The Ethereum network has received an upgrade on December 8th, delaying the difficulty bomb for what developers hope to be the last time before the Ethereum Mainnet merges with the Beacon Chain. The difficulty bomb, which will make ETH unpractical to mine, is needed to help shut the lights on the current proof-of-work network that is causing so much frustration for users due to its slow speed and ridiculously high gas fees.

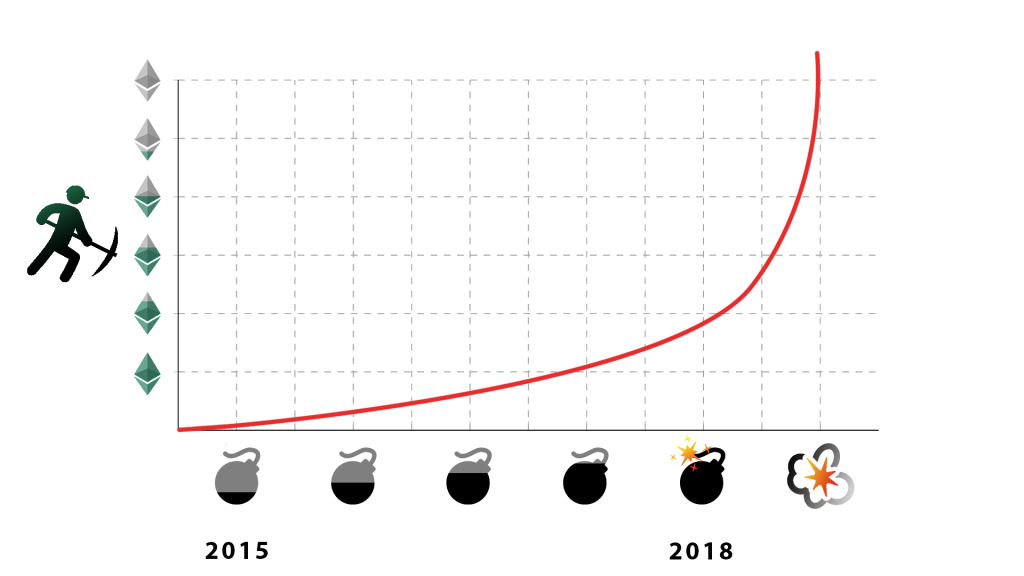

Like the Muir Glacier update that was implemented in January earlier this year, the latest Arrow Glacier upgrade adjusts the framework and schedule of the Ethereum “Ice Age.” Intended to increase the difficulty level for new blocks to be created, the Ice Age algorithm will cause blocks to eventually be too time-consuming for computers to mine, freezing the Ethereum network.

What is the difficulty bomb?

Unlike more recently created blockchains, the Ethereum network still operates on a proof-of-work (PoW) consensus mechanism. PoW requires a large amount of computing power to keep the network running, and thus needs a large amount of electricity to maintain network operations.

By placing the difficulty bomb into the Ethereum network, developers hope to incentivize ETH miners to transition Ethereum to a proof-of-stake (PoS) model by staking their ETH holdings rather, which would greatly benefit Ethereum users by making the network more scalable to its current user size.

Proof-of-stake would mean that instead of using large amounts of computing power to create blocks, holders of large amounts of Ethereum could become validators in the network. Some benefits that could solve current PoW problems include:

- Lower energy consumption (more environmentally friendly)

- Increase overall decentralization for the network

- Lower barrier to entry for assets priced in Ethereum (NFTs for example)

- Increase support for shard chains (increase scalability to increase transactions per second)

How will Eth 2.0 improve the Ethereum network?

Likely before summer 2022, the Ethereum Mainnet will merge itself with the Beacon Network, ceasing the current PoW consensus and emerging as Eth 2.0, a superior alternative that can solve current issues plaguing Ethereum users to a point where it is nearly unusable.

Once fully merged, the Ethereum network will have many new features available to new users, such as facilitating smart contracts on the PoS system, shard chains to scale the network, and allowing users to withdraw staked ETH.

Ethereum 2.0 is the best-case scenario for ETH

While Ethereum is among the most popular chains to facilitate a crypto transaction, its current transactions per second (TPS) is anywhere from 10 to 30. While this was not an issue when cryptocurrencies were relatively new, there is now a demand for millions of transactions a day, meaning users must out-bid each other on gas fees to prioritize their transactions.

While there is nothing wrong with being popular, the current Ethereum network can’t function properly if it doesn’t scale up to its current user base. New blocks are also very energy-intensive and require powerful computers to be created. PoS would be much more environmentally friendly and help alleviate some of the bad press the crypto industry has received regarding its unnecessary carbon emissions.

Once merged, the new Ethereum network (Eth 2.0) would solve a majority of the issues with the current PoW model, namely gas fees, transactions per second, and reducing the computing power needed to maintain the network.

Proof of stake would be beneficial for Ethereum, but it’s not without its own faults that must also be considered. Network threats such as a 51% attack could threaten the validity of transactions, as PoS gives a lot more power to validators.

Sharding also comes with its own unique problems, since validators are distributed across shards more sparingly, creating a possibility validators could take control of a shard and approve transactions at will without repercussions.

In any case, it is inevitable that Ethereum must metamorphize into a PoS network in order to not only solve its systemic issues but to stave off competitors like Solana, Polkadot, and Binance Smart Chain. This new generation of layer-1 networks is currently taking painful nibbles at Ethereum’s vast corps of developers and users, attracting them to their own fast and scalable platforms natively designed for DeFi and NFTs, as well as new areas such as GameFi and metaverse protocols.

In the meantime, it’s not a bad idea to start accumulating ETH on the likes of a CoolWallet Pro and staking it where possible.

This article doesn’t constitute financial advice of any kind. Opinions are that of the author alone.