Introduction

Stablecoins don’t get as much attention as they always should. While they may be crypto’s version of a boring accountant or librarian, these stable assets are such an integral part of the cryptocurrency ecosystem, offering a stable value pegged to traditional currencies like the U.S. dollar, that without them, the whole sector would likely cease to exist. They serve as a safe haven during market volatility and are increasingly used for transactions both within and outside the crypto space in new arenas like Web3 and DeFi, helping normal and institutional users move value from anywhere to anywhere through the power of blockchain.

In this article, we’ll explain why we need these digital currencies instead of traditional money, also known as fiat currency. We’ll also delve into the world’s best stablecoins, including Tether (USDT), USD Coin (USDC), Dai (DAI), Binance USD (BUSD), and TrueUSD (TUSD).

Great news: Our CoolWallet hardware wallets (Pro and S) both support all these amazing stablecoins in safe cold storage, while you can also keep them safe in our hot wallet module on our CoolWallet App.

Whether you’re receiving payment in USDT or buying the dip with USDC, cashing out in TUSD, or getting your gold bug on with PAXG, it’s no exaggeration to say that these stable assets make the crypto world go round.

What Are Stablecoins?

Stablecoins are cryptocurrencies designed to minimize price volatility and maintain a stable value relative to a target price, usually pegged to a fiat currency like the U.S. dollar or a commodity like gold.

Stablecoins attempt to tackle one of the main critiques of cryptocurrencies – their volatility. The prices of popular cryptocurrencies like Bitcoin and Ethereum fluctuate wildly, making them impractical as a medium of exchange. Stablecoins aims to bridge the gap between the stability of fiat currencies and the technological benefits of cryptocurrencies.

Stablecoin Basics

What types of stablecoins are there?

There are three main types of stablecoins based on how they maintain their peg:

Type 1: Fiat-Collateralized

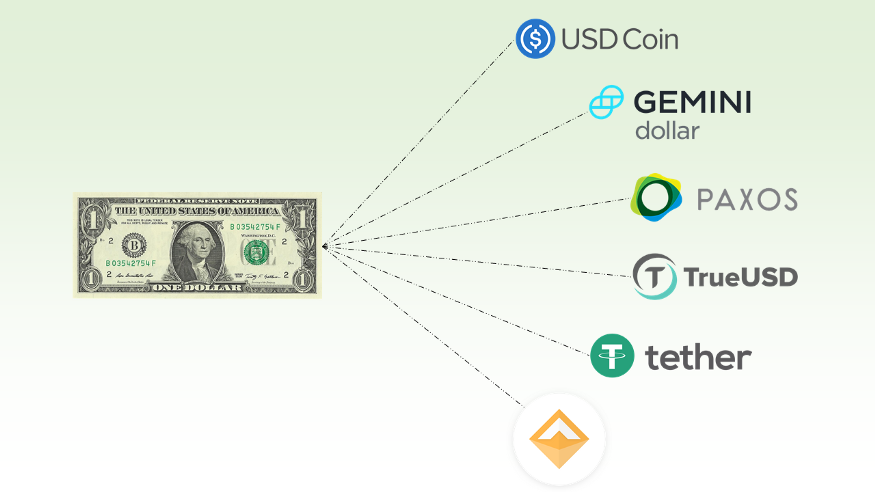

Fiat-collateralized stablecoins maintain reserves of fiat currencies like the U.S. dollar to back the value of the stablecoin. The issuer must hold currency reserves equal to the number of stablecoins in circulation. Popular fiat-backed stablecoins include Tether (USDT) and USD Coin (USDC).

Type 2: Crypto-Collateralized

Crypto-collateralized stablecoins use reserves of other cryptocurrencies to maintain their peg. Because the collateral is volatile, these stablecoins are often over-collateralized to absorb price fluctuations in the backing asset. MakerDAO’s DAI stablecoin is crypto-backed, using Ether reserves as collateral.

Type 3: Algorithmic

Algorithmic stablecoins use supply-adjusting algorithms and incentives to expand and contract the supply of the stablecoin to maintain the target price. TerraUSD is its most infamous example, and went down in flames with billions of dollars in 2022. However, in 2023, new entrants like Cardano’s Djed are trying to make it work. Warning: It’s best to stay away from algo stablecoins until they’re insured or backed by a decade of stability.

Why Do We Need Stablecoins?

Stables have unique benefits such as the following:

- Price stability allows stablecoins to be used as a reliable medium of exchange and unit of account.

- Faster and cheaper to transfer across borders compared to traditional remittances.

- Allows traders to hedge against crypto market volatility.

- Can generate yield through lending and staking due to over-collateralization.

- They’re a bridge between decentralized crypto assets and real-world assets.

Why Stablecoins Can Be Risky

- Fiat-backed stablecoins rely on audits and transparency of reserves.

- Crypto-backed stablecoins are susceptible to collateral devaluation.

- Algorithmic stablecoins are complex and can fail to maintain the peg.

- Regulatory uncertainty around whether stablecoins are securities.

- Potential loss of seigniorage revenue for central banks.

Overall, stablecoins aim to unlock the benefits of cryptocurrencies while minimizing volatility, serving as a bridge between crypto assets and fiat currencies. But they come with their own unique risks that need to be addressed through proper regulation and transparency.

The World’s Top 5 Biggest Stablecoins

The stablecoin market is led by Tether, followed by USD Coin, but other players like Dai, Binance USD, and TrueUSD are also significant. Collectively, these stablecoins represent a market capitalization of over $120 billion, highlighting their growing importance in the crypto ecosystem.

Table: Overview of Top Stablecoins

| Stablecoin | Market Capitalization (Billion USD) | Price (USD) | Market Cap Dominance (%) | 24h Trading Volume (Billion USD) | Notable Features |

| Tether (USDT) | 84 | 0.9998 | 6.72 | 63 | Dominates the stablecoin market despite TetherFUD reserve controversies |

| USD Coin (USDC) | 25 | 0.9999 | 2.00 | 8 | Backed by Circle and Coinbase, Web3 partnership with Grab |

| Dai (DAI) | 5 | 1.0002 | 0.43 | 0.303 | Decentralized, overcollateralized to prevent depegging |

| Binance USD (BUSD) | 2 | 1.0003 | 0.17 | 0.893 | Issued by Binance and Paxos, under fire in the US |

| TrueUSD (TUSD) | 3.3 | 0.9989 | 0.27 | 0.708 | Fully backed by USD, transparent and secure |

1. Tether (USDT)

Tether continues to dominate the stablecoin market with a market cap of over $84 billion. Despite controversies and regulatory scrutiny, it remains a popular choice for traders and investors.

Quick Stats:

- Market Capitalization: $84 billion

- Price: $0.9998

- Portion of the total crypto market: 6.72%

- Volume (24h): $63 billion

2. USD Coin (USDC)

USD Coin, backed by Circle and Coinbase, has been gaining traction. With a market cap of over $25 billion, it’s the second-largest stablecoin and is widely considered a reliable and transparent option, especially in the United States. Circle recently announced a cool Web3 partnership with Asian super-app Grab, which will open it up to 200 million new users in Asia.

Quick Stats:

- Market Capitalization: $25 billion

- Portion of total crypto market: 2.00%

- Volume (24h): $8 billion

3. Dai (DAI)

Dai is unique as it’s a decentralized stablecoin from MakerDAO. With a market cap of over $5 billion, it’s smaller compared to USDT and USDC but offers the advantage of being free from centralized control. Unlike the failed Terra USD algo stable, DAI is overcollateralized to ensure it doesn’t depeg and collapse.

Quick Stats:

- Market Capitalization: $5 billion

- Market Cap Dominance: 0.43%

- Volume (24h): $303 million

4. Binance USD (BUSD)

Binance USD, issued by Binance and Paxos, has a market cap of over $2 billion. It’s a newer entrant but has been quickly gaining market share, thanks to the credibility and infrastructure provided by Binance. That is, until US regulators went after it and Binance.

Quick Stats:

- Market Capitalization: $2 billion

- Market Cap Dominance: 0.17%

- Volume (24h): $893 million

5. TrueUSD (TUSD)

TrueUSD is another reputable stablecoin with a market cap of over $3 billion. It’s fully backed by USD and offers a transparent and secure option for those looking to avoid volatility.

Quick Stats:

- Market Capitalization: $3.3 billion

- Market Cap Dominance: 0.27%

- Volume (24h): $708 million

Which Stablecoins Does CoolWallet Support?

CoolWallet’s hardware wallet series (CoolWallet Pro and CoolWallet S) and its CoolWallet App support the world’s leading stablecoins on multiple EVM-compatible layer-1 chains and layer-2 networks. You are free to send, receive, swap, and trade these stablecoins securely in cold storage.

CoolWallet’s supported stablecoins include:

- USD Coin (USDC): Ethereum, Base, Arbitrum, Optimism, OKXChain, Avalanche, Polygon, ZkSync, BNB Chain, Tron

- Tether (USDT): Ethereum, Bitcoin, Solana, Arbitrum, Optimism, OKXChain, Avalanche, Polygon, ZkSync, BNB Chain, Tron

- DAI (DAI): Ethereum, Arbitrum, Optimism, Avalanche, Polygon

- Binance USD (BUSD): Ethereum, Linea, BSC, Polygon

- TrueUSD (TUSD): Ethereum, Avalanche

- Paxos Standard (PAX) and Paxos Gold (PAXG): Both on Ethereum

- Gemini Dollar (GUSD): Ethereum

- JUST (JUST): TRON

- Compound USDT and USDC: Ethereum

A checkmark (✓) indicates support.

| Stablecoin | Ethereum | Bitcoin | Solana | Arbitrum | Optimism | OKXChain | Avalanche | Polygon | ZkSync | BNB Chain | Tron | Linea | BSC |

| USDC | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||

| USDT | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||

| DAI | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||

| BUSD | ✓ | ✓ | ✓ | ✓ | |||||||||

| TUSD | ✓ | ✓ | |||||||||||

| PAX/PAXG | ✓ | ||||||||||||

| GUSD | ✓ | ||||||||||||

| JUST | ✓ | ||||||||||||

| Compound | ✓ |

The Pro model supports more coins and tokens overall compared to the CoolWallet S, including additional capabilities for staking, DeFi apps, and NFTs. It uses an upgraded EAL6+ certified secure element chip for enhanced security.

Stablecoins vs Fiat Currency

How are Stablecoins and Fiat Similar?

Both stablecoins and fiat currencies aim to maintain a stable value over time and are therefore deemed reliable a medium of exchange and store of value. This means they can be saved up or used to transfer value in everyday commercial transactions, with a face value (for example $1=$1) that is accepted and redeemable globally.

And of course, the world’s biggest stablecoins peg their value to fiat currencies like the dollar, so their values move together with other currencies.

Differences between Stablecoins and Fiat Currency

While they may appear similar mainly due to their corresponding value, stablecoins, and fiat currency are very different from each other. Here are the biggest differences.

Centralized vs. Decentralized

Fiat currencies are centralized assets issued and regulated by governments. They are backed by the public’s trust in the government and the stability of the country’s economy.

On the other hand, stablecoins operate on decentralized blockchain networks, making them less susceptible to centralized control, interference, or fraud.

Of course, stablecoins are far more centralized than cryptocurrencies like Bitcoin and Ethereum, and their issuers will intervene in specific cases of money laundering and terrorism financing to freeze user accounts. Previously, Circle froze funds of the sanctioned Tornado Cash protocol, while Tether locked $160 million on three accounts last year after requests by law enforcement.

Intrinsic Value: Asset-Backed vs.Trust-Backed

Fiat currencies are not backed by any tangible assets and therefore have no intrinsic value. While years ago they were backed by governments’ gold and silver reserves, nowadays their value is purely derived from public trust in that government.

Stablecoins are backed by other assets, giving them a form of intrinsic value.

However, there is still an element of trust involved, in this case, the stablecoin issuer. When there is enough fear (see Tether FUD) about the issuer and its reserves, the stablecoin’s value can de-peg, crashing their value, as we’ve seen with several stablecoins in the past, including USDT and USDC. While the latter two bounced back quickly, smaller stables, especially algorithmic ones, often disappear for good after they’ve depegged (lost their 1:1 value peg).

Physical vs. Digital

Fiat currencies exist in both physical (banknotes and coins) and digital forms, where they are strictly controlled by their central bank.

Stablecoins, however, are purely digital and operate on blockchain technology, which makes them programmable money that can interact with blockchain-based applications and smart contracts.

This makes them ideal for decentralized finance (DeFi), which in turn can be used by anyone in the world without restriction, whether they’re a big financial institution or billions of unbanked users across developing countries.

Regulation

Fiat currencies are tightly regulated by central banks and governments, which have the power to control the money supply and maintain currency stability. For example, since the 2020 pandemic we’ve seen the US Fed first revive its economy through fiscal stimulus (essentially increasing the money in circulation) and then effect a policy of quantitative tightening to bring rampant inflation under control.

Stablecoins are not directly controlled by any central authority but are subjected to increasingly uniform regulation and legal requirements. Organizations like the G20 are concerned about their impact on monetary policy, while China has banned them and the US is still developing their policy. However, the regulators of Singapore, the EU, and the UK have firm frameworks in place for how to deal with stablecoins.

Cost, Efficiency, and Speed

Stablecoin transactions are generally faster, cheaper, and more transparent than fiat transactions. Stablecoin transactions usually settle in only seconds or minutes versus days for fiat transfers, and cost only a few cents, depending on which blockchain network is used.

These advantages have not gone unnoticed by governments, who are applying blockchain tech to build CBDCs for a variety of reasons such as intermediary-free and faster cross-border settlement.

DELIVERED EVERY WEEK

Subscribe to our Top Crypto News weekly newsletter

Use Cases of Stablecoins vs Fiat Currency

Fiat currency remains the dominant form of money for all traditional commerce transactions. This covers everything from paying your taxes to receiving your salary or wage, taking a loan, buying a car, or just groceries.

Stablecoins provide a faster, cheaper alternative to send money anywhere or get access to DeFi lending and borrowing services which don’t require any paperwork (other than KYC occasionally).

Conclusion

Stablecoins are not just a fad; they are becoming fundamental financial instruments in the crypto market. Their growing market capitalization indicates increased adoption and trust among users irrespective of the efforts of some regulators. Whether you’re a trader, investor, or just someone looking to escape volatility, stablecoins offer a viable solution.

If you’re interested in learning even more about the history of stablecoins such as Libra, check out our 2019 series. Just know some of the info (such as on CBDCs) is a little outdated!

- In Part I of our Guide to Stablecoins (2014-2019), we discussed the history, features, benefits and current landscape of this new digital asset class.

- In Part II: Libra- A Future Under Fire, we dove into Facebook’s fledgling Libra project.

- In Part III: Central Bank Digital Currencies, we investigated the impact that powerful new government-owned stablecoins might have.

- In Part IV, we looked at new stablecoins issued by Big Business and leading cryptocurrency companies like IBM, JP Morgan, Wells Fargo, Binance, and Bitfinex.