Table of Contents

- What is DeFi?

- Why is DeFi “Decentralized”

- Getting Started with DeFi

- CoolWallet: The Best Wallet for DeFi Beginners

- Buying Crypto from a CEX: A Step-by-Step Guide

- Fees and Risks of Buying Crypto

- DeFi Tools for Beginners: Unlocking the Power of Decentralized Finance

- What is a Decentralized Exchange (DEX)?

- Benefits of a Decentralized Exchange

- What are Liquidity Pools?

- Benefits of Liquidity Pools

- What is Yield Farming?

- Benefits of Yield Farming

- What is Decentralized Lending and Borrowing?

- How to Evaluating DeFi Projects

- Risk Management and Due Diligence

- Is DeFi the Future of Banking?

This article is for educational and entertainment purposes only and is not financial advice of any kind. All opinions are that of the author only. Do your own research when investing in a hardware wallet to best secure your crypto assets.

Introduction

After a dramatic rise to mainstream awareness during the DeFi Summer of 2020, followed by a swift crash back to earth in late 2021 as the bull run ran out of steam, Decentralized Finance (DeFi) is once again back in an uptrend. Vindicated by the collapse of centralized custodians like FTX and Celsius in 2022, DeFi is has reclaimed its crown as the future of the crypto industry thanks to its unique ability to help people self-custody their assets AND trade, stake and borrow and lend them as they see fit, without the need for any intermediary and in the non-custodial wallet of their choice. And of course, there’s also that growing influence in Web3, NFTLand and other arenas such as GameFi (Play-to-Earn), which are heavily reliant on the incentivizes that these smart contract-powered protocols bring.

This revolutionary financial movement is already disrupting traditional finance (TradFi), offering a tantalizing glimpse into a world where each individual user is their own bank.

However, diving in to the Wild West of DeFi without sufficient knowledge can lead to confusion and bad decisions, which can soon lead to an empty crypto wallet. The key to success in this young and hugely innovative sector is understanding the risks and finding the right strategies that align with your goals. So, our budding new “DeFi Degen”, let’s break down the fundamentals in our 2023 DeFi For Beginners Guide, a follow up to our 2021 edition, giving you everything you need to know before taking the first steps into the world of decentralized finance.

Primer: What is DeFi?

DeFi uses blockchain technology to allow the average person to tactically aim and supply their assets to work for them instead of traditional financial institutions, like banks. By replacing traditional intermediaries with decentralized applications (dApps) and smart contracts, DeFi democratizes access to financial services, making them available to anyone with an internet connection. DeFi services can include peer-to-peer lending, liquidity providing, and many others typically unavailable to traditional finance users, available 24/7, 365 days a year.

Why is DeFi “Decentralized”?

DeFi is decentralized because it operates on blockchain networks rather than relying on traditional, centralized financial institutions. This means that instead of having a single authority or institution controlling and managing financial services, DeFi uses distributed networks of nodes that run on open-source protocols and smart contracts. This makes it impervious in most parts to regulations, as it operates across borders over the internet, and resistant against centralized fraud and scams. However, DeFi users suffer different risks which stem from technology exploitations such as hacks, or protocol teams who act maliciously, such as scams.

Benefits of DeFi: Why should I use it?

- More power over your money: DeFi lets you take charge of your money without relying on banks or other financial institutions. You have the freedom to access and use your funds whenever you want without having to go through middlemen.

- Saves you money: DeFi transactions are often cheaper compared to TradFi as there are no intermediaries and expensive systems to maintain. This means you can avoid paying extra fees and use your money for things you actually need.

- No restrictions on who can use it: DeFi is accessible to anyone who wants to use it, regardless of their location or financial status. You don’t need to have a bank account or meet specific requirements to get started with DeFi.

- More transparency and security: Since DeFi is built on public ledgers, which means that all transactions are visible to everyone on the network, it’s much harder to cheat or manipulate the system since blockchain data is immutable, which provides a higher level of transparency and safety

- Exciting and always changing: DeFi is a new and rapidly expanding field that’s full of exciting projects and opportunities to explore. As DeFi continues to grow and evolve, there are always new and innovative ways to manage your money and invest in the things you care about.

In short, DeFi platforms deploy blockchain to empower individuals to take control of their finances and enjoy lower fees, greater innovation, and enhanced security. Problems in traditional finance such as international transfers, securing a loan, or putting your capital to work are non-existent thanks to the invention of smart contracts and public ledgers that put every user on an equal playing field.

How do I get started with DeFi in 2023?

Before exploring the benefits of DeFi, familiarize yourself with the key terms below to understand the general systems the entire cryptocurrency industry operates within. Without these vital advancements, the entire idea of crypto and DeFi would not exist.

Key Concepts to Know Before Starting

CoolWallet Pro: The Best Wallet for DeFi Beginners

Looking for a feature-rich DeFi wallet that offers the flexibility of moving your assets between elite cold storage and a feature-rich hot wallet functionality? Look no further than CoolWallet, whose CoolWallet Pro hardware wallet features an EAL6+ secure element and Fort Knox-like biometric security. Coupled with its CoolWallet App, which has a separate Web3 hot wallet module for the latest coins and NFT collections, CoolWallet is the perfect wallet for DeFi beginners, as it offers an ideal balance between superior security and ease of use. This user-friendly wallet makes managing and protecting your digital assets a breeze, even for those new to decentralized finance.

With its MetaMask integration, CoolWallet allows users to explore a vast range of DeFi applications and protocols effortlessly. Its secure element ensures the utmost protection for stored private keys, while the cold storage feature keeps them offline and safe from cyber threats.

CoolWallet supports a wide variety of cryptocurrencies, including the best layer-1 coins and their DeFi ecosystem tokens and all major ERC-20 and BEP-20 tokens. Its compatibility with Ethereum, Binance Smart Chain, Arbitrum, Polygon, Optimism and other EVM-based networks enables users to easily participate in DeFi activities such as yield farming.

Connecting securely to MetaMask using a QR code, CoolWallet Pro users can confidently sign transactions without exposing their private keys. Additional security features, like AES256 encrypted Bluetooth and 2+1 factor authentication, provide an extra layer of protection for your crypto assets.

Buying Crypto from a CEX: A Step-by-Step Guide

Crypto is an essential component of DeFi, as it provides the underlying currency for transactions, investments, and financial products within the ecosystem.

To begin using DeFi you’ll first need to purchase some cryptocurrency. A popular method is purchasing crypto from a centralized exchange (CEX) like Coinbase, Binance, or Kraken. Different countries will support different exchanges, so research which one is most convenient in your country.

Here’s a simple step-by-step guide:

- Sign up: Register for an account on a CEX platform, providing the necessary personal details and verifying your identity.

- Deposit funds: Link your bank account or credit/debit card to the CEX, then deposit fiat currency (e.g., USD, EUR) to fund your account.

- Select the crypto: Choose the cryptocurrency you’d like to purchase, such as Bitcoin (BTC), Ethereum (ETH), or a stablecoin like USDT.

- Buy: Place an order to buy the desired amount of crypto, and the exchange will execute the transaction at the current market price or your specified limit price.

- Withdraw: Once the transaction is complete, transfer the purchased crypto to a secure DeFi-compatible wallet for further use within the DeFi ecosystem.

Fees and Risks of Buying Crypto

When buying crypto and transferring it to your non-custodial wallet, be aware of fees and potential risks. Common fees include trading fees charged by the CEX, which can be a percentage of the transaction value, as well as network fees for transferring crypto to your wallet.

DELIVERED EVERY WEEK

Subscribe to our Top Crypto News weekly newsletter

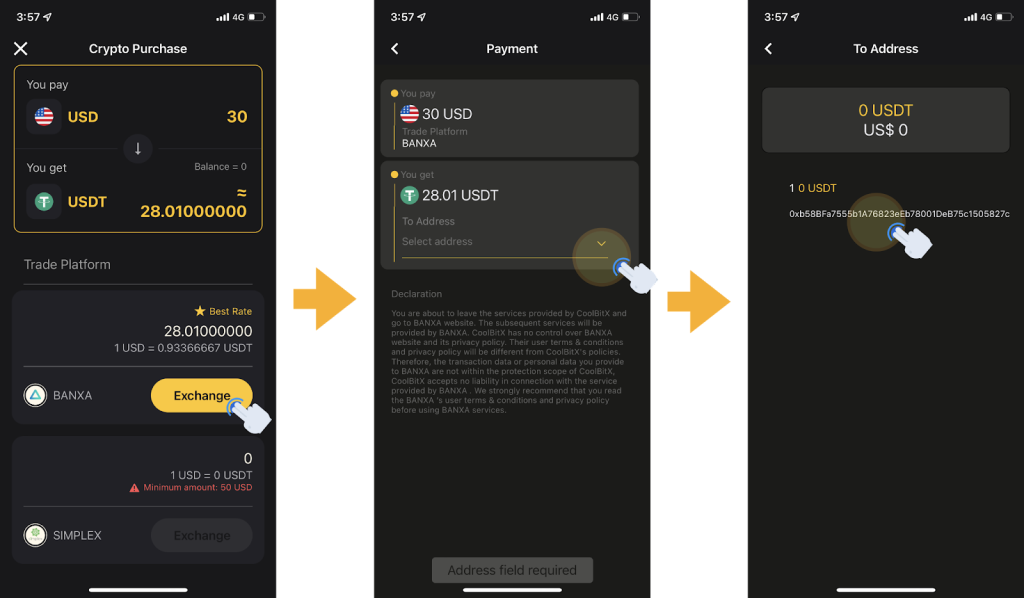

CoolWallet App: Buy crypto with fiat directly from our integrated partners

Don’t want the hassle of visiting a centralized exchange and buying crypto with fiat from them?

Why not use CoolWallet App to directly buy crypto with dozens of supported international fiat currencies like USD, EUR, JPY, GBP, AUD,ZAR and more?

CoolWallet App offers our users the choice of 3 top-notch integrated crypto payment service providers:

1) MoonPay (learn more)

2) Simplex (learn more)

3) Banxa (learn more)

Pay in your favorite fiat currency and get the cryptocurrency of your choice with the best rates! (Please note that third-party KYC in line with AML regulations may be required). It’s super easy to do and only takes a couple minutes.

Essential DeFi Tools for Beginners

Now that you understand the basics of blockchain and have funded your wallet, every DeFi tool has instantly become available to you. especially if you use WalletConnect on CoolWallet App, which allows you to simply scan a QR code to connect your cold wallet to various DeFi protocols, including MetaMask.

Here are some essential tools that can immediately benefit you depending on your preferred investment strategy:

1) Tool 1: Decentralized Exchanges (DEX)

Decentralized exchanges (DEXs) allow users to trade crypto assets without relying on a centralized authority, like a traditional exchange. Built on blockchain networks, DEXs use smart contracts to enable trustless trading, providing users with enhanced privacy, security, and control over their funds. Some popular beginner-friendly DEXs include Uniswap and 1Inch which offer intuitive interfaces and support for a wide range of tokens.

Check out our guide on how to use 1inch with your CoolWallet natively in our CoolBitX Crypto app (also referred to as the CoolWallet app).

Why should I use a DEX?

Decentralized exchanges are usually the first places that promising new coins are listed (as well as thousands of scammy ones, so keep that in mind)> They are valued for their lower fees, increased privacy, and larger token variety, and of course, most importantly, they allow you to self-custody your coins at all times. Unlike most CEXs, a DEX will not require a user’s private information, as they do not provide an onramp for fiat currency.

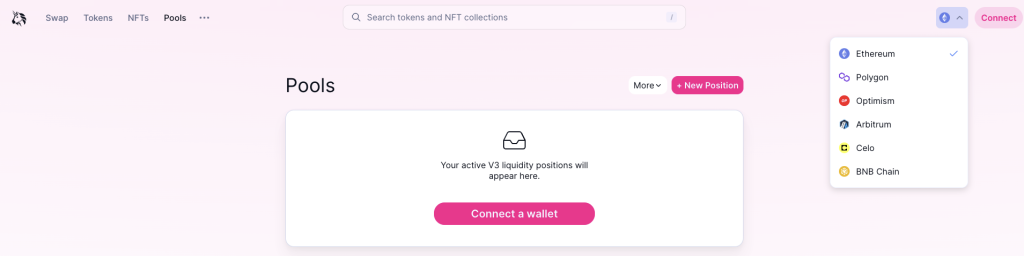

Tool 2: Liquidity Pools

Liquidity pools are DeFi protocols who faciliate the collections of tokens locked in smart contracts, allowing you to trade assets without needing a counterparty. Liquidity pools replace the need for an order book, which attempts to match willing buyers and sellers together. By contributing assets to a liquidity pool, users become liquidity providers (LPs) and earn rewards through trading fees. Some DEXs double as liquidity pool providers. Here are 5 of the biggest DeFi liquidity pools to get started.

- Uniswap: Uniswap is a DEX and liquidity pool for Ethereum and its leading layer-2 chains Polygon, Optimism, Arbitrum as well as BNB Chain (all supported by CoolWallet). It allows users to swap supported tokens and provide liquidity to earn trading fees. Uniswap has become one of the largest and most popular decentralized exchanges, with billions of dollars in trading volume.

- SushiSwap: SushiSwap is another decentralized exchange that operates on the Ethereum blockchain and others like Fantom, Avalanche, Optimism and Arbitrum

- It was created as a fork of Uniswap, but with some additional features such as yield farming and staking. Users can provide liquidity to SushiSwap’s liquidity pools and earn rewards in the form of SUSHI tokens.

- PancakeSwap: PancakeSwap is a decentralized exchange that operates on the Binance Smart Chain. It allows users to swap BEP-20 tokens and provide liquidity to earn trading fees. PancakeSwap has gained popularity due to its lower transaction fees and faster confirmation times compared to Ethereum-based decentralized exchanges.

- Curve: Curve is a decentralized exchange that is designed for stablecoin trading and allows users to swap stablecoins and provide liquidity to earn trading fees across different chains. Curve is known for its low slippage and tight spreads for stablecoin trading.

- Balancer: Balancer is a decentralized exchange that allows users to create custom liquidity pools with up to eight different tokens and set their own fee structure. Balancer also includes features such as token swapping and portfolio rebalancing.

- Other honorable mentions include Aave and Compound.

Benefits of Liquidity Pools

As more liquidity is added to a pool, price slippage decreases, providing efficient trades that benefit the entire DeFi ecosystem. By becoming liquidity providers (LPs), users can diversify their investment portfolios, gain exposure to various tokens and projects, and turn nearly every cryptocurrency, especially their stablecoins, into active assets that earns compounding interest for them annually.

Tool 3: Yield Farming

Yield farming is a risky DeFi strategy involving lending or staking crypto assets to earn rewards in the form of interest or new governance tokens. Users can maximize returns by participating in various DeFi platforms and taking advantage of the incentives they offer, however, they need to be aware of threats such as rug pulls (where the project founders or developers drain the pool, because hey they set up the smart contract remember) and impermanent loss (where volatility in the price of the assets destroys the value of your assets). Yield farming is a pro feature in DeFi and comes with higher risk, as projects are often anon and untested.

Benefits of Yield Farming

Yield farming enables users to earn passive income on their crypto assets, often providing higher returns than traditional investments. Additionally, yield farming can help users diversify their portfolios and gain exposure to new tokens and projects.

What is Decentralized Lending and Borrowing?

In a nutshell, users can lend or borrow digital assets in a secure, peer-to-peer manner. By utilizing smart contracts, these transactions are automatically enforced and executed on the blockchain, meaning that users can trust that their funds will remain safe throughout the process.

Benefits of Decentralized Lending and Borrowing

This form of lending and borrowing is extremely cost-effective; since no middleman is needed to facilitate the transaction, costs are kept low. Decentralized lending and borrowing also eliminate counterparty risk by ensuring that both parties have their assets safely stored in their own wallets or accounts with no possibility of theft or fraud.

How to Evaluate a DeFi Project

Before getting involved with a DeFi project, it’s important to do your own research (DYOR) to ensure that it’s legitimate and aligns with your financial goals.

Here are some beginner-friendly ways to evaluate a DeFi project before you invest:

Tip 1 – Research the project’s team:

Look for experienced, credible, and visible team members with a proven track record in the crypto or finance industry. Founders with no real experience are a massive red flag.

Tip 2 – Read their whitepaper:

A whitepaper is a detailed document about a project that can provide insights into the project’s goals, use cases, and roadmap.

Tip 3- Locate the project’s community:

Projects with a lot of community support and visibility show strong consumer confidence and faith in the team behind it.

Tip 4 – Learn about their partnerships:

A deep dive into their partnerships will produce a lot of knowledge about their protocol’s role in the overall DeFi ecosystem and lead to discovering other products you may be interested in later on.

Risk Management and Due Diligence

As with any investment, managing risk is an essential aspect of DeFi participation. Understanding the potential risks associated with a project, such as smart contract vulnerabilities, market volatility, and liquidity concerns, can help you make informed decisions. Conducting your own research and due diligence is a vital component of successful risk management in the DeFi ecosystem.

Is DeFi the Future of Digital Banking?

DeFi has the potential to reshape the future of banking by offering decentralized, transparent, and accessible financial services. However, it’s still a relatively new and evolving field. While DeFi may not completely replace traditional banking, it could influence the finance industry to take both crypto and the benefits of blockchain seriously, driving innovation and offering more choices for consumers. As the technology matures and gains wider adoption, DeFi could become an integral part of the financial landscape alongside traditional banking services.

To learn more about CoolWallet’s role in the future of DeFi check out our other blog posts of detailed guides on how we can help you explore Web3 with the coolest wallet.