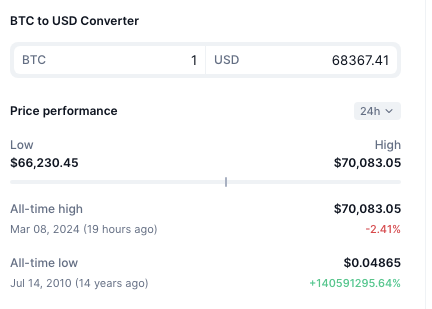

On March 5, 2024, Bitcoin (BTC) defied the crypto naysayers yet again to surge past its previous all-time high (ATH) of November 2021, setting a new record at $69,170 on CoinMarketCap charts. Only 3 days later, it has done the previously unimaginable, hitting the magical $70,000 mark for the first time.

Let that sink in for a minute.

$70,000.

This milestone marks a significant rebound from the nasty bear market, clocking a 50% gain in value for crypto’s flagship asset this year alone. And we’re not done yet.

Bitcoin’s March rally has been punctuated by record trading volumes and open interest in Bitcoin futures, indicating strong demand and participation from both institutional and retail investors who have woken up to the fact that in the Year of the Dragon it’s best to go LONG on Bitcoin in 2024, like we already told you last year.

Source: CoinGlass.com

While the first ATH celebration at $69,000 was brief, with Bitcoin soon retracting to around $59,000 to flush out overleveraged long positions before settling back in at over $65,000, the move has reignited discussions about the cryptocurrency’s potential and just what is driving its latest bull run. Let’s dig in.

But first, some Dave Portnoy!

Key Factors Driving Bitcoin’s Crazy 2024 Rally

Spot Bitcoin ETFs

The recent approval of spot Bitcoin exchange-traded funds (ETFs) by the U.S. Securities and Exchange Commission (SEC) has been a game-changer. These ETFs have attracted massive inflows, creating consistent buy pressure as they accumulate actual BTC to back the ETF shares. Notable players like BlackRock, Fidelity, and Grayscale have launched their own spot Bitcoin ETFs, making it easier for institutional investors to gain exposure to BTC than ever before, without all that pesky Not Your Keys, Not Your Crypto nonsense (which actually gives it its real value).

Bitcoin Halving

The anticipation of the Bitcoin halving event, expected in April 2024, has helped to amplify the momentum that the spot ETF launches have created. The halving, which will reduce the block reward for miners from 6.25BTC to a miserly 3.125 BTC, has historically led to a deflationary pressure and significant price rallies in the past, kicking off some epic bull runs.

DeFi and Ordinals

Following the Taproot upgrade in 2021, Bitcoin’s evolving ecosystem, including the growth of decentralized finance (DeFi) and the emergence of Bitcoin Ordinals, has added new dimensions to its utility and appeal. With BRC20 tokens popping up and off everywhere and Bitcoin layer-2s using the network’s well-documented safety and decentralization to build new financial networks, the arguments of Bitcoin simply being boring old digital gold are not holding much water anymore.

Macro Environment

The macroeconomic landscape, including persistent inflation and the prospect of interest rate cuts, has bolstered the appeal of Bitcoin as both a hedge against inflation and a speculative asset. Moreover, the way Bitcoin is reported on US company balance sheets will soon change as the new FASB reporting rules take effect. Add in a US election year and its classification as a commodity by the SEC, and things are all lining up for mass adoption.

Bitcoin Price Predictions and Future Outlook

As Bitcoin regroups for another imminent attempt at the $70,000 resistance level, predictions for its future price are varied but generally very optimistic. Analysts forecast a range from $100,000 to $150,000 by the end of 2024, with some like Cathie Wood even projecting a long-term target of $250,000 to $1 million. The smart money believes that as inflation and central banks’ money supply manipulation continue, a scarce asset like Bitcoin with its maximum 21 million coins can only go up in value over time.

Also, in a recent podcast, crypto investor Raoul Pal remarked that we’re still very early in mainstream adoption, as institutional investors or billionaires will gradually increase their investment over time. Couple that with the fact that millennial investors can now add Bitcoin to their 401k savings each month with no hassle, and the future is looking very bright.

Conclusion

The success of spot Bitcoin ETFs, the upcoming halving event, new use cases such as Ordinals and DeFi that bring with it mountains of new transaction volume, and the continued adoption of Bitcoin as a store of value are key factors that you can’t ignore. And as history has shown, Bitcoin gains eventually make their way down the funnel to other areas such as DeFi, Web3 and NFTs over time.

Despite the excitement around Bitcoin’s new ATH, it’s essential to approach the market with caution. The cryptocurrency remains volatile, and the current rally could be followed by significant corrections. Therefore a steady hand may be the best approach for navigating the ever-evolving crypto landscape.

HODL Bitcoin with CoolWallet

Nothing is as steady as Bitcoin in cold storage, and if you’re looking to accumulate BTC in an elite and convenient hardware wallet, look no further than CoolWallet Pro (for experienced investors) and CoolWallet S (for novices and HODLers). Did you know it was the world’s first Bitcoin mobile hardware wallet in 2016?

With a cutting-edge EAL6+ secure element, open-source code, biometric verification on its accompanying CoolWallet App, tamper proof and waterproof protection, and real-time Web3 Smart Scan technology helping you to thwart those dangerous phishing attempts, CoolWallet remains the smartest choice for serious crypto investors who don’t want to sacrifice security for ultimate convenience.

Disclaimer: This article is for educational purposes only and none of its content is financial advice. Cryptocurrency investment is highly volatile and risky. The author’s opinions are his own.