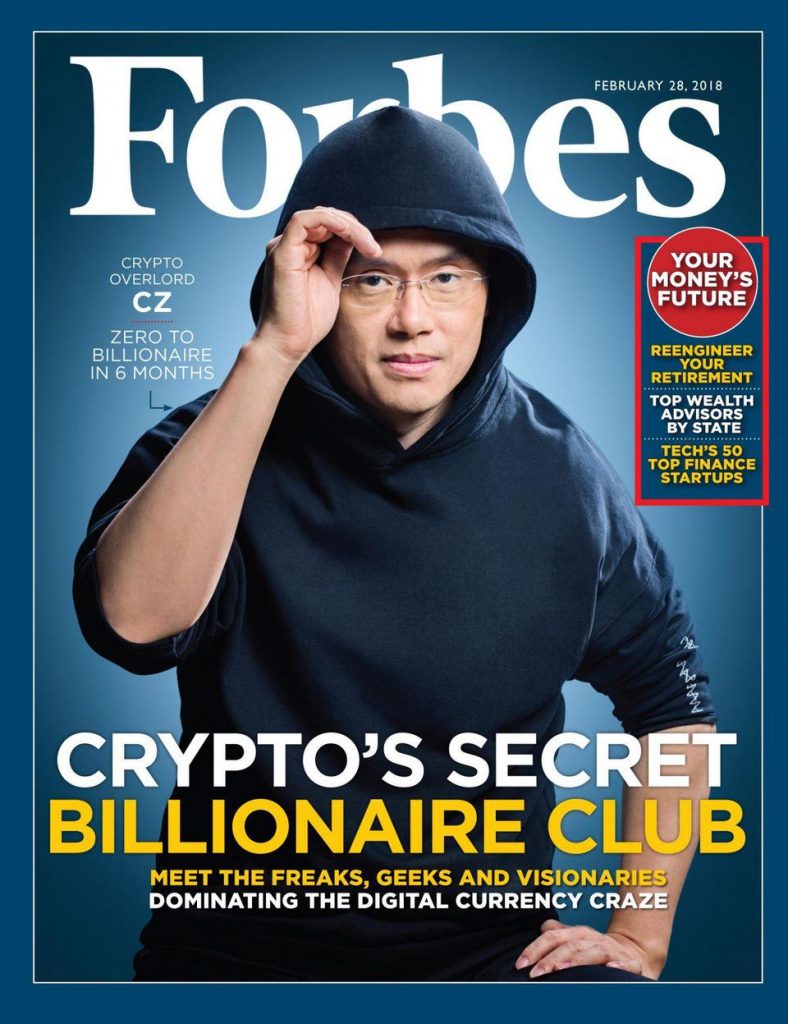

On November 21, 2023, Binance, the world’s largest cryptocurrency exchange, and its founder Changpeng Zhao, also known as CZ, reached a long-awaited settlement with US authorities, concluding many of the civil and criminal investigations into the exchange, but also leaving CZ to possible jail time

As part of the settlement, Binance agreed to pay a staggering total of $4.3 billion in fines. This includes $2.7 billion in civil monetary penalties and disgorgement and $1.6 billion in criminal fines and forfeiture. The fines will be paid to various government departments, including the U.S. Treasury and the Commodity Futures Trading Commission (CFTC), who all had ongoing legal actions against Binance.

In a shocking turn of events, CZ, possibly the biggest name in the crypto space, pleaded guilty to breaking U.S. anti-money laundering laws and agreed to step down from his role as CEO of Binance, which will now be filled by the experienced ex-Abu Dhabi regulator Richard Teng.

CZ posted bail for $175 million after persuading the judge that he be allowed to return to his residence in the UAE and he will also pay a $50 million fine to the CFTC.

The SEC also delivered new charges against US exchange Kraken, despite its payment of a $30 million fine only 10 months ago, worryingly again declaring several cryptocurrencies, including Solana and Cardano, to be securities. Interestingly, Ethereum and XRP are not on the list.

The Case Against Binance and CZ

The SEC previously filed 13 charges against Binance entities and CZ, alleging that they operated unregistered exchanges, broker-dealers, and clearing agencies, misrepresented trading controls and oversight, and engaged in an extensive web of deception, conflicts of interest, lack of disclosure, and evasion of the law

The SEC’s complaint alleged that since at least July 2017, Binance.com and Binance.US, while controlled by Zhao, operated as exchanges, brokers, dealers, and clearing agencies, earning at least $11.6 billion in revenue from transaction fees from U.S. customers.

The securities regulator, which has been criticized for being on a perceived witchhunt against crypto companies, charged Binance for the unregistered offers and sales of BNB, BUSD, and crypto-lending products known as “Simple Earn” and “BNB Vault.”

In addition to the SEC’s charges, Binance and CZ faced accusations from the U.S. Department of Justice and the U.S. Commodity Futures Trading Commission (CFTC). The CFTC sued Binance for offering unregistered crypto derivatives products in the U.S., alleging that Binance had a “maze of corporate entities” demonstrating the exchange’s “willful evasion of U.S. law”.

Why Did Binance and CZ Settle?

So, why did Binance settle? The answer lies in the severity of the charges and the potential consequences of not settling. The U.S. authorities accused Binance of prioritizing profits over the safety of the American people, and of using new technology to break the law. The settlement allows Binance to continue operating, albeit with significant penalties and compliance requirements over the next few years, as it exits the US market (BinanceUS will remain). This can be considered a win, as it avoids what would have been a long and arduous court battle over multiple years.

Looking ahead, the future of Binance is uncertain but not necessarily bleak. While the settlement may result in a short-term loss of market share (over $1 billion in funds have been withdrawn in the 24 hours after the news broke), Binance could regain its dominance in the long term. The settlement also concludes many of the civil and criminal investigations into the exchange, providing some level of closure and stability. With a new bull cycle anticipated for 2024 and 2025, creating a clean slate to operate from is a smart play.

The need for self-custody

The US’ latest actions against centralized exchanges (CEXs) again underscore the importance of using a self-custody hardware wallet like CoolWallet. As we saw in the past with horror events like the collapses of Mt. Gox and FTX, no exchange is too big to fail, especially when targeted by regulators and hackers. This doesn’t mean Binance will go under, however, it definitely adds more risk to its services. As we’ve seen with other failed exchanges like Mt. Gox, FTX, and Cryptopia, liquidators can take years to refund exchange users, if at all.

Reputable centralized exchanges like Binance, Coinbase, and Kraken have all been targeted by US regulators this year and threatened with a long list of consequences if they don’t comply.

Last year’s cascade of crypto custodian failures showed us that taking control of your crypto assets is the safest option. If you don’t own your private keys, then you don’t own your crypto.

Self-custody with a non-custodial wallet gives users full control over their private keys and, therefore, their funds at all times. This means that even if a regulatory body were to take action against the wallet provider, users’ funds would remain safe and accessible as only you have access to your funds thanks to the power of blockchain cryptography.

With so many hacks and scams happening in the crypto space, the smart choice for users is a hardware wallet with a proven track record and ample features.

DELIVERED EVERY WEEK

Subscribe to our Top Crypto News weekly newsletter

Look no further than CoolWallet, a trusted Web3 hardware wallet brand established in 2014 that allows you to HODL and stake your crypto in elite and easy cold storage for the next bull run, retaining full control over your funds at all times.

Its open-source EAL6+ secure element, encrypted Bluetooth, 2+1 FA verification, and convenient tamperproof and waterproof design keep your portfolio discreet, safe, and within reach, anywhere, anytime.

But don’t take our word for it. The world’s biggest crypto exchanges like Binance, OKX and Crypto.com have all partnered with us in the past for special co-branded CoolWallet editions (see our Binance-branded CoolWallet S below).

In addition, the CoolWallet App boasts almost all the functionality of centralized exchanges, but with the peace of mind of cold storage and without the ills of centralization. You can purchase cryptocurrencies with a credit card or trade them for other digital assets or NFTS on platforms such as UniSwap, 1inch, MetaMask, OpenSea, and more.

Our latest Bridge Swap integration with XY Finance also allows you to easily and affordably bridge your assets across different blockchains (for example, bridge USDT ERC20 tokens for USDC BEP20 tokens).

Conclusion

The Binance settlement is a dramatic turn of events that could mark the end of Binance’s global dominance. However, it can also be considered a win for the crypto exchange and the industry, as it likely brings to an end the fear of Binance being sanctioned and CZ being arrested, and brings to an end speculation about the fate of the crypto exchange.

It certainly took a lot of courage for CZ, possibly the most popular person in the crypto industry, to fly to the US and subject him to the country’s laws, as the UAE where he resides has no extradition treaty with the United States, and Sam Bankman-Fried was found guilty only last month, and could possibly be sentenced to over 100 years in 2024. At the very least the settlement provides a clear road ahead for Binance to get fully compliant and in the good graces of regulators.

The result also boosts the prospects of a Bitcoin spot ETF by BlackRock and others being approved soon, since the regulatory housecleaning against FTX, Binance, Coinbase and Kraken leaves less of an argument for SEC chairman Gary Gensler and company that crypto markets continue to be manipulated.

The Binance saga serves as a stark and timely reminder of the regulatory challenges still facing the crypto industry.

While most CEXs shrugged off their AML responsibilities in the early days of their existence, the crypto landscape has permanently changed and compliance is no longer optional. Ignorance of the law is no excuse and there are real consequences for failing to meet regulatory standards.

As the dust settles, the crypto industry will be watching closely to see how Binance navigates its new reality and what this means for the future of crypto exchanges. In the meantime, explore how self-custody with CoolWallet Pro and CoolWallet App can help you HODL safely in style.