What are Bitcoin Layer-2 Networks?

Bitcoin Layer-2 Chains

- Lightning Network

- Stacks

- Rootstock

- Liquid Network

- Dovi

- Statechains / Mercury Layer

- MAP Protocol

- OMNI Layer

Introduction

As 2024’s bull market gains momentum in the wake of the SEC’s recent Bitcoin spot ETF approvals and the upcoming Bitcoin Halving, there are lofty expectations for not only Bitcoin but also the Layer 2 chains that are helping it to scale and offer DeFi services and build Dapps on top of it, following the success of Ethereum L2s like Arbitrum and Optimism and incoming zero knowledge proof rollups.

Executing transactions on Layer 2 in parallel to the Bitcoin main network has been possible for a few years now, thanks to the Taproot upgrade and the innovative technologies put forth by several key players. Some of these L2s, as they’re known, offer more than others in terms of functionality. Other popular blockchains have had a great deal of development in Layer 2 solutions in all categories and use cases, and the tech gets more refined each year. Bitcoin is still not to be counted out for regular transactions and continues to serve its purpose as “digital gold” and a scarce safe haven asset well Recent developments in Bitcoin Layer 2 technologies are showing promise and some of the shortcomings are being ironed out, and could very well help Bitcoin to reach Satoshi Nakamoto‘s vision of it as a P2P electric cash system.

What Are Bitcoin Layer-2 Networks?

Layer 2 solutions are frameworks that build on Bitcoin to leverage its security and decentralization and help it to scale with faster and more transactions. work to solve the ever-present issue of how to conduct smaller day-to-day transactions using Bitcoin without the inconvenience of having to wait an unreasonable amount of time for your transaction to clear on the Bitcoin main network while paying a big fee for the pleasure. Especially now with the rise in Ordinals and BRC20 transactions which bring with them massive network congestion, it’s more important than ever to try and settle them on a a layer 2, where these small transactions can be transacted in just a few seconds with very minimal fees (a few pennies or less). Users are free to settle their tabs on the main Bitcoin chain whenever they wish.

Since Bitcoin is the granddaddy OG of the blockchain/cryptocurrency universe and home to patient HODLers and fervent Bitcoin maxis, there is high demand for a robust and effective Bitcoin Layer 2 that can facilitate micro-transactions while wallets (both hot and cold) hold the main icebergs of BTC for the long term. Smart contracts and a DApps are a welcome bonus and keep the Bitcoin ecosystem competitive.

The Best Bitcoin Layer-2 Chains in 2024

Lightning Network

Lightning is probably the best-known Bitcoin Layer 2 and has been live since 2018. It has gained a good chunk of market share and developers are working to make using it seem seamless. It works by opening payment channels via multi-signature wallets between users. It can be a bit cumbersome because the channels need to be adequately funded to allow payments through the network, but it enjoys the support of many key Bitcoin opinion leaders like Michael Saylor and its deployment in Bitcoin nations like El Salvador has helped it gain a lot of traction.

Various payment apps have emerged to pool users together to form a web of connections so that users don’t have to keep opening new payment channels and can instead connect through these networks and rely on the logic of the code to ensure transactions find a quick and reliable route to their destinations. It has been compared to the Internet in the way it relies on a web of connections between users, but since it is a currency that is being transferred, it does introduce additional security risks from potential “bad actors”.

Stacks (STX)

Previously known as Blockstacks, Stacks aims to bring smart contracts and decentralized applications (Dapps) to the Bitcoin blockchain. It is a layer-2 blockchain associated with the Bitcoin ecosystem, designed to enhance Bitcoin’s capabilities by enabling the execution of smart contracts and the creation of DApps such as Ordinals, Demex and stakingDAO. Stacks has its own native cryptocurrency called STX and is built on a consensus mechanism called Proof of Transfer, which connects directly with the Bitcoin blockchain. Bitcoin is staked and replaced with the Stacks token (STXK) for use in quick and cheap transactions with massive scalability. The project has received attention for its unique approach of leveraging the security and robustness of the Bitcoin blockchain while adding new functionality and use cases. Stacks has also been notable for being the first token offering qualified by the U.S. Securities and Exchange Commission (SEC). This has its pros and cons, and Stacks has received criticism for kowtowing to regulators and the L2’s tendency toward centralization.

Rootstock (RSK)

Claiming to have the world’s most secure smart contracts, this L2 solution operates as a sidechain to Bitcoin and runs on the basis of “merged mining” where Rootstock miners secure and earn the Rootstock native RSK tokens as they mine Bitcoin. Similar to Stacks, users can stake BTC on Rootstock to receive RSK tokens for use in transactions and smart contracts. People have complained about the extended time it takes to stake on Rootstock while you wait for 100 BTC to be accumulated by users to form a staking block. Once staked, however, a user has access to a system where transactions can be sent to and fro with high throughput and scalability. It is also fertile ground for DApp development.

Liquid Network

The Liquid Network is a Bitcoin sidechain and also conducts transactions in units of Bitcoin, as does the Lightning Network. However, the Bitcoin that you transact with on the Liquid Network is called “Liquid Bitcoin”. A user locks up Bitcoin on the main chain in exchange for 1:1 Liquid Bitcoin that is unlocked to freely transact on the sidechain that is the Liquid Network.

The network is adept at handling smart contracts and can also be used to store other tokens and assets. Developers can add functionality for stablecoins, on-chain assets, gaming integration, and more. It leaves the door open for creative uses of the sidechain while maintaining the ability for any user to “cash out” and settle on the Bitcoin mainchain.

Additionally, there is functionality on the Liquid Network to verify different classes of investors, such as “accredited investors” in the US for purposes of investing in businesses, technology projects, or securities. This is an area of great potential and there is somewhat of a technological arms race to see which L1s and L2s can best facilitate this and gather partnerships and market share.

DELIVERED EVERY WEEK

Subscribe to our Top Crypto News weekly newsletter

Dovi Network (DOVI)

Dovi is a newer Bitcoin Layer 2 just launched in 2023 with support from crypto heavyweight Kucoin Labs. The system enables a variety of more advanced DeFi services such as decentralized exchanges and various types of market-making and lending platforms. The focus has primarily been on privacy and efficiency and all of the added services are programmed on top of the Bitcoin mainchain. Best of all, it’s EVM-compatible, allowing the deployment of Ethereum-designed smart contracts on the Bitcoin network.

Mercury Layer

Statechains is a new technology that enables users to transact along a chain of other users through digital signatures to ensure that the transaction gets to its ultimate destination, collaboratively sharing UTXO with a pre-signed transaction as a last resort tool for Bitcoin users to enforce their ownership. The Statechains allow transfers off of the Bitcoin chain, thereby saving fees and allowing greater scaling. They operate similarly to the Lightning Network but require a degree of trust between parties in a transaction, but it is more censorship resistant than some other L2s.

An interesting new project launched in January 2024, known as the Mercury Layer, which builds on Statechains technology by adding “blinding”, which prevents the operator of a Statechain service from knowing anything about what is being transferred.

MAP Protocol

Also quite new on the scene is the MAP Protocol which uses BRC-20 tokens that utilize individual satoshis (100 million satoshis in one Bitcoin) on the Bitcoin network and imbues them with qualities that allow them to be part of smart contracts. This is very similar to Bitcoin ordinal collectibles, but here the ordinal inscriptions are used for instructions for smart contracts. This can also be used to allow D-Apps to operate and perform various functionalities. A comprehensive Bitcoin L2 ecosystem has been built using the MAP Protocol.

Honorable mention: OMNI Layer

Formerly known as Mastercoin, OMNI Layer is one of the original layer 2 protocols, going back to 2014. It also can facilitate smart contracts, custom currencies, and decentralized crowdfunding. Its popularity has waned in the last few years as many other layer-2 networks sprung up, and it has been dropped by the Binance exchange and stablecoin issuer Tether that has stopped supporting it.

Conclusion

With so much happening on a plethora of layer-2 chains that uses Bitcoin’s renowned security and decentralization to scale, build Dapps and deliver DeFi services, it’s clear that the world’s biggest blockchain is much more than just boring old “digital gold”. Expect an avalanche of new layer-2s and eventually layer-3s that will continue to build out the world’s most valuable and decentralized blockchain in the coming years.

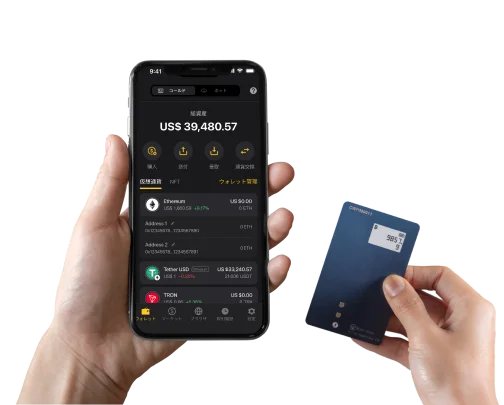

Looking to keep your Bitcoin safe on a highly secure Bitcoin hardware wallet that you can take with you wherever you go? The answer is CoolWallet.

This blockchain security pioneer’s CoolWallet Pro is a leading Bitcoin cold wallet with an EAL6+ secure element (open source), military-grade encrypted Bluetooth, a powerful CoolWallet App and various additional cutting-edge security measures such as 2+1FA and SmartScan anti-phishing transaction monitoring.

CoolWallet launched the first Bitcoin mobile-native hardware wallet in 2016 and has since iterated with powerful newer versions such as CoolWallet S (2018) and CoolWallet Pro, their flagship DeFi model. In 2024 it has an exciting new roadmap that will redefine the cold storage landscape yet again.