New to Bitcoin and its universe of cryptocurrencies? Bitcoin isn’t easy to understand but this guide will walk you through everything you need to know. Fear not- CoolWallet has answers to your biggest questions!

Table of Contents

- Part 1: Bitcoin Basics

- What Is Bitcoin?

- What is the total supply of Bitcoin?

- How are Bitcoin and blockchain connected?

- How is Bitcoin different from Ethereum and other coins?

- Why is Bitcoin so valuable now?

- How do I check the Bitcoin price?

- Will Bitcoin’s price keep going up?

- Are There Physical Bitcoins?

- Is Bitcoin a Currency or Digital Asset?

- How Safe is Bitcoin?

- How do I Buy Bitcoin?

- Is It Better to Trade or HODL Bitcoin?

- Should I Invest in Bitcoin?

- Can Bitcoin get hacked?

- How anonymous is Bitcoin?

- What is Bitcoin Pizza Day?

- What is the Bitcoin Halving?

- Bitcoin price predictions

- Will the Bitcoin flippening ever happen?

Part 2: Bitcoin Wallets for Beginners

- What Is a Bitcoin Wallet?

- What is the easiest-to-use Bitcoin hardware wallet?

- How Can I Recover a Lost Bitcoin Wallet?

Introduction

Bitcoin, Bitcoin, Bitcoin. Now at $70,000 and going! Love it or hate it, but you can’t fade it, as we say in crypto parlance. The world’s fastest-ever growing asset has evolved in only 15 years from an obscure peer-to-peer technology supposedly used by criminals on the Dark Web to a shining new financial asset embraced by traditional financial firms and proclaimed by the likes of BlackRock CEO Larry Fink amidst turbulent global macro-economic conditions as a “flight to quality”.

Hey, I Left Crypto in 2022 After FTX! What did I miss? 2024 TL;DR

So… you jumped off the Bitcoin bandwagon around the time its price went off a cliff together with FTX and Sam-Bankman Fried, dropping to a shockingly low $15,000 in the doldrums of the brutal 2022 bear market. And now everyone from Donald Trump to Jim Cramer are praising BTC’s powers again. What gives?

In a few words: Spot ETFs. Halving. Election year. FASB Reporting. Quantitative easing. Ordinals. Layer-2s.

- After a decade and dozens of costly attempts, the holy grail of Bitcoin was finally reached when the SEC approved a number of Bitcoin Spot ETFs in 2024, thus opening the door to real mass adoption. The ETF frontran the 4th Bitcoin Halving happening in April 2024 and billions of mainstream money have been into the series of Bitcoin spot ETFs managed by blue chip firms BlackRock, Fidelity, Van Eck, and others, and it shows no signs of abating.

- It’s also better for companies to now put Bitcoin on their balance sheets. The Financial Accounting Standards Board (FASB) last year changed how companies report Bitcoin on their financial statements, starting at the end of 2024. Companies now account for Bitcoin as an “indefinite-lived intangible asset” rather than a current asset like cash. This better reflects Bitcoin’s long-term store-of-value.

- Some fun new inventions have helped to expand Bitcoin’s use case to new arenas such as DeFi, NFTs and even AI. The Taproot upgrade in 2021 has enabled innovations such as Ordinals, the BRC-20 token standard and a slew of layer-2 networks such as Stacks. With billions and billions of dollars from anyone from retail investors to the world’s biggest investment funds to nation states piling into the entire Bitcoin ecosystem, we’re only just getting started.

It’s therefore no surprise that analysts last year found that 88% of Bitcoin didn’t move hands in 2023. It’s now easier and safer to buy and own Bitcoin than ever before and the world is waking up. Investors are stockpiling their sats and HODLing for all they’re worth. They know what’s coming.

Now in March 2024, Bitcoin is back in a big way, skipping over $70,000 and currently in price discovery on the road to $100,000 and beyond. It’s a very slippery slope though, and to help get you started, we’ve compiled a guide that will walk you through the basics of Bitcoin in order to help you decide if it is right for your portfolio.

We’ll be covering some easy and not so easy questions make sure we get everyone on the same page. Let’s start with the most important information as it pertains to 2024. (Check btc usd chart.)

What Is Bitcoin?

Bitcoin can be defined as either a digital asset or currency powered by blockchain technology, and was created by the pseudonymous Satoshi Nakamoto in 2009. It is not a security, like stocks, as it is decentralized.

This means that unlike banks or fiat currencies, Bitcoin is not controlled by any centralized authority. Instead, it operates as a decentralized network, with not one entity in control. Transactions on the blockchain are approved by a network of “miners” operating computers that solve complicated puzzles. The information on the network is immutable, transparent and all account holders are pseudonymous, meaning that while their identity isn’t revealed, all their movements can be traced.

What is the total supply of Bitcoin?

Bitcoin has a maximum supply of 21 million tokens. However, only 19.64 million of them are in circulation (date: 3 March 2024) since the mining process is still ongoing. BTC has an average block time of 10 minutes, which is the length of time that each block is added in the chain.

Mining will end once all 21 million coins are minted, which is expected to occur sometime in the year 2140. Considering that there are tons of “lost coins” or wallets whose users can no longer access, as much as 5 million BTC, there will never be 21 million coins in circulation, which adds to Bitcoin’s scarcity as a store of value.

Many believe that the creator of Bitcoin, Satoshi Nakamoto, owned roughly 1 million BTC, which he first mined in the first two years after Bitcoin’s launch. If he still owns those coins, he would have a net worth of roughly $60 billion, enough to make him one of the richest people alive.

How are Bitcoin and blockchain connected?

A blockchain is simply a distributed database that offers a consensus mechanism that enables two parties that don’t trust each other to transact, as well as a transparent public ledger. Blockchain serves the operating system, with Bitcoin as the first application. Bitcoin is a peer-to-peer payment system that is built on top of a blockchain.

How is Bitcoin different from Ethereum and other coins?

When it comes to system security and decentralization, Bitcoin is in a league of its own. It is best-suited for payment applications thanks to its robust proof-of-work consensus mechanism. However, to achieve this feat, it had to sacrifice other features, such as system flexibility.

Bitcoin vs Ethereum

Unlike Ethereum, Bitcoin can hardly run complex applications, and even when it could, it’s usually too cumbersome to design and costly to execute. Ethereum’s system flexibility allows it to easily execute smart contracts capable of running various decentralized applications (dapps).

Ethereum and many other altcoins use a proof-of-stake (PoS) consensus mechanism, or some variation of it, to power applications built on their blockchains, which has enabled various applications beyond simple payment mechanisms such as decentralized finance (DeFi) and non-fungible tokens (NFTs).

Bitcoin vs DeFi

DeFi refers to an ecosystem of financial applications that replicate and innovate traditional financial systems in a manner that eliminates intermediaries. One could argue that Bitcoin is the first form of DeFi, however, the term, at large, usually involves complex financial applications like decentralized exchanges, lending marketings, prediction markets that cannot be executed on the Bitcoin network per se.

Bitcoin vs NFTs

Non-fungible tokens (NFTs) are blockchain-based tokens that represent unique digital items. The most popular standard for building NFTs is ERC-721, which is powered by the Ethereum network. Back in 2012, Bitcoin had a concept called Colored Coins, which were small fractions of Bitcoins (called satoshis) that were distinct and had the ability to represent real-world assets, sort of like a precursor to NFTs.

Unfortunately, Colored Coins didn’t pan out as each colored coin could only be as strong as its weakest link since Bitcoin’s scripting language wasn’t designed for this type of activity.

In 2021, Bitcoin holders had to sit and watch as NFTs absolutely exploded on the scene, pulling a lot of attention away. Fast forward to 2023, and Bitcoin Ordinals Theory created by Casey Rodarmour set off the NFT revolution, flooding the Bitcoin main network with micro transactions that facilitate inscriptions on individual satoshis, and driving up its value.

Why is Bitcoin so valuable in 2024?

Value is primarily driven by supply and demand. And Bitcoin has a capped supply of 21 million coins, of which maybe only 16 million will ever be accessible, which makes it quite scarce compared to other currencies like the USD, for example, which has an unlimited supply.

The emission of each new coin has been decreased due to the Bitcoin Halving event, a process that halves the number of Bitcoins being minted, The last halving in May 2020 took BTC mining rewards from 12.5 BTC to 6.25 BTC, leading to a supply shock as there is now more demand for new Bitcoin than what is being mined. The next one in April 2024 will reduce it to only 3.125 BTC.

The culmination of these events which creates real scarcity have earned Bitcoin the moniker “digital gold”.

In contrast, governments across the globe, especially the US Federal Reserve, went on a printing spree during the Covid pandemic, injecting trillions of fiat money into the economy in order to issue stimulus checks and emergency funds to citizens amidst the coronavirus.

And this has led many individuals and institutions to question their nation’s monetary policy and transfer some of their wealth to safe haven assets like Bitcoin. In fact, institutional demand for Bitcoin has been astronomical, with the likes of MicroStrategy, Tesla, Grayscale, Rothschild Investment Corporation, among many others, getting some exposure to the apex cryptocurrency.

How do I check the Bitcoin price?

Head over to Coinmarketcap and you’ll see a list of cryptocurrency prices, with Bitcoin at the top. You can also visit our blog page at coolwallet.io/blog for the latest Bitcoin price. There are a plethora of other options as well, such as Coingecko.com. While different cryptocurrency exchanges sell Bitcoin at marginally different prices, which can be used for price arbitrage, the prices are usually very close to being the same. However, Korean exchanges tend to sell Bitcoin at higher prices, resulting in the so-called “Kimchi premium”.

Are There Any Physical Bitcoins?

No, don’t be fooled by all those internet images of people showing off gold Bitcoin coins. Bitcoin is an entirely digital asset built on a cryptographic distributed technology. This means that all BTC is created, stored, and traded using Bitcoin’s distributed ledger. There are no physical Bitcoins in existence and there never will be. However, it would be theoretically possible to store Bitcoins on a physical storage device and spend them that way, similarly to credit chips in Star Wars.

Is Bitcoin a Currency or Digital Asset?

The definition of Bitcoin varies wildly between countries. In the United States, FinCEN has classified Bitcoin as a virtual currency and the SEC views it as a commodity (thankfully!) while other countries like Russia have defined Bitcoin as a digital asset or property.

Instead of viewing Bitcoin as purely a currency or digital asset, it is better to view it as a digital store of value, or digital gold. This means that Bitcoin can be used as a currency, or as a speculative asset.

How Safe is Bitcoin?

As far as emerging asset classes go, Bitcoin is highly volatile — but safe. The proof-of-work (PoW) consensus mechanism helps secure the blockchain. At the moment, most risks are related to user error.

The biggest safety concerns for Bitcoin are:

- Loss of wallet access: Approximately $130 billion in BTC has been lost and is now inaccessible.

- User error during transfer: There is no recourse if users accidentally transfer their Bitcoin to the wrong wallet address.

- Scams and hacks: Bitcoin scams and hacks are on the rise and users need to be careful to avoid social engineering attacks designed to gain access to their wallets.

- Regulatory risks: These vary from region to region, but some governments are attempting to make Bitcoin trading illegal.

- Technical risks: Bitcoin’s technology isn’t perfect. Theoretically, miners controlling 51% of the processing power on the network could mint fraudulent blocks, undermining BTC’s price.

- Market risks: Bitcoin, like all cryptocurrencies, is highly volatile and exposes holders to the risk of losing their investments.

How do I Buy Bitcoin?

To buy Bitcoin, you first need to convert fiat currency (“cash”) into BTC. To do this you need to use a crypto exchange service or trading app. There are a variety of these that operate globally but the most commonly used services are crypto exchanges like Binance, Bybit and Coinbase, where you can also get a sign-up bonus. Alternatively, you could also opt for instant crypto marketplaces like MoonPay, Changelly, BitPay, ChangeHero, and Simplex that allow you to purchase Bitcoin directly with a credit card, but they tend to be more expensive.

After you have made a purchase, your Bitcoins will be moved to a wallet, normally on the exchange where you made the purchase. It is not recommended to leave your Bitcoins on an exchange unless you’re planning to trade it soon. If not, you could lose it in the event of a hack or data breach.

How to Buy Bitcoin With the CoolWallet

Buying, exchanging and selling crypto commodities like Bitcoin on the CoolWallet is as easy as it can be to get crypto to your hardware wallet.

The CoolWallet’s app has a marketplace section with integrated fiat-to-crypto and crypto-to-crypto options like BitPay, ChangeHero, Changelly and Simplex, with whom it has all partnered, all available in-app to help you top up on Bitcoin and other crypto assets in no time.

Is It Better to Trade or HODL Bitcoin?

Whether you should actively trade or hold (Hodl) your Bitcoin purchases long-term will depend on your risk tolerance. It is certainly possible (especially in a bull market) to make money trading. But it adds a layer of risk to an already risky investment. Traders need to beat the market, which requires significant background knowledge in things like technical analysis and candlestick charts.

For most people the best option is probably to invest a small amount of money over a long period of time to account for highs and lows, which is known as dollar cost averaging. This will enable you to take advantage of the long-term gains in Bitcoin price.

Should I Invest in Bitcoin?

Our guide offers no financial advice, unfortunately. Only you can answer this question but hopefully, this guide has helped you figure that out for yourself! Bitcoin is undoubtedly a highly volatile asset but it is still early in its lifecycle. An investment could outperform other assets in your portfolio. If you want to invest in Bitcoin, keep these three golden rules in mind:

- Diversify: Bitcoin is great, but don’t put your entire portfolio in one asset. Diversification will protect you if things go south.

- Don’t Invest What You Can’t Afford To Lose: Don’t take out a loan to buy crypto; don’t invest your rent money in Bitcoin. Only spend money that you don’t need to get through the month.

- Keep Your Wallet Safe: Make sure that only you have access to your wallet’s private keys, and ensure that your seed phrase is stored somewhere safe.

DELIVERED EVERY WEEK

Subscribe to our Top Crypto News weekly newsletter

Can Bitcoin get hacked?

Hacking Bitcoin is possible in theory, but highly unlikely. Firstly, there is no way around Bitcoin’s “proof-of-work,” which means that if hackers want to alter any information in its database, they need to produce at least 51% of the network’s hash power, an incredible feat in and of itself.

Furthermore, they also need a lot of coordination between colluders to successfully pull it off. And even then, it’s not a guarantee that they could steal some coins let alone take control of the network for an extended period.

Hacking Bitcoin is too risky and impractical that most hackers don’t even bother. In other words, it is a trillion dollar bug bounty program with no critical vulnerability found in its 12 years of existence.

How anonymous is Bitcoin?

Bitcoin is a pseudonymous cryptocurrency since it doesn’t directly link a user’s address to his real-world identity. However, the user’s public address could be traced back to his IP address or exchange account he uses to send or receive BTC through blockchain analysis.

There are ways to increase anonymity in transacting with Bitcoin, but it usually involves other cloaking mechanisms such using a TOR browser and avoiding the purchase of Bitcoin through credit cards or any service provider that requires KYC.

What is Bitcoin Pizza Day?

Bitcoin Pizza Day is a yearly celebration to commemorate the first account of Bitcoin being used to pay for physical goods, which fell on the 22nd of May in 2010. The transaction involved crypto enthusiast Laszlo Hanyecz, who bought two Papa John’s pizzas and paid 10,000 BTC (its value was about $27 at the time), which is worth roughly around $579 million in today’s price.

What is the Bitcoin Halving?

The Bitcoin halving is an event that happens every time the network has mined 210,000 blocks, which results with the cutting of rewards in half. The “halvening,” which happens approximately every four years, is an ongoing process that ends when all 21 million coins have been minted.

Bitcoin price predictions

When it comes to the future price of BTC, there is no shortage of predictions coming from supporters, skeptics, and impartial entities. For anyone who experienced the great fall from 2017’s all-time highs to 2018’s depths, there will be some bitter memories and reminders on how quickly sentiments can change from FOMO to FUD. Therefore investors should not be swayed by opinions, but do their own research (DYOR).

Most bullish predictions point to the dwindling trust in the fiat monetary system and the recognition of Bitcoin as an alternative store of value that is far superior to gold.

According to MicroStrategy CEO Michael Saylor, “Bitcoin is going to flip gold, and it’s going to subsume the entire gold market cap…until it grows to $100 trillion”. Saylor didn’t give a timeline but if we assume that Bitcoin has a circulating supply of 19 million by then, each Bitcoin would be valued at around $5.26 million, which is 92x its current valuation.

Gemini exchange founders Tyler and Cameron Winklevoss are a little more conservative in their forecast, stating that Bitcoin will hit $500K per coin sometime in this decade. Citibank managing director Tom Fitzpatrick, however, predicts that number one crypto will breach the $318K mark sometime this year.

On the flipside, Bitcoin critic Nouriel Roubini, who has been outspoken about his views on BTC and blockchain technology since 2018, has recently proclaimed that the asset’s fundamental value is negative if we consider its carbon tax. “I predict that the current bubble will eventually end in another bust,” he added.

In 2018, two Yale economists had published a report that showed that the odds of Bitcoin dropping to zero is roughly 0.4%.

What’s up with Bitcoin Laser Eyes?

The viral Bitcoin laser eye movement happened on social media like Twitter and Clubhouse in 2021 following the Gamestop short saga by Wall Street Bets. In order to show solidarity and propel Bitcoin’s price up, many influencers and social media users changed their profiles to the “laser eyes” version, which basically means they’re laser focused on getting Bitcoin to $100,000.

Will the Bitcoin flippening ever happen?

Some pundits in crypto have talked about a concept called “the Flippening,” which is a prediction that sometime in the future, Bitcoin will be usurped by another altcoin as the leading cryptocurrency. Believers of the flippening usually argue that Bitcoin is an outdated system that can’t scale and is dreadful to the environment.

However, defenders have pointed out that the use of renewable energy within the Bitcoin mining space is increasing while most of its energy consumption comes from excess supply, which would have been wasted if it weren’t used in securing the Bitcoin network.

Some members of the Bitcoin community are more supportive of Bitcoin forks than the main network. Bitcoin Cash (BCH) and Bitcoin Satoshi’s Vision (BSV) adherents have called out Bitcoin’s scaling problem countless times; just as much as they’ve declared that their fork will eventually “flip” BTC due to their higher transaction capacity.

Yet it appears that the crypto community also values attributes other than scalability considering that there are thousands of altcoins that are orders of magnitude faster and more efficient than BTC, yet none of them have ever come close to flipping Bitcoin. XRP, XLM, NANO, and DGB are some cryptocurrencies that are far more scalable than BTC today. But most Bitcoin maximalists argue that BTC cannot be matched since it is the most secure and decentralized monetary system in existence.

However, there is a growing number of individuals who feel that dapp-focused blockchains, especially Ethereum, are far superior since Bitcoin has limited smart contract applications and is mainly used as a medium of exchange. In this case, a Bitcoin proponent’s rebuttal would point to the fact that Bitcoin is designed to be programmable money and having a flexible smart contract functionality would compromise this attribute by increasing the cryptocurrency’s attack vector.

Many crypto experts say that Bitcoin and smart contract platforms like Ethereum and Polkadot have very different applications, and hence, should not be in competition in the first place.

What Is a Bitcoin Wallet?

A bitcoin wallet is essentially your Bitcoin account. You can use your wallet to store, send, and receive Bitcoin. There is no limit to the number of wallets you can have. Wallets are composed of private keys, which only you should know, and public keys, which others can use to send you Bitcoin.

A bitcoin wallet is essentially your Bitcoin account. You can use your wallet to store, send, and receive Bitcoin. There is no limit to the number of wallets you can have. Wallets are composed of private keys, which only you should know, and public keys, which others can use to send you Bitcoin.

They typically come in three main forms:

- Paper Wallets: These are wallets that you store offline. If you keep the paper in a safe place, it can be a very secure way to store your Bitcoin. However, it does make them vulnerable to fire, water damage, etc.

- Software Wallets: These are active online wallets. While not unsafe, they open you up to more risk than a hardware or paper wallet. Most software wallets are stored on your smartphone, which makes them convenient for everyday use.

- Hardware Wallets: These wallets are, like paper wallets, offline and are never connected to the internet, unlike software wallets. Also called cold storage, they are designed to be a safer storage device than paper wallets. They often operate using some form of two-factor authentication. It is recommended that you hard-reset a hardware wallet before first use, in case it has been tampered with.

What is the easiest-to-use Bitcoin hardware wallet?

Did you know that the first-generation CoolWallet was the world’s first Bitcoin hardware wallet to connect to a mobile phone, launching in 2016?

It was followed up by the CoolWallet S in 2018 which supports multiple assets.

The CoolWallet S is often labeled the world’s most convenient hardware wallet because it can be stored in your physical wallet and only works with your own mobile phone.This provides users superior cold storage at their fingertips on the go.

The form factor of a credit card, the CoolWallet’s patented compression technology makes it virtually immune to physical tampering, while its secure element and biometric verifications provide further enhanced security. Moreover, this cold storage, which connects to paired phone via encrypto Bluetooth, is also waterproof and features a unique embedded e-paper screen.

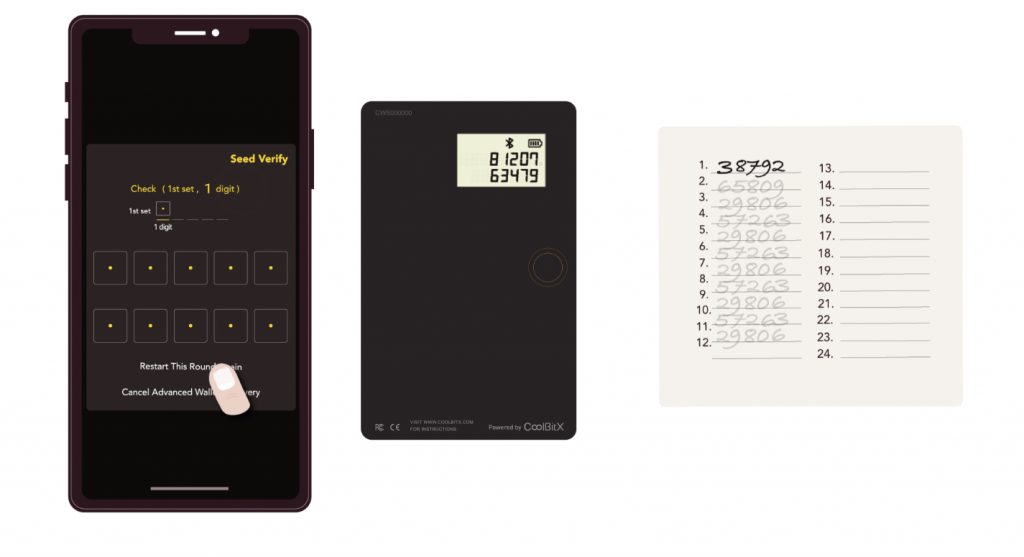

How Can I Recover a Lost Bitcoin Wallet?

When you create your first wallet you will be given 12 to 24 random words. This is your seed phrase and is necessary to recover your wallet if something happens. Seed phrases should be stored offline in a safe place (eg, safe deposit box). And you should never share it with anyone, as it will allow them to recreate your wallet and potentially access your funds.

With the CoolWallet it’s simple: If you lose your phone or card, you can simply restore your funds by accessing it on a different CoolWallet or phone by using your recovery seed. If you don’t have access to a CoolWallet, you can use options like TrustWallet (not advised as software wallets are not as secure as cold wallets).