Phew, what a time to be alive. The year 2020 is rightfully universally considered an “annus horribilis” for the ages. It was certainly the crypto industry’s most volatile year yet by a socially distanced mile, easily surpassing the previous parabolic crypto bull market of 2017.

Unique new drivers such as the COVID-19 pandemic and its socio-economic fallout, the Bitcoin Halving, Ethereum 2.0, DeFi, huge regulatory changes, PayPal and the U.S. Presidential Elections all coalesced into a perfect storm that blew Bitcoin to previously unfathomed new highs of $30,000 thanks to unprecedented institutional adoption in the last quarter of the year.

Of course, the COVID-19 coronavirus had the biggest impact of the year, permeating every corner of our lives in 2020. It had knocked the cryptocurrency space off-balance at first, crashing all markets and driving Bitcoin below $4,000 at one pone. The pandemic added jet fuel to crypto’s acceleration, catapulting it into unchartered territory and new heights both in new investments and prices.

But before we get too excited about what 2021 has in store for crypto miners, traders, investors, stakers, and those that are still on the fence, let’s look back into the 12 months that were. Below, we look at several major factors that took the cryptocurrency space by storm. As a bonus, we shall look at experts’ opinions on what to expect in 2021.

COVID-19 crashes, then drives Bitcoin price

The COVID-19 pandemic also revealed glaring potholes in fiat-based systems, attracting more people to invest and learn about crypto as a store of value for the new decade.

Consequently, the decentralized finance (DeFi) space only exploded in 2020 despite being in existence since 2017. With the rise of crypto prices and billions of dollars locked in DeFi, the year 2021 looks bright.

Although COVID-19 was discovered towards the end of 2019, global markets started to feel its effects from March 2020. Apart from the traditional finance sector dwindled, cryptocurrencies also took a hit, and prices plummeted. Bitcoin’s price, for example, fell to below $4 billion dollars.

U.S. : Elections, Riots, Regulations, and Stimulus Checks

Thanks to the falling global economy and massive layoffs, the United States government formulated a stimulus package worth approximately $300 billion dollars to cushion Americans.

Ordinary citizens received the package in the form of checks and direct deposits. Analysts had forecasted that some of the recipients had bought Bitcoin (BTC) afterward. Their argument was supported by the price of BTC rising to hit the $10K mark after the funds started hitting recipients’ accounts. Bitcoin had struggled to reach this mark for the previous seven weeks.

Before the dust settled around the stimulus package, next came the hotly contested presidential elections between President Donald Trump and Joe Biden. Further political turmoil came in the form of the Black Lives Matter campaign, which saw widespread protests and riots across the country, leading to fears of a civil war.

Compared to the last presidential election in 2016, Bitcoin seemingly responded positively to 2020’s election, as its deflationary supply made it appealing as safe-haven asset status and this time round the stakes were much higher. During this period, the leading cryptocurrency recorded a gradual increase to reach $14K, a price it came close to two years ago.

Bitcoin Halving and Institutional Adoption Lead to $20K+ ATHs

Interestingly, Bitcoin halvings follows the same schedule as the US elections. The first halving happened in 2012, the second in 2016; and in May 2020, it underwent its third programmed supply cut.

This recent halving slashed mining rewards from 12.5 to 6.25 Bitcoins for every successfully mined block. However, Bitcoin didn’t respond to the hype pre- and post-halving right away.

According to Cynthia Wu, a department head at Matrixport, a digital currency financial services firm, the price didn’t increase because the event had been discussed extensively pre-halving. Consequently, the coin’s price “was already priced in.”

Intriguingly , Bitcoin saw a price pump after receiving support from unusual quarters: Institutional investors.

Institutional investors flock to Bitcoin and crypto

MicroStrategy, a business analytics firm, ignited institutional investments.

The firm’s first Bitcoin investment was made in August 2020 and was worth $250 million. It was followed by another investment a month later worth $175 million, and the third involved $50 million. Currently, Microstrategy holds roughly 40,824 BTC.

Apart from the Nasdaq-listed firm, PayPal, a financial services company, dipped its toes into the Bitcoin world in 2020, causing a massive price spike ever since. In a statement, PayPal said it would allow its US customers to hold, trade, and pay with Bitcoin directly from their wallets in 2021.

Other large firms and institutions that have invested in Bitcoin include insurance giant MassMutual, Ruffer, Grayscale, Guggenheim Investment Fund, and Square. Notably, firms accumulating BTC are on the rise.

According to a recent analysis by Glassnode, institutional investors are using over-the-counter (OTC) desks to buy Bitcoin. Unfortunately, not all of them are announcing their adoption of the king of cryptocurrencies just yet.

Ethereum’s Big Year: Infura, Beacon Launch, PoS Transition and Eth 2.0 Staking

Away from Bitcoin, the second-largest crypto in market cap has experienced its share of ups and downs throughout the year.

Infure outage and unexpected hardfork

The major downside that went through was an unplanned halt. On November 11, DeFi platforms running on the Ethereum protocol were inaccessible.

This occurred after a bug in the network caused a split in transaction history. The division happened due to an issue with Infura, a server run by Consensys to help keep DeFi systems in sync with the main ETH-powered blockchain.

The split affected popular applications such as MakerDAO, MetaMask, and Compound. An analysis by Infura indicated that the problem originated from a bug in the Go Ethereum (Geth) side coming from an update code. Unfortunately, the damage was already done. The bug created a fork of the Ethereum chain, causing exchanges like Binance to halt interaction with the second-largest cryptocurrency.

Ethereum 2.0 and Beacon Chain launch

Fortunately, the Infura scandal’s effects on the crypto ecosystem were eclipsed by Ethereum’s stride to shift from a proof of work (PoW) to a proof of stake (PoS) system. The launch of Ethereum 2.0’s Beacon Chain marked the shift.

With the upgrade, Ethereum seeks to keep up with if not surpass the transaction speeds of traditional financial firms such as PayPal and Visa.

Ethereum staking takes off

From the onset, Ethereum investors welcomed the PoS-based Ethereum by interacting with the Eth 2.0 deposit contract. To become validators, users needed to send 32 ETH to the contract.

However, those without a full 32 ETH could still participate but had to rely on third-parties such as Coinbase, where these services stake the amount and share the staking rewards with ETH delegators depending on their delegated amount.

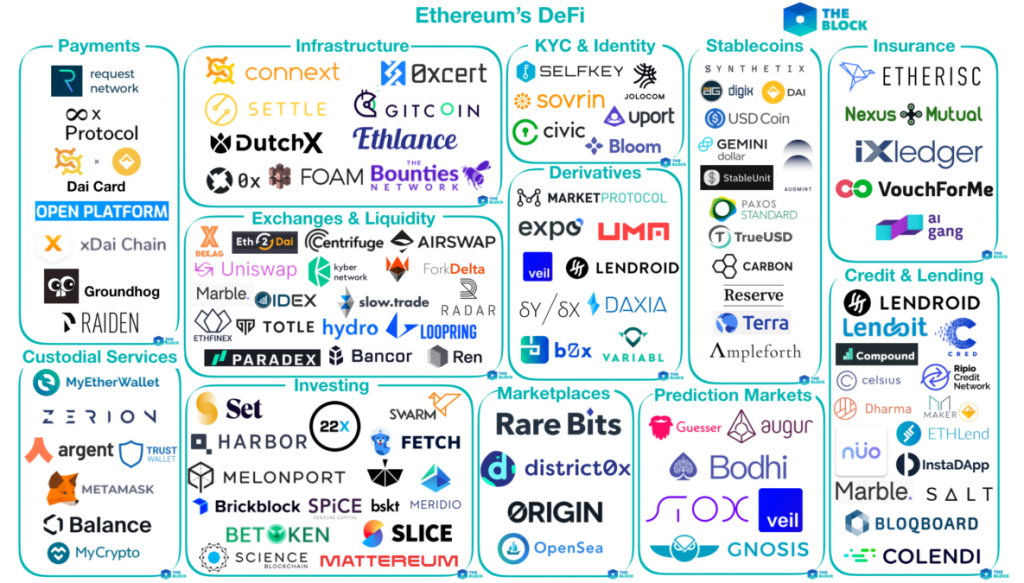

DeFi Defies All Expectations

In 2020, the nascent DeFi cryptosphere received tremendous growth and recognition, leading to comparisons with 2017’s unregulated ICO boom. Only two years ago, DeFi was just another “possibility,” and crypto enthusiasts didn’t give it much attention.

In 2020, the space experienced incredible innovations leading to more than $14 billion locked in DeFi platforms from a meager $1 billion at the beginning of the year.

With the innovations came massive new profit-making opportunities, none bigger than yield farming and liquidity mining with innovative new protocols like Yearn Finance (YFI), Compound, Yam Finance and a string of copycat projects that delivered initial riches before fizzling out.

Compound, another notable DeFi system, revived the mood in the space by releasing a white paper detailing the architecture of its unreleased decentralized platform, Compound Chain, meant to power a new breed of DeFi applications. According to Compound, the new blockchain will “scale Compound over the next century.”

However, in the 3rd quarter of 2020, the DeFi space began to cool off due to several exit scams, “rug pulls”, smart contract hacks and less investor confidence after rumors circulated that SushiSwap, a clone of the leading UniSwap DeFi network, was exiting the ecosystem. The protocol’s anonymous founder, Chef Nomi, denied abandoning the protocol and even transferred the network’s admin status to Sam Bankman-Fried, the CEO of FTX, a derivatives trading platform.

Despite bringing new ways to make profits and provide distributed lending, most DeFi networks aren’t audited despite being open-source. To some, this has the likeness of the initial coin offering (ICO) mania and may have grave consequences.

Decentralized Exchanges (DEX) and the Rise and Fall of Meme Tokens

2020 was also a year that the DeFi scene saw an increase in food-meme coins like SushiSwap. This phenomenon saw tokens sporting the names of burgers, sushi, and food into yield farming protocols that offered insane compound returns on investment (APY) by incentivizing staking with both interest and governance tokens as rewards.

These struck gold in a big way, as many DeFi investors loved to take a gamble on new tokens (hence their nickname “DeFi degens”), seemed to be foodies and were enjoying the treat.

Popular food-meme coins that took the space by storm in 2020 include Sushi, BurgerSwap (Burger), Yam Finance (YAM), BakerySwap (BAKE), Pizza (PIZZA), Hotdog.Swap (HOTDOG), Kimchi Finance (KIMCHI), and Meme (MEME).

However, as the food they represented had a limited shelf life and soon went stale for investors. Most of the projects’ teams pulled the rug on investors.

On August 2, the YAM platform, for example, reported a bug in its code that would make it hard for the community to reach a consensus. This caused its price to crash to near zero as the developer team took a four-week audit of the code.

Others like the HOTDOG token went cold soon. It crashed from a price of $4K to $1 in just five minutes as a hacker or developer “rugpulled’(stole the staked funds). KIMCHI wasn’t secure either. It moved from $6 to $1.90.

Following news that Chief Nomi had exited the SushiSwap project and liquidated his position, SUSHI’s price tanked from $11.7 to $1.20 within five days.

XRP: Airdrops and Securities

The year 2020 is ending nightmarishly for Ripple (XRP), and its retail investors are feeling the brunt of the pain.

Flare Networks’ Spark token airdrop

Things started well the announcement that Flare Networks would airdrop the Spark Token, an addition to the XRP ledger, to all registered XRP holders to support DeFi applications. This was believed to be a positive event.

However, when they conducted the FLR airdrop, XRP’s price fell instead of appreciating. To receive free coins, investors had to buy XRP, claim the Spark (FLR) tokens, then convert FLR into XRP. Some analysts have pointed to the drop in the price of XRP to a colossal number of FLR holders cashing out. More than 40 billion FLR tokens were airdropped.

SEC charges lead to exodus of investors

The biggest reason XRP investors were cashing out was the lack of clarity from the SEC regarding XRP’s legal status, leading Ripple to threaten that they would relocate from the States to elsewhere more friendly.

The situation took a turn for the worse following the recent charges brought against Ripple Labs and two Ripple executives, Brad Garlinghouse (CEO) and Chris Larsen (Chairman).

The US Securities and Exchange Commission (SEC) charged the company and its executives with issuing $1.8B in unregistered securities, a move many, even Ripple, saw coming. In order to determine if an asset is a security or commodity, U.S. regulators use the Howey Test, which basically ascertains whether a token’s value comes from its intrinsic qualities (such as Bitcoin) or from expected profits thanks to the work of a centralized issuer (like Ripple).

In return, major cryptocurrency exchanges such as Coinbase and Bitstamp have halted XRP trading and deposits.

This massive FUD led to XRP’s price dropping from a high of 70c to under 20c.

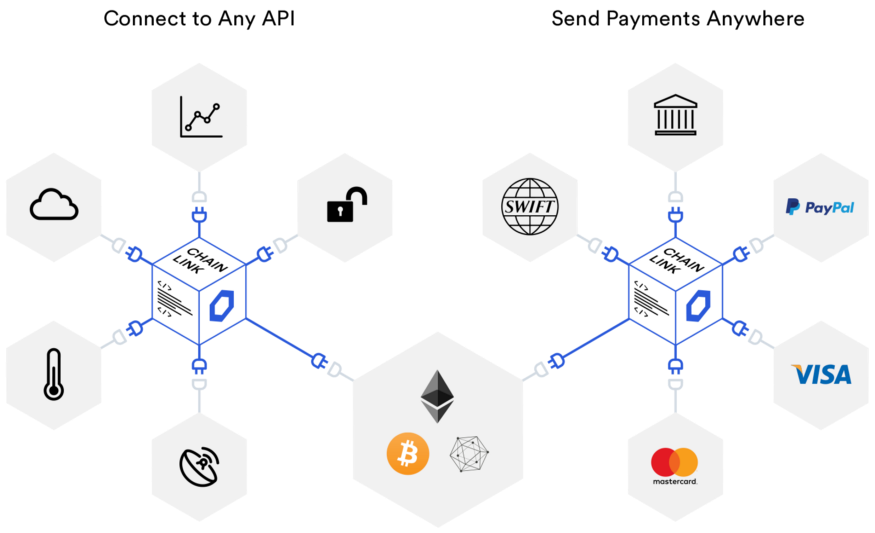

Oracle-based Coins Pump in 2020

The prices of Oracle-based tokens have been on the rise in 2020. Chainlink (LINK), for example, has recorded tremendous gains. A report by Messari, a crypto data analytics firm, indicated that LINK is among the top-performing oracle tokens in 2020. In the first eight months of 2020, the LINK price rose by four times.

Other oracle protocols whose coins have seen massive growth this year include Band Protocol, Zap, and Dos Network. These platforms’ coins had recorded between 3K% and 4K% gains for 12 months up to August 2020.

The surge in price for LINK and BAND may be attributed to their listing on Coinbase Pro. The rise can be used as an appreciation sign towards the part played by these platforms on the DeFi scene.

Oracle platforms connect off-chain and on-chain data sources. Consequently, DeFi projects can cater to a wide range of applications.

Security: $1.8 Billion Lost Through Scams and Hacks

As cryptocurrency investors celebrated their gains, scammers, hackers, and fraudsters once again, crawled the space looking for easy targets as in previous years. And, they got them.

By October 2020, $1.8 billion had already been lost through hacks and other fraud-induced tactics. Notably, DeFi platforms became a lucrative target for malicious actors to manipulate holes in protocols’ codes. Exploitations from DeFi platforms accounted for approximately 21% of the total digital currency thefts in 2020.

A report by CipherTrace indicated that crypto users in the US sent 88% of their BTC ATM transactions to offshore exchanges, most of which had scam-like characteristics. Among notable crypto exchange hacks in 2020 is the KuCoin hack that saw roughly $281 million siphoned out of the exchange.

The biggest hack for many was the brazen Twitter Hack. In mid-2020, a 17-year old hacker and others breached the Twitter accounts of high profile individuals such as Elon Musk, Barack Obama, and Joe Biden and tweeted they’re doubling Bitcoin sent to a given address. From this, the hackers made around $121,000, before being apprehended by law enforcement.

Regulation: FATF’s Travel Rule, SEC vs Ripple and FinCEN vs Private Wallets

In 2019, the Financial Action Task Force (FATF) formulated new regulations affecting digital asset service providers or VASPs. Commonly known as the travel rule, the regulations require VASPs to record their sender’s and recipient’s information when facilitating a crypto trade. This rule continues to affect custodial wallet service providers, digital currency funds, crypto exchanges, and other crypto payment startups.

Apart from the travel rule, the US Financial Crimes Enforcement Network (FinCEN) and the Federal Reserve were rumored to be formulating ways to regulate private, self-custody crypto wallets.

It’s also rumored that there are more stringent crypto-focused regulations in the pipeline by the two US regulators. Unfortunately, most of these new regulations have a 30-day response period instead of the average 60-90 days.

Word in the streets has it that the changes “are coming directly from political appointees, rather than long-term career people at FinCEN or on the policy side.”

It would appear that at least price-wise, these regulations seem to be helping the crypto industry at present, possibly making it more appealing and less risky for traditional financial institutions to enter the market as they already comply with most of these regulations.

On the plus side, the Office of the Comptroller’s announcement in July that U.S. banks could indeed offer crypto services to American retail investors, kicked off the institutional investment frenzy and caused many U.S. banks to take a different look at crypto.

What to expect in 2021

Stepping into 2021, the cryptocurrency ecosystem could potentially experience significant gains, after the momentum buildup created in 2020 in both the general crypto space and the DeFi subsector.

This will be boosted by more adoption from institutional investors. In an industry where adoption can affect the prices when secret institutional investors finally make their involvement public, it’s likely that the bulls will be fully charged and in control.

Other areas analysts predict massive growth in 2021 is the proliferation of central bank-issued digital currencies (CBDC), clarity on crypto regulations, and ease in purchasing BTC.

Additionally, there will be an increase in cryptocurrency derivatives trading platforms as stablecoins inch closer to becoming the de facto method to send money across borders.

Closing Thoughts

After looking back in the year 2020, it’s clear the cryptocurrency space went through some difficult times. Not only did it survive it, but it thrived in the resulting chaos, offering a real future to mainstream investors. For example, despite the BTC price falling below $4K in March, it has peaked at over $28K as of December 30, 2020.

Furthermore, despite the regulatory uncertainty and systemic security issues in the DeFi space, the total value locked (TVL) in these systems has closed the year at more than $14 billion despite starting the year at $1 billion.

In 2021, the crypto industry is projected to experience more dramatic changes.

For instance, more institutions are projected to dip their toes into the BTC world, further driving the price of the leading cryptocurrency. Additionally, the DeFi subsector is projected to mature while regulators invite crypto companies to the table. Ethereum will advance further to its PoS final form and reach Serenity by either 2021 or 2022.

Will we see Bitcoin back at $10,000, or will it hit $100,000? Sorry, but we don’t do price predictions at CoolWallet.

What we can say is that exciting times are ahead. Goodbye 2020, and welcome 2021!

Stay safe and Happy New Year!