What to Know About Bitcoin Spot ETFs

- What is a Bitcoin Spot ETF?

- How does a Bitcoin Spot ETF differ from a Bitcoin Futures ETF?

- Why did the SEC approve Bitcoin Spot ETFs now?

- What are the benefits of investing in a Bitcoin Spot ETF?

- What does the SEC’s approval signify for Bitcoin?

- Can we expect an influx of new investors in Bitcoin due to this approval?

- Will the approval of Bitcoin Spot ETFs affect Bitcoin’s price?

- Are Bitcoin Spot ETFs risk-free investments?

- Could this approval lead to the launch of other cryptocurrency ETFs?

- What should potential investors consider before investing in a Bitcoin Spot ETF?

Hallelujah! After years and years of waiting, weathering crazy bull and bear market cycles, three halvings and painful hacks and bans, we finally did it. For real this time.

On Wednesday 10 January 2024, the US Securities and Exchange Commission (SEC) announced that after a decade of rejections, it had FINALLY approved a Bitcoin spot ETF (in fact, 11 of them) in the United States. This concludes years of lobbying, dozens of application rejections, and finally makes it as easy to buy and own BTC as a traditional stock. And we’re only in the second week of January!

Bitcoin is now a legitimate financial asset, in fact the fastest-growing one in history, and not some shady money laundering and terrorism-funding vehicle for bad actors that should be banned.

The ETF approval puts the entire crypto industry firmly on track on the road to mass adoption, by making it possible for all institutional investors to invest in Bitcoin (and soon others?) in a regulatory compliant manner. It not only legitimizes Bitcoin in the eyes of many traditional investors but also paves the way for broader acceptance and integration of cryptocurrencies into mainstream financial systems. And thanks to the Taproot upgrade and innovations like Bitcoin layer-2s like Stacks and Lightning Network, BRC20 tokens and Ordinals all transforming the world’s oldest blockchain, Bitcoin is far from just safe old”digital gold”. We’re only just getting started.

But wait up: wasn’t Bitcoin invented to fight the traditional financial system?

Ahh yes, the elephant in the room: crypto was founded and built on the idea of financial self-governance, to fix the problems around those greedy TradFi intermediaries, and the idea that those same big Wall Street fat cats like BlackRock, who has 10 trillion dollars of assets under its management, and JP Morgan, who has been one of crypto’s biggest adversaries, will now be making big profits off our backs, might be jarring to many, especially Bitcoin maximalists who see them as the reason Satoshi Nakamoto invented it in the first place.

However, there is simply no other way for the worlds of Bitcoin, Web3 and DeFi to thrive without mainstream acceptance and some regulation that makes it possible for any investor, big or small, to own a slice of the new financial system that it’s creating. A Bitcoin spot ETF bridges the gap between traditional finance and the crypto world, making it easier for a broader audience to engage with and invest in cryptocurrencies. It brings in a whole new generation of crypto investors, from the biggest businesses, to your pension fund, to your grandma and yes, even that irritating neighbor who laughed at you in 2022 when you lost money on FTX and Luna.

So, Bitcoin is the gateway drug, and where it goes, eventually others will follow. We are moving from analog to digital money, and this is the way. And quickly too please, before central bank digital currencies (CBDCs) try to enslave us.

Satoshi Nakamoto’s Bitcoin and the blockchain technology it introduced is a remarkable technical achievement that will forever change the way the world creates digital networks and transfer value and information across it. It created for the first time in human existence a transparent, trustless and immutable network that’s backed by a public ledger that is there for anyone to see, and it fairly rewards network participants, instead of all-powerful intermediaries, for their services of securing and supporting the decentralized network in the form of a cryptocurrency.

Yes, the value of that currency is completely speculative and arbitrary, based on market forces and human emotion, but the system that it enables is rooted in fact and concrete, dynamic on-chain data.

The Bitcoin Spot ETF launches this week certainly marks the end of an era. Where Bitcoin was once the rebellious teenage financial dissident standing outside the gates of TradFi shining a light since 2008 on its excesses and inherent flaws, now it’s been invited inside, into the belly of the beast, where its former enemies are lauding it and preparing a banquet this week in its honor.

As they say in economics, there’s no such thing as a free lunch, and the likes of BlackRock are certainly not the charitable types.

So should we even self-custody our Bitcoin anymore, or just give it to the big dogs now to manage it for us? Self-custody is very important, as it helps to ensure the network is very decentralized and therefore immune to attacks on privacy and anti-censorship, but here’s what’s important:

Bitcoin is a decentralized peer-to-peer network that is open to anyone to use to transfer value, anywhere in the world, at any time, with a fixed maximum supply of 21 million BTC, the last which will be mined in 2140. Let’s read that again: Anyone, anytime, anywhere.

Whether that is a billion-dollar investment fund in New York, or a young student paying for a coffee in Bali, or a Kenyan small farmer cashing out some satoshis to buy new equipment, nothing’s changed. It’s still about saying yes to personal financial freedom, and no to bloated intermediaries and manipulated and inflationary centralized money supply.

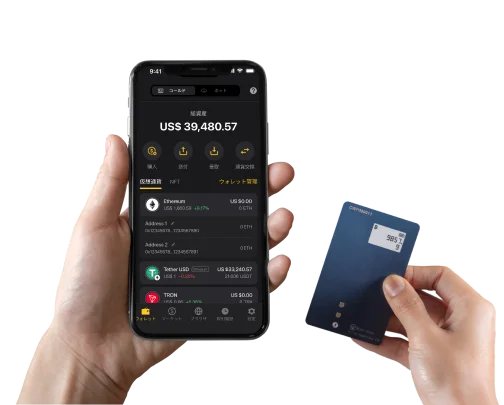

So, keep it on an exchange, buy it as an ETF through your financial broker, or just keep it safe in cold storage on a hardware wallet like CoolWallet, where nobody can take it from you thanks to our open-source EAL6+ secure element, encrypted Bluetooth, real-time malicious transaction scanning, and tamperproof design.

The choice is, and has always been, yours and yours alone. That is the promise of Bitcoin, and that is the power of crypto. Mass adoption cannot be stopped anymore, so sit back, HODL and enjoy the journey. Next stop: The 4th Bitcoin Halving!

To the Moon!

Written by Werner Vermaak for Team CoolWallet

Disclaimer: This article is not financial advice, and for educational purposes only.

What to Know About Bitcoin Spot ETFs

1. What is a Bitcoin Spot ETF?

A Bitcoin Spot ETF is an exchange-traded fund that tracks the current price of Bitcoin, allowing investors to invest in Bitcoin without directly purchasing the cryptocurrency.

2. How does a Bitcoin Spot ETF differ from a Bitcoin Futures ETF?

A Bitcoin Spot ETF tracks the current, or “spot,” price of Bitcoin, while a Bitcoin Futures ETF is based on futures contracts predicting Bitcoin’s future price.

DELIVERED EVERY WEEK

Subscribe to our Top Crypto News weekly newsletter

3. Why did the SEC approve Bitcoin Spot ETFs now?

The SEC’s approval comes after increased market maturity, improved regulatory frameworks in the crypto industry, and growing institutional interest, addressing earlier concerns about market manipulation and investor protection. Also, some might say it’s a US election year and that Gary Gensler, who cast the deciding vote in favor of Bitcoin, was under immense pressure to do so!

4. What are the benefits of investing in a Bitcoin Spot ETF?

Bitcoin Spot ETFs provide a regulated, simpler way to gain Bitcoin exposure without the complexities of direct cryptocurrency ownership, such as storage and security issues.

5. What does the SEC’s approval signify for Bitcoin?

The SEC’s approval of Bitcoin Spot ETFs adds legitimacy to Bitcoin as a viable asset class and signifies its growing acceptance in mainstream finance.

6. Can we expect an influx of new investors in Bitcoin due to this approval?

Yes, the approval is likely to attract new investors, especially from traditional finance, who prefer regulated investment vehicles.

7. Will the approval of Bitcoin Spot ETFs affect Bitcoin’s price?

The introduction of Bitcoin Spot ETFs could potentially drive up Bitcoin’s price due to increased demand, but it may also bring more stability due to higher liquidity from institutional investors.

8. Are Bitcoin Spot ETFs risk-free investments?

No, like any investment, Bitcoin Spot ETFs carry risks, including market volatility and regulatory changes in the crypto space. However, you won’t have to worry about private keys or exchange hacks anymore.

9. Could this approval lead to the launch of other cryptocurrency ETFs?

Yes, the approval sets a precedent and could pave the way for spot ETFs based on other major cryptocurrencies in the future, IF they’re deemed to be commodities, and not securities.

10. What should potential investors consider before investing in a Bitcoin Spot ETF?

Potential investors should consider their risk tolerance, market volatility, the evolving regulatory landscape, and conduct thorough research before investing in a Bitcoin Spot ETF.