Quick takeaways

- Ethereum’s Shanghai upgrade is happening on 12 April 2023

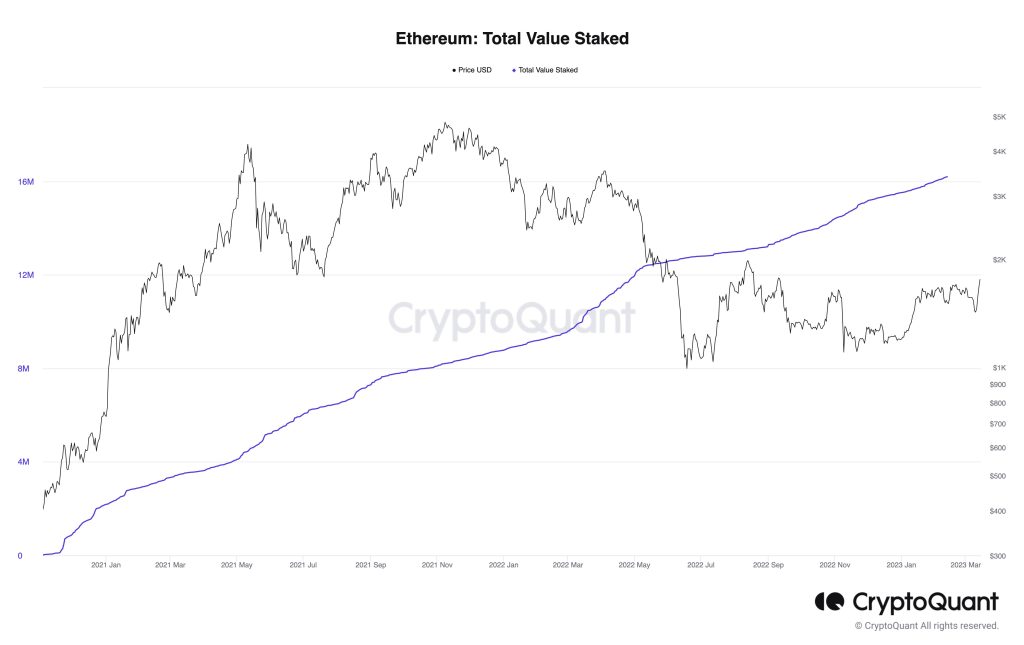

- Its EIP-4895 update will enable 16m staked ETH withdrawals

- Shanghai will make ETH staking flexible and appealing

- Short-term volatility is possible, but long-term prognosis stays healthy

Introduction

Ethereum is set for another major milestone over the next few weeks with its much-anticipated Shanghai upgrade, which will finally enable early stakers dating back to 2020’s “ETH 2.0” Beacon Chain launch to withdraw their funds. The fork is now officially set for 12 April 2023.

Just as in 2022 with the epic Ethereum Merge event which after years of delays finally transitioned the world’s biggest crypto ecosystem from an energy-sapping proof-of-work chain to a proof-of-stake one that is exponentially more eco-friendly (99.95% more energy efficient in fact), there’s a lot of tension in the air. This time though, not only about the fallout if the upgrade is unsuccessful, but also what happens after it is concluded and potentially millions of newly unlocked ETH hit markets.

In this post, we will explain what the Ethereum Shanghai upgrade is, why it matters, and what we can expect from it.

What is the Ethereum Shanghai Upgrade?

The Ethereum Shanghai upgrade is a hard fork of the Ethereum blockchain that aims to make significant improvements to the network. The upgrade is named after the Ethereum developer conference held in Shanghai, China, in November 2022. The upgrade will include various changes, including EIP-4895, which is designed to increase the liquidity and competitiveness of the Ethereum network by allowing users to withdraw staked Ether (ETH). This change will unlock millions of staked ETH, providing more liquidity to the network and boosting its staking ratio. Additionally, the upgrade will also introduce changes to the consensus mechanism and improve the overall efficiency and security of the network.

Why is the Ethereum Shanghai Upgrade Important?

The Ethereum Shanghai upgrade is a significant milestone for the Ethereum community.

The introduction of EIP-4895 will enable Ethereum stakers to withdraw their ETH from the Beacon Chain, a feature that was not previously possible. This will provide stakers with more control over their assets and will likely encourage more people to participate in the network and lock their ETH to help secure it and earn rewards in return.

The Shanghai upgrade will be complemented by another upgrade called Capella, which will enable an update on the consensus layer where nodes run the Proof of Stake Beacon chain. The Sepolia Shapella is the testnet execution of the Shanghai upgrade, providing confirmation that ETH withdrawals are no longer just an expectation, but a matter of time before they are implemented.

How will stakers be able to unlock their ETH?

A validator that wants to unstake their ETH can either make a partial or full withdrawal. The first is to unstake only any accrued ETH rewards earned since 2020, while the latter requires a validator to unstake their full 32 ETH and exit the chain altogether. With so much happening on Ethereum and set to happen in coming years, this could be a very unwise decision, one that investors are well aware of.

What is the Ethereum Shanghai Upgrade Trying to Achieve?

The Ethereum Shanghai upgrade is trying to achieve several things, including:

- Allowing users to withdraw staked ETH, thereby increasing the liquidity and competitiveness of the network

- Improving the efficiency and security of the network.

- Providing greater opportunities for developers to build on the Ethereum network.

- Ensuring that the Ethereum network remains competitive and relevant in the blockchain landscape.

Why will Ethereum Shanghai happen in April instead of March 2023?

Originally slated for release in the second half of 2023, the Ethereum Shanghai upgrade’s release date was brought forward following a meeting of Ethereum developers in December 2022. The tentative date for the upgrade to go live was March 2023, but it was recently moved to April 2023.

Lead Ethereum developer Tim Beiko explained on Twitter that with the Goerli testnet upgrade scheduled for 14 March, there simply wasn’t enough time this month to review the results after 16 March and proceed. There was no set mainnet upgrade date, but if things go well with Goerli, they will most likely set a final date during the next developers meeting on 16 March.

What is EIP-4895 and What Will It Achieve?

Ethereum Improvement Protocol 4895 (EIP-4895) is a crucial part of the Ethereum Shanghai upgrade. It will allow users to withdraw staked ETH, increasing the network’s liquidity and competitiveness while also boosting its staking ratio closer to its competitors. It is estimated that around 16 million ETH will be unlocked following the upgrade, providing more liquidity to the network and potentially increasing its value as result, as users will be able to stake and unstake their Ether with ease, which can lead to a big buy-in from both retail and institutional investors.

Impact of the Ethereum Shanghai Upgrade on Ethereum

Short term- some volatility expected

The Ethereum Shanghai upgrade is expected to have both short and long-term impacts on the Ethereum network.

In the short term, the network’s liquidity will be increased as millions of staked ETH are unlocked, potentially leading to an oversupply of ETH that can drive the price down. However, this is debatable, as the staking unlocks will happen over several months, ensuring that there’s no mass volume of new ETH that can be dumped on markets. Also, there are huge incentives for ETH stakers to letting their Ether ride indefinitely.

Long term prognosis remains good

Most investors might in fact also take a long view on the prospects of ETH, which includes many bullish factors, such as these:

- Ethereum is now proof of stake and therefore becoming very attractive for institutional investors who are mandated by ESG regulations or pressure to their investments eco-friendly.

- With Ethereum’s validator rewards now shifted from miners to stakers, staking returns is also set to increase over time.

- The 2021 London hardfork introduced EIP-1559’s deflationary mechanism that burns Ether when transactions ramp up.

- Ethereum layer-2 chains have been the big story of 2023 so far, exploding in adoption and DeFi metrics such as total value locked (TVL). With 2 technologies vying for supremacy, namely Optimistic Rollups (eg. Optimism, Arbitrum, Polygon, Base Network) vs Zero-Knowledge (ZK) rollups (e.g. ZKSync, StarkNet, Polygon ZKEVM), the battle has only started and the Layer-2 Wars will drive millions more users to the Ethereum ecosystem.

- The US Fed has indicated after the Silvergate and Sillicon Valley that it might begin quantitative easing soon, which will together with 2024’s Bitcoin Halving drive huge interest in the risk-on crypto markets.

In Summary

The Ethereum Shanghai upgrade is a highly anticipated event for the Ethereum community, and for a good reason. With the introduction of EIP-4895 and other significant changes, the network will become more efficient, cost-effective, and environmentally friendly.

This upgrade will likely boost the network’s liquidity, increase its staking ratio, and provide more opportunities for developers to build on the network. Ultimately, the Ethereum Shanghai upgrade is another vital step in the development of the Ethereum blockchain, ensuring that it retains and grows its lead over rival chains such as Solana, Cardano, BNB Chain and Avalanche who are all waiting for the big dog to slip up (and all supported by CoolWallet Pro and CoolWallet App).

Of course, we need to keep in mind that a recession is expected for world markets in the second half of the year, which may adversely impact the entire crypto sector as investors move into safer and less volatile assets. And crypto is VOLATILE, as last week’s Silvergate and USDC depeg again underlined. The entire crypto industry went from extreme fear to elation in less than 72 hours, after the US government stepped in to save the country’s banking system. This will certainly not be the last financial crisis this year.

Based purely on fundamentals though, Ethereum isn’t losing a beat or its top spot any time soon, despite what regulators like the SEC and NY Attorney General might have planned.

The chain keeps improving and rolling out new features in line with its ambitious roadmap, thereby attracting more DeFi, Web3 and NFT talent every step of the way.

In the long term, the upgrade’s improvements to the consensus mechanism, efficiency, and security of the “World’s Computer” will make Ethereum more attractive for developers to build on, and users to transact on, and this continuing network effect will inevitably result in more investors and skyrocketing prices.

By Werner Vermaak

Please note: This article is not financial advice of any kind, but for educational and entertainment purposes only. All opinions are that of the author only. Please DYOR when investing in cryptocurrencies, and invest wisely, not on emotion.