The CoolBitX team was out in full force last week at Taipei’s recent Asia Blockchain Summit 2019- a highlight on the annual crypto calendar where cryptocurrency decision-makers and thought leaders dissect some of the burning issues in our industry.

CoolBitX helped run a booth with the Litecoin Foundation to promote our Special Litecoin Edition CoolWallet S, and I delivered a keynote speech on how virtual asset service providers (VASPs) could stay compliant with the far-reaching latest Financial Action Task Force (FATF) new regulations.

How to keep your Exchange Compliant with FATF Rules

In my keynote address “How to Keep your Virtual Currency Exchange Compliant with FATF Rules”, I talked about the FATF’s latest Recommendations and our Anti-Money-Laundering (AML) solution that will allow VASPs to stay compliant.

The Need for Better Regulation

Over $1.7 billion in virtual assets were stolen from exchanges, wallets and ICO’s through scams and hacks in 2018 alone (and 2019, sadly is not bucking the trend), much of this funneled to money launderers, crime syndicates, and terrorist organizations. Coming from a traditional FinTech security background, I knew that it was simply a matter of time before the world’s regulators would put their foot down.

The Latest FATF Recommendations (June Guidance)

The FATF’s latest guidance, issued in late June as its US presidency came to an end, includes non-binding recommendations that its 200 member countries are expected to enforce or risk being added to the dreaded “Non-Cooperative Countries or Territories” (NCCTs) blacklist of countries under sanction.

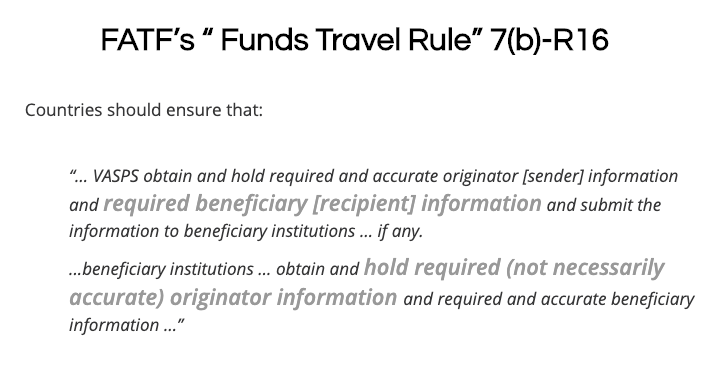

During their June Plenary, days before the G20 conference, the FATF officially adopted the controversial new “Travel Rule” recommendation for VASPs, a requirement that mirrors FinCEN’s Travel Rule as enshrined in its Bank Secrecy Act. In short, digital exchange counterparts now need to share both originating and beneficiary information during a transaction.

Issues with the Travel Rule

Blockchain technology was designed for a private exchange of information between parties that obsoletes the need for intermediaries. VASPs will now potentially have to sign agreements with thousands of other digital exchanges around the globe and still not be able to identify the real-world identities behind private wallets.

This could drive a big chunk of virtual asset users from centralized exchanges back to anonymous private wallets, and out of reach of both VASPs and authorities- which completely defeats the purpose of the FATF policy.

What happens if parties don’t comply?

Non-compliance is off the table. Countries have 12 months to ensure that both local VASPs and foreign VASPs (optional at this stage) are AML-compliant, can manage or mitigate the risk posed by obfuscation tools such as mixers and tumblers, and should look for solutions to identify transgressing VASPs.

VASPs can expect to be increasingly penalized, shut down and even prosecuted, while end users can be classified as money transmitters and penalized, as happened recently with FinCEN and an individual P2P exchanger.

CoolBitX’s Solution

We’ve been working on a solution since the FATF made their regulatory intentions clear during their October 2018 Plenary.

Sygna is an end-to-end compliance solution that will solve some of the cryptocurrency industry’s biggest regulatory headaches and achieve the following milestones:

- Create a SWIFT solution for Virtual Assets

- Implement KYC/AML transaction screening on private wallets

We’ll provide more information in the near future (VASPs are welcome to contact us at [email protected]).

Benefits for Countries, VASPs and Users

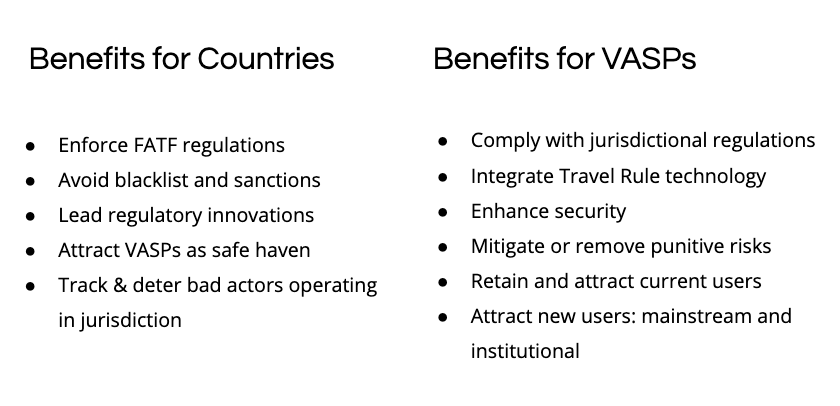

These solutions have the ability to turn the FATF regulatory threat into an opportunity for all affected parties.

Countries will be able to enforce FATF regulations and thereby avoid getting blacklisted. It would also be seen as a safe haven for VASP compliance, thereby retaining current service providers, attracting new ones and chasing away bad actors who want to avoid governmental scrutiny.

VASPs will solve the Travel Rule technical conundrum and comply with jurisdictional regulations, enhance their security, retain current users and attract a whole new client base of law-abiding mainstream and institutional investors. Finally, users will have a universally compliant virtual identity and more secure and legally recognized assets.

Conclusion

The FATF recommendations present us with an opportunity over the next 12 months to build innovative solutions that will legitimize our industry and deter bad actors who will likely abscond to less illuminated cryptocurrency avenues.

With China, a country less receptive to virtual assets than the US, on the FATF throne until the June 2020 review, the onus is now on us to come up with answers, or worse “solutions” may be foisted upon our industry.