Table of Contents

- Introduction

- Spot ETF Approval Helps Bitcoin Beat US Recession

- Fourth Bitcoin Halving Comes and Goes

- Laser Eyes Rejoice! Bitcoin Hits $100k in Q4 2024

- Ethereum Rips, But Doesn’t Flip and Then Slips to L2s and Solana

- ETH L2 Wars: 10x Transactions, 2-3 Dominant Chains

- FASB and Coinbase Makes Corporate Crypto Holdings Sexy

- NFTs Make a Comeback Thanks To Bitcoin Ordinals and Web3 Games

- Binance and US Lose Number 1 Spots

- Stablecoin Market Cap Crosses ATH of $200 Billion

- Solana Summer Continues?

- DEX Market Share Increase

- Web3 Gaming Gets A New Poster Boy

- Decentralized Physical Networks (DePin) Go Global

- DeFi Accepts KYC And Gets Institutional Adoption

- Conclusion

Introduction

Despite huge global economic challenges in 2023, the crypto sector, boosted by a resurgent Bitcoin, has had an incredible year and all eyes and ears are now on where it’s going in 2024.

There is an overload absolutely legitimate reasons why crypto can recapture the world’s attention after the rise of artificial intelligence stole most of its thunder last year. It all starts with Bitcoin of course, but there’s so much more going on.

We gazed into the looking glasses of smart money, seeing what firms like a16Z, Van Eck, Bitwise and others believe 2024 might hold for crypto and Web3, but keep in mind that these companies all have significant skin in the game and will therefore in most cases be very bullish.

Here are some of the biggest predictions, trends and narratives for 2024. Please note that this article is for educational purposes only, purely speculative in nature and should not be considered as financial advice of any kind.

Source: Decrypt.co

Spot ETF Approval Helps Bitcoin Beat US Recession

Crypto markets spinned like a yoyo in 2023 on fears of a delayed global economic meltdown and unbridled FOMO for next year’s Bitcoin halving and expected Spot ETF approval. According to Van Eck, the U.S. is expected to enter a recession in early 2024, which will cool off the economy and lead to declining economic indicators.

By the end of 2023, inflation is once again on the up according to the latest CPI data and with the Nasdaq at near record highs and the majority of investors expecting the money printers to start BRRRing in 2024, anything is possible.

Despite this, over $2.4 billion is projected to flow into newly approved U.S. spot Bitcoin ETFs in the first quarter of 2024, helping to keep Bitcoin’s price above $30,000 despite significant potential volatility. A BitWise report holds that spot bitcoin ETFs could capture 1% of the $7.2 trillion U.S. ETF market, or $72 billion, within five years.

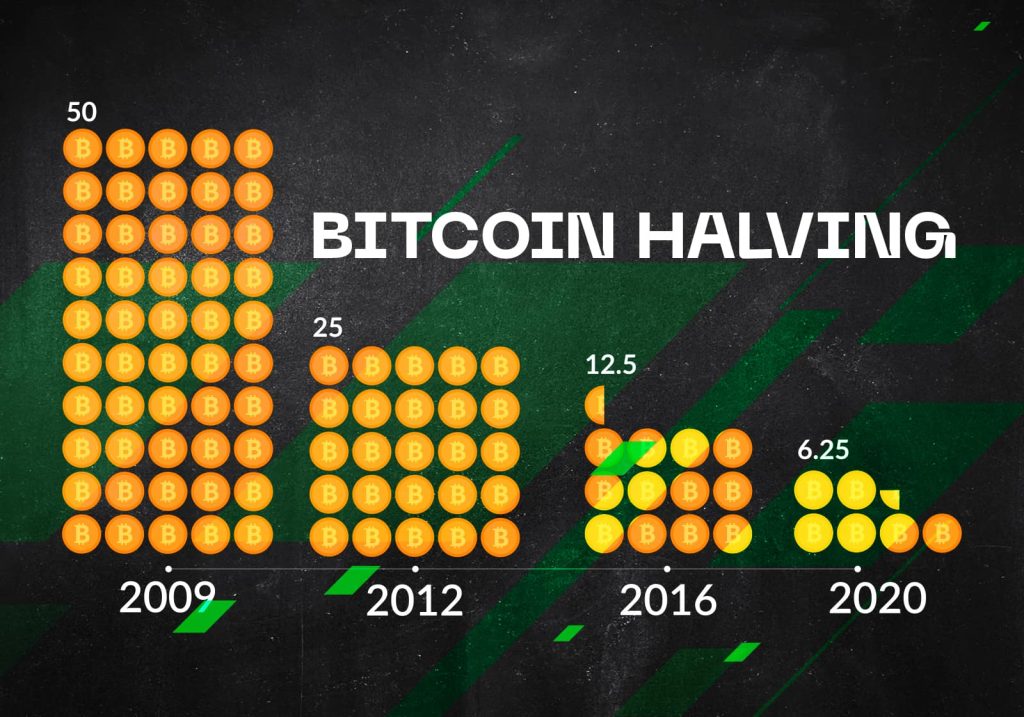

Fourth Bitcoin Halving Comes and Goes

In 2023 everyone and their grandma became an expert on the intricacies of Bitcoin’s diminishing mining rewards algorithm and those that didn’t get the memo in 2016 and 2020 and missed the huge bull runs the following years, are now lying in wait to cash in on the expected price surge that will follow once BTC’s block rewards drop from 6.25BTC to 3.125BTC. What many may be missing is that the Bitcoin halving and ETF approval will be the moment where many HODLers finally take some profit.

The fourth Bitcoin halving in April 2024 is predicted to occur smoothly without major forks or missed blocks. This event will likely cause a consolidation in the market as unprofitable miners disconnect, followed by a rise in Bitcoin’s price above $48,000.

The smart money has been on accumulating BTC under $20,000 and betting on mining companies, which has seen their stock prices spike last year. Low-cost miners like CLSK and RIOT are expected to outperform others, with at least one publicly traded miner predicted to increase tenfold by year’s end.

Laser Eyes Rejoice! Bitcoin Hits $100k in Q4 2024

After the Halving is done and Bitcoin ETFs are hopefully finally a reality, there could potentially be a temporary slump in interest in crypto markets. In the latter half of 2024, amidst a landscape of high global electoral activity and potential regulatory shifts, Bitcoin is forecasted to reach an all-time high, potentially coinciding with the US elections on 5 November 2024. Will we finally see $100,000 and “I told you so” posts from all those laser eye Bitcoin maxis? Analysts like Van Eck believe so and Bitwise holds that Bitcoin will trade above $80,000, setting a new all-time high.

Ethereum Rips, But Doesn’t Flip and Then Slips to L2s and Solana

Since its Beacon Chain launch in 2020 and Merge in 2022, Ethereum has left its competitors in the dust as the planet’s biggest proof-of-stake chain and Web3 ecosystem. Its Dencun fork in Q1 2024 will introduce EIP-4884’s proto-danksharding upgrade an important step on the journey to full sharding, and make L2s cheaper in the process, driving the average transaction cost below $0.01, paving the way for more mainstream uses. Ethereum revenue will more than double to $5 billion as users flock to crypto applications.

Talks of the Great Flippening will be everywhere again, but analysts don’t think Ethereum will surpass Bitcoin’s market cap in 2024 just yet. Ethereum should have a very strong year, and may outperform all major tech stocks and even Bitcoin, but will likely lose some market share to other smart contract platforms, like Solana, due to uncertainties around its scalability roadmap centralized staking pools like Lido and high price which might drive degens elsewhere to earlier-stage opportunities.

ETH L2 Wars: 10x Transactions, 2-3 Dominant Chains

Post the EIP-4844 upgrade, Ethereum’s Layer 2 chains like Polygon, Arbitrum, Optimism and the slew of new ZK rollup chains are predicted to explode in terms of value and usage, collectively reaching twice the current DEX volume and a crazy 10x the number of Ethereum transactions by Q4 2024. According to a16z layer-2s’ contribution to Ethereum transactions 4x’d from 1.5% to over 7% in 2023, and this figure will continue to spike in 2024. We’ll see a consolidation by the end of 2024 where 2-3 dominant players will rule the market due to liquidity fragmentation, with one of them overtaking Ethereum in monthly DEX volume/TVL.

FASB and Coinbase Makes Corporate Crypto Holdings Sexy

New accounting treatments will encourage corporate crypto holdings. Companies like Coinbase will report significant Layer 2 blockchain revenues, and non-crypto financial entities may explore creating quasi-public blockchains, spurred by favorable accounting guidelines for crypto assets.

The new FASB regulations that come into effect in December 2024 (and sooner for other companies) will make it very appealing for companies to keep crypto like Bitcoin on their balance sheets.

Companies will have to record gains and losses on crypto each quarter based on market prices (fair value) instead of just recording losses like before. This better reflects crypto’s value and will give investors better information to evaluate companies with crypto, making investment more attractive and the crypto market more legitimate.

DELIVERED EVERY WEEK

Subscribe to our Top Crypto News weekly newsletter

NFTs Make a Comeback Thanks To Bitcoin Ordinals and Web3 Games

After being ridiculed in 2022 and most of 2023, the NFT sector is set for a huge comeback next year. NFT volumes are anticipated to hit new heights in 2024, driven by Ethereum’s top collections, enhanced Web3 crypto games that are actually fun to play, and of course, the ascent of Bitcoin Ordinals, which might see the NFT issuance ratios between ETH and BTC move as close as 3-1, with Stacks (STX) emerging as a significant player.

Binance and US Lose Number 1 Spots

After a challenging 2023 which was always expected after the FTX collapse devastated so many retail investors the year before, the world’s biggest exchange Binance is expected to lose its top position in spot trading volumes following a $4 billion settlement with U.S. regulators and the resignation of its high-profile CEO Changpeng “CZ” Zhao.

According to Van Eck, new competitors like OKX, Bybit, Coinbase, and Bitget could potentially take the lead, although they’ll likely get the same scrutiny from regulators if they grow big enough. This shift will also influence the eligibility of exchanges to provide liquidity for ETF-authorized participants and sponsors.

The ramifications of 2023’s Operation Chokepoint 2.0 may well come to haunt the US in the coming years, as US-based Web3 projects continue to leave the States in favor of friendlier destinations like the UAE, Hong Kong and Singapore and cost the United States its crown as the global leader in Web3.

Stablecoin Market Cap Crosses ATH of $200 Billion

With the bull market, risk-on conditions and well-defined regulations such as Europe’s MiCA all encouraging investment, new money will continue to pour into crypto in the form of stablecoins like USDT, USDC, and PYUSD. The total value of stablecoins is projected to exceed $200 billion, a new all-time high. More money will settle using stablecoins than using Visa.

Surprisingly Circle USDC is expected to overtake USDT, reflecting a growing institutional preference for US-compliant USDC. This shift might be influenced by potential regulatory actions against entities involved with USDT for various infractions.

Solana Summer Continues?

After crashing to $8 post-FTX, Solana has been on tear in 2023 and its Breakpoint conference served as a call to arms, with high-profile new projects such as memecoin BONK, price oracle Chainlink usurper Pyth and DeFi darlings Jito and Jupiter bringing in hundreds of millions (if not billions) of dollars into the Solana ecosystem and more than doubling the price of SOL.

As the primary alternative to Ethereum, 2024 could be one long Summer of Solana as its lack of network outages, ultra-low transaction fees and superfast TPS capabilities sees it surpass its former glory as it becomes a top three blockchain by market cap, TVL, and active users.

Solana is predicted to become a top 3 blockchain by market cap, TVL, and active users. Its price oracle, Pyth, may surpass Chainlink in Total Value Secured, driven by innovations and growing TVL on high-throughput chains.

DEX Market Share Increase

Decentralized exchanges (DEXs) will see a surge in market share for spot crypto trading, driven by high-throughput chains like Solana and improved wallet features. This shift will be accompanied by a decline in BTC and ETH dominance post-halving, favoring DEXs that help DeFi users to transact on layer-2 and layer-2 chains, which are cheaper and faster and perfect for frequent transacting. New DeFi trends like LSD restaking will suck in a lot of ETH in the process, to be utilized across many upcoming ecosystems.

Web3 Gaming Gets A New Poster Boy

After a disappointing collapse in 2022 , the nascent blockchain gaming sector will finally see significant growth with at least one game surpassing a million daily active users. High-budget games on platforms will overcome technical challenges in Web3 gaming and make it appealing to actual gamers.

Axie Infinity kicked off the Web3 gaming craze in 2021, but the sector took a knee under the weight of industry hype and a crushing bear market. Luckily, builders kept building thanks to huge VC funds and it’s time to level up. A new blockchain game behemoth will rise and in the process surpass 1 million daily active users, as users go from Play-to-Earn (P2E) to simply playing games and earning rewards in the process. Platforms like Immutable, with high-budget games and super-effective token models, are prime candidates for this revolution, potentially rivalling the success of mainstream AAA games.

Decentralized Physical Networks (DePin) Go Global

Decentralized physical infrastructure (DePin) networks have seen some solid traction towards the end of 2023, and innovators like Hivemapper and Helium will see substantial growth in 2024. Hivemapper will aim to challenge Google Street View with its community-owned mapping protocol, while Helium’s decentralized 5G network will try to make P2P WiFi a global reality.

DeFi Accepts KYC And Gets Institutional Adoption

Unfortunately, Know Your Customer (KYC) measures may become an unavoidable part of DeFi, particularly in the US, with platforms like UniSwap leading this integration. This shift will hopefully attract institutional liquidity and increase protocol fees, enhancing the competitiveness and token value of participating protocols.

Conclusion

We could easily write another 20 pages on what’s potentially in store for crypto in 2024, with half on it devoted to the rise of zero knowledge rollups, Solana airdrop season, DePin and the new generation of meme coins like Bonk and Pepe, but we can’t do all the work for ya.

In the end, the narrative will likely be on Bitcoin till its spot ETF approval and halving happens, after which it’ll shift to Ethereum and its layer-2s and L1 competitors. With billions of new dollars pumped into crypto by institutional and retail investors, degens will be on the lookout for brand new opportunities on surging ecosystems like Solana and Base, so remember this golden rule of crypto: Expect the unexpected at all times and educate yourself. Tread carefully!

One thing that is within your control though is how you secure your crypto assets. Look no further than CoolWallet’s powerful CoolWallet Pro hardware wallet and feature-abundant CoolWallet App, from which you can buy, sell, stake, store and transfer crypto protected by elite cold storage and real-time Web3 transaction smart scanning.