Table of Contents

- Introduction

- Bitcoin Halving (April 2023)

- BlackRock Bitcoin Spot ETF (January 2024)

- Ethereum Sharding To Take Web3 To Next Level

- New Narratives Led By AI Cryptocurrencies and Bitcoin Ordinals

- Macro-economic recovery

- New FASB Accounting Rules for Bitcoin

- What Could Stop The Next Crypto Bullrun In Its Tracks?

- Conclusion

- Make CoolWallet Your Crypto Self-Custody Vault

Written by Werner Vermaak

Introduction

It’s been a torrid 2 years since the biggest crypto bull run to date fizzled out in late 2021 after record inflation levels caused central banks to raise interest rates. Web3 funding, NFT floor prices, and metaverse fever dreams disappeared together with billions of investors’ money as fraud, scams and hacks by the likes of FTX and Terra Luna led to cryptocurrency collapses, custodial bankruptcies, and finally a slew of shocking arrests that made crypto self-custody the only smart choice in 2023.

Despite all this, crypto is poised to take center stage again with a potential new bull market in 2024 and 2025 thanks to many positive factors and trends. This time, it might not just be a short-lived hype but a moment that could change the face of the global financial sector as it levels up thanks to new technologies such as artificial intelligence.

This is the rose-tinted view of not only crypto folks, but also several analysts who agree that a cryptocurrency bull run is just on the horizon, although they hold differing perspectives on its precise timing, potential outcomes, and the catalysts that might trigger this phenomenon. Is this

In this article, we will explore the significant events that have the potential to trigger the biggest tidal wave in crypto history. We will also take a look at the challenges that could create major roadblocks for crypto’s major comeback. LFG!

Disclaimer: Please note that this article is not financial advice but are for educational purposes only. Cryptocurrencies are highly volatile and speculative digital assets that require knowledge and caution, so do your own research before investing.

1. Bitcoin Halving (April 2023)

In crypto, everything still begins and ends with Bitcoin, no matter what all those ETH and Solana fanboys tell you. And the world’s first cryptocurrency is taking an arsenal of good news into the coming year. The biggest one: the Bitcoin halving.

In case you’ve been living under a (black) rock, the Bitcoin Halving, also called ‘halvening,’ is a cyclical event occurring every four years, during which the rewards distributed to Bitcoin (BTC) miners are slashed by 50%. (The next scheduled halving is expected to happen on April 30, 2024)

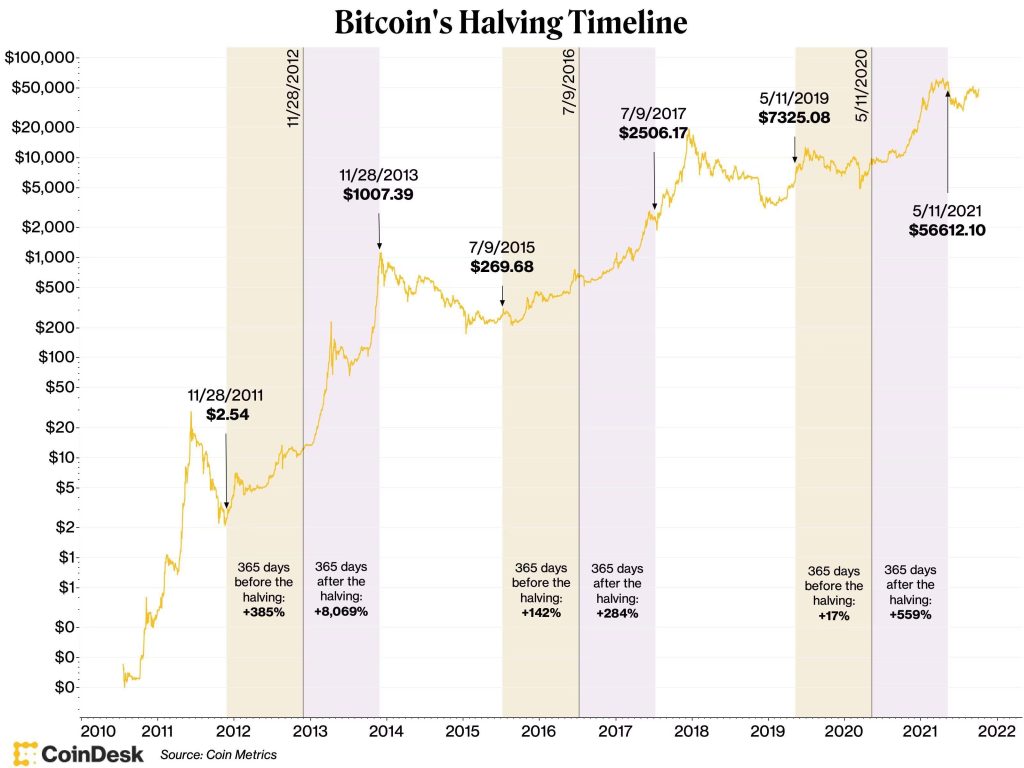

As a result, there’s a dramatic decrease in the fresh daily supply of BTC, increasing its scarcity, and enhancing its value. This event is indeed a big deal in the crypto sphere, but not everyone agrees on how much it would really affect the entire crypto and financial industry. Tell that to the market. Each previous halving in 2012, 2016, and 2020 had a huge effect (see chart below) on the markets in the years after, helping to drive Bitcoin’s price up exponentially.

With only 3.125 BTC now set for collection as incentive with each block after the halving, and that cut in half in 2028 and the century after, there will likely be another big supply shock in 2024 as miners and both institutional and retail investors start stockpiling their sats.

Of course, things are rarely that easy to predict in crypto. It’s important though to not make the Bitcoin Halving the sole reason for buying BTC. Financial markets typically price in future events way in advance, and with everyone and their dog greedily awaiting the halvening, you can be sure to expect the unexpected before and after the event, especially now that there are once again massive TradFi investment firms interested in crypto.

It’s also important to note that the 2 biggest crypto events of 2021, namely the Coinbase listing and El Salvador‘s official acceptance of BTC as legal tender, also marked each cycle’s Bitcoin top at first $63,000 and then $69,000. It was all downhill after that! However, the halving is not simply news, but a fundamental change in how Bitcoin is mined and emitted. With over 19 million BTC already mined and less than 2 million left until its last satoshi is mined in 2140, time is running out to accumulate cheaply.

2. BlackRock Bitcoin Spot ETF (January 2024)

BlackRock, a colossal asset management firm that oversees $9 trillion in assets, has finally submitted an application for a BTC-focused exchange-traded fund or Spot Bitcoin ETF. If the Securities and Exchange Commission (SEC) approves this proposal, and chances are high, given BlackRock’s ETF success history of 576-1, this could catapult BTC’s profile in mainstream adoption as a recognized and secure asset class which can be custodied by a fully regulated institution and traded like any regular stock.

A Bitcoin spot ETF is probably the single most bullish news that the Bitcoin faithful have been waiting for for over 10 years. Here’s why:

- It will attract new retail and institutional inventors who were once cautious about crypto assets.

- It could stimulate the widespread adoption of Bitcoin, enhance its liquidity, mitigate its volatility, and promote more predictable price movements.

- Above all, its regulated nature is perhaps its most compelling feature, as government oversight can directly prevent any illicit financial activities orchestrated by malicious actors.

Mark Yusko, managing director of Morgan Creek Capital Management, anticipates that BlackRock wouldn’t be the only player in the Bitcoin ETF arena. SEC could also at the same time approve the dust-gathering ETF proposals of other global asset management firm applicants like ARK Invest, Fidelity, and more, soon.

While some analysts like Bloomberg believed in August that there’s a 75% chance we might even see an approved ETF this year, it’s unlikely it’ll come in 2023.

3. Ethereum Sharding To Take Web3 To Next Level

Cheaper and faster transactions are some of the crucial elements that could catapult a decentralized platform into mass adoption. And given Ethereum’s massive size and influence, achieving these two goals could make an impact on specifically the growing Web3 industry which needs more decentralized power faster and cheaper. Ethereum’s current layer-2 roll-up solutions have already demonstrated their ability to be a fast and secure way to process data. But they tend to be expensive, which cancels a large part of the benefits they provide.

The platform is actively working on a set of solutions to address this issue. The first piece it aims to implement is what it calls ProtoDanksharding (also called EIP 4844), which intends to reduce the cost of rollups by creating so-called ‘data blobs,’ which basically save on-chain data ー that expires in 1 to 3 months.

This means that these data packets don’t have to be permanently saved on Ethereum, which costs a lot. In fact, more than 90% of the rollups’ cost goes just for the upkeeping of these massive data, no matter when they’re needed or not. Rollup data can still be saved, but the responsibility to store them now falls on the entities that actually need them, including indexing services, crypto exchanges, and more.

Once implemented, Ethereum anticipates that data blobs could significantly boost the platform’s throughput and reduce its transaction costs. It aims to ship Proto-Danksharding (named after its developers) in late 2023. After this initial stage, the decentralized giant will then proceed to develop its next phase, called Danksharding, which aims to facilitate millions of transactions per second.

These upgrades, with all the massive benefits at their back, could potentially trigger an influx of new crypto-decentralized applications (dApps) onto Ethereum’s platform.

4. New Narratives Led By AI Cryptocurrencies and Bitcoin Ordinals

The dramatic rise of artificial intelligence (AI) in 2023 has pumped the prices of blockchain platforms that incorporate it into their offerings. Red-hot examples of web3 services providing ‘crypto AIs’ include SingularityNET, Phala Network, and Cortex. Given the growing popularity of AI, including it as a central feature could potentially enhance the appeal of crypto-based platforms and increase the demand for their digital currencies.

As blockchain and AI continue to intertwine in Web3, and a new metaverse narrative continue to take shape, expect digital asset technology, which is tailor-made for these use cases, to take main stage again.

And of course, this year also saw a somewhat controversial new use case for Bitcoin after its Taproot upgrade as the BRC20 token standard and Bitcoin Ordinals created new demand for block space on its network, driving transaction fees and its price up to over $30,000 in the first quarter. While

5. Macro-economic recovery

According to S&P Global, one of the leading providers of credit ratings and financial analytics, there exists a correlation between crypto and macroeconomics. This is not a surprise to anyone who has had to see risk-on assets like Bitcoin and altcoins take a beating any time a central bank raised interest rates in their quest to bring inflation down.

As 2020’s post-Covid crash reaction showed us, when governments use economic stimulus and super-low interest rates to revive flagging markets, volatile assets like crypto and stocks can skyrocket in value thanks to all those fresh new bills in circulation. With a recession on the cards and the highest interest rates in decades severely depressing economic confidence this year, central banks and regulators around the world will have to start putting money back into the economy in 2024 or 2025 after they reach their inflation goals in order create jobs and stave off an economic collapse (which Arthur Hayes says is “thankfully” coming only in 2026 or so). More money in circulation means more investments in crypto like Bitcoin, both as a speculative investment as well as an inflation hedge.

Another interesting data disclosed by S&P Global is that the government’s actions do not always serve as the primary driver of crypto’s growth. There are instances when increased demand for cryptocurrency is propelled by public dissatisfaction.

According to their data, during periods when an economic downturn is believed to stem from the administration’s erroneous financial policies, the public often turns to digital currencies as a safe haven. This choice appears to be the most logical, if not the only, option since decentralized assets are not under the control or influence of any government entity. However, as we’ve seen with crashing crypto prices, digital assets are very far from being reliable safe haven assets at present.

6. New FASB Accounting Rules for Bitcoin

After lobbying by Bitcoin whale and lead evangelist Michael Saylor, an under-the-radar but very important new accounting rule has come into force, one that Saylor says “eliminates a major impediment to corporate adoption of bitcoin as a treasury asset.”

The FASB fair value rule for Bitcoin is a new accounting standard that requires companies to use fair-value accounting for certain crypto assets that meet the predefined criteria, such as Bitcoin. The rule was adopted on September 6, 2023, by the Financial Accounting Standards Board (FASB)

The new FASB rule on Bitcoin lets companies show the real-time value of their Bitcoin stash on their balance sheets. So, if the price of Bitcoin goes up, the financial look of a company can get a nice boost. Before, companies had to undervalue their crypto holdings, but now, they can show the ups and downs of their crypto’s worth right away. This new rule makes it easier for anyone checking out a company to see how their crypto investments are doing, which can be a big help in deciding whether to invest in that company.

Also, this change by FASB is kind of a nod to how important digital currencies like Bitcoin are becoming in the big picture of business and economy. While it might make a company’s earnings look like a rollercoaster ride due to the ever-changing value of Bitcoin, it also allows them to show when they’re bouncing back financially if Bitcoin’s value climbs up. Companies can switch to this new way of accounting anytime they want, which is great. This rule change is good news for Bitcoin and could invite more big investors to join the crypto club, making companies’ financial outlook even brighter.

What Could Stop The Next Crypto Bullrun In Its Tracks?

Another High-Profile Crypto Scandal

The FTX scandal and the bankruptcy of Celsius have significantly tarnished the reputation of the crypto industry. And as a result, it has drawn the public’s attention (yet again) to cryptocurrencies’ safety and legitimacy.

These incidents, together with other crypto-related hacks and scams, have prompted a reactive response from the administration, resulting in proposals aimed at imposing regulatory measures on the emerging industry.

Should another high-profile crypto fraud or prosecution occur, this could finally lead to severe legal responses from regulators and other government institutions.

The New US President

With U.S. President Joe Biden and former U.S. President Donald Trump officially announcing their presidential candidacy, their campaign’s progress, or ‘winnability,’ could impact crypto’s upcoming bull run.

Both of these candidates have track records that, in some respects, favor cryptocurrencies. President Biden, for instance, signed an executive order aimed at exploring potential regulatory frameworks for decentralized assets. On the other hand, former President Trump ventured into non-fungible tokens (NFTs) and was reported to hold $2.8 million worth of ETH.

While these are promising signs for the future of crypto assets, their stance on cryptocurrencies could potentially change anytime soon, depending on public sentiments.

And given their immense influence and the position they’re running for, any critical stance they might take on cryptos soon could have a negative impact on the anticipated bull run crypto holders are awaiting.

The SEC and regulation

Unfortunately, the FTX scandal has given financial regulators like the US Securities and Exchange Commission (SEC) ample ammunition to shut down or at least seriously curtail the freedom with which cryptocurrencies and the entities behind them operate. The last year or 2 saw the SEC and its chairman Gary Gensler go all out against crypto projects it deems to be securities (such as Ripple and Hex) and exchanges it believes contravened US legislation (such as Binance and Coinbase). However, with so much on the line during the US Elections, it’s likely that Gensler and co. will be a bit less active during that time. It’s also worth noting that Gensler agrees that Bitcoin is not a security and that Bitcoin is where any bull market starts and ends. With better regulation around the globe from the EU to Asia expected for everything from DeFi to stablecoins, this regulatory clarity could give the greenlight to millions of new investors to get stuck in.

Conclusion

Based on the things we discussed in this article and many other factors we didn’t cover, there’s a lot of upside to look forward to in Cryptoland in 2024 that could see the digital asset class, led by Bitcoin and Ethereum of course, become the hottest commodity in the world again. However, there’s a long way to go and the battle is often lost for many HODLers right before things get better.

Sticking around until then and making the right non-emotional investment decisions requires a lot of grit and determination, as markets will once again become very volatile and market makers and institutions try to shake out weak retail hands and swallow up their profits. The best thing we can do right now is to remain informed, be vigilant against bad actors, protect our assets, and not haste just to get a piece of coming opportunity. If you’re going to invest, do some research to identify previous cycle trends and new narratives, only allocate what you’re willing to lose (this makes you less likely to make decisions based on emotion) and spread your buys over a period to get a more stable price.

Make CoolWallet Your Crypto Self-Custody Vault

And of course, in case you capitalize and crush the next bull market if and when it happens, the next biggest challenge is to keep your crypto portfolio safe in cold storage. Last year saw over $4 billion stolen in hacks and scams and 2023 isn’t far behind, with big names like Mark Cuban (MetaMask) and Vitalik Buterin (Twitter) already victims.

Be aware of the latest Web3 phishing campaigns and hacking methods and stay safe in cold storage with a battle-tested hardware wallet you can trust.

CoolWallet’s Pro hardware wallet has an EAL6+ secure element (open source for full transparency), biometric verifications and military-grade encrypted Bluetooth communication. It’s also waterproof and tamper-proof, fits in your actual wallet, and comes with a feature-rich CoolWallet App which has a real-time SmartScan to protect you against malicious or fake smart contracts and suspicious behavior when transacting.