Hot wallets are fun and cheap, but security concerns remain an ever-present issue. Without cold storage, vulnerabilities will always loom. Here’s why you need a hardware wallet to properly secure your crypto assets.

The list of crypto’s 2022 security breaches, most recently the Solana hot wallet and $190 million Nomad bridge hacks in August 2022 reads like a horror novel for crypto owners. Even worse, it feels like a recurring sequel that’s bigger and badder than each previous year. That’s because crypto crime is on the rise each year, as this Chainalysis report shows.

There’s no way to sugarcoat it: Retail crypto users are at risk from an ever-increasing range of hacks and scams that are growing increasingly bolder trickier and bolder the more sophisticated our industry is becoming thanks to innovations in areas like DeFi and Web3, even if markets are subdued.

Choosing the correct wallet for your cryptocurrency storage in 2022 is now more important than ever before. Still, it remains a difficult consideration that even seasoned crypto users struggle with. Do you sacrifice security for better convenience by using a “hot” Internet-connected and software-only crypto wallet application, or do you go the extra mile and buy a “cold” wallet (also called a hardware wallet) that’s completely offline, but which you need to lock up somewhere in a dark corner of your house for extra peace of mind?

Well, let’s shed some light on this matter.

One thing though remains undeniable. Using cold storage in the form of a dedicated device such as a hardware wallet is the safest option for everyday investors in Bitcoin, Ethereum, and layer-1 altcoins like BSC, AVAX, ADA and MATIC and Solana, whether you simply HODL or dabble in the rapidly evolving worlds of decentralized finance (DeFi), Web3 and non-fungible tokens (NFTs).

However, what might come as a surprise is just how much cold wallets have evolved in recent years to bridge the gap in convenience, features and ease of use with their hot wallet counterparts and centralized exchanges. In fact, you can even use a hardware wallet like CoolWallet in conjunction with MetaMask to supercharge your asset security.

This article provides a layman’s explanation of cold storage and explains the myriad benefits of hardware wallets, in particular those for CoolWallet users.

Whether you are a newcomer to cryptocurrencies or a veteran from the early days of the technology, whether you plan to HODL or trade each dip and pump, you can’t go wrong with cold storage.

Crypto wallet basics

First off, you bought or are thinking of buying some crypto, most likely on an exchange. However, you want to really own and control your own crypto. To do this, you’ll need a crypto wallet to store and use your cryptocurrency. Think of wallets as bank accounts that interact with the blockchain. While some overlap, they can be divided into hot and cold varieties. Hardware wallets, like those made by CoolWallet, Ledger, and Trezor, are cold storage solutions that are considered to be the safest option for normal crypto users.

Cold wallets or hardware wallets are custom hardware that store your private key offline, and only use it to sign or verify transactions over an encrypted USB or Bluetooth connection. Therefore they are not directly connected to the Internet. For additional security, the best hardware wallets will also feature a secure element (SE) chip that permanently locks your private key away.

Hot wallets (and their private keys/recovery seeds) remain online. Both wallet types use an application program (app or browser extension) to connect to the web, allowing the user to connect to a myriad of DeFi and Dapp options. This distinction engenders certain advantages and disadvantages.

Hot Wallets: Pros & cons

Hot storage comprises web-based, mobile phone, and desktop wallets. Some of the most popular options out there are MetaMask, the world’s most popular crypto wallet (ETH, BSC, MATIC, AVAX, and other EVM-supported chains) TrustWallet (BSC and others), Phantom (Solana), GeroWallet (Cardano) and Keplr Wallet (Cosmos).

CoolWallet offers native support of MetaMask, and our WalletConnect integration allows our users to safely and quickly connect to other Dapps as well.

Pros:

- Hot wallets are super convenient and popular, as they are free to install and quick and painless to use. They are ideal for making purchases and withdrawals on the fly, especially if you don’t want to trade on a centralized exchange.

- Unlike cold wallets, hot wallets usually only require a single piece of hardware, e.g. a computer or a smartphone.

Cons

Hot wallets are like actual wallets — while convenient, they are easily lost or stolen.

- Their security is only as good as that of the phone or computer that they are stored on.

- Since they (and the wallet credentials) are connected to the Internet, hot wallets are susceptible to hacks.

- Hot wallets are easy targets for phishing campaigns, where a wrong click can inadvertently give wallet access or authorization to a malicious party to steal your assets, as was seen with the OpenSea blind signing controversy recently.

Pros and cons of Cold Storage Wallets

The most common variety of cold storage, the hardware wallet, is usually comparable in size to a USB stick (Ledger, Trezor) or a credit card (CoolWallet). Paper wallets are also considered a form of cold storage, but it’s essentially only a written or printed copy of your private key or recovery seed.

Pros

- Cold wallets, at least the most secure ones, have elite safety components such as a secure element on which they spend a lot of research and development.

- Most require biometric verification to unlock and access the accompanying app, which you can use to connect with DeFi and Web3 protocols via QR code.

- You need physical control of both the cold wallet and the accompanying phone/PC app to make a transaction.

- A physical button press on the device is required to authorize any transaction, making remote hacks all but impossible.

- If you lose your cold wallet, you can simply use your recovery seed to restore access to your funds on a different wallet (either hot or cold)

- If you lose your phone or computer where your cold wallet app is on, simply download and install it on a new device and pair it with your device.

- Thanks to in-app browser support, Web3 and WalletConnect compatibility with thousands of Dapps, cold wallets are more user-friendly than ever before.

Cons

- Cold wallets are sophisticated devices and and will cost you between $50 and $200, depending on their specs and features.

- You must still store and protect your recovery seed in order to restore it if needed.

- You can still be susceptible to some types of phishing attacks if you physically approve a malicious transaction without doublechecking.

- Cold wallets will always offer fewer features and coin support than hot wallets, due to physical limitations and firmware requirements for new coin support and features.

- Cold wallets with bulkier USB designs can be vulnerable to supply-chain attacks, where the device is tampered with before it reaches the end-users.

Ultimately, for anyone serious about really looking after their crypto, the added security and reliability make hardware wallets the best options for long-term crypto storage. Serious crypto users tend to keep the bulk of their funds in cold storage and use hot wallets for easy access to smaller portions.

This brings us back to our original quandary — which hardware wallet is best for you? While everyone should consider their own needs, we’re going to be biased and say that CoolWallet has something for everybody- caters to both the everyday user with the CoolWallet S, and a more sophisticated DeFi/NFT user with the advanced CoolWallet Pro model.

What to consider when choosing the best hardware wallet for you

How convenient is my crypto wallet to use?

For years, there was simply no question as to whether hot or cold wallets were more convenient to use, with the software-only wallets winning hands down. This was because cold wallets required extra steps to set up, required a tethered USB connection or wireless Bluetooth connection and due to firmware issues, couldn’t offer the same plethora of marketplace and trading options as well as coin support, instead focusing rather on providing blue-chip security for blue-chip crypto assets.

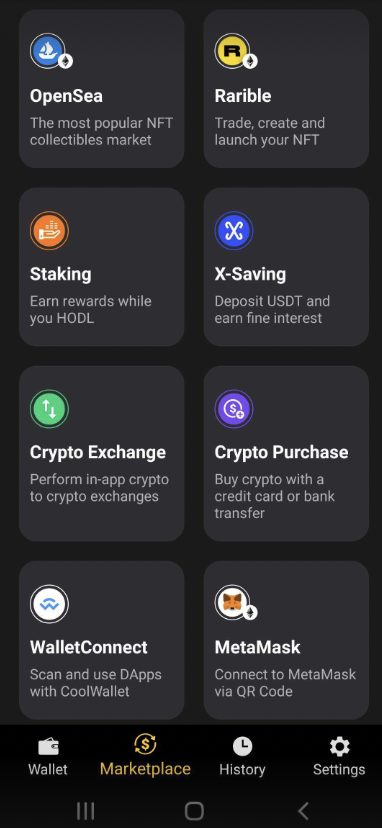

This has since changed dramatically with the advent of the DeFi summer in 2020. Hardware wallets like CoolWallet and Ledger now sync seamlessly with the best DeFi DEXs like Uniswap and 1Inch as well as NFT marketplaces such as OpenSea and Rarible, to name a few.

Comparing apples with apples, CoolWallet holds several unique advantages over its rivals in the realm of convenient cold storage in all conditions.

Unlike other cold storage options, the CoolWallet’s form factor is truly unique. It fits easily and discreetly into its users’ actual wallets and is the same size and thickness as a normal credit card. This innovative form factor is buttressed by a military-grade encrypted Bluetooth connection to iOS and Android smartphones via the CoolBitX Crypto app.

CoolWallet is made for everyday use and is highly durable (it can be bent slightly) and is waterproof. It also boasts a daylight-readable E Ink display. In sum, its advanced form factor produces a solution that provides similar convenience to hot wallet solutions without sacrificing the security associated with cold storage.

How secure is my crypto wallet?

When it comes to security, hot wallets don’t hold a Japanese candlestick to hardware wallets, despite what they or phone manufacturers may tell you. This is because a hardware wallet is a dedicated storage device that has specialized components and requires physical verification of transactions, which means any hacker cannot do their dirty work over a mere phishy link and online connection. Do note that of course if a user is fooled into providing said physical verification, they can still lose their funds though.

Let’s take the CoolWallet Pro for example. Our flagship model uses a multi-step verification process to approve and secure crypto transactions, enabling its users to buy, HODL, and trade with confidence. Illustratively, it relies on an EAL6+ Secure Element (SE) chip.

In addition, there is also a free CoolWallet app that uses face and fingerprint identification along with passcode verification. These features are facilitated by a private and secure encrypted military-grade Bluetooth connection (AES256).

CoolWallet also boasts a patented cold compression lamination, making it tamperproof, as any attempt to remove the waterproof exterior will be immediately visible to a user and there’s simply no space to insert malicious components, unlike its USB-form peers.

The CoolWallet’s eye-catching e-ink display is not only to impress your friends- it enables you to visually check transaction details (eg the receiving address) and also the ability to set up or recover your wallet completely offline (see our Advanced Recovery guide here) instead of having to enter your seed phrase into your phone.

CoolWallet S also has a highly regarded support team and passionate communities on Facebook and Twitter.

Buy, sell, trade, and HODL confidently anywhere

Some say CoolWallet got its name because it’s a cold wallet that acts like a hot wallet thanks to its feature-packed CoolWallet app. Here’s a few things you can do with it:

Crypto & Fiat services

You can send and receive thousands of crypto assets (e.g. all ERC20, ERC721 and ERC1155 tokens on Ethereum, Arbitrum and Polygon, as well as BEP20 and TRC20 custom tokens).

You can buy crypto with a credit card or bank transfer(Simplex or Banxa) and withdraw fiat to your bank acount (BTC Direct), or exchange assets in crypto-to-crypto transactions (ChangeHero/Changelly/1Inch)

DeFi Web3 Tools

You can stake supported assets like DOT/ATOM/TRX/XTZ and SOL (Q3 2022) in-app, or Eth 2.0 for stETH liquid staking with Lido

You can connect to MetaMask via QR Code, autoswitch chains with Rabby’s multichain browser and scan Dapps and DEXs with a WalletConnect QR code

Non-Fungible Tokens (NFTs)

CoolWallet offers a native integration of OpenSea and Rarible, allowing you to collect and trade the best NFTs on the world’s best NFT marketplaces.

Supported cryptocurrencies

Layer-1s: Bitcoin (BTC) , Ethereum (ETH), Avalanche (AVAX C-Chain), Binance Smart Chain (BSC), Crypto.org & Cronos (CRO), Cardano (ADA), Cosmos (ATOM), Kusama (KSM), Polkadot (DOT) ,Solana (SOL), Terra (LUNC/LUNA), Tron (TRX), Tezos (XTZ), Algorand (coming Q4 2022), Fantom (coming Q4 2022), Near Protocol (coming Q4 2022)

Layer-2s: Polygon (MATIC), Arbitrum

Other supported altcoin chains:

- Ethereum Classic (ETC), Binance Chain (BC), Litecoin (LTC), Ripple (XRP), Stellar (XLM), Horizen (ZEN), Icon (ICX), Kinesis Gold &Kinesis Silver (KAU/KAG) and more

Stablecoins (multi-chain support for most):

- USD Circle (USDC), USD Tether (USDT), Binance USD (BUSD), True-USD (TUSD), Fei USD (FEI), JUST USD (USDJ, Paxos USD (USDP). Other stablecoin tokens can be custom added to supported chains)

Conclusion

Taking self-custody of your crypto and keeping it safe is an essential component of the ethos of crypto, as encapsulated by the phrase “Not Your Keys, Not Your Crypto”. While crypto investment decisions can be tricky and stressful, security shouldn’t be. We hope this article helped convince you of the importance of cold storage.